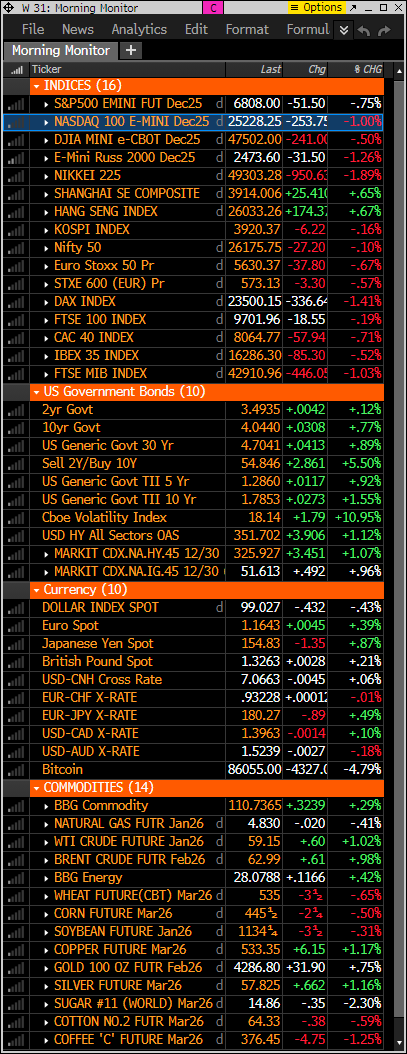

- S&P futures down 0.75% and Nasdaq futures down 1% in Monday morning trading. Asian markets mixed with Nikkei down 1.89% with China up. European indexes are down led by DAX 1.6%. Treasuries weaker with yields up 1-4 bp from short end to the back end. Gold up 0.8%. Bitcoin down 5% after losing ~20% last month. WTI crude up 1%.

- Fairly quiet from a headline perspective coming out of last week’s Thanksgiving holiday in the US. Upward pressure on JGB yields on ramp in BoJ December tightening expectations and renewed selling pressure in Bitcoin seem to be getting the most attention. Black Friday headlines suggested solid but not spectacular start to holiday shopping season. Trump said he has made his Fed Chair pick, with Kevin Hassett still seen as the frontrunner.

- ISM manufacturing on the US economic calendar this morning. Street looking for an uptick to 49.0 in November from 48.7 in October. Nothing on the calendar for Tuesday. Wednesday brings ISM services and ADP private payrolls for November. Initial claims and Challenger job cuts for November out on Thursday. Friday brings September PCE/personal income/personal spending along with the preliminary December reading for University of Michigan consumer sentiment and inflation expectations. Fed in quiet period ahead of 10-Dec FOMC decision.

- Very quiet in terms of corporate news. This week does bring some notable earnings reports, including MRVL and CRWD on Tuesday, CRM, SNOW, M and DLTR on Wednesday and KR, DG and HPE on Thursday. UNH to sell last part of its South American business for $1B. MU reportedly spending $9.5B+ to build an HBM plant in Japan. “Zootopia 2” from DIS had a good holiday debut with nearly $160M in domestic sales. LULU subject of a financial press article highlighting divisions between founder/largest shareholder and current CEO.

- Key Upgrades/Downgrades: Arete Research upgrades TTWO, U. Barclays downgrades AMT, CCI. Zscaler downgraded to market perform from outperform at Bernstein. Goldman Sachs initiates ACHR, BETA, EVEX, and JOBY. HSBC upgrades CVX; downgrades TTE.FP. Carvana initiated buy at UBS.

