Premarket Price Action

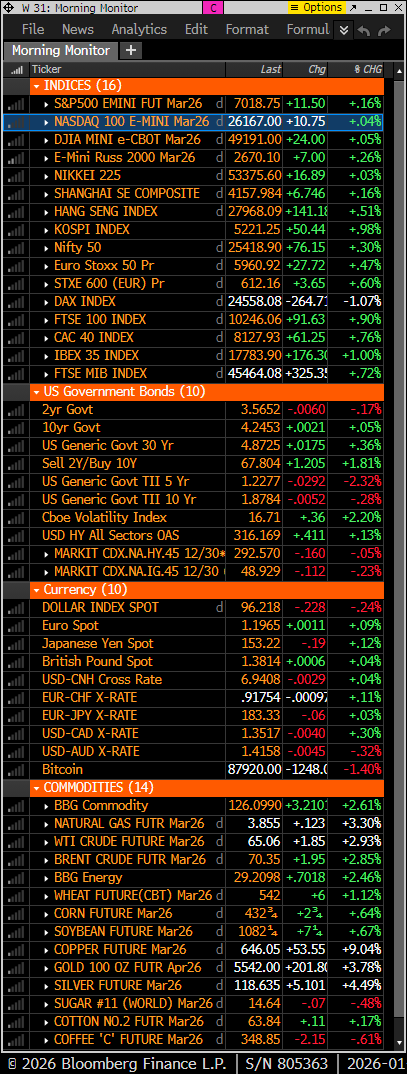

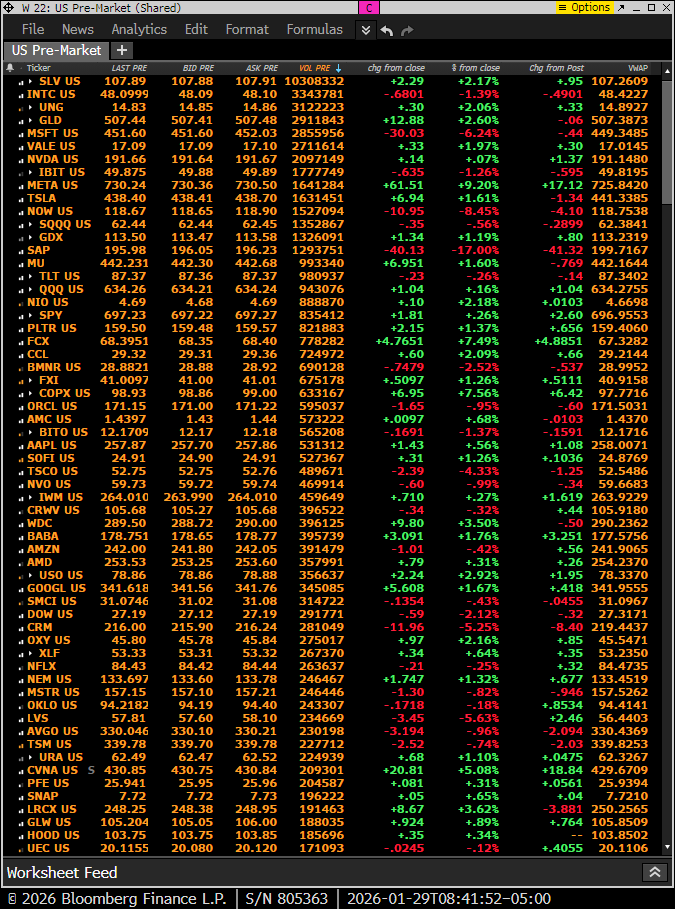

- US equity futures: S&P +0.2%, Nasdaq +0.1%, Russell 2000 +0.2% well off overnight highs

