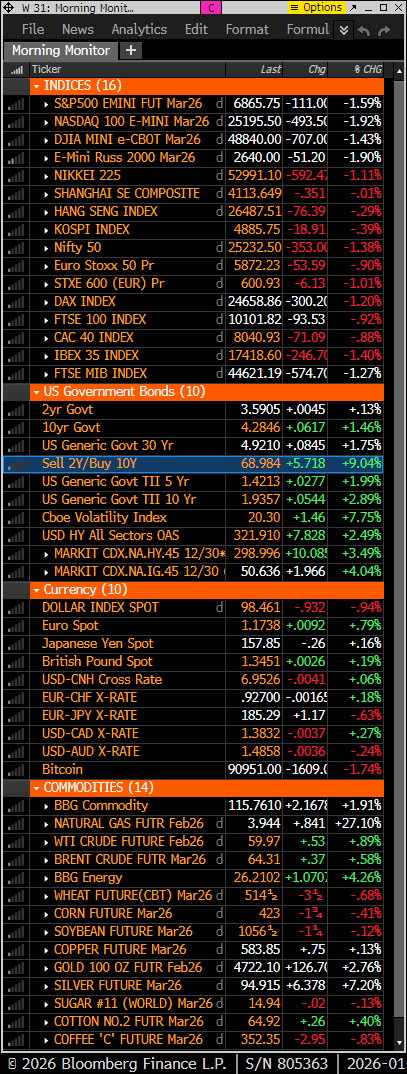

Premarket Price Action

US equity futures: S&P down 1.6% | Nasdaq 1.95%| Russell 2000 down 1.95%

Treasuries: Rates higher with longer-end yields higher by 5-8bps 10, 30-year yields charts below

Dollar: DXY meaningfully lower -0.85%

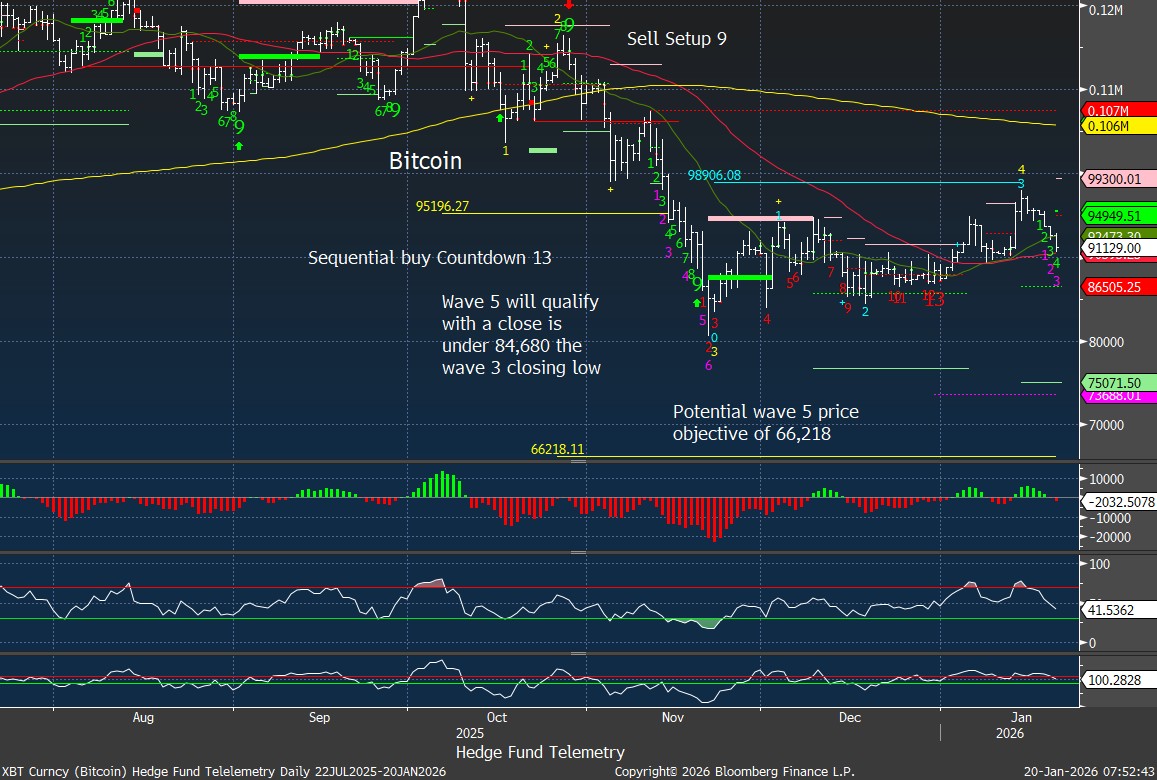

Crypto: Bitcoin down 1.7%. Daily and weekly charts below

Commodities: Gold +2.8% | Silver +7% | Crude up 0.9% | Natural Gas up 25% (two-day move)

Overnight – Global Markets

Asia: Broadly lower. Japan led declines amid a sharp back-up in JGB yields tied to election and fiscal concerns. China was comparatively stable but failed to provide offsetting support.

