HIGHLIGHTS AND THEMES

- One thing that has been occurring is with the two largest weights in the Bloomberg Commodity Index which has been either crude is up and gold down for the week negating upside for the index

- The daily chart of the Bloomberg Commodity Index has a defined short term range

- Crude has potential scenarios for upside and downside that I explain

- Gold bounced off 50 day while Silver has breakout potential if it can get through tough resistance

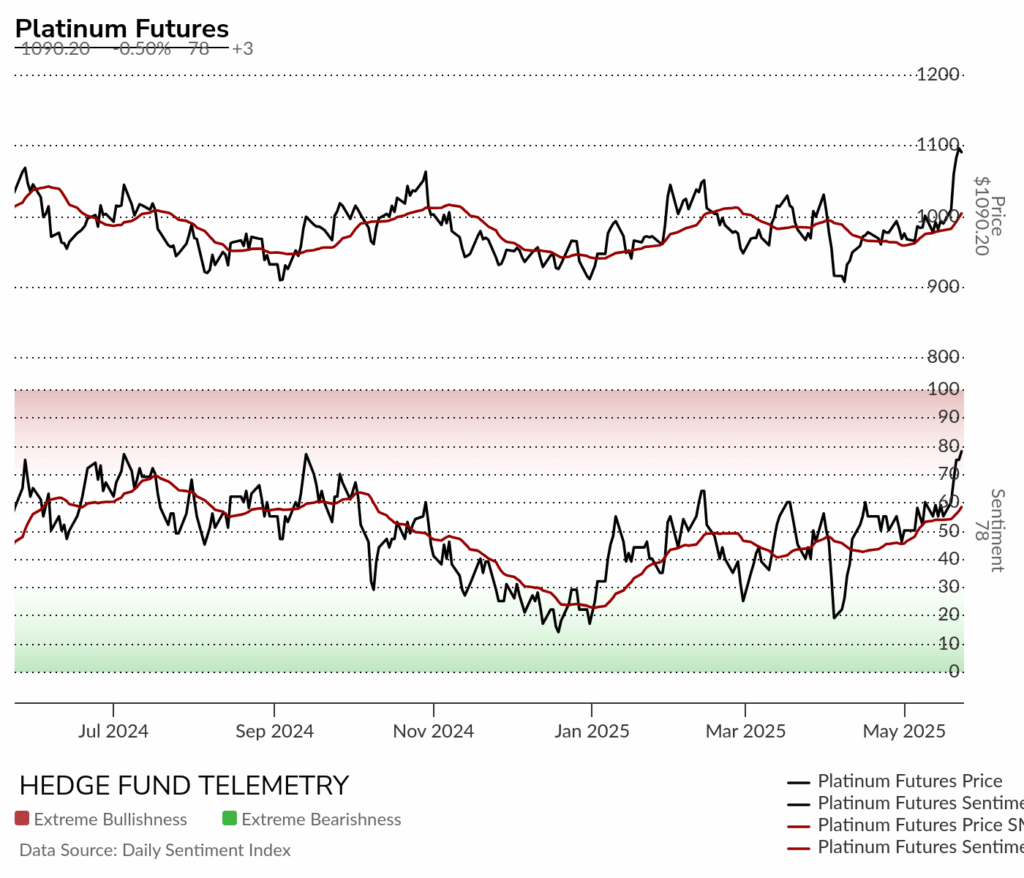

- Platinum broke out and might be extended

- Livestock remains elevated

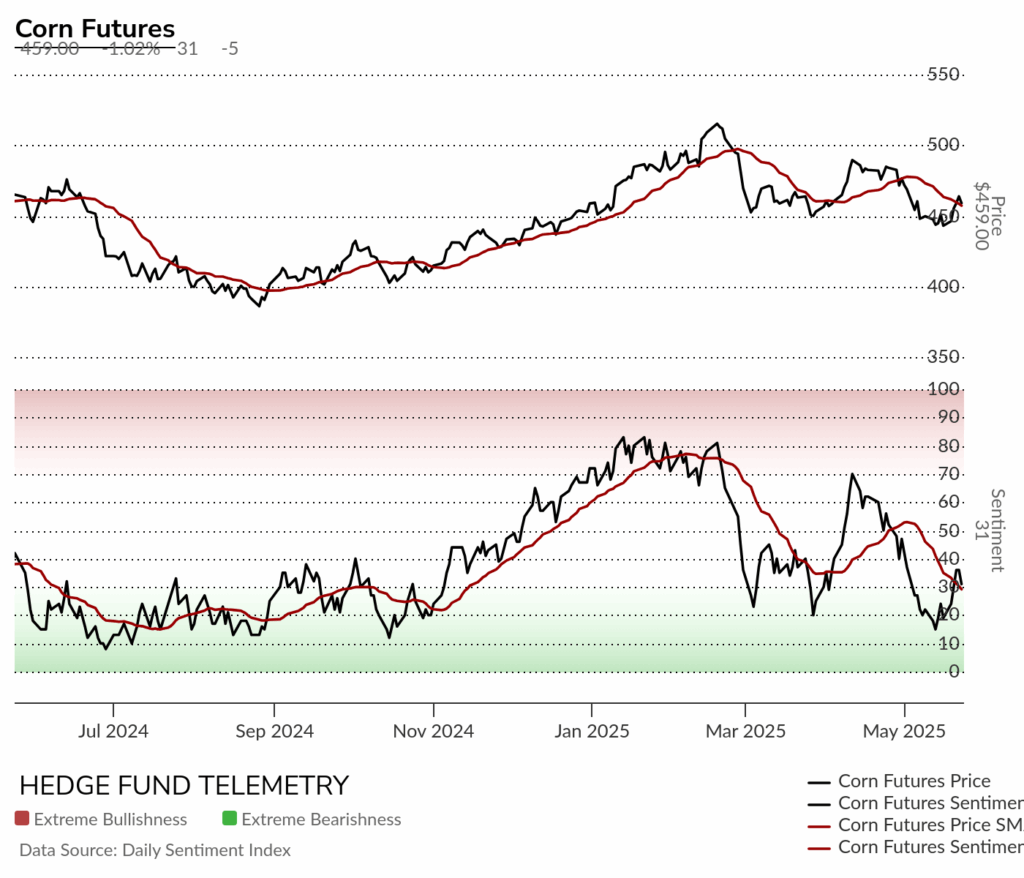

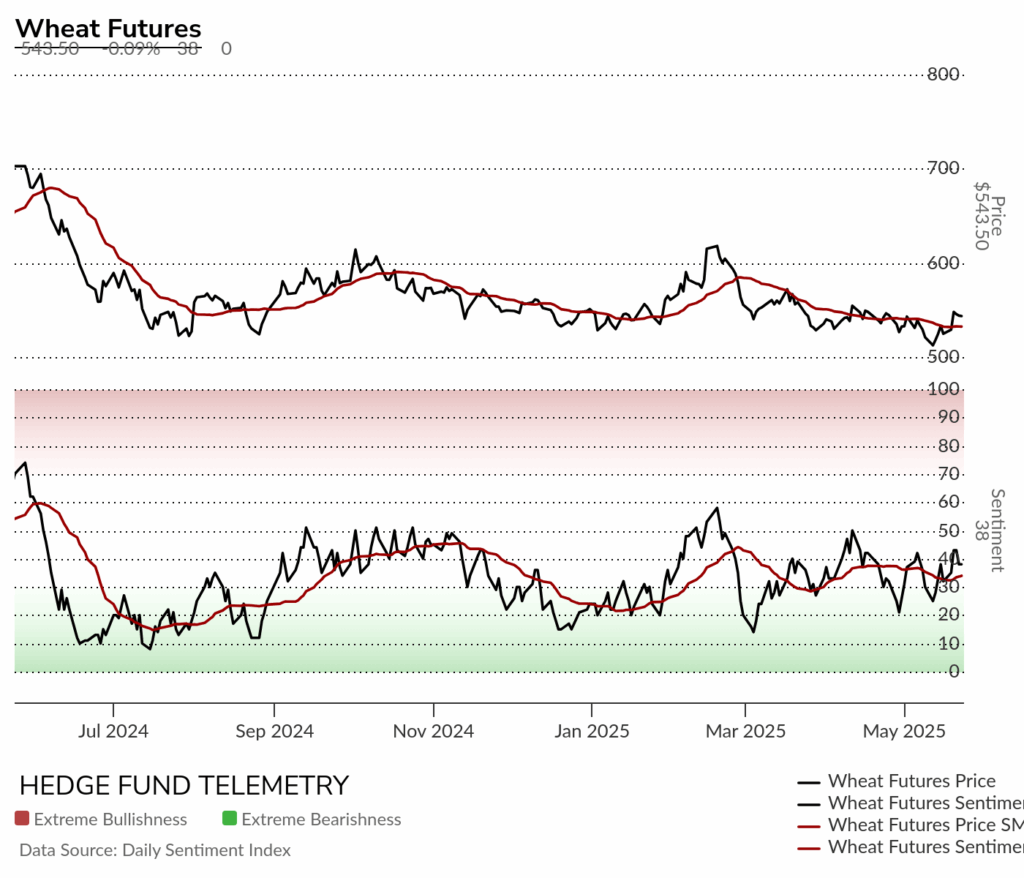

- Grains are trying to improve but still no confirmation to increase conviction

- Coffee, Sugar and Cocoa weak

Comments on charts. If you have questions or would like more context, please email.

