What we’ve learned over the past five years is that speculative capital doesn’t disappear — it migrates. The same cohort keeps showing up, just wearing a different costume. I’ve called these people “Stock Nomads.”

Phase 1: Meme Stocks (2020–2021)

The modern template begins with GameStop, AMC Entertainment, Bed Bath & Beyond, and the Reddit-driven retail surge.

- Narrative dominance over fundamentals

- Float obsession, short interest as “fuel”

- Price action divorced from cash flow, earnings, and valuations

- Ended with violent mean reversion once marginal buyers exhausted

Key tell: social coordination on Reddit + linear upside assumptions.

Phase 2: SPACs & Zero-Rate Optionality (2020–2022)

As meme fatigue set in, the crowd rotated into SPACs — pre-revenue companies sold on TAM “total addressable market” and forward dreams.

- Valuation anchored to future hypotheticals

- Peak issuance marked the top, not the bottom

Key tell: projections replacing earnings, dilution ignored.

Phase 3: Crypto & NFTs (2021–2022)

Next came digital scarcity narratives — Bitcoin, Ethereum, and NFTs.

- Price momentum validated belief systems

- “Adoption” used as a substitute for cash flow

- Reflexivity collapsed once liquidity tightened

Key tell: price = proof of concept.

Phase 4: Metals as a “Safe-Haven Trade” (2025–present)

Between the crypto unwind and the next thematic wave, speculative capital made episodic lunges into metals, particularly SPDR Gold Shares and iShares Silver Trust. The latest surge was supported by CNBC and other business stories focused on the huge gains in GLD, and more so, SLV. When that happens, it’s crowded.

These moves were marketed as macro hedges — inflation, debasement, geopolitical stress — but the behavior was still speculative, not defensive.

- Momentum-driven inflows vs allocator rebalancing

- Leverage and options activity dominated short-term flows

- Silver, in particular, traded like a high-beta risk asset, not a store of value

The most recent example was telling: after sharp upside bursts, both GLD and SLV broke hard last Friday, with price rolling over decisively once momentum stalled. There was no slow distribution — just air pockets once the narrative lost traction.

Key tell: assets framed as “insurance” trading with risk-on volatility and failing at the first sign of pressure.

Phase 5: AI & Semiconductors on-Steroids (2024–Present)

Today’s iteration centers on AI—the most institutionally palatable form of speculation yet.

- Real revenues, but extreme multiple expansion

- Growth assumptions pulled forward decades

- The scarcity story of the memory chips after 2 years of having no issue comes to the forefront

- Narrative elasticity masks valuation risk

This is where speculation wears a suit: institutional buy-in, surprisingly, after the retail crowd, real products, but still driven by extrapolation rather than marginal returns.

Key tell: price action accelerating faster than estimate revisions.

Overall, this trend of speculators moving from one shiny new thing to another will end because retail is all in, complacent, levered, using call options, and institutional investors are also involved. I expect it will end when the major indexes break down from the recent sideways range.

I have earnings previews below for key stocks reporting through Wednesday. And as I mentioned, I will be traveling on Friday and will not be posting notes. The BLS announced it will postpone the January jobs data due to the government shutdown.

