Everything has become binary in the markets. In this cycle, investors and traders are being pulled toward binary, event-driven bets (earnings, Fed, CPI, product launches, court rulings, AI demos, etc.) because the market structure now actively rewards short-horizon “all-or-nothing” behavior. It’s dangerous, as people are taking huge casino-like risks betting on binary short-term outcomes using risky strategies, such as short-term options and leverage, and the proliferation of prediction markets that have readily adopted sports betting, available via a brokerage account on your phone. This isn’t investing. It’s no wonder “buy good company and wait” is underperforming. Betting on an economic report or if Elon Musk will tweet more than 69 times in a day, with $1000 to make $5000 in 24 hours or lose it all, has an addictive payoff profile for many.

This behavior has led people to make bad decisions, often by taking a one-big-bet approach rather than diversifying. There’s a lot of FOMO involved and encouraged on social media and by brokerage firms like Robinhood, with hope, drama, identity (“I nailed NVDA’s earnings”), and a dopamine rush. When slow compounding is out of favor in uncertain environments, lottery behavior rises. So participants adapt by gambling on binary events not just because they are reckless (they are) but also because the structure incentivizes it. Robinhood appealed to new investors during the Covid lockdown since they ‘don’t charge a commission‘ and was in 2021 accused of gamification of investing with unsuspecting customers, offering margin, options without hesitation. Since then, they toned it down briefly, but when crypto and ODTE options became in vogue, they took advantage of the latest speculative trend. Today, with crypto taking a dump, they are going full steam ahead with offering prediction market/sports bets within a brokerage account.

In the past, the term “10 bagger” referred to a speculative bet on a stock with huge upside potential. Last year, the term “100 bagger” emerged for stocks that offered lottery-winning returns. It greatly disappointed me to see a person I know pushing these types of trades using bizarre social media posts to create an army of buyers, much like the GameStop and AMC days. The result was a binary event: most people lost money, leaving them holding the bag at much higher levels.

The current cycle is dominated by AI/platform stories centered on “Either this company wins AI…or it’s irrelevant.” I strongly disagree with the “Winner take all” thinking because, of course, AI will disrupt many business models; however, solid companies tend to adapt to new technologies. Yesterday, banks were down on some story of an AI company disrupting the wealth management model – using an AI agent vs a human. Software companies have seen huge declines due to the multiple ways AI will disrupt their models. They certainly have disrupted stock prices, and recently, I’ve started with small positions, with valuations way down and various oversold and exhaustion signals in play. The winner-take-all mentality will likely shift to companies that roll out their own AI initiatives to their existing customer base, which will be accretive to their current revenues. These companies are not looking to disrupt but rather to implement AI within their current offerings with a monetization strategy. Most are increasing capex carefully to enable the transition; however, they are not spending excessively. It’s opened up an opportunity to buy low at historically low valuations, while the riskier bet might be putting money on the hyperscalers who are spending absurd amounts to be that binary winner-take-all. These hyperscaler companies don’t mind spending more than their cash flow allows, even as they now take on substantial debt. Other technology cycles saw companies spend like crazy, creating overcapacity and, in hindsight, waste. The legacy software companies might be AI compounders, and not AI lottery tickets.

Investing is not a binary event; it’s a process. It takes work, discipline, and a repeatable process that manages risk with position sizing. It also takes time and patience. The current environment has many people taking huge risks with short-term binary win-or-lose trades/bets. The pattern of boom-busts is well-documented across bubbles, manias, and late-cycle melt-ups. This time is not different, as human psychology will never change. Understanding this is essential if you want to be successful in the long term when investing in the markets.

It’s sometimes amusing when I get feedback from a particular idea I recommended in the past. A year ago, I had a subscriber send a very angry email because he put “a lot” into the three uranium ideas, and they went down 10%-20%. The day he sent the email, I was adding to them as I often do, buying a 2% weight and then adding up or down to a max of 5%. He unsubscribed. I recently got an email from him this week saying I was right on with those, and he wanted to know if they still had upside to buy from here, and if I would give him a discount if he returned as a subscriber. Keep in mind, these are up well over 100% from a year ago. I said I am looking elsewhere for ideas that are oversold, out of favor, well valued, and showing exhaustion signals. I also said no to a discount. The funny thing is, after 9 years (the subscription service), I can tell when I’m about to get hot with ideas and when it’s likely to be a period of consolidation by the number of people subscribing and unsubscribing. I have a strong subscriber base (thank you), but I can tell by those chasing performance. Culling some of the chasers happens, and the real investors, I know get much more from my work than a short-term trade.