BLOOMBERG COMMODITY INDEX DAILY AND WEEKLY

Bloomberg Commodity Index daily has a defined range in the short term

Bloomberg Commodity Index Weekly sideways for the last two years

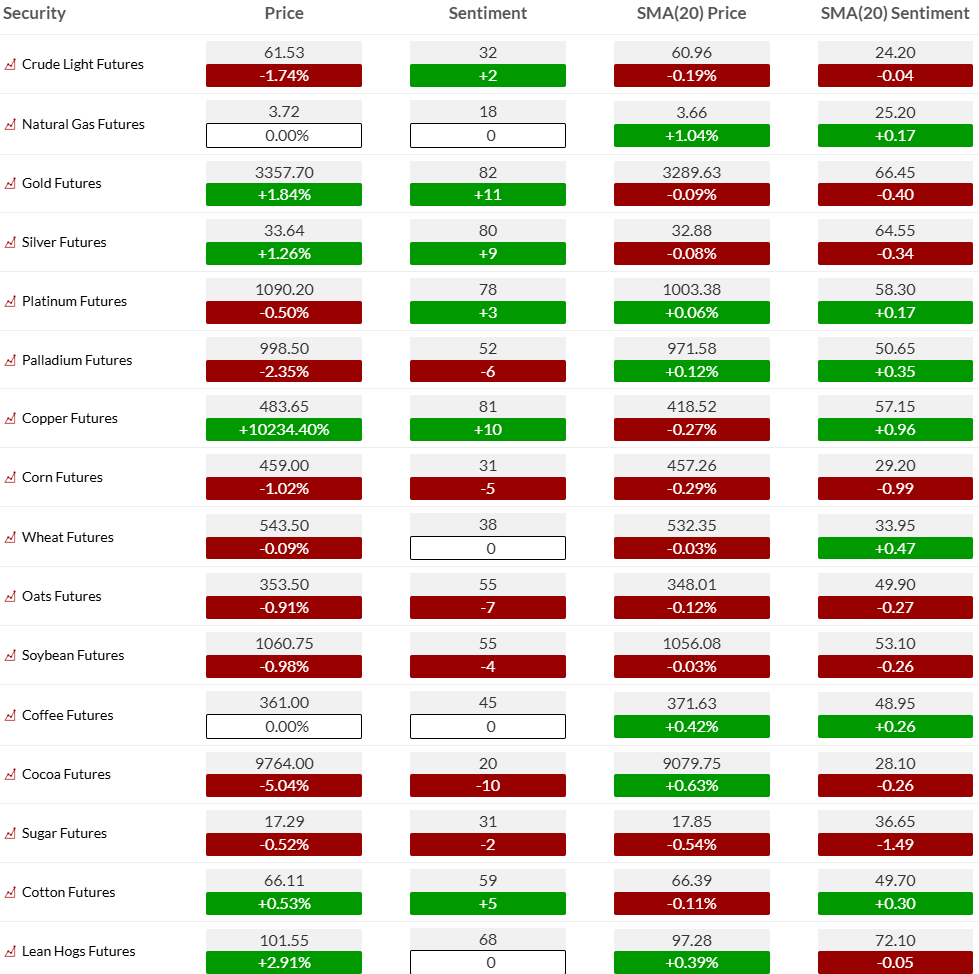

COMMODITY SENTIMENT OVERVIEW

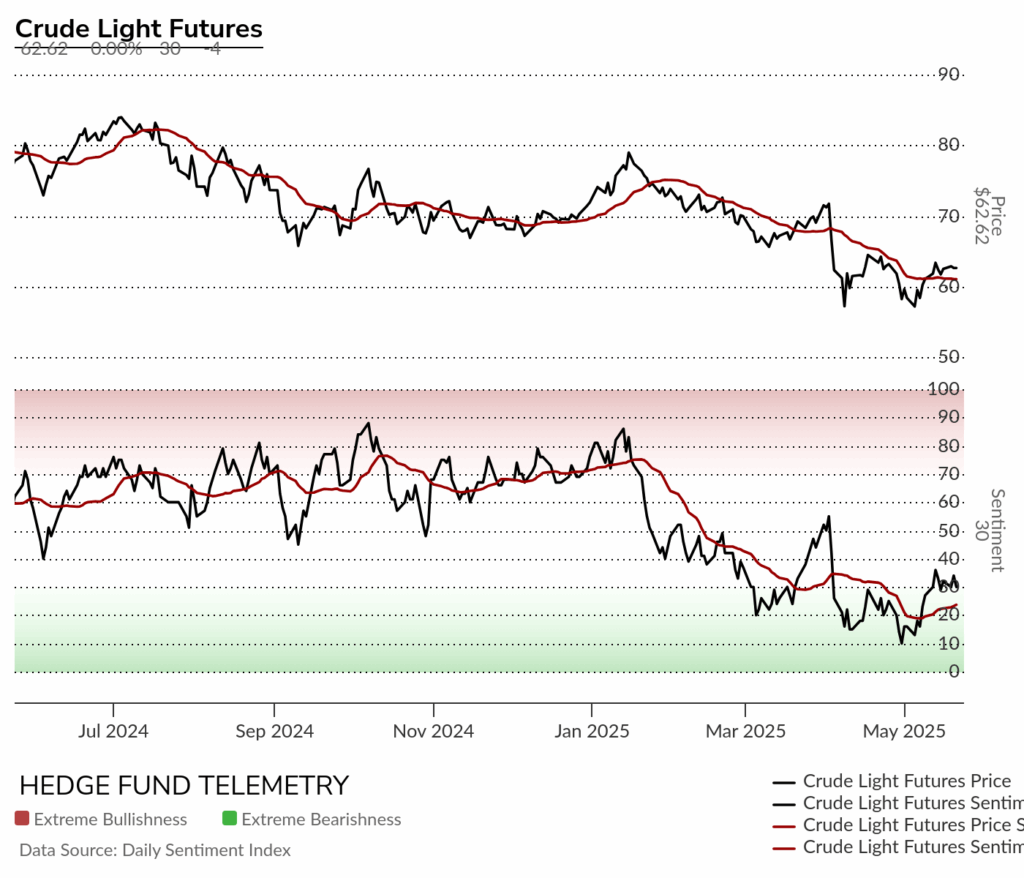

OIL AND ENERGY

Bloomberg Energy Index daily continues to hold recent levels

WTI Crude futures daily with downside Sequential Countdown pending on day 4 of 13. If this higher low wave 2 can hold recent lows and move above wave 1 and more importantly the TDST resistance at 64.87 then the pending Sequential will cancel into upside wave 3 of 5 with potential wave 3 price objective of 67.71

WTI Crude futures bullish sentiment remains under pressure

WTI Crude futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Natural Gas futures daily with Sequential on day 8 of 13.

Natural Gas futures bullish sentiment remains under pressure

Natural Gas futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

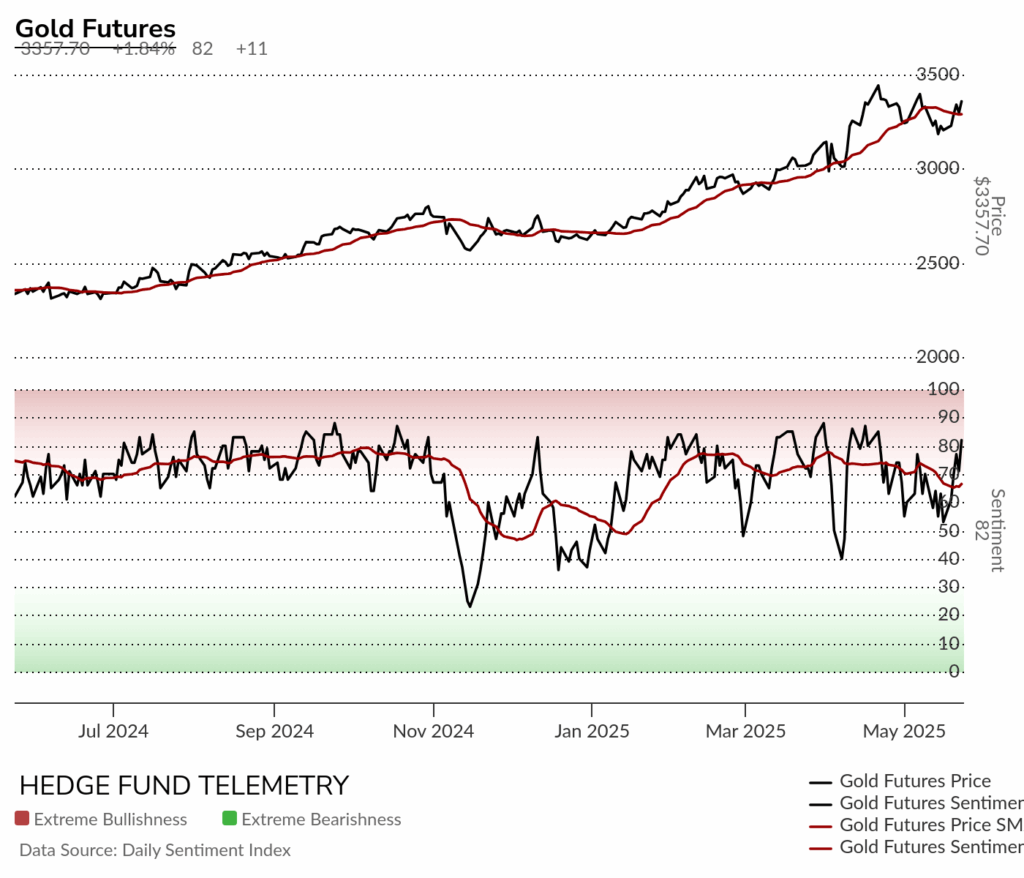

Metals

Gold daily backed off to the 50 day which was my first target

Gold bullish sentiment held the 50% midpoint level which is bullish

Gold futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Silver daily trades well and might make a move higher