Quick Market Views

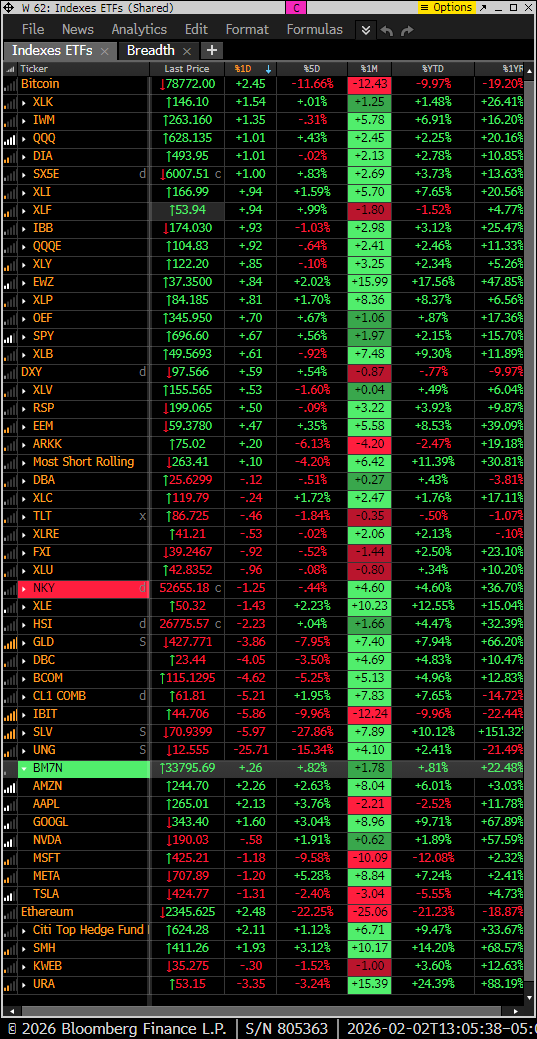

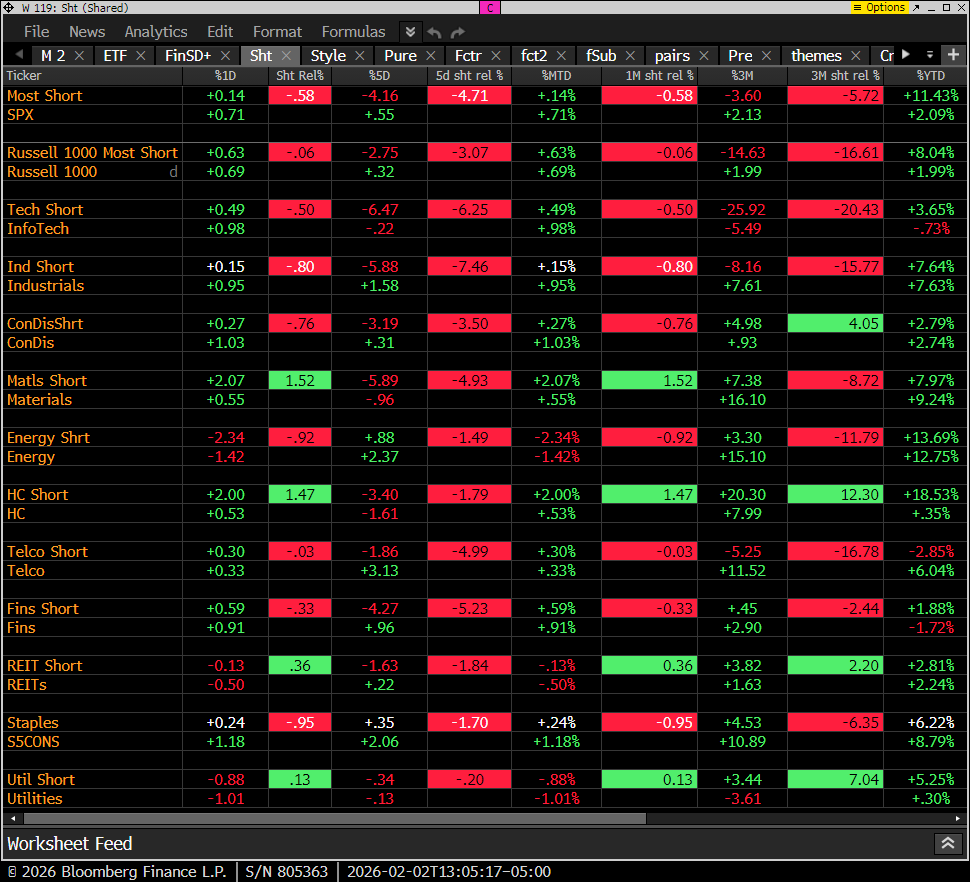

Stocks: Strong bounce back with indexes and speculative mix with defensives and what worked a week ago down hard. Mag7 is mixed with AAPL, AMZN, GOOGL up with META, NVDA, TSLA, and MSFT down. Staples is the best sector – thanks mostly to WMT leading. Short baskets are not seeing squeezing as this is a chase into the more crowded larger weights in the sectors.

Bonds: Rates are ticking higher up 4bps with breakout levels getting closer. This is a macro and equity market risk.

Commodities: A big down day with the Bloomberg Commodity Index down 4.5%. Crude is down 5% (Iran fears lessened). Natural Gas is down 26.5% – with a little warmer weather on the east and concerns about the Carolinas cold in the past) I sold the UNG long on Friday thankfully locking in a 26% gain. Copper and Gold are down 2% and Silver up 0.5% – (futures not ETFS)

Currencies: US Dollar strength continues up strong +0.75%. Bitcoin is bouncing +1.9%

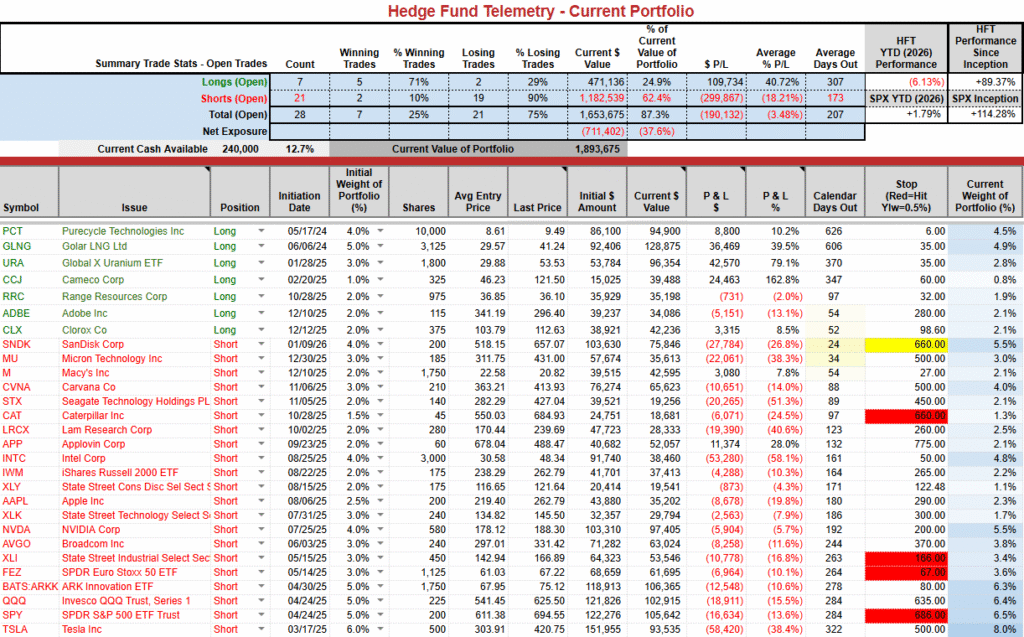

Current Portfolio Ideas:

Changes: The short-term SPY and QQQ momentum should confirm a back-to-buy by going to print. I covered the PLTR short ahead of earnings, locking in a hard-fought gain. I have earnings previews below and all I want to do is buy a Feb 6th expiration PLTR 150 straddle – buy the 150 put and 150 call for ~$15. See below I will trim 1% URA long to bring to 2% from 3% as it’s been one year since we started buying URA. URA is up 88% YoY.

Thoughts: Good old Elon Musk, who has had challenges with the truth over the years with his business promises, showed up in the Epstein files after denying he ever basically knew Epstein or GMAX. His solution to this revelation about his relationship with Epstein is to float the idea of merging one or all of his companies. The latest talk is SpaceX buying XAI. Tesla bought SolarCity years ago to make Elon whole, along with his family, as it was nearly bankrupt. I’ve seen in the past that mergers can create a lot of accounting holes that go into the abyss. XAI is a company bleeding cash. I doubt he’ll take the optionality off and will want SpaceX to go public. Memory chips are up again today, and it’s more about the above discussion. By the way, DRAM spot pricing has been declining in the last week. That will matter when the prices of the memory chips fade.