market snapshot

economic reports today

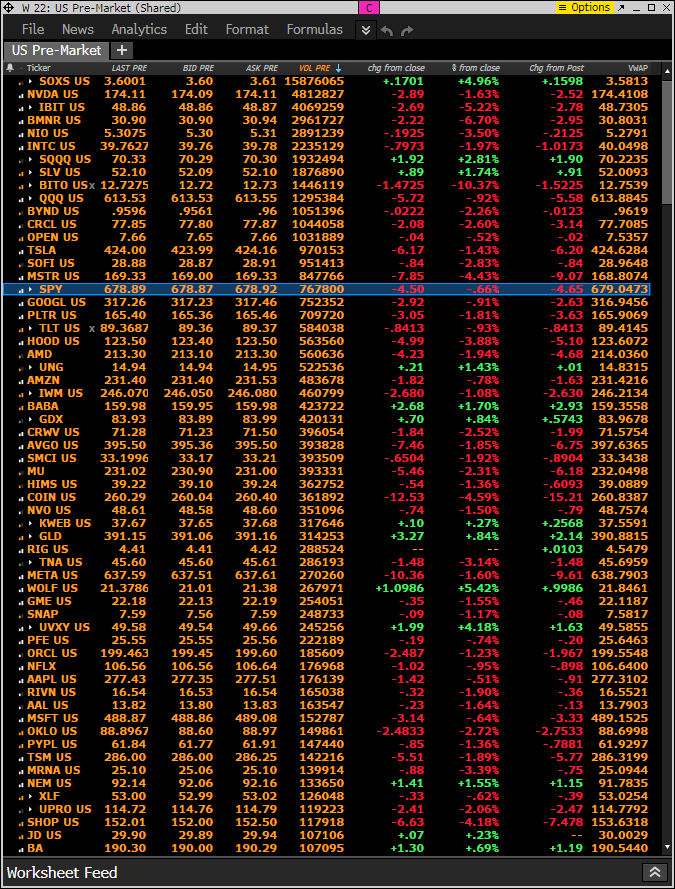

premarket trading

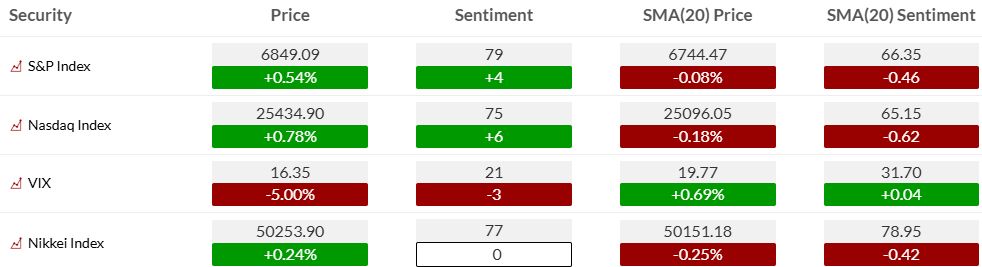

US MARKET SENTIMENT

S&P and Nasdaq bullish sentiment lifted off the recent 50% midpoint level back into the elevated zone >70%

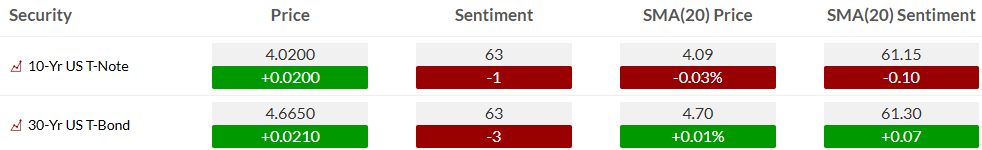

Bond bullish sentiment has been hanging around the ~60% level for months

US MARKETS

S&P futures 60-minute tactical time frame below a 4 day average VWAP after recent Sequential and Combo 13’s and sell Setup 9 on Friday.

S&P futures daily with secondary Sequential pending with potential lower high corrective wave 2 of 5. Above the 20 and 50 day at 6765.

Nasdaq 100 60-minute tactical time frame with recent Sequential and sell Setup 9. Below a 4 day VWAP

Nasdaq 100 futures daily also with a potential lower high wave 2 of 5. Nasdaq 100 cash index might get the Sequential 13 today as it was on day 12 of 13 on Friday.