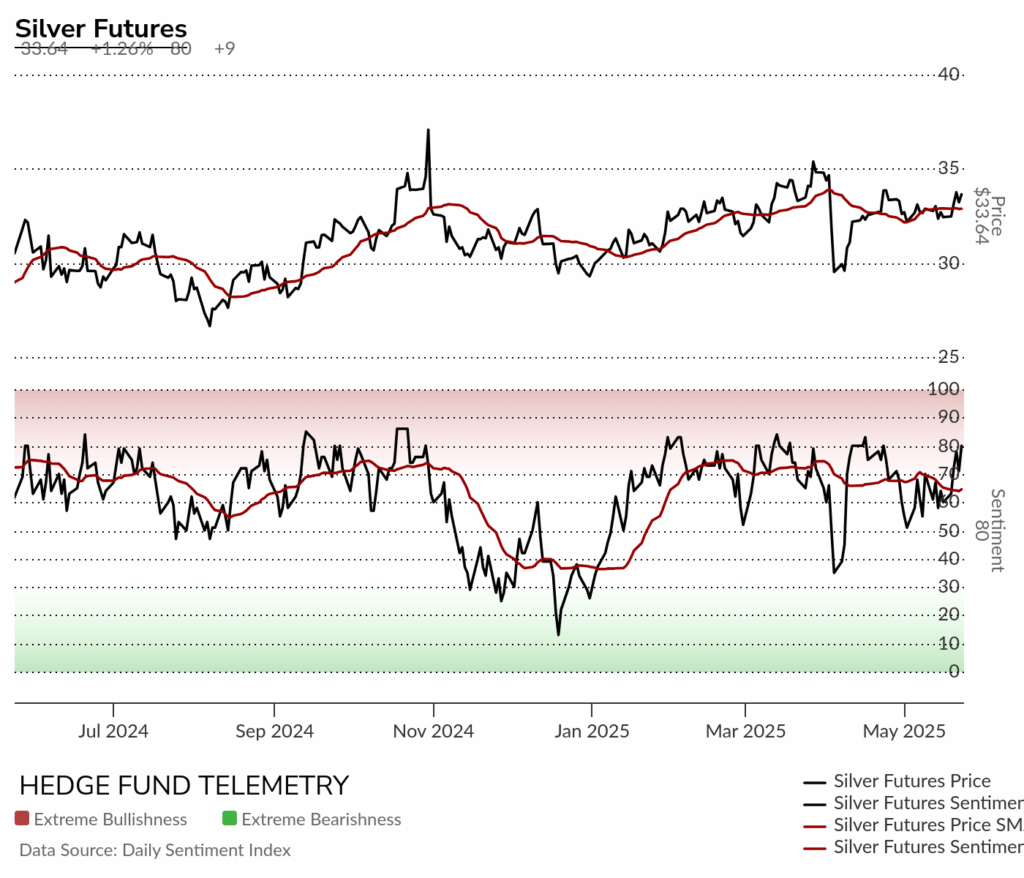

Silver bullish sentiment at 80% and back in extreme zone.