US INDEXES

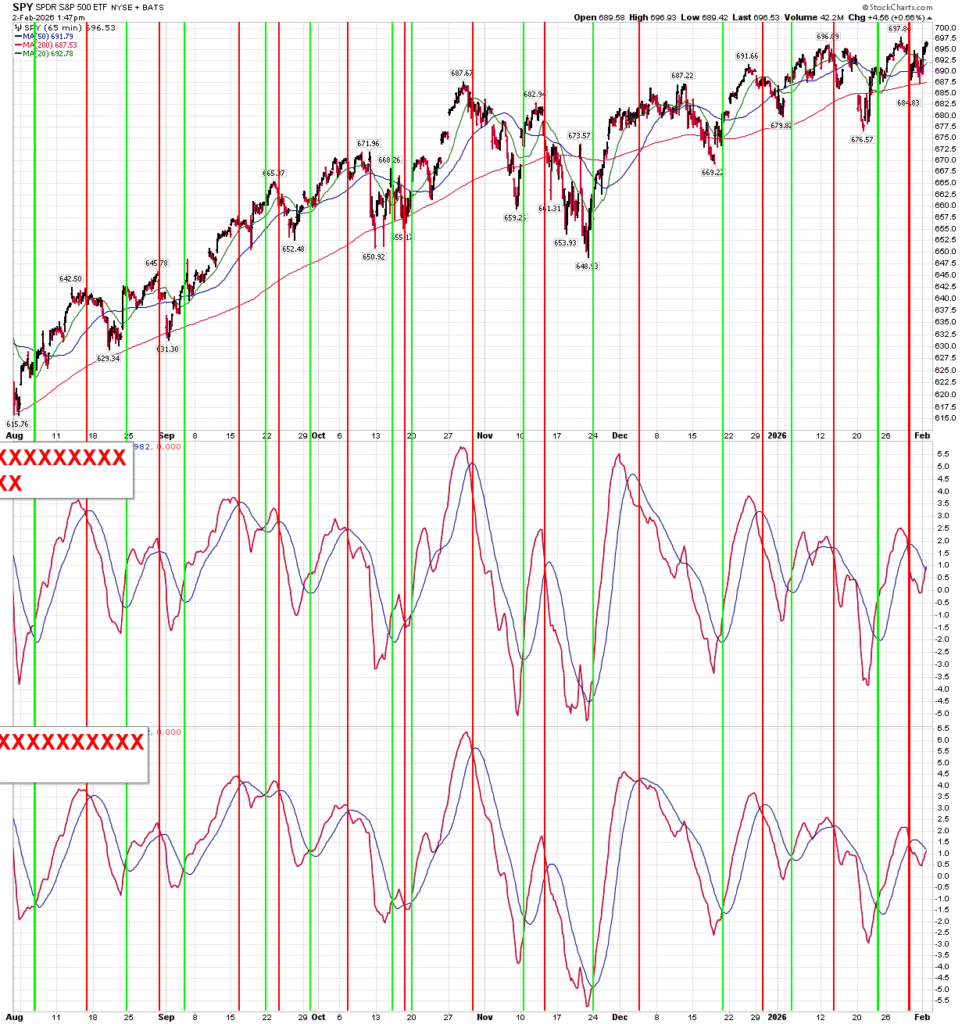

S&P futures 60-minute tactical time frame with strong snapback after last week’s weakness. New sell Setup 9 which has been good at inflection points. There is potential for continuation with the Sequential on hour bar 4 of 13.

S&P 500 Index daily sideways range with recent Combo 13. 50 day is first support.

Nasdaq 100 futures 60-minute tactical time frame with new Sell Setup 9 which has worked well at inflection points

Nasdaq 100 Index daily range bound with 50 day as near term support. Bigger support at the TDST Setup Trend at 24,239

Current Portfolio

The choppy narrow action has the short term SPY and QQQ nearly confirming back to buy signals. Expect whips in this environment.

earnings previews through wednesday

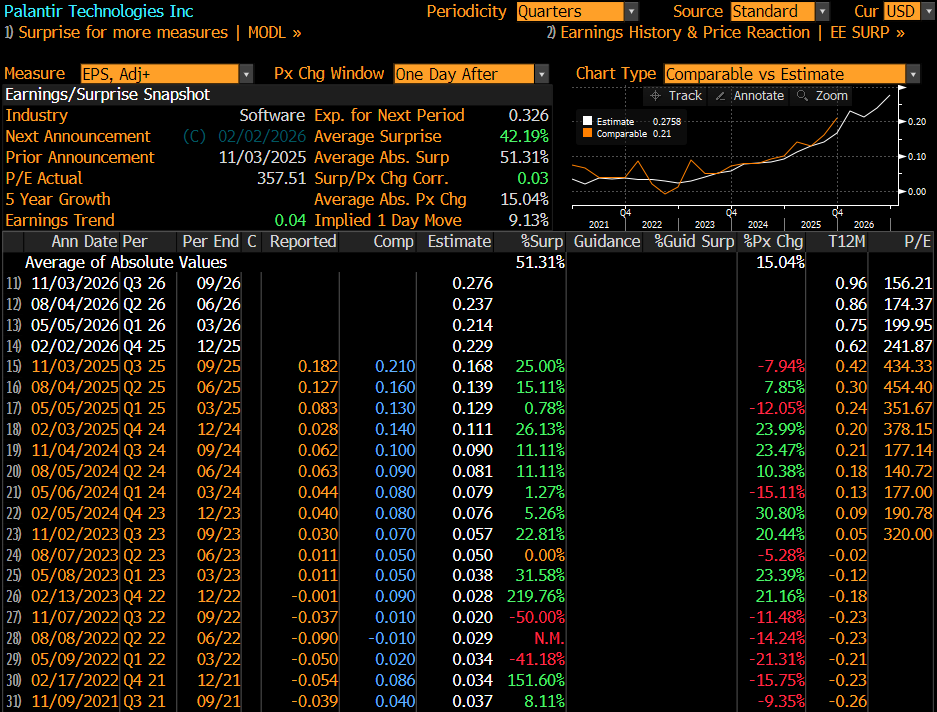

PLTR (Palantir) – Fundamentals remain strong, but valuation is the gating factor (300+ PE for example) and expectations are extreme. The Street is modeling Q4 revenue +61% to $1.33B, EPS 23c, and 52% op margins. Setup is asymmetric: execution likely solid, but multiple risk dominates any incremental upside unless guidance materially re-anchors growth durability. I covered the short position this morning. Short interest isn’t a factor as there is only 2% of the float short but the options traders have been heavy buyers of puts – that could cause a squeeze. The daily chart broke the 200 day and November lows now in downside wave 3 of 5. The weekly shows the precarious break with nothing but air under if the response is negative. I bought the Feb 6th expiration 150 straddle for ~$15. If this goes up to 165, I break even but if this goes off the cliff the downside could be worse as there are a lot of speculators in this one at higher levels.