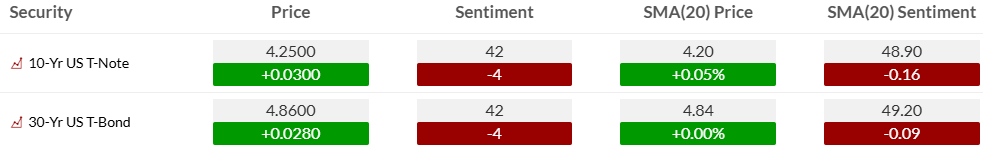

- Treasuries: rates +1–2 bp – still see upside rate risk

- Dollar: DXY -0.15% – possible bounce ahead

- Crypto: Bitcoin -1.4% daily and weekly charts below

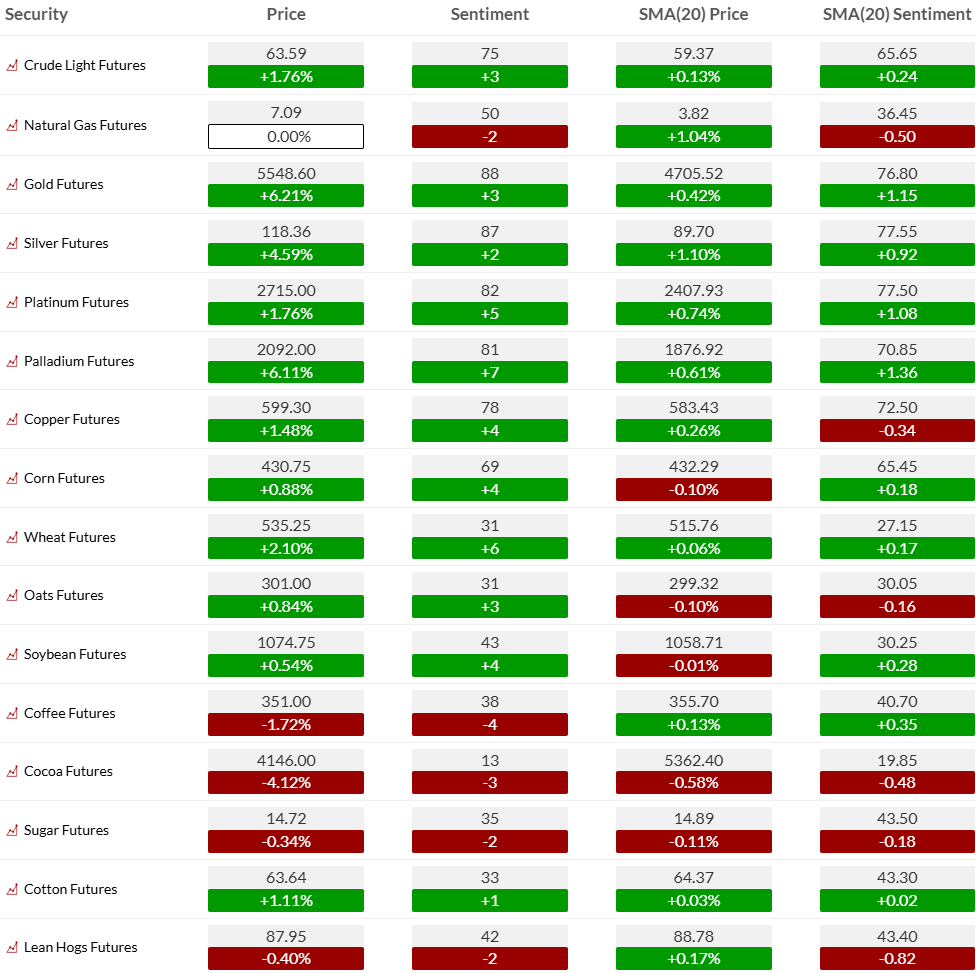

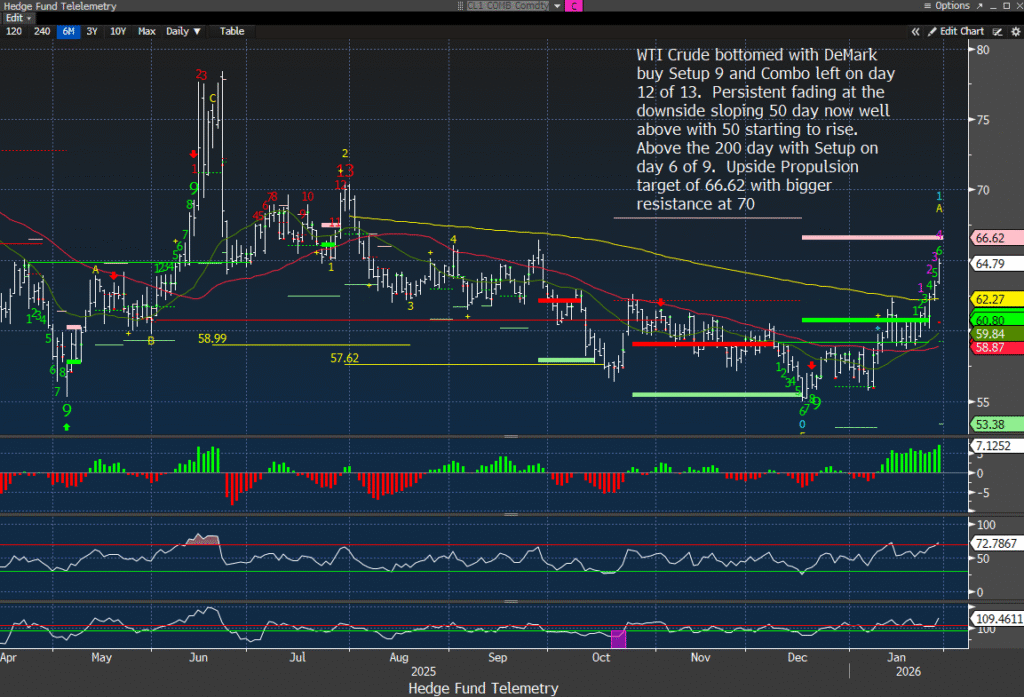

- Commodities: Gold +4%, Silver +5%, Crude +3.2% see charts below, Nat Gas +2.5%, Copper +9.5% see chart below

Overnight – Global Markets

- Asia: Mixed. Korea (+1.0%) and Hong Kong led; Taiwan (-0.8%) lagged. Japan marginally higher.

- Europe: +0.4% with leadership in industrials, basic resources, and energy; tech and healthcare lag. ABB strong on earnings; SAP sharply lower on backlog disappointment.

Portfolio update

CAT with good numbers thanks to the power segment for data centers, stock only up 1%. I will hold the current lowered weight short. LMT decent numbers but might also be priced in. I will hold the small short. LRCX very good numbers as expected but might be getting expensive and priced in after the recent run. TSLA not great but some see not as bad as feared. I will hold short and put spread – cover the lower strike if price collapses. More on this later

Premarket Setup and What’s Driving Markets

US equities ended flattish Wednesday with continued mega-cap tech bifurcation. Premarket tone is constructive but narrow, led by AI monetization winners and commodity-linked assets.

What’s driving markets:

- AI earnings dispersion: META’s revenue/guidance reset optimism while MSFT/NOW reinforced that “inline is the new miss.”