Europe: Heavy selling across major indices with cyclicals, industrials, luxury, and basic resources underperforming. Defensives (staples, insurance, telecom) holding up on a relative basis.

Premarket Setup and What’s Driving Markets

US equities are opening the week on the defensive following the long holiday break, with risk assets repricing lower into a renewed trade and rates shock. Premarket tone is decisively risk-off, led by global rates pressure rather than domestic growth data. Gold and silver strength underscores the defensive bid as equities absorb multiple macro stress points simultaneously.

Key drivers:

- Trade/geopolitics: Fresh escalation risk tied to Trump’s Greenland tariff threats and potential EU countermeasures.

- Rates shock: Rapid rise in Japanese yields spilling over into global bond markets, pressuring US long-end yields.

- Danish pension fund announced they will exit US Treasuries

- Positioning reset: Elevated equity sentiment/positioning and stretched valuations, leaving little buffer for policy-driven volatility.

- AI dispersion: Intensifying bifurcation within tech as agent-based tools disrupt legacy software and hardware demand assumptions.

- Short term bounce is possible with S&P 60 minute with new Sequential and Combo 13’s – a lower high bounce would be the outcome

Macro & Policy Focus

- Today: No major US economic data scheduled.

- This week: Focus shifts to Trump’s Davos remarks (Wednesday), Supreme Court proceedings involving Fed Governor Cook, and potential SCOTUS decisions related to tariffs.

- Fed: In blackout ahead of next week’s FOMC meeting; markets now pricing fewer than 50bp of cuts through year-end.

- Rates narrative: Global duration under pressure as Japan joins the list of countries exporting higher yields.

- Good video on Japan with newfound inflation and what it means with huge debt

Key Company & Sector Movers

- AI / Tech:

- NVIDIA suppliers reportedly pausing H200 component production after China blocked shipments.

- Apple regained top market share position in China on strong holiday demand.

- AI agent tools (Claude Code) are accelerating dispersion and pressuring legacy software names.

- APP Applovin is down hard with a report of financial money laundering used at APP, not by the company but an Asian money laundering syndicate.

- Financials:

- JPMorgan Chase in focus after Trump threatened legal action over alleged “debanking.”

- Industrials / Materials:

- 3M guidance flagged as slightly light.

- D.R. Horton delivered a revenue and closings beat, reiterating FY26 guidance.

- Consumer / Retail:

- Proxy fight intensifying at Lululemon Athletica.

Key S&P 500 Upgrades / Downgrades

Upgrades:

- INTC (Intel): Raised to Hold, HSBC; PT $50 (Classic capitulation upgrade to ‘hold’ from sell)

- O (Realty Income): Raised to Buy, Deutsche Bank; PT $69

- PEG (PSEG): Raised to Overweight, Wells Fargo; PT $92

- REG (Regency Centers): Raised to Buy, Deutsche Bank; PT $83

- SOLV (Solventum): Raised to Outperform, Mizuho; PT $100

- SPG (Simon Property): Raised to Buy, Deutsche Bank; PT $205

- TT (Trane Technologies): Raised to Outperform, Oppenheimer; PT $460

- UDR: Raised to Buy, Truist; PT $—

Downgrades:

- AVB, EQR, PSA: REITs broadly downgraded across Deutsche Bank

- BLDR: Cut to Equal-Weight, Stephens

- CDW, NTAP: Cut to Equal-Weight/Underweight, Morgan Stanley

- COP: Cut to Neutral, JPMorgan

- DPZ: Cut to Equal-Weight, Morgan Stanley

- EIX, SO: Utilities downgraded at Wells Fargo

- RF: Cut to Market Perform, KBW

- WRB: Cut to Sell, TD Cowen

Initiations:

- A (Agilent): Rated New Buy, HSBC; PT $180

Trend takeaway: Sell-side caution is increasing in cyclicals and rate-sensitive sectors, while selective defensives and quality industrials are seeing support.