The implied move is 9.13% below the average move after earnings of 15%. This is one reason I am buying a straddle.

Short interest has moved lower overall in the last year. Only 0.61 days to cover which is more due to it trading heavy volume each day with the day trader crowd. On the Options Rank there has been heavy put buying again and that has worked well for upside moves.

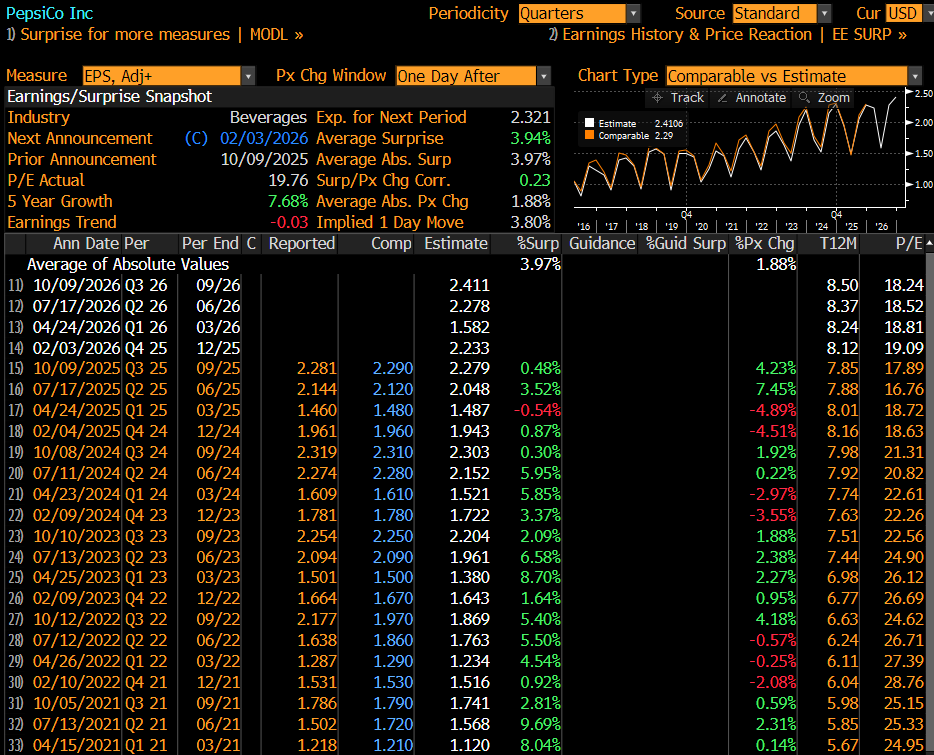

PEP (PepsiCo) – Staples sentiment is cautious, but beverages remain the preferred pocket and management’s restructuring/value-creation narrative is a partial offset. The Street looks for Q4 organic growth +2% (NA food -1.5%, NA beverages +1.8%) with EPS $2.23. Focus will be on mix, pricing durability, and margin protection rather than top-line acceleration. The two charts below show this moving up over 10% into this report back to resistance where it has pulled back. I will be happy to sit on sidelines as there is no edge – I would prob lean short but again I’m doing nothing

The implied move is 3.8% and this generally has not moved much after earnings

Short interst has been rising in a choppy chart with 2.63 days to cover. Some of that might have covered with the recent move up as short interest can be stale. On the Options Rank this is a good example of why this data can be valuable. A the lows there was heavy put buying with the green dots – and the price moved up. Now there is heavy call buying with the red dots.