- Commodities breakout: Precious metals and copper extending upside momentum, helped by a softer dollar and geopolitical risk premium.

- Geopolitics: Crude bid on escalating Iran strike rhetoric; defense and energy sentiment firm.

- Macro relief: Government shutdown odds falling toward ~40%, reducing near-term tail risk.

Macro & Policy Focus

- Data today: Q3 unit labor costs, initial claims (205K est.), Nov trade balance, factory orders

- Rates: Market still debating June vs. July Fed cut; back-end yields drifting higher

- Supply: $44B 7-year Treasury auction

- Politics: Shutdown risk receding; Iran risk rising

Key Company & Sector Movers

- IP International Paper to separate into two companies

- Samsung is down after earnings with warnings of weaker smartphone sales in Q1, still see memory tightness. DRAM prices btw down again today which might be the catalyst for memory chip stocks to top (soon – I hope)

- Commodities / Miners: Strong across Europe and US on metals surge

- Energy: Crude-driven bid on geopolitical risk

Key S&P 500 Upgrades / Downgrades

Upgrades

- LRCX: Raised to Buy, Summit Insights – memory capex confidence building

- FTNT: Raised to Buy, Rosenblatt – security spend stabilization

- GM: Raised to Buy, DZ Bank – cycle optimism creeping back

Downgrades

- FSLR: Cut to Market Perform, BMO – policy and multiple pressure persist

Trend: Analysts leaning into capex and cyclical recovery selectively, while trimming policy-exposed clean energy.