A few people asked for the link to join our Slack Channel. Here it is. I’m going to do a Market Update webinar on Friday – here’s the link to register.

Quick Market Views

Stocks: The S&P is up 0.1%, NDX up 0.3% and Russell down 0.5%. Breadth is mixed with NYSE up 230 net issues, Nasdaq down 1100 net issues with S&P up 287 down 215 issues. Energy is leading with Consumer Staples next best sector. Mag 7 is down 0.35%. Sideways consolidation after the recent two day bounce.

Bonds: Rates are higher with 2’s up 6bps, 10’s up 3bps, 30’s up 3bps – the strong jobs data reversed bonds

Commodities: Mostly all up with Crude up 1.5%, Natural Gas up 2%, Grains mixed with Wheat leading, Copper up 1%, Gold up 1.5%, and Silver up 4.5%

Currencies: US Dollar index is little changed after moving higher after the strong jobs data. Bitcoin and other cryptos are under pressure with Bitcoin down 1.6%

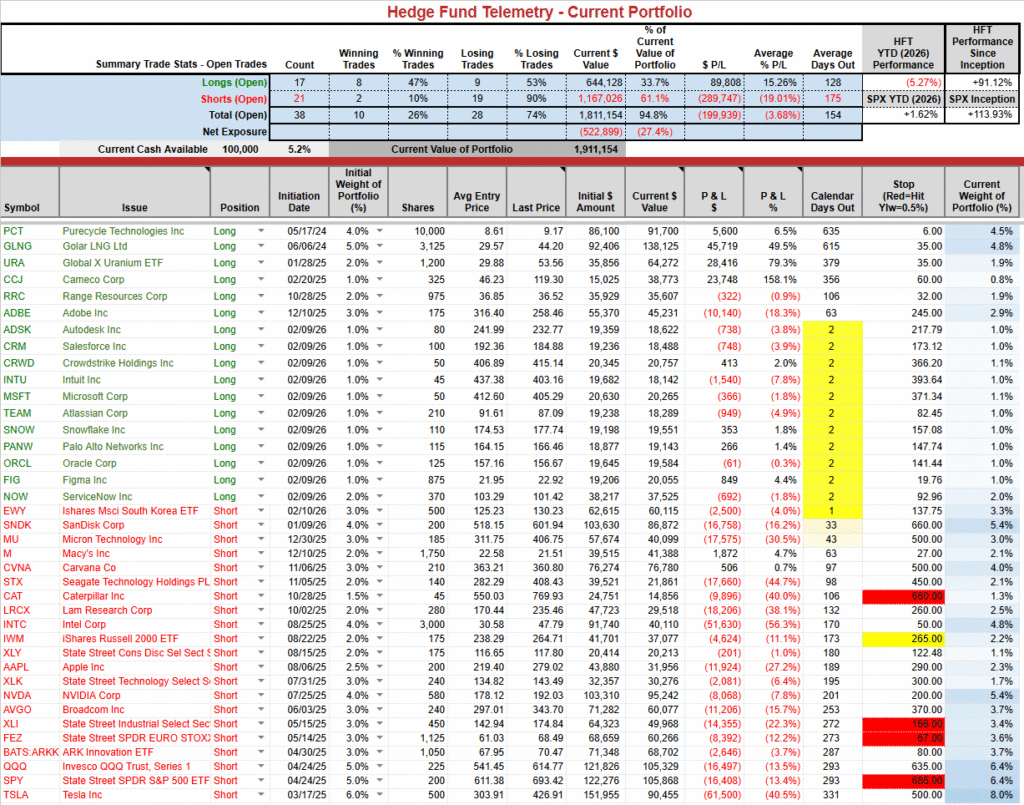

Current Portfolio Ideas: Giving back some today

Changes: I will add 1% to the ADSK and TEAM long ideas, bringing them to 2% weights

Thoughts: Yesterday, I said there was a little rotation from semis to software and stressed that it would take some time; I will reiterate this belief. GLNG continues to trade well with no news. CVNA is down hard today on reports that a court case will allow documents from the related private company absorbing the losses for CNVA. Stay tuned.