Silver futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

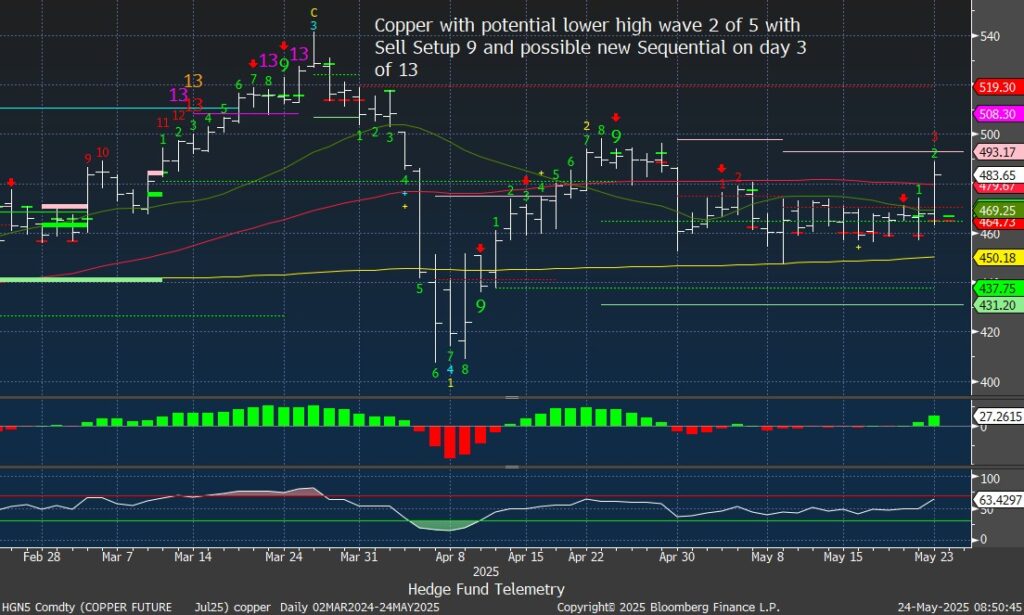

Copper futures daily still has a bullish looking chart if the 200 day can hold

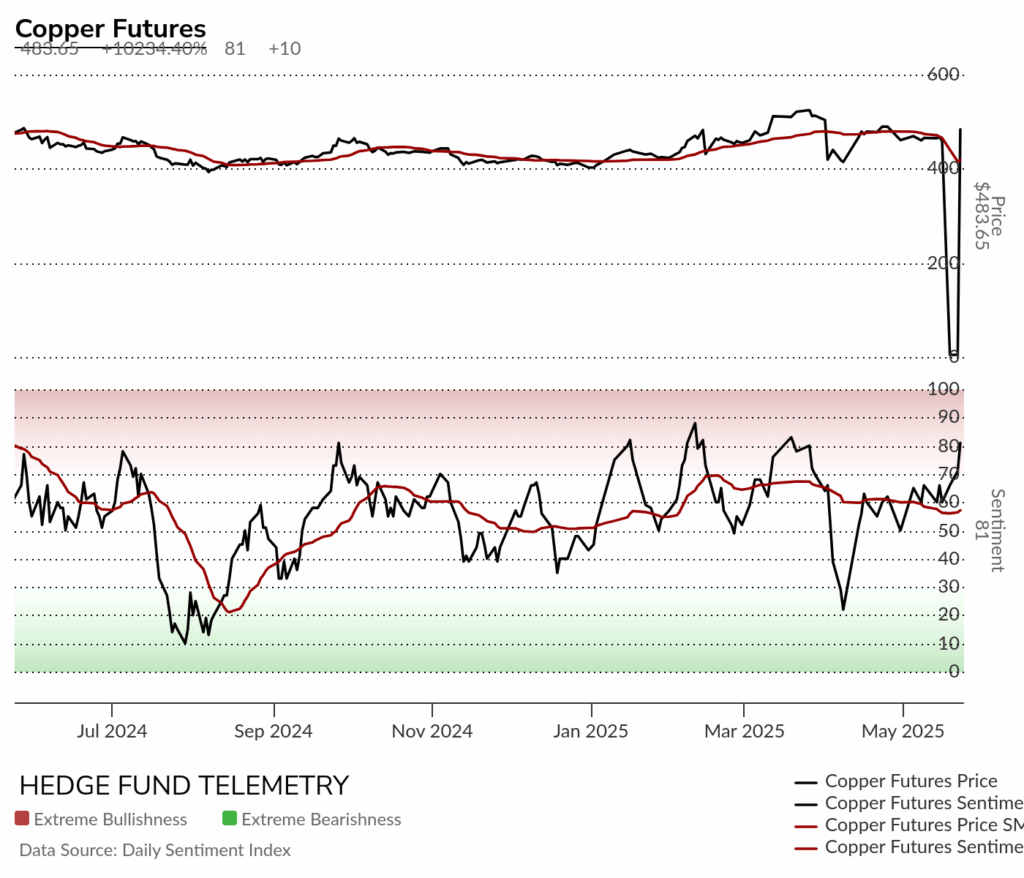

Copper futures bullish sentiment had a price break I’ll fix this weekend. It’s in the extreme zone at 81%

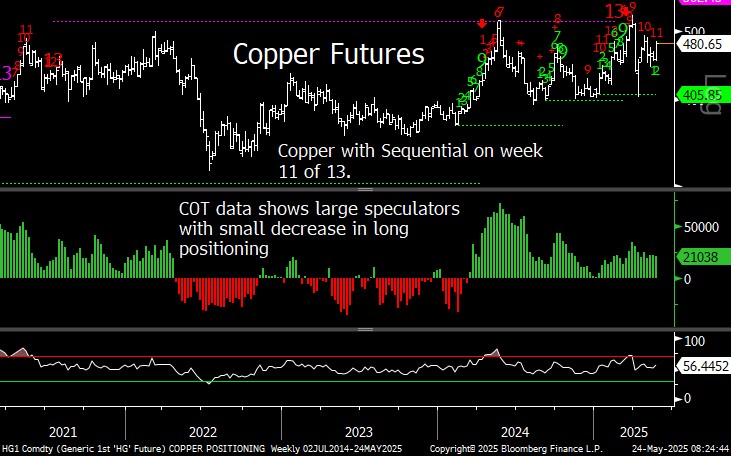

Copper futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Platinum daily broke out and might be extended

Platinum bullish sentiment broke out higher at 78% possibly extended

Platinum Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

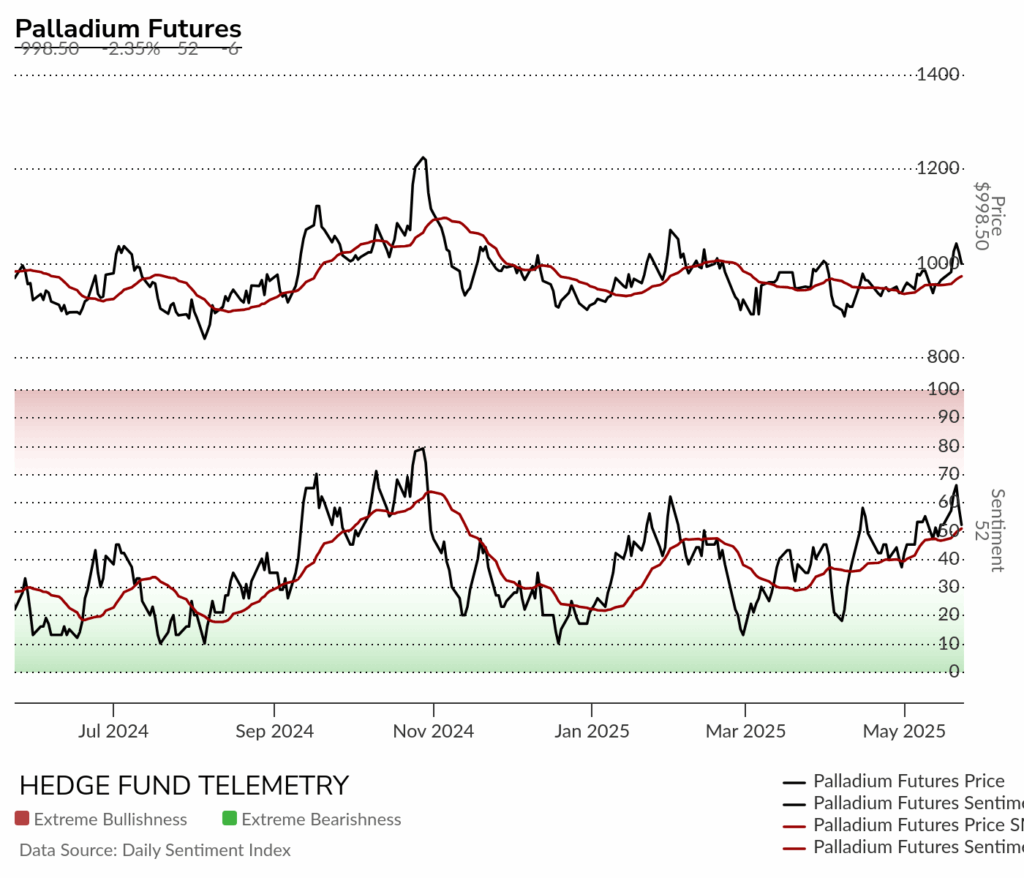

Palladium daily finally got the Sequential sell Countdown 13

Palladium bullish sentiment slight back off from 6 month high

Palladium Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Grains

Corn futures daily trying to make a move or is this another lower high?