EARNINGS SUMMARY

LUV (Southwest) – Big upside guide: 2026 EPS $4+ vs. Street $3.20; mgmt calls $4 the floor. Turnaround actions working; demand tone solid despite weather noise.

LVS (Las Vegas Sands) – EBITDA beat ($1.41B vs. $1.32B) driven by Marina Bay Sands; Macau slightly light. Singapore strength offsetting China softness.

WHR (Whirlpool) – Ugly Q4 miss on sales/margins, but 2026 guide broadly inline and FCF better. Story shifts to recovery credibility, not Q4 damage.

IBM – Clean beat on EPS, sales, and margins; Software +11% FXN the standout. 2026 guide modestly ahead, FCF solid. Execution narrative intact.

LRCX (Lam) – Beat and raise; FQ3 guide well ahead. AI/HBM demand strong, but expectations already elevated.

META – Big EPS/revenue beat; Q1 guide well ahead. Capex/expense ramp for 2026 very heavy, but cash flow supports it. Debate shifts back to spend discipline vs. growth.

MSFT – Results solid, but Azure only inline, capex surged, FCF light, cloud margins down Q/Q. Expectations too high; nothing broke, nothing surprised.

NOW (ServiceNow) – Beat KPIs, guide slightly ahead, buyback expanded. Fundamentals strong, but AI disruption narrative still an overhang.

TSLA (Tesla) – Beat low bar; margins improved, non-auto growth helps. Optimus/xAI hype front and center, but valuation still far ahead of earnings reality.

CAT (Caterpillar) – Big beat on EPS, sales, margins; Power & Energy +23%, power gen +44% on data centers. Backlog surged. 2026 solid, tariffs manageable.

RCL (Royal Caribbean) – Q4 inline, 2026 guide modestly ahead. Capacity, yield, and cost discipline drive growth; demand commentary bullish.

TSCO (Tractor Supply) – EPS/comps miss; 2026 guide light. Consumer shifting toward essentials, discretionary slowing.

BX (Blackstone) – Distributable EPS beat; monster inflows $71.5B. IPO pipeline reopening as liquidity returns.

MRSH (Marsh) – EPS beat on organic growth; Consulting offsets insurance softness. Steady execution.

PHM (Pulte) – Headline miss masked by items; orders/deliveries strong, aggressive buybacks continue. Demand constrained by confidence, not rates.

DOW (Dow) – EPS/EBITDA beat, but Q1 sales guide ugly. Cost cuts escalated; cycle still challenged.

LMT (Lockheed) – Slight EPS miss, but sales, FCF, backlog strong; 2026 guide ahead. THAAD production ramp adds visibility.

CMCSA (Comcast) – Results inline, FCF big beat. Broadband weak, Peacock strong, wireless ok. Mixed tape.

MA (Mastercard) – Strong EPS beat on margins and tax; volumes steady ex-US better than US. 2026 outlook inline, spending healthy.

What We’re Watching Today

- Follow-through (or lack thereof) in META-led AI optimism

- Precious metals: momentum continuation vs. exhaustion

- Reaction to claims data and 7-year auction

- Whether cyclicals confirm Europe’s late-cycle DeMark warnings

Bottom Line

This remains a barbell tape: AI monetization winners and real-asset inflation hedges working, while “merely good” earnings are sold. Sentiment is elevated but not extreme—yet leadership is narrowing. Risk is no longer macro-driven; it’s earnings precision and expectation control.