US INDEXES

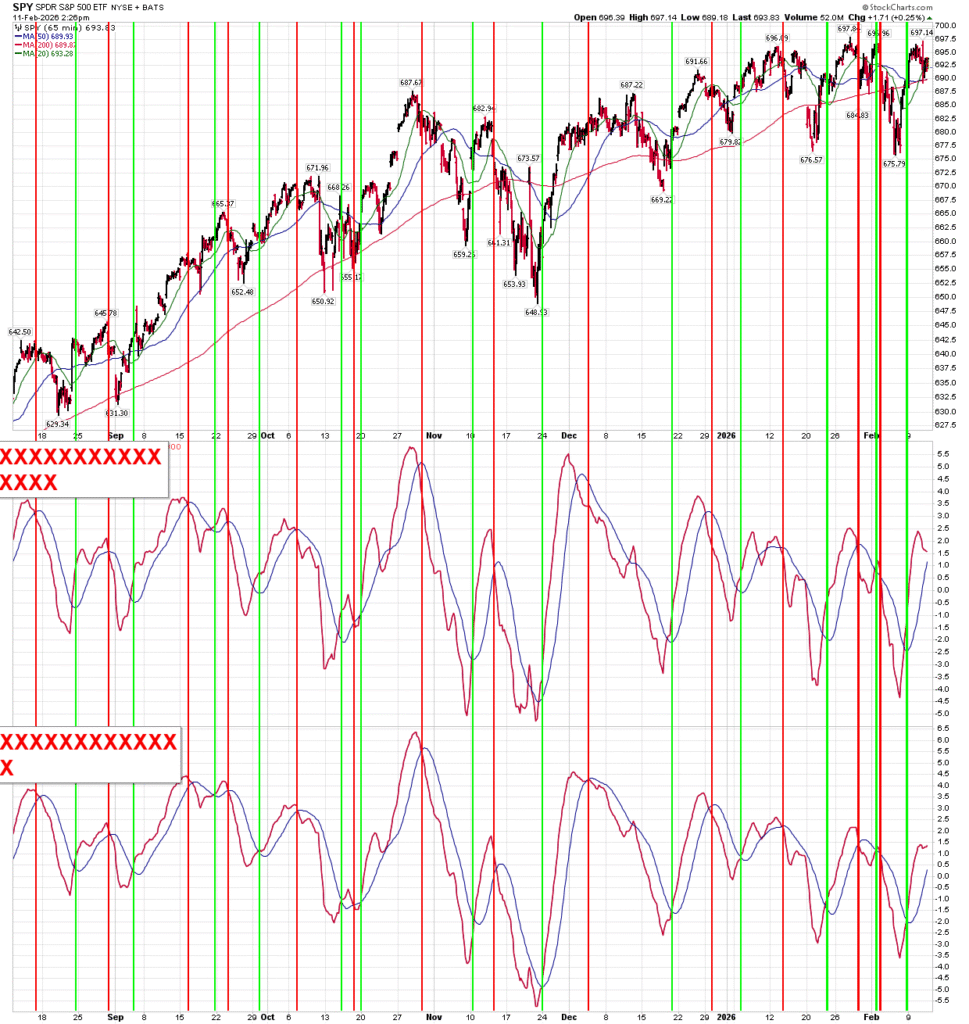

S&P futures 60-minute tactical time frame continued stalling

S&P 500 Index daily nothing new to report with the action still in a range. The red arrow down is a DeMark Camouflage. Gap up, below open but still up on the day. A sign of underlying selling. Happening on NDX too

Nasdaq 100 futures 60-minute tactical time frame similar to the S&P 60 minute stalling still after the recent bounce.

Nasdaq 100 Index daily has been going nowhere since October

Dow Jones with new Combo 13.

Current Portfolio

ADSK should get the Sequential buy Countdown 13 tomorrow. I’ll add 1% to bring to 2% long

With the SPY and QQQ chopping and mostly sideways in the last few days the buy signals remain but the indicators are starting to pinch so they could turn to sell in the coming days.