Corn futures bullish sentiment remains under pressure

Wheat futures daily bounced with Combo 13 but stopped at 50 day

Wheat futures bullish sentiment sideways still

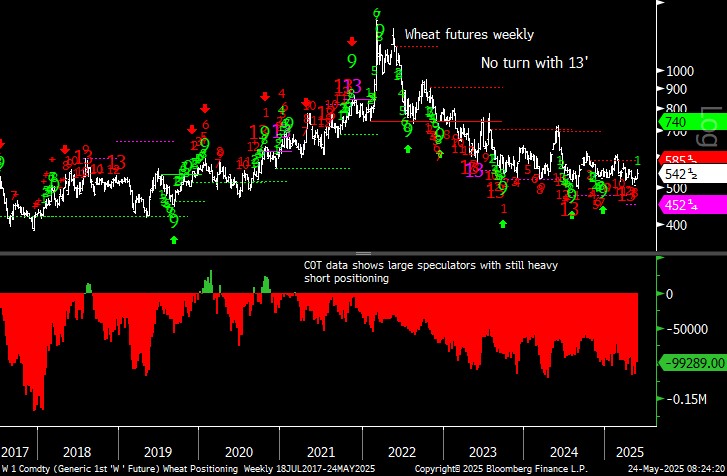

Wheat futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Soybean futures daily holding above the 50 and 200 day with TDST resistance at 1076

Soybean futures bullish sentiment has been making higher lows

Soybean futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Livestock

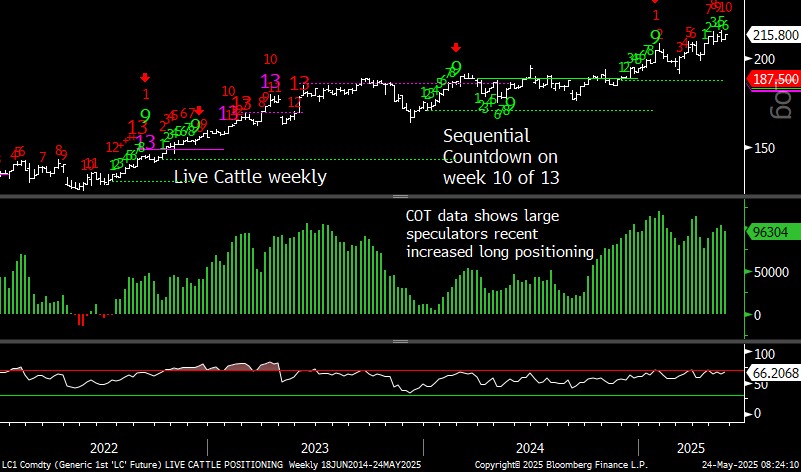

Live Cattle futures daily held the 20 day with Sequential pending on day 12 of 13. A little more upside needed for 13