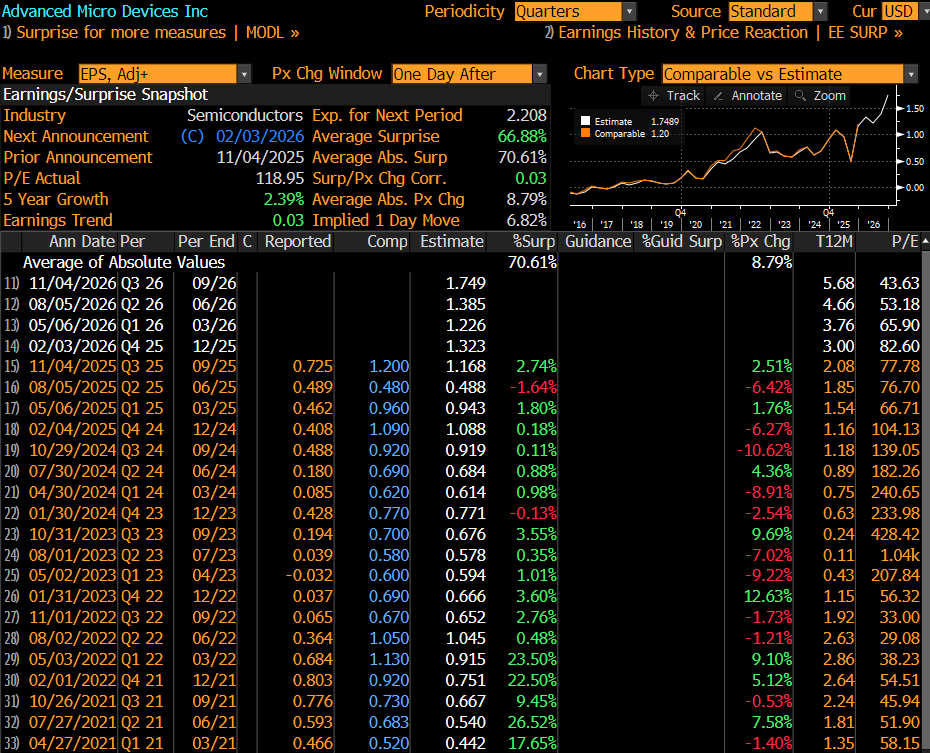

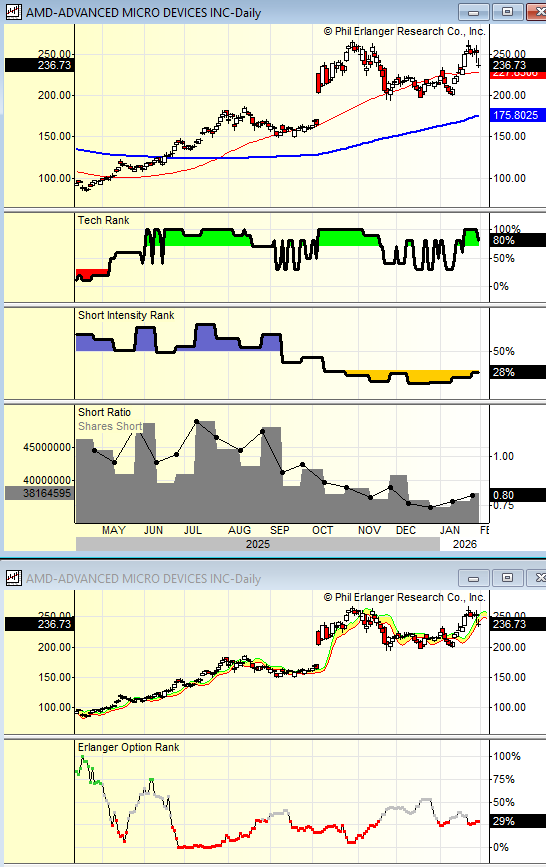

AMD (Advanced Micro Devices) – Sentiment is constructive on share gains from new launches and partnerships, though investors remain mindful of competitive pressure between NVDA and custom accelerators. For Q4, the Street models revenue +26% to $9.63B (Data Center +28.7%, Client +24.5% to $2.88B), GMs 54.5%, and EPS $1.32. Guide and AI revenue visibility matter more than the quarter. INTC client was weak and they could also have issues with the higher memory prices but the AI talk will dominate. Recent Combo sell Countdown 13 on the highs. I was short this and made money recently but I don’t have a strong read to buy or sell.

The implied move is 6.82% below the average post-earnings move of 8.79%. Mixed action after earnings gives few clues

Short interest has moved lower in the last 6 months with 0.8 days to cover. On the Options Rank there is moderate-heavy call buying again with red dots.

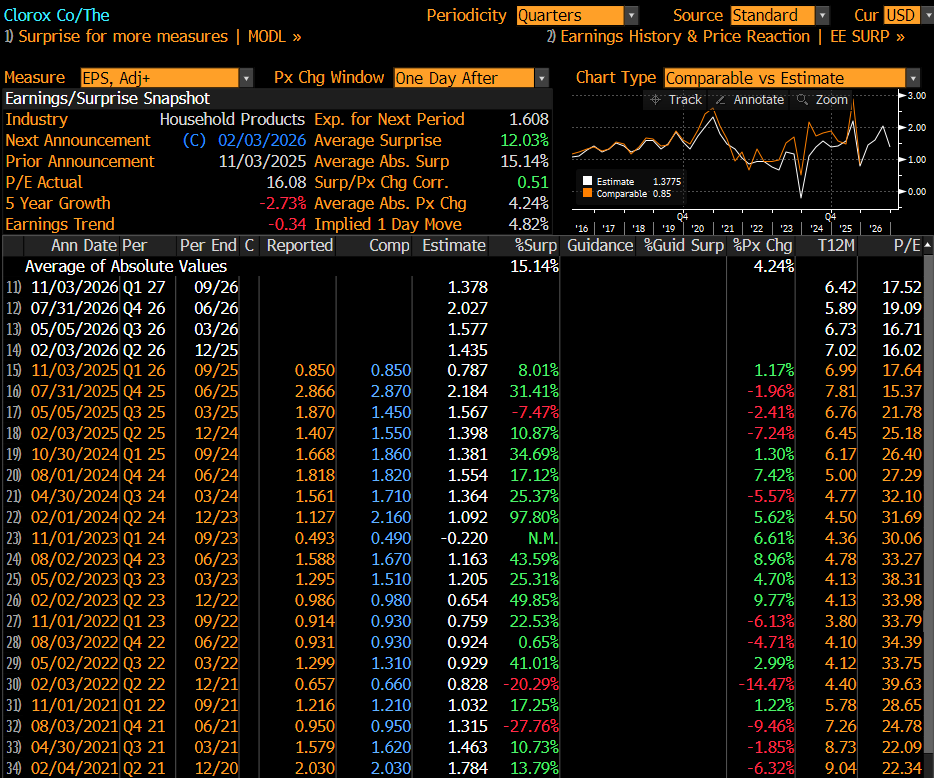

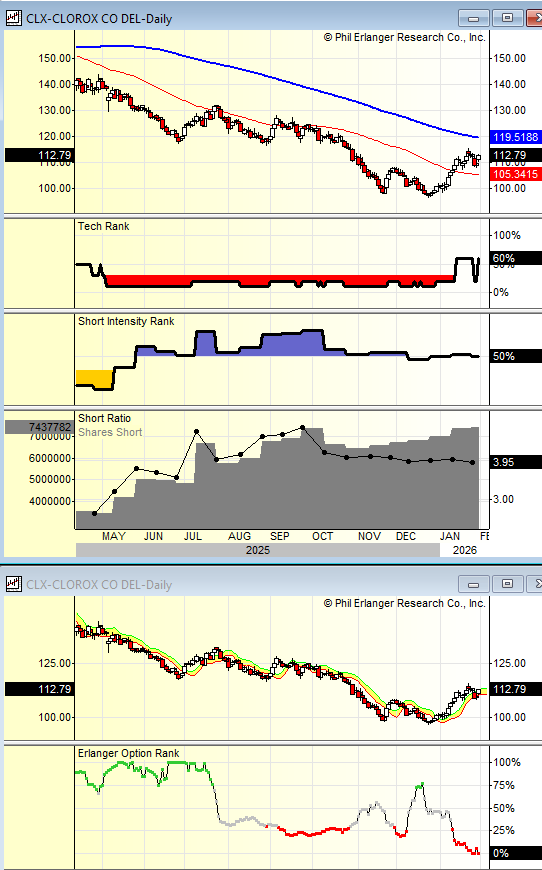

CLX (Clorox) has been a defensive idea that is working as we bought it lower. The daily chart is above the 20 and 50 day and has an upside Sequential on day 4 of 13. Since I have a gain in this I will hold this and absorb any downside risk.