earnings previews – APP, CSCO, MCD

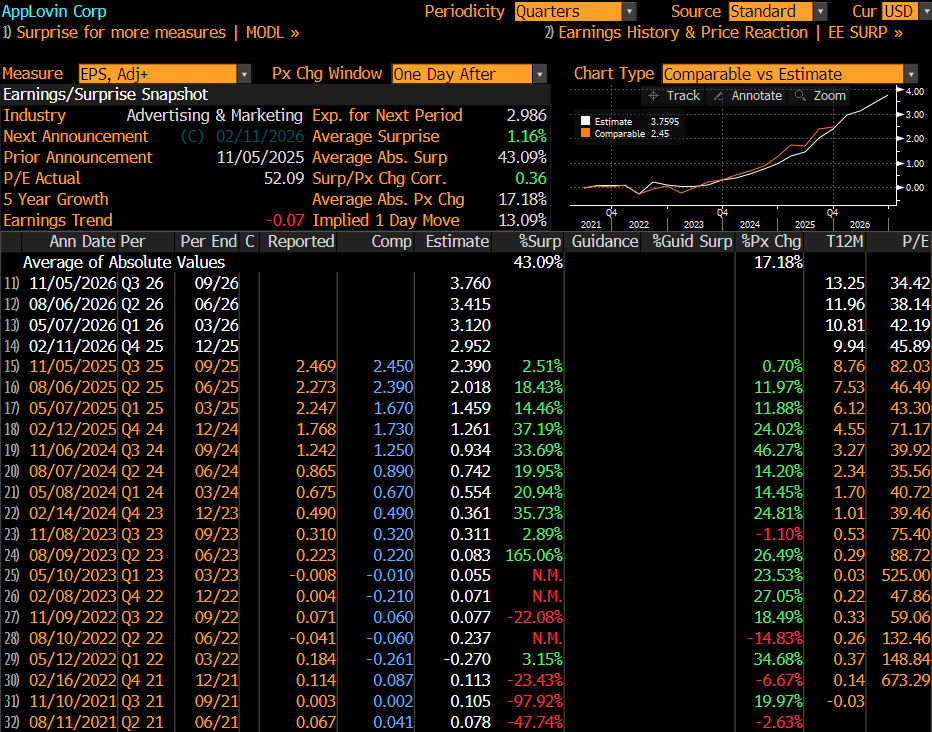

APP (AppLovin) reports Wednesday after the close with fundamentals still well-liked, though recent tech volatility has raised sensitivity around high-multiple momentum names. The core monetization and platform leverage story remains intact, but positioning increases the importance of guidance. The Street expects EPS +70% to $2.95, EBITDA +57% to $1.33B, and revenue +17% to $1.61B. The reaction will hinge more on forward margin sustainability than Q4 upside. I have traded this one well despite the wild moves. I recently covered the remainder of this due to the decline (duh), the pending DeMark buy Countdown 13’s – this only got to day 12 so it is is possible if this is down or flat tomorrow. Add in the heavy put buying that caused this upside squeeze. I will happily sit this one out with the implied move and average price move after earnings more than my liver can handle. Sometimes after doing well at a Blackjack table it’s good to walk away for a while.

The implied move is very high at 13% and actually less than the average move of 17%. Last Q it didn’t even move 1% likely crushing the options traders.

Short interest has been moving lower since October with 1.93 days to cover. More informative the Options Rank shows heavy put buying with the green dots giving some potential for an upside squeeze.