Live Cattle futures bullish sentiment remains in the elevated zone

Live Cattle futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

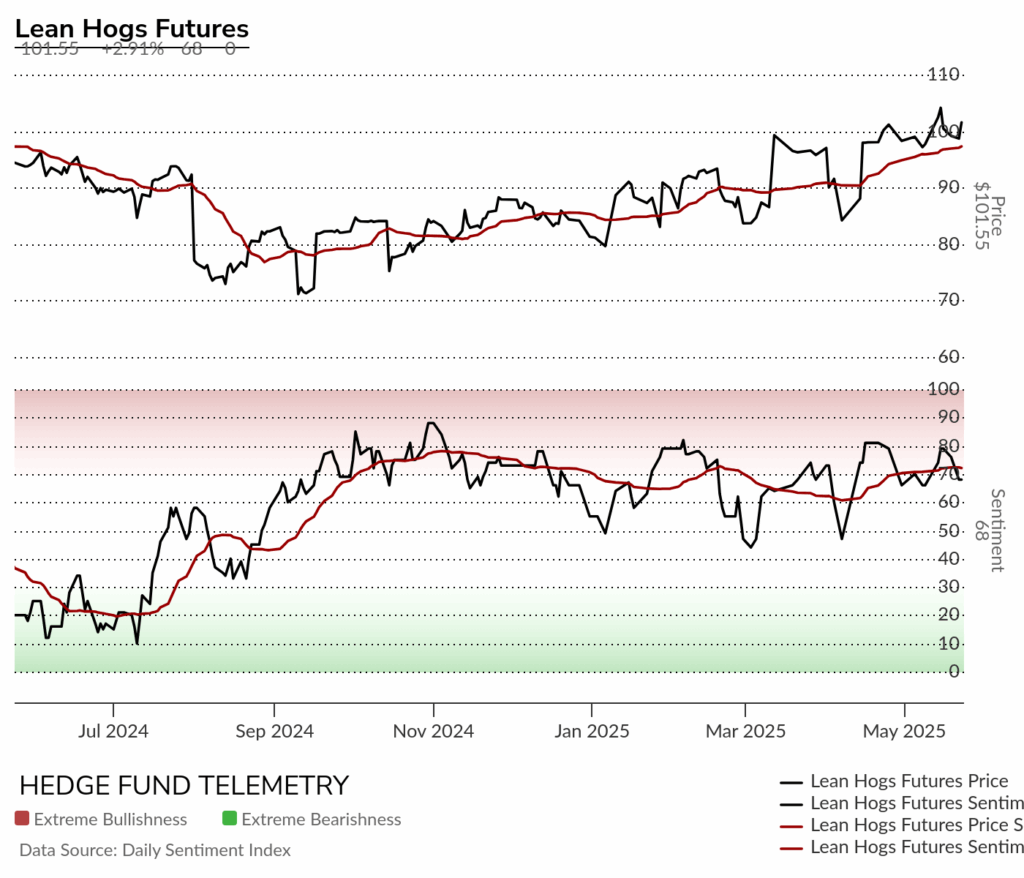

Lean Hogs futures daily backed off but still has upside Sequential in progress

Lean Hogs bullish sentiment steady

Lean Hogs Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

Softs

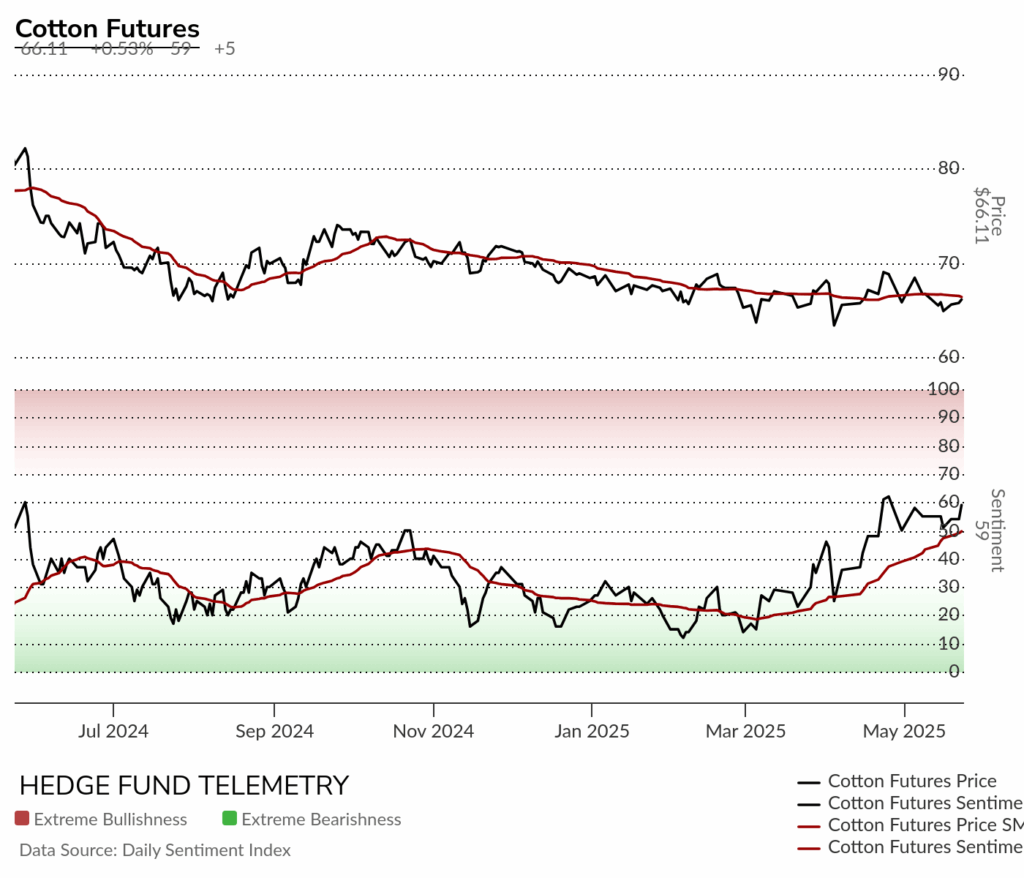

Cotton futures daily has not been able to reverse trend

Cotton futures bullish sentiment looks OK for a higher move but will price follow?