market snapshot

economic reports today

premarket trading

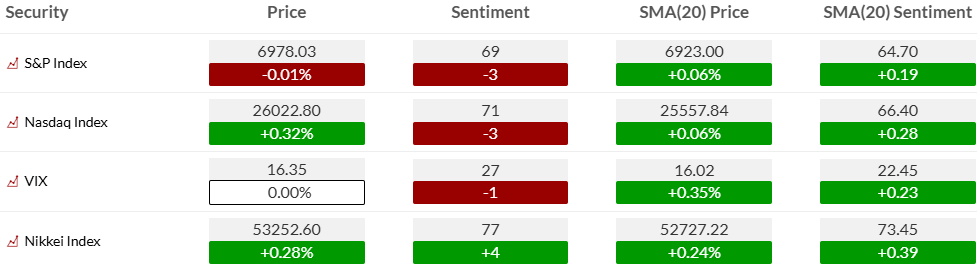

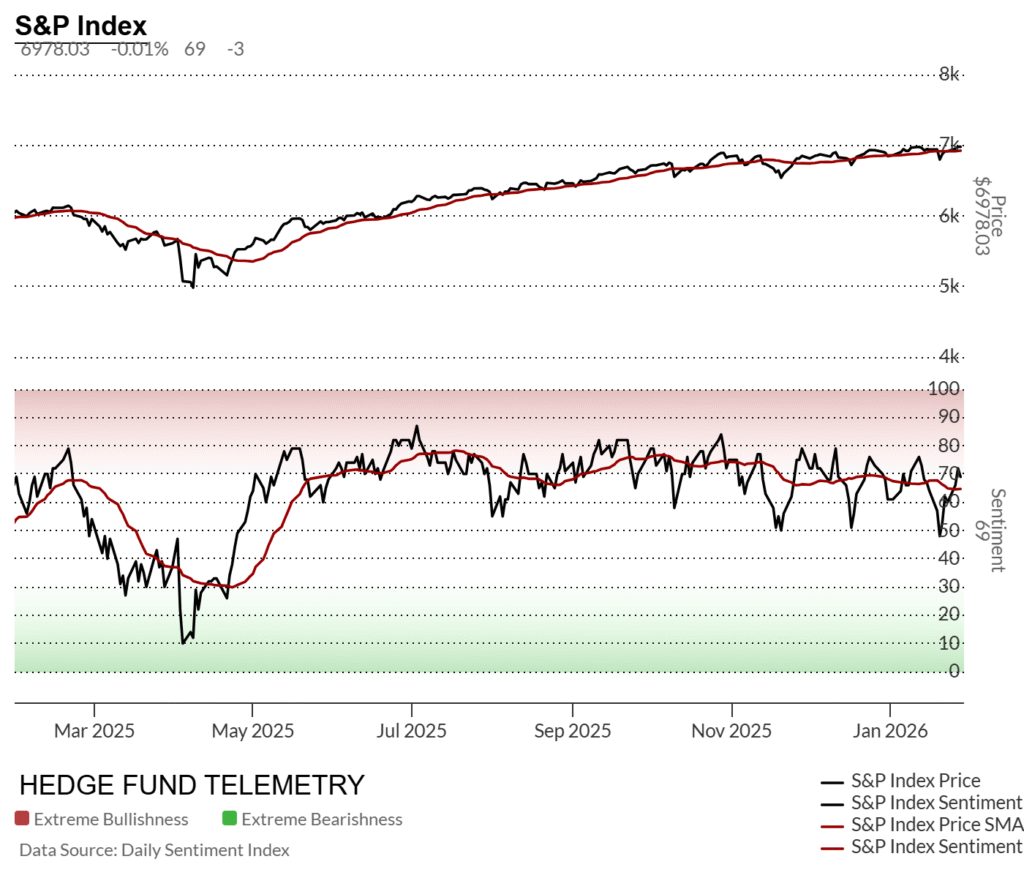

US MARKET SENTIMENT

S&P 500 bullish sentiment: ~69%, drifting lower (-3) but still elevated

Nasdaq bullish sentiment: ~71%, also slipping lower (-3)

Rates: Treasury sentiment softening modestly as yields grind higher

FX: Dollar sentiment improving short term, but still below its 20-day average (mean-reversion risk for a bounce soon)

Gold & Silver: sentiment elevated (mid/high-80s) and diverging sharply from 20-day averages → momentum strong, but crowded

Copper: sentiment improving but still below precious metals—relative catch-up continues

US MARKETS

S&P futures 60-minute tactical time frame stalled yesterday after the recent move. The bounce might be a corrective lower high wave 2 of 5. There is a downside Sequential pending on hour bar 3 of 13 so let’s see if that develops with lower prices.