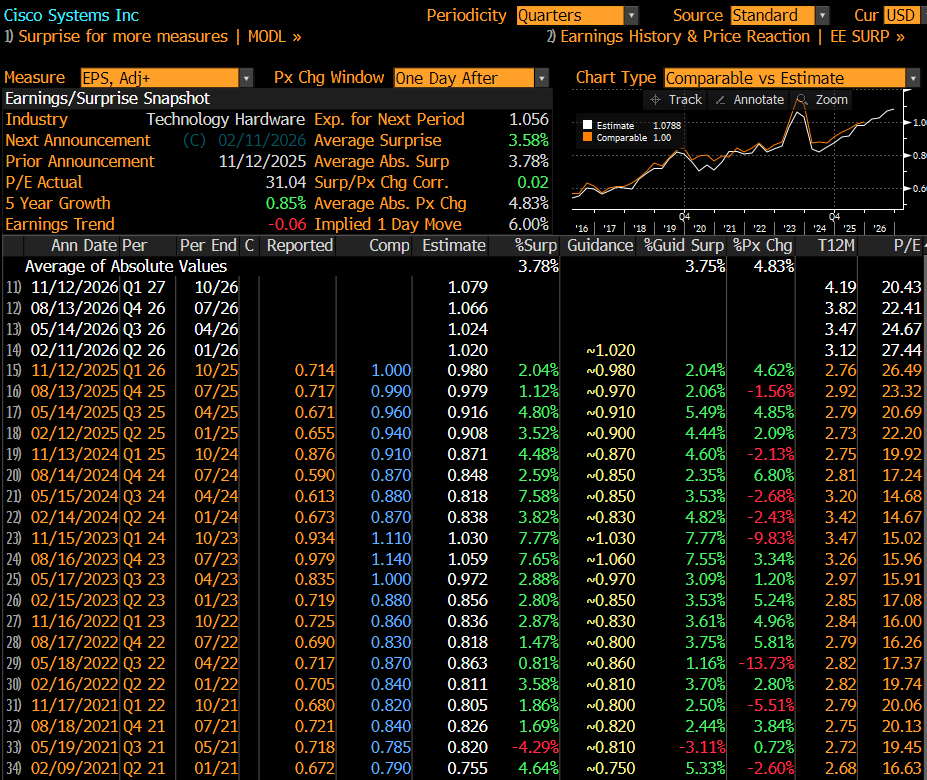

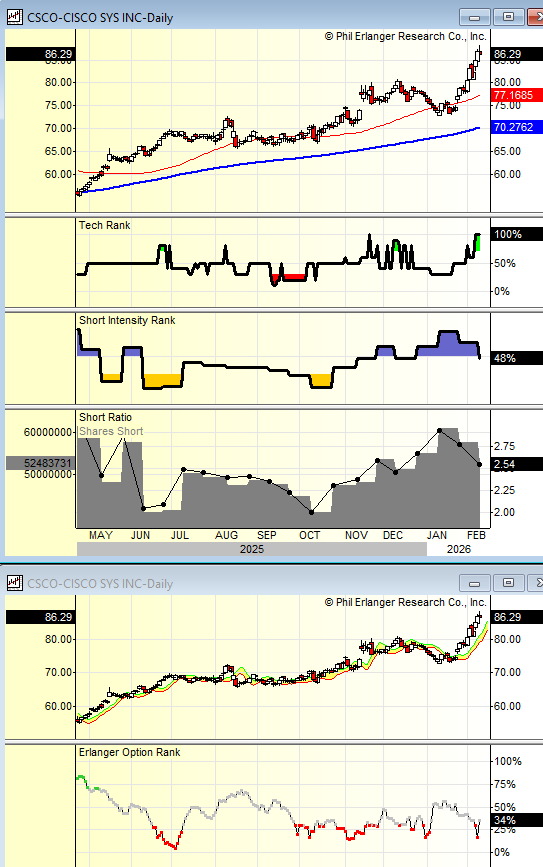

CSCO (Cisco) reports FQ2 Wednesday after the close with sentiment quietly bullish following several quarters of consistent execution. The company benefits from solid enterprise and data center demand, selective AI exposure, reasonable valuation (<20x PE), and dependable capital return. The Street models revenue +8% to $15.1B (Networking +14.7%), gross margins of 68%, and EPS of $1.02. Investors will focus on order momentum, AI-related networking demand, and backlog trends. The last earnings report gapped higher and faded. This move might have cleared out some recent shorts thus limiting squeeze potential. I’ll sit this one out but I’d lean slightly (barely) long as they will highlight how wonderful their AI stuff is like they did last quarter

The CSCO weekly has a new Combo 13. To think this peaked in 2000 and just made a new high is incredible.

The implied move is 6%

Short interest has declined over the last 6 weeks and is likely even lower after the recent squeeze higher. On the Options Rank there has been moderate heavy call buying with the red dots.