The implied move is 4.82% and generally doesn’t trade that much up or down after earnings. It’s cheap at 16x

Short interest has been steady with nearly 4 days to cover (it doesn’t trade volume like others more in focus each day). On the Options Rank I bought this when there was heavy put buying with green dots and now it has heavy call buying. That is a bit of a concern for being long into the print.

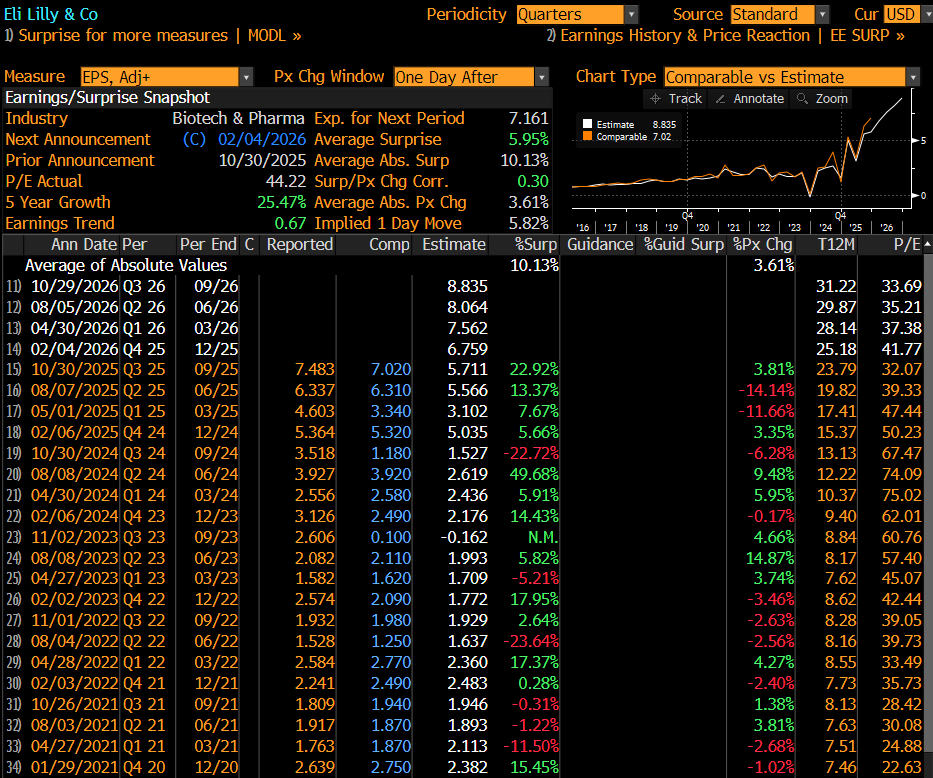

LLY (Eli Lily) is the most important HC name (largest weight), and I admit I do not like trading HC because the specialists have a much better read. The stock must hold 1000, as it has been trading sideways since November. There is an upside Sequential on day 6 of 13, so it’s possible to see higher, but the large crowded-ness with this one, people won’t ask questions and sell breaking this support.

The implied move is 5.82% with a few real downside moves in the last year after earnings – which is a little concerning.

Short interest has moved higher in the last 6 weeks with 2 days to cover. On the Options Rank there was heavy call buying with the red dots and now setup more neutral with some skeptics buying puts but not heavy