Extra charts we’re watching

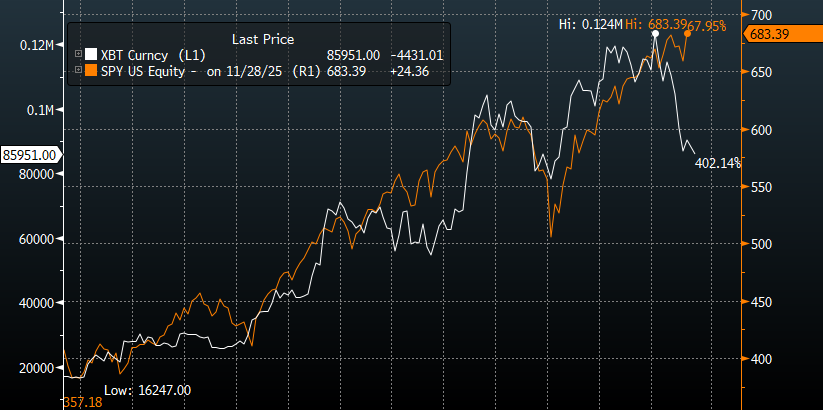

The weekly chart of Bitcoin and SPY has been correlated since 2023, and Bitcoin has since broken away from SPY.

US Dollar Index daily backing off again today with Setup on day 5 of 9 with potential higher low corrective wave 2 of 5 pullback

US 10-Year Yield bounced off TDST Setup Trend support but below flat 50 day at 4.08%

US 30-Year Yield has breakout potential over 4.80% with upside Sequential in progress. A move over the blue wave 1 will qualify upside wave 3

Bitcoin Daily failed bounce at 20 day with Sequential on day 4 of 13

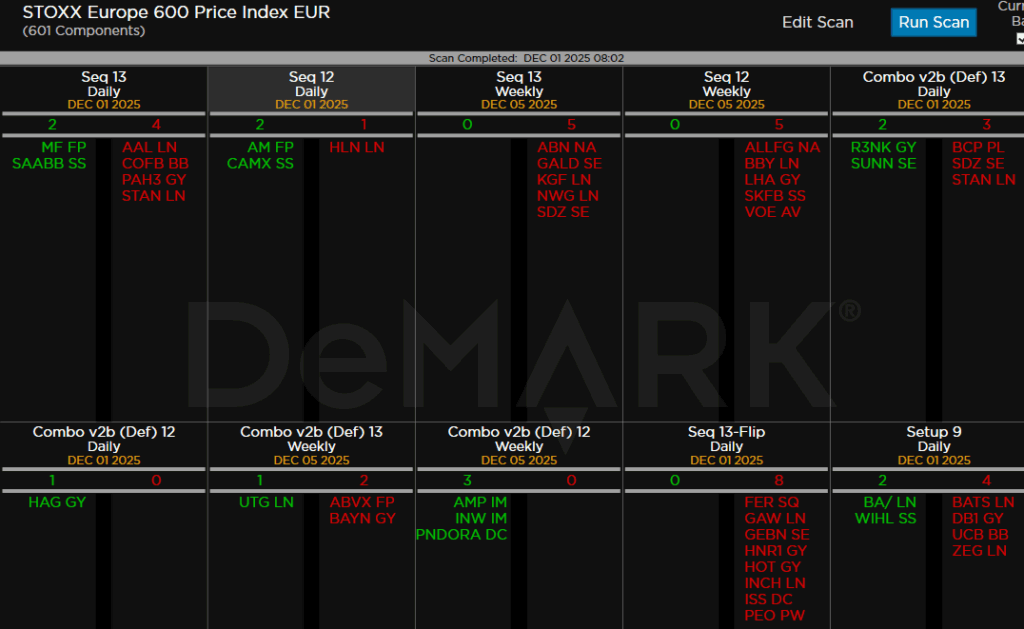

DeMark Observations – Euro Stoxx 600