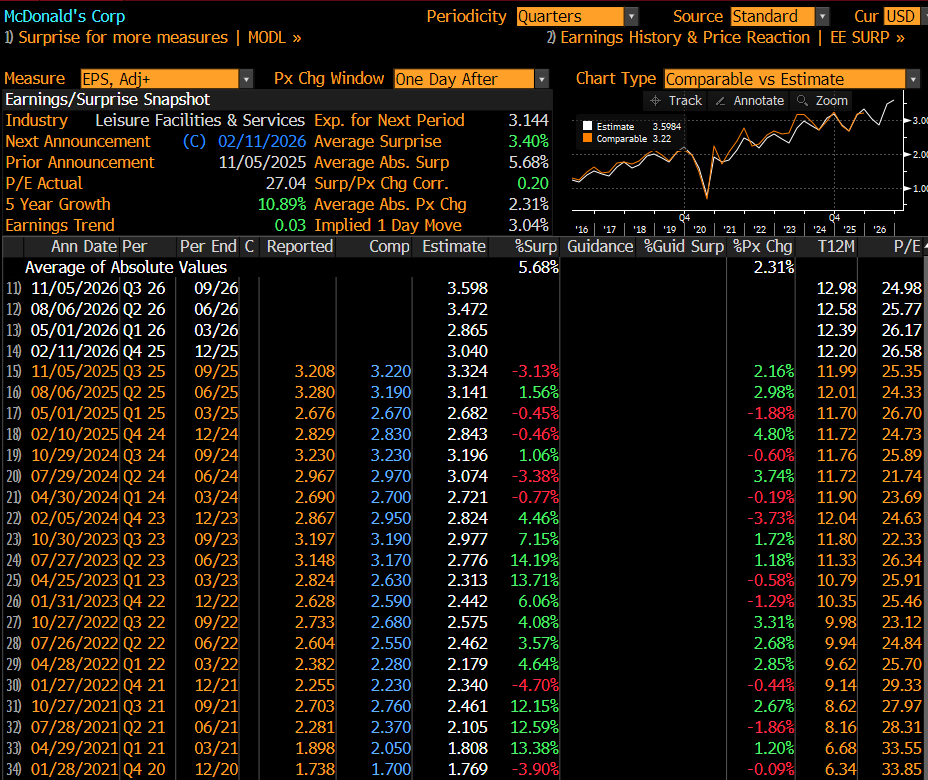

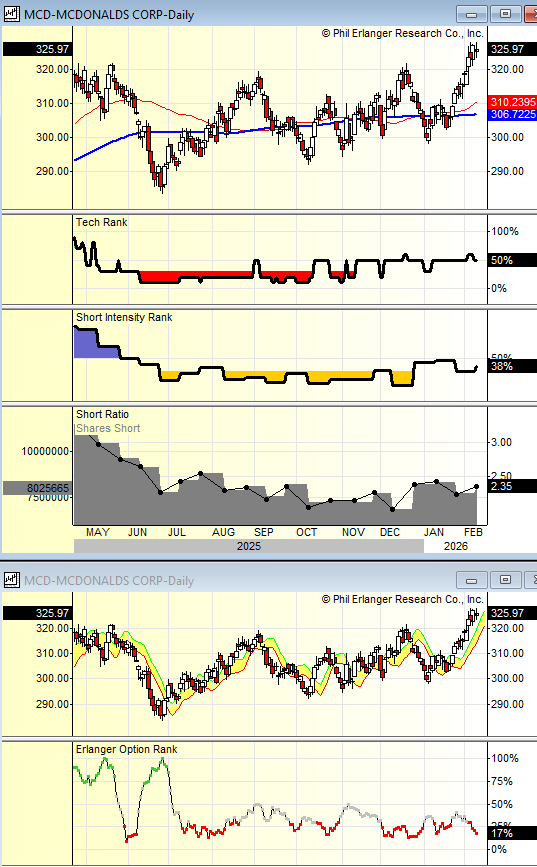

MCD (McDonald’s) reports FQ4 Wednesday pre-open with sentiment steady and constructive, as investors increasingly view the stock through a staples/defensive lens rather than discretionary. The company is expected to leverage scale, value positioning, and operating discipline to capture share in a mixed consumer backdrop. The Street is modeling comps of +3.7% (US +4.8%), operating margins of 45.8%, and EPS of $3.02. Focus will be on US traffic durability and margin resilience more than the headline beat. MCD tends to move on comps and with the stock poking higher there is potential for it to continue however since this rarely moves more than 3% and a slight concern is high call buying. Sidelines.

The implied move is 3%, and historically, that’s about what to expect after earnings.

Short interest has been steady and not very informative. On the Options Rank there has been heavy call buying with the red dots. A bit of a risk lower with the short term call buying.