What We’re Watching Today:

- Whether global yields stabilize or continue to pressure equity multiples

- Trade rhetoric follow-through vs. de-escalation signals out of Davos

- Leadership: equal-weight vs. mega-cap divergence

- Precious metals follow-through as a stress signal

Markets are repricing policy and rates risk into elevated sentiment and extended positioning. What must hold is stabilization in global yields and trade rhetoric; what breaks is the late-cycle equity bid.

market snapshot

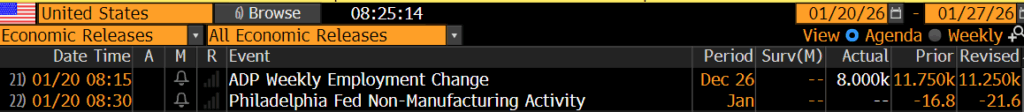

economic reports today

premarket trading

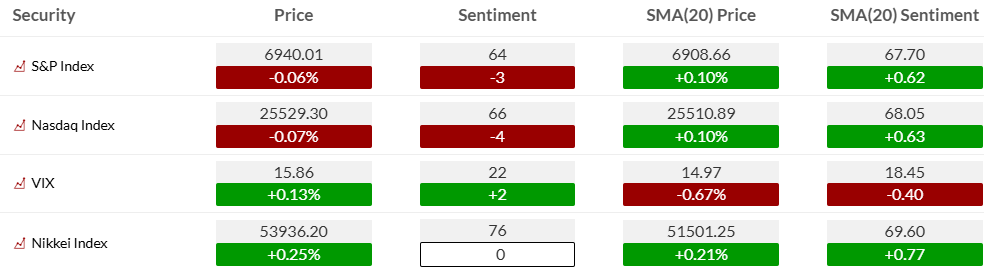

US MARKET SENTIMENT

Both indices are significantly lower on today down over 1% with sentiment backing off modestly on Friday (S&P sentiment 64 → –3; Nasdaq 66 → –4). Importantly, the sentiment levels are now below the 20-day moving average, testing trend support.

This is classic late-trend behavior — price trying to grind higher while sentiment momentum fades. Historically, this configuration increases the odds of range expansion or volatility, not an immediate trend break.

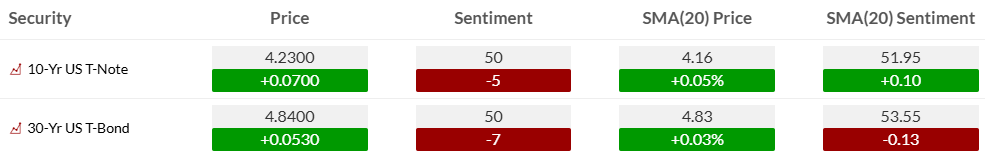

10-yr and 30-yr Treasuries:

Yields are edging higher, but sentiment is deteriorating (–5 on 10-yr, –7 on 30-yr). Despite that, price remains marginally above 20-day averages, signaling that rate markets are losing bullish momentum without yet breaking trend.

This reflects growing unease around duration rather than outright risk-off behavior. A failure to regain sentiment traction would increase the odds of another upward yield test.

U.S. Dollar:

Sentiment remains elevated (75) but flat on the day, with price hugging the 20-day average. This reflects crowded positioning rather than fresh buying.

Yen:

Yen sentiment remains extremely depressed despite a minor uptick, reinforcing the risk of counter-trend squeezes if positioning shifts.

Bitcoin:

Bitcoin sentiment has softened slightly, but price remains well above trend, consistent with consolidation rather than distribution at this stage.