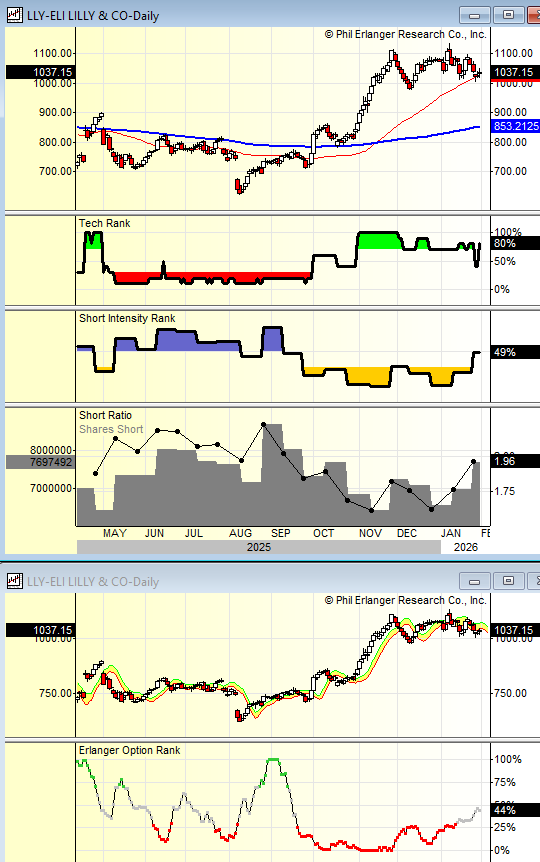

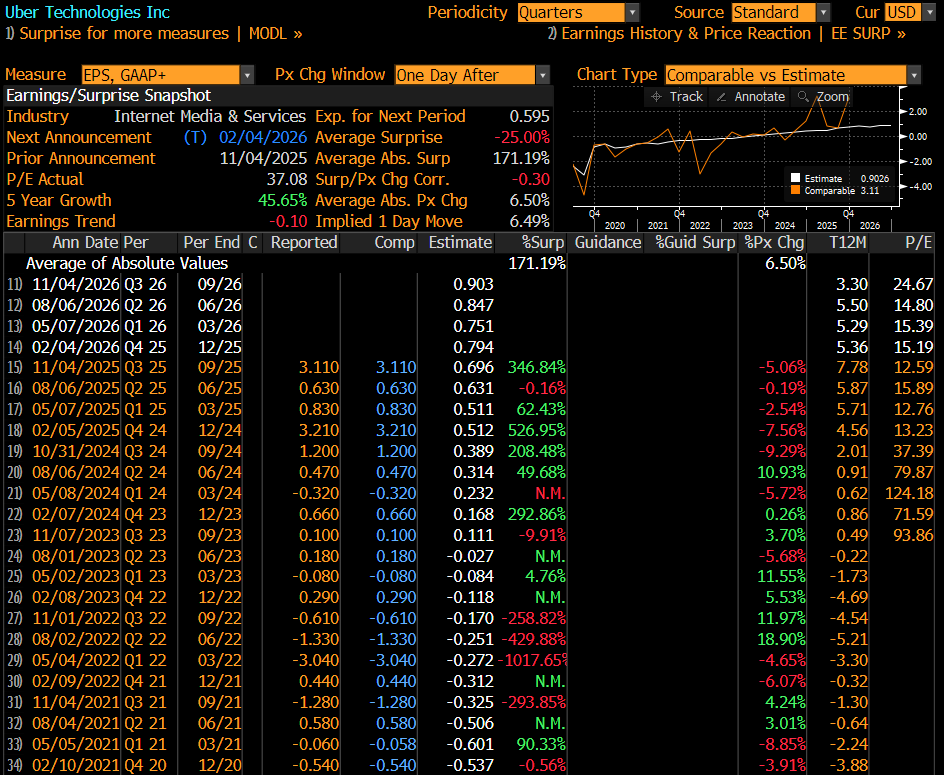

UBER (Uber) – Core fundamentals are robust and Q4 should print cleanly, but autonomous risk remains the longer-term overhang. The Street expects revenue +19.5% to $14.3B, bookings +20.7% to $53.4B (Mobility +19%, Delivery +22.8%), and EBITDA +34.6% to $2.48B. Attention shifts toward the transition to adjusted operating income/EPS in 2026 and the sustainability of margin expansion. The two charts are mixed. The daily has a new Sequential buy Countdown 13 and buy Setup 9; however, the weekly shows downside support risk higher. I am mixed on trying to trade this one as it must hold this 80 level support

The implied move is 6.49%. It’s been down in the last 5 quarters after earnings

Short interest has dipped in the last month but remains steady. 2.39 days to cover. On the Options Rank there has been heavy put buying with the green dots. This has seen bounces when the put buying is heavy.