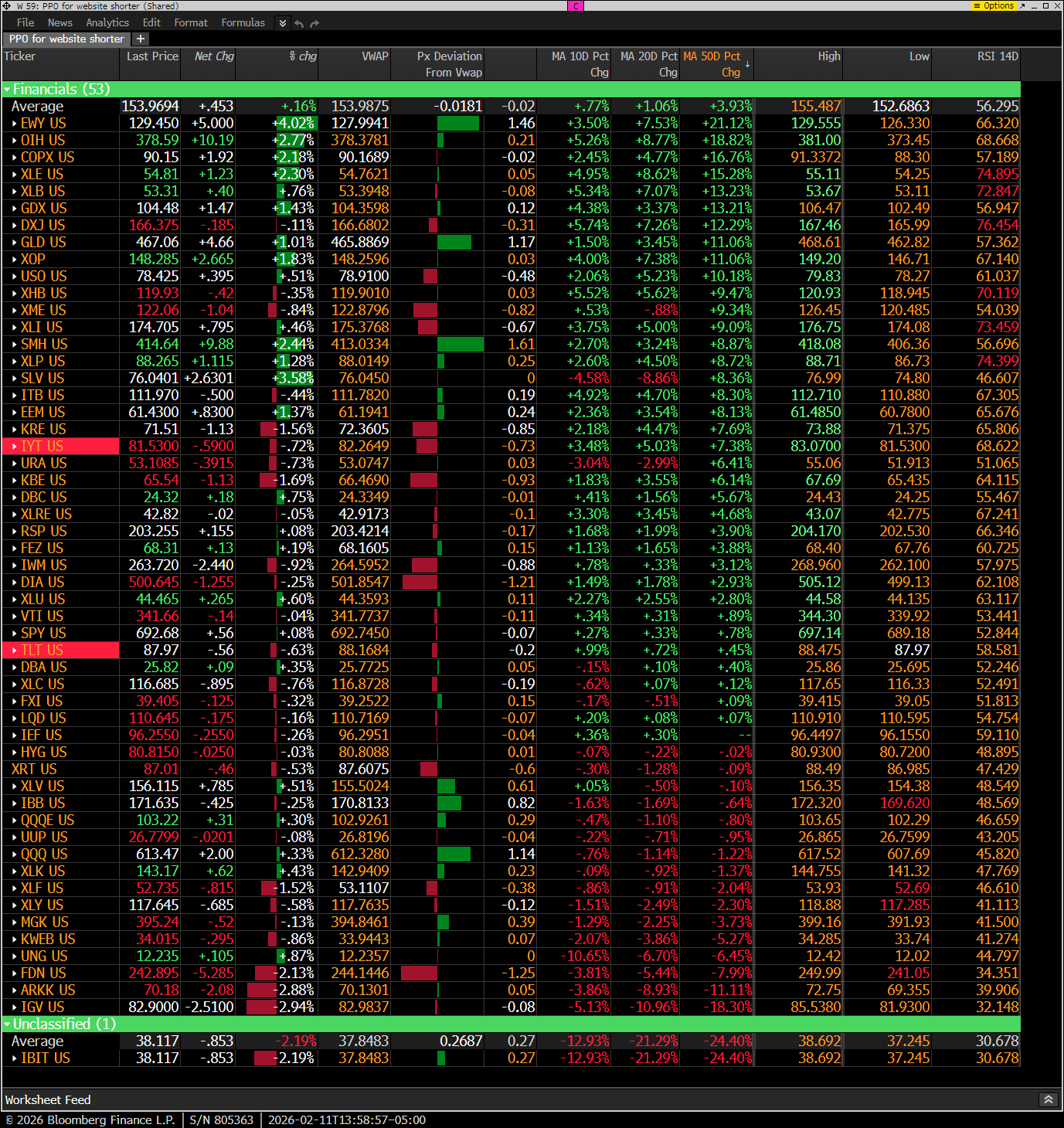

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. Mixed action with what has been working the best today and what has not been working is being sold. Rotating from yesterday’s rotation.

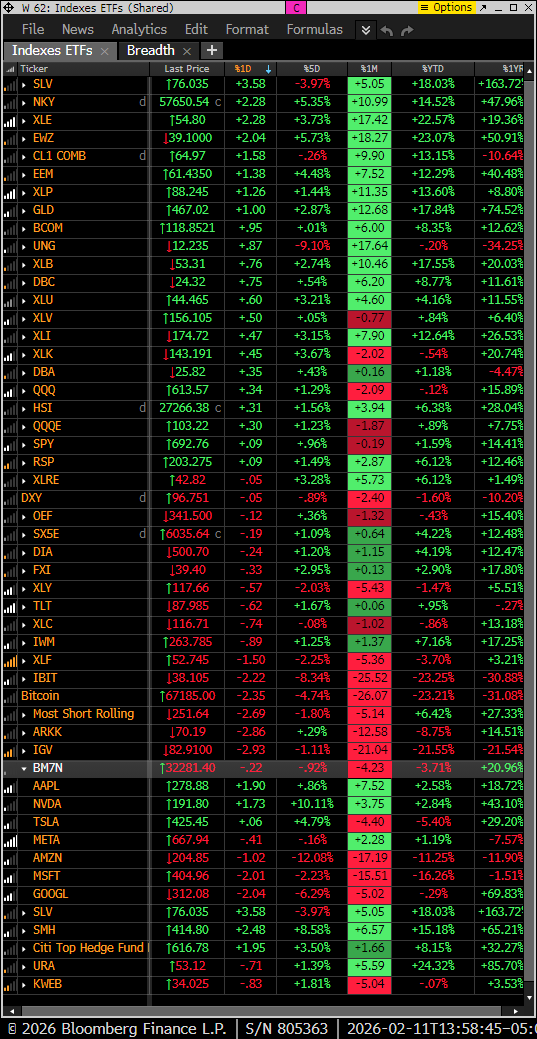

Index ETF and select factor performance

ETF with today’s performance with 5-day, 1-month, and 1-year rolling performance YTD.