Cotton Futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

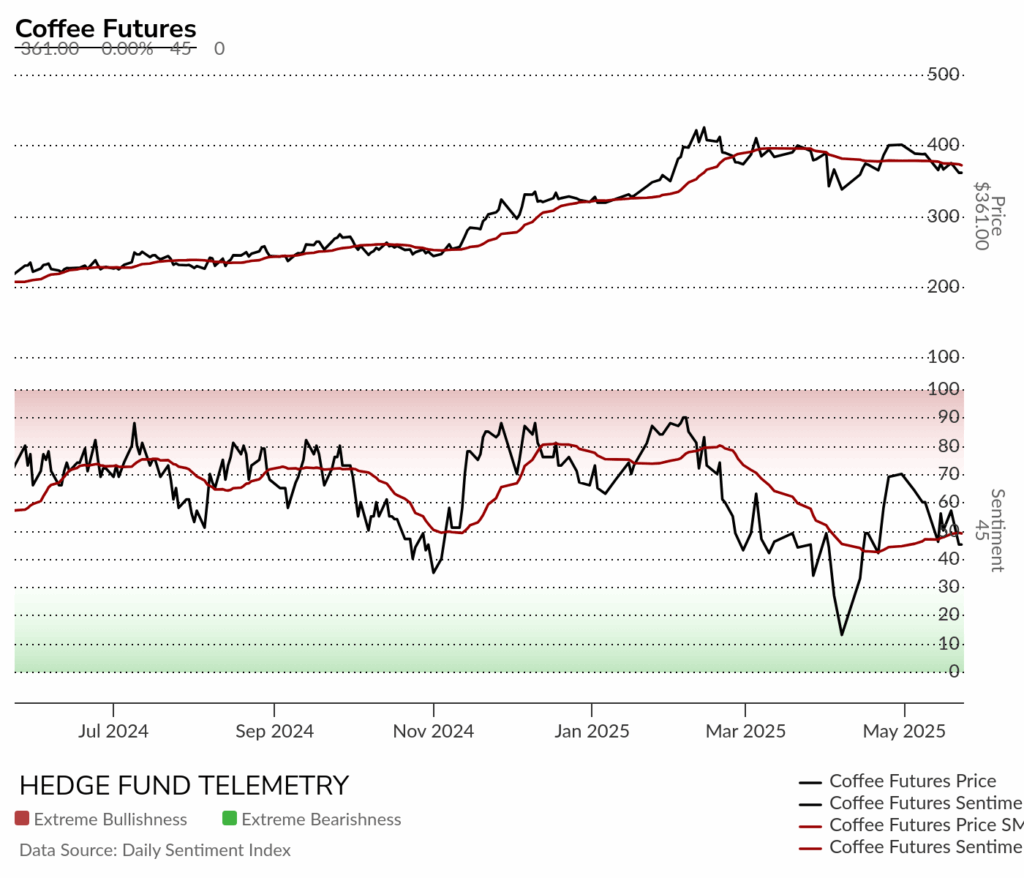

Coffee futures daily with new recent low this week

Coffee futures bullish sentiment slipping lower

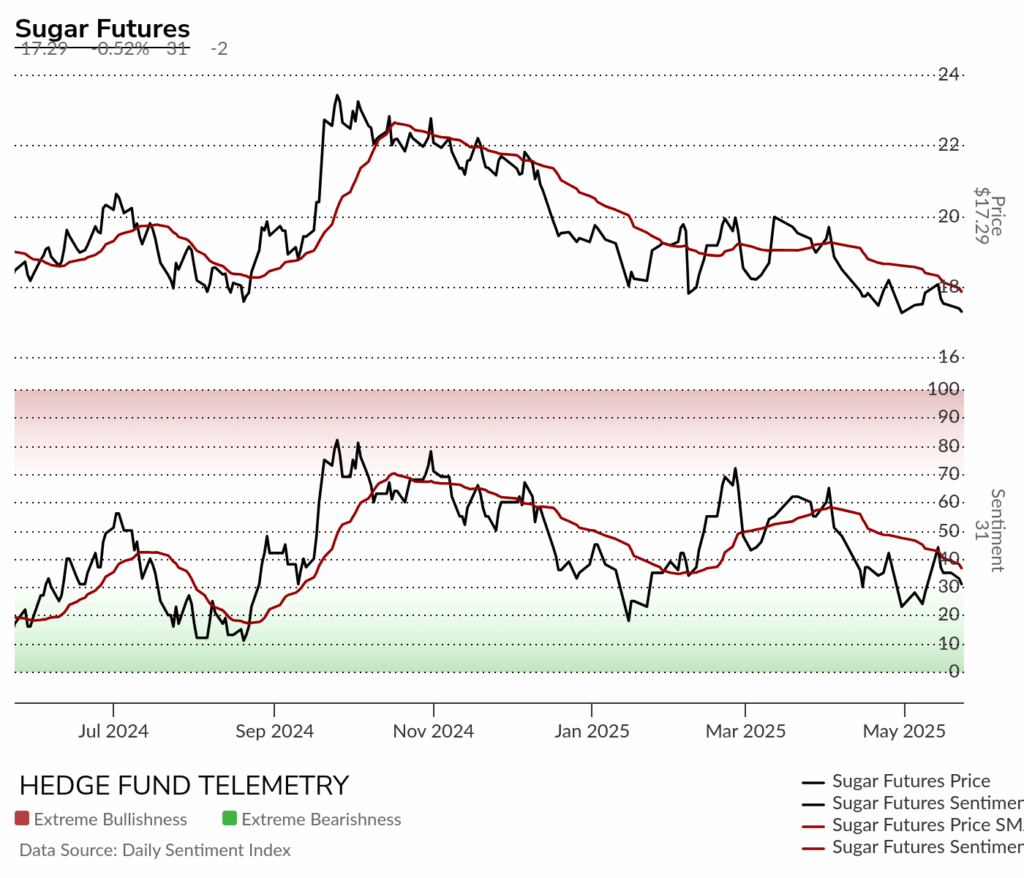

Sugar futures daily with Sequential in progress on downside

Sugar futures bullish sentiment remains under pressure