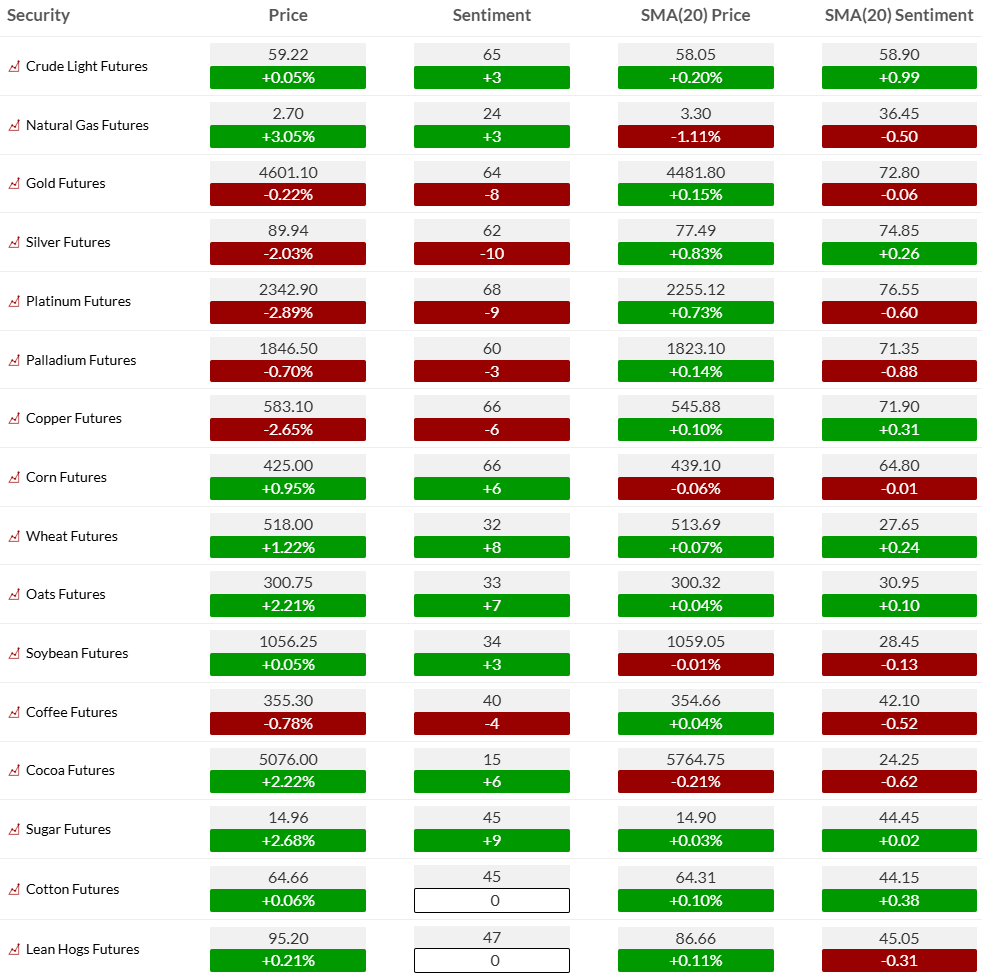

Energy:

Crude sentiment continues to firm, while natural gas remains volatile with price strength up huge in last 2 days but still below its 20-day price average — a non-confirmation worth watching. Expect a huge move on today’s sentiment.

Precious metals:

Gold, silver, platinum, and palladium are showing price weakness amid declining sentiment, even as prices remain above short-term averages. This divergence suggests distribution rather than accumulation.

Industrial metals & ags:

Copper sentiment has slipped further despite trend support. Ags are mixed, with corn, wheat, oats, sugar seeing sentiment improvement but no decisive price breakout.

US MARKETS

S&P futures 60-minute tactical time frame has both DeMark Sequential and Combo 13’s in downside wave 3 of 5. A corrective lower high wave 4 bounce is possible. Wave 4 would qualify if below wave 2 (yellow 2) and with a 13 bar/hour closing high.

S&P futures daily has been in a rolling pattern in the last 4 months. Just below the 50 day today but off the overnight lows. TDST Setup Trend Support at 6677 could come into play

S&P 500 daily with extended view of just Setup 9’s and Sell/Buy Countdown 13’s shown. Recent Sequential and Combo 13’s have seen nominal pullbacks or periods of stalling. The percentage of stocks above the 50-day is elevated at 72% with a new sell Setup 9, which should see a pullback in the number of stocks above the 50-day.

Nasdaq 100 60-minute tactical time frame bouncing off lows in downside wave 5 now

Nasdaq 100 futures daily topped in October and has made small lower highs. I continue to watch the TDST support at 24,548 which might come into play.

Extra charts we’re watching

Euro Stoxx 50 with sharp reversal down after recent Combo 13 and sell Setup 9. Below 20 day and above 50 day.

US Dollar Index daily very weak this morning with a pending upside Sequential on day 2 of 13. When only on day 2 I put less emphasis on this as I like to see day 5 or 6 for a more consistent trend continuation.

US 10 and 30-Year Yield yields are rising which has been my call. Upside Sequential Countodowns (secondary Countdowns as I have explained) still have potential to move higher.

Bitcoin Daily still has a downside wave pattern and an upside wave pattern. Breaking the downside wave 3 closing low would qualify downside wave 5.

Bitcoin weekly also has a downside wave pattern with the recent bounce qualifying lower high wave 2 of 5. A break of wave 1 will qualify downside wave 3 of 5 with a potential price objective of 64k.

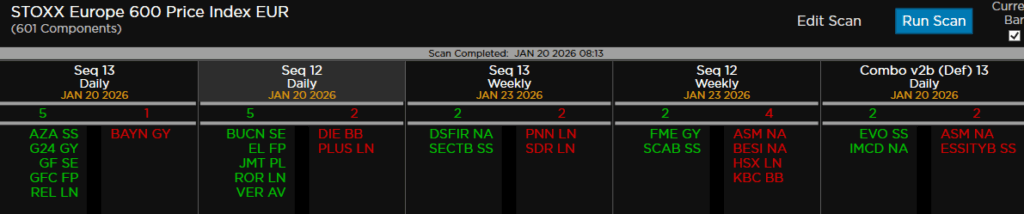

DeMark Observations – Euro Stoxx 600

After a large number of sell Countdown 13s, there are many price flips on the downside. A “price flip” is defined as a contra-trend move identified by a close that is higher/lower than the close four price bars earlier.