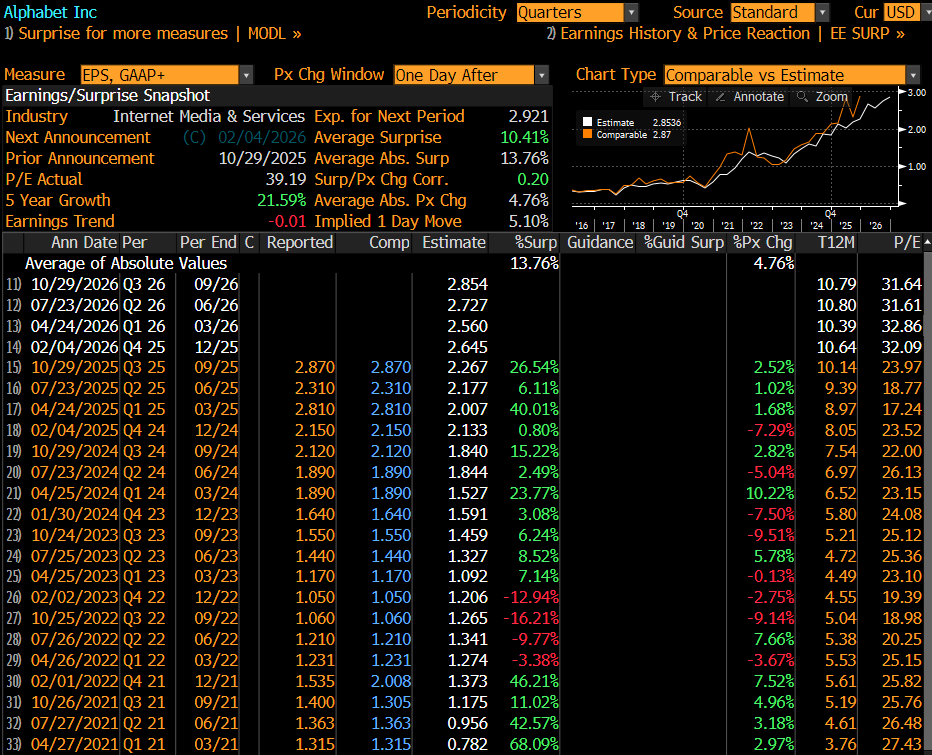

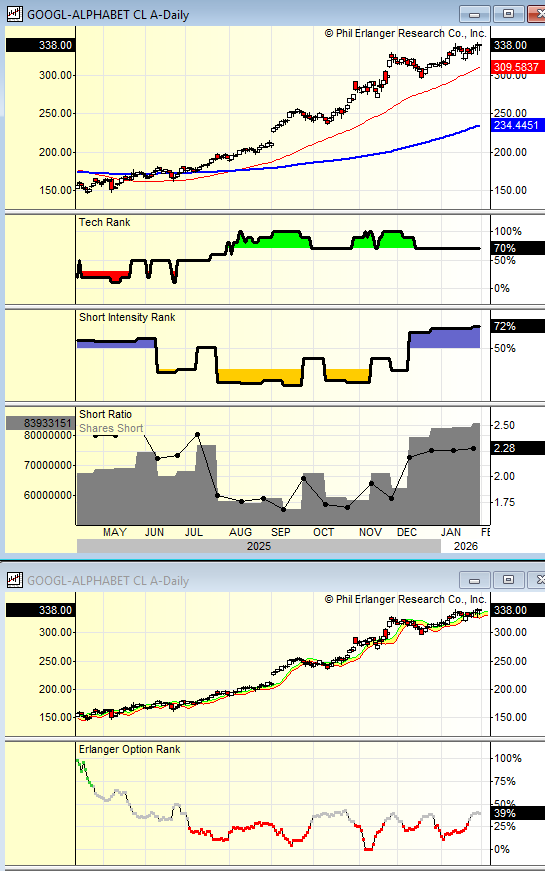

GOOGL (Alphabet) – Arguably the strongest fundamental sentiment across mega-cap tech, driven by Gemini/TPU momentum, Cloud acceleration, and resilient Search/YouTube. The Street is modeling Q4 revenue ex-TAC +16.5% to $95B, op income +19% to $36.95B, EPS $2.65, with capex nearly doubling to ~$28B and FCF down ~45% to ~$13.5B. The debate centers on capex intensity vs. AI-driven revenue durability, not demand. The stock is stretchced and the best of the Mag7 YTD and YoY – even better than NVDA. I would love to buy this one on a meaningful pullback. They have a lot of levers to pull adn don’t give guidance so it’s difficult to make a call on the quarter and response.

The implied move is 5.1%

Short interest is a little elevated for them. 2.28 days to cover. On the Options Rank there was recent heavy call buying with the red dots and that has moderated

Hedge Fund Telemetry ETF Percentage Price Oscillator Monitor

The PPO monitor (percentage price oscillator) force ranks ETFs by percentage above/below the 50-day moving average. This monitor and others are offered to Hedge Fund Telemetry subscribers on Bloomberg. SLV no bounce and UNG nat gas back to the bottom from the top in one day! Wild

Index ETF and select factor performance

ETF with today’s performance with 5-day, 1-month, and 1-year rolling performance YTD. Some wild 5 day moves down: Bitcoin, IBIT, GLD, BCOM, SLV and UNG

Goldman Sachs Most Shorted baskets vs. S&P Indexes

This monitor has the S&P indexes and the Goldman Sachs most shorted baskets. Today’s gains are not a short squeeze situation.

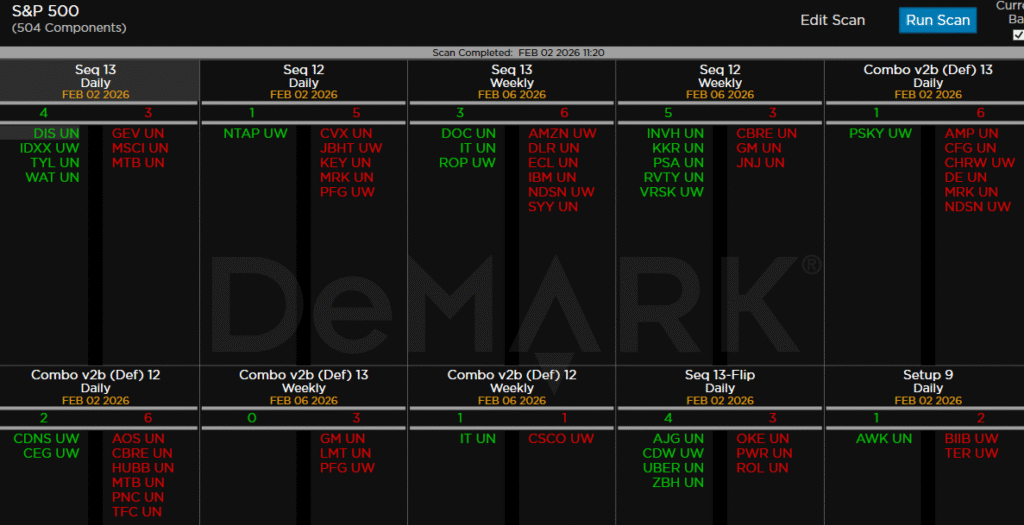

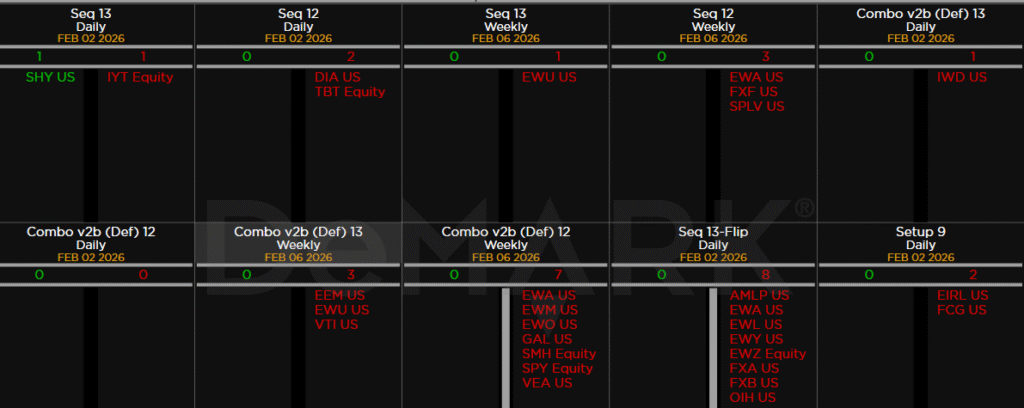

DeMark Observations

Within the S&P 500, the DeMark Sequential and Combo Countdown 13s and 12/13s on daily and weekly periods. Green = buy Setups/Countdowns, Red = sell Setups/Countdowns. Price flips are helpful to see reversals up (green) and down (red) for idea generation. The extra letters at the end of the symbols are just a Bloomberg thing. Worth noting: Mixed action

Major ETFs among a 160+ ETF universe. A few worth watching – IYT, DIA Sequential 13’s daily. Weekly Combo 13’s and on deck 12’s EEM, VTI, SMH, SPY

If you have any questions or comments, please email us. Data sources: Bloomberg, DeMark Analytics, Goldman Sachs, Street Account, Vital Knowledge, Daily Sentiment Index, and Erlanger Research