Sugar futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators

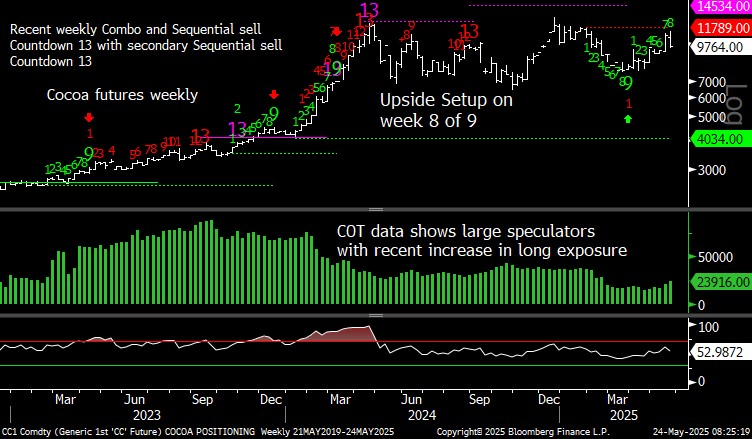

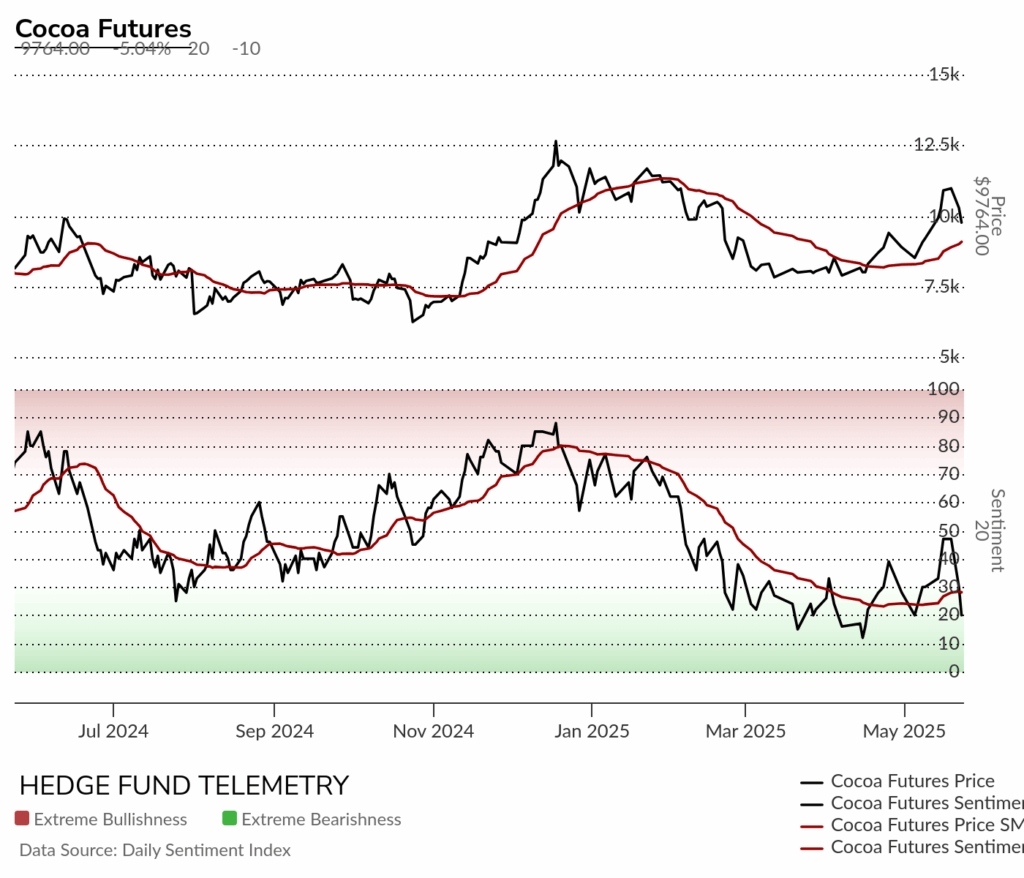

Cocoa futures daily reversal with sell Setup 9

Cocoa futures bullish sentiment with failure at 50% midpoint level

Cocoa futures Commitment of Traders large speculators and weekly DeMark Setup, Sequential, and Combo indicators