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Short baskets are mostly down on the day and have been outperforming the S&P recently. Shorts down = they are making money/S&P up less.

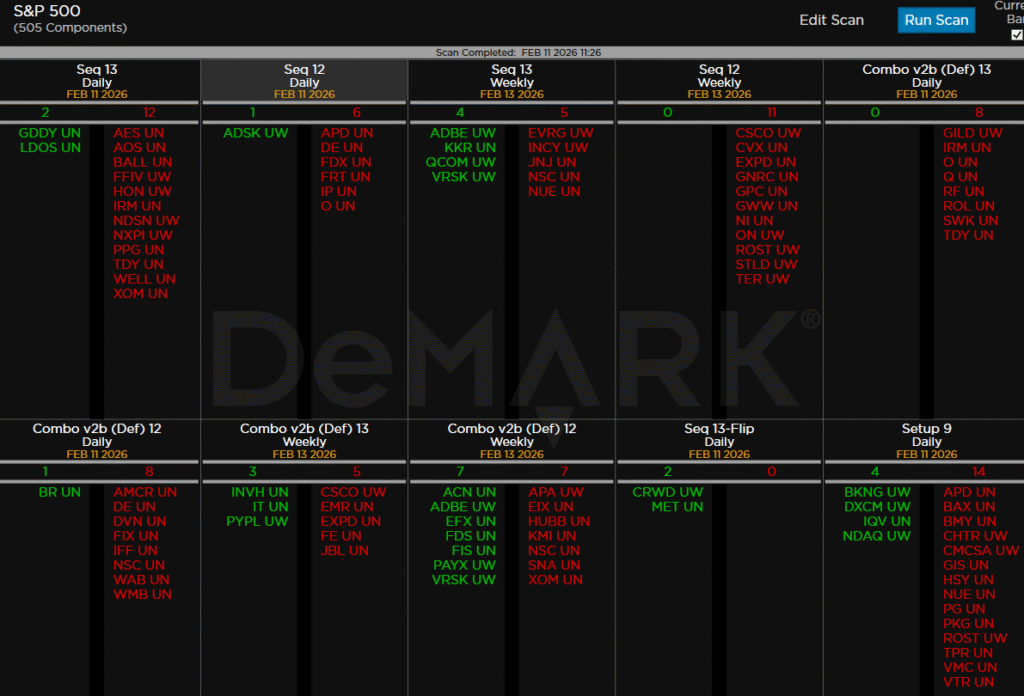

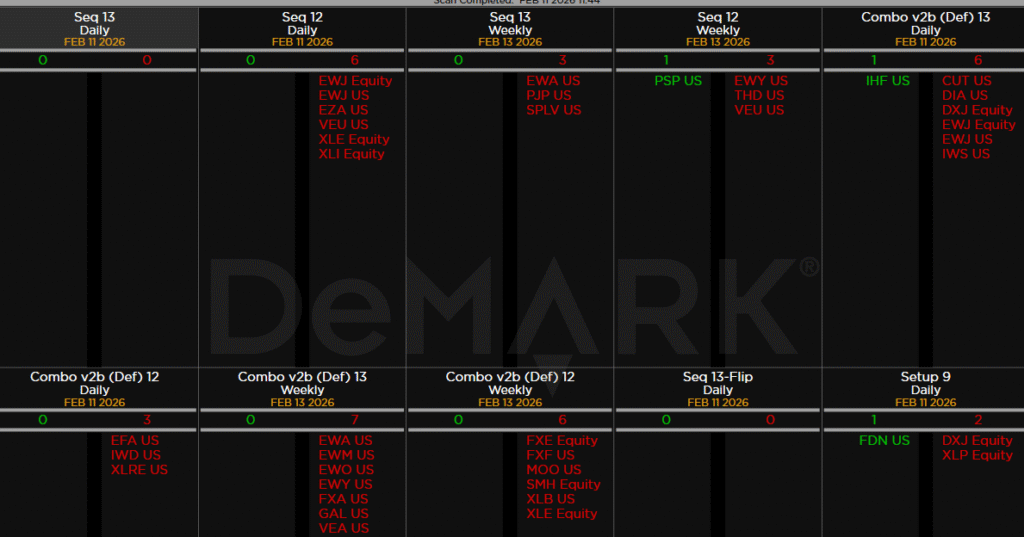

DeMark Observations

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: Seeing more sell signals on daily and weekly time frame. Perhaps some names you’re following? XOM, FDX, CSCO, DE

Major ETFs among a 160+ ETF universe. XLE and XLI with Sequential on day 12 of 13

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research