S&P futures daily with recent DeMark Sequential sell Countdown 13. This has been mostly in a range since September with nominal gains.

Nasdaq 100 60-minute tactical time frame continues to stall.

Nasdaq 100 futures daily off the opening print last night and now little changed.

Extra charts we’re watching

I’ve mentioned to a few people that I am launching a new monthly note in February that will appeal to more people, rather than the separate currency and commodity notes. It’s called The Big Picture, and it will cover what is happening across all markets, with structured ideas that range from trades for a month or two to longer-term trends. Look for more details soon. As you might know, I shifted more constructively long with commodities last September. Copper has been one of my favorite long ideas for the past year, and I mentioned it on the commodity weekly this past weekend. It’s higher now on day 8 of 13. It could still go higher.

Crude daily is doing all the right things now and could continue to do so. I don’t like it when it is at risk of Iran or something in the Middle East, so if it can lift with other commodities absent geopolitical volatility, then it’s game on.

Crude weekly with both Sequential and Combo buy Countdown 13’s at the lows with reversal over 50 week

US Dollar Index daily might see a bounce in the coming days with the likely buy Setup 9 tomorrow. RSI is oversold too at 22

US 10-Year Yield is steady today now on day 10 of 13 with Sequential and upside resistance now at 4.30%

Bitcoin Daily “Remember me?” Nobody talks about crypto these days! Risk remains still to the downside and on the daily chart if the wave 3 closing low and perhaps 80k (Big round number) breaks then the downside risk would increase.

The weekly topped with both Sequential and Combo 13’s albeit a little momentum was left. It did qualify into downside wave 3 (although not confirmed – need closing low for the week)

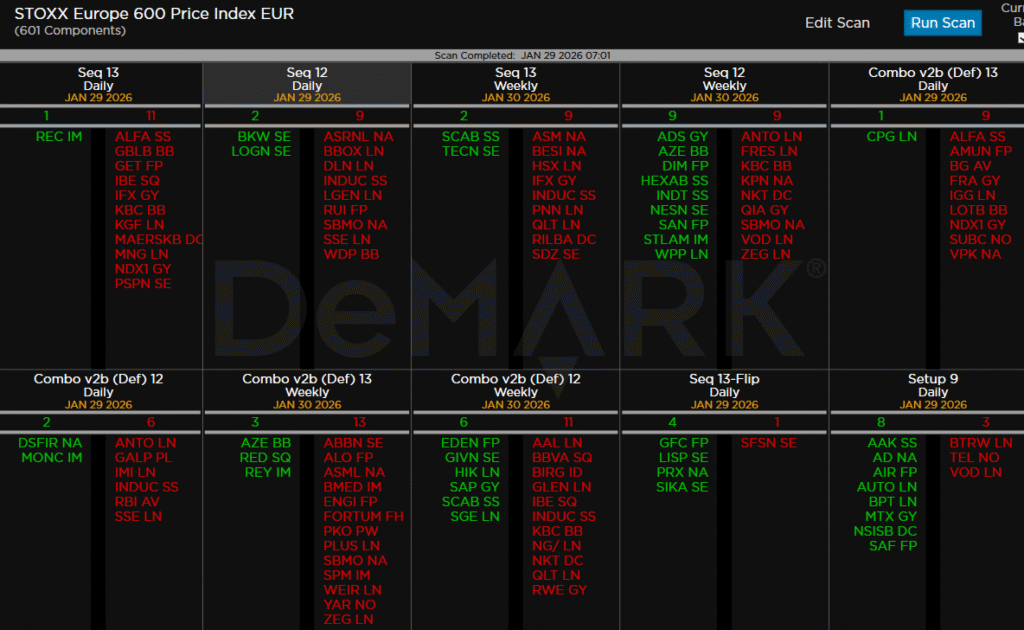

DeMark Observations – Euro Stoxx 600

- A rising cluster of Sequential 13s and Combo 12/13s on the daily AND weekly timeframe

- Signal skew favors exhaustion risk, particularly in cyclicals and financials