Crude: -0.562M

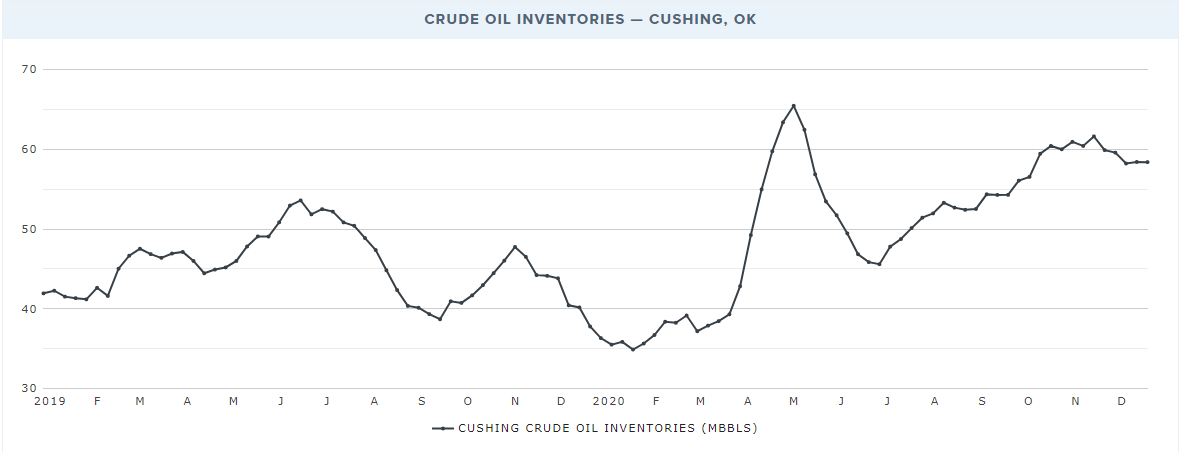

Cushing: -0.026M

Gasoline: -1.125M

Distillates: -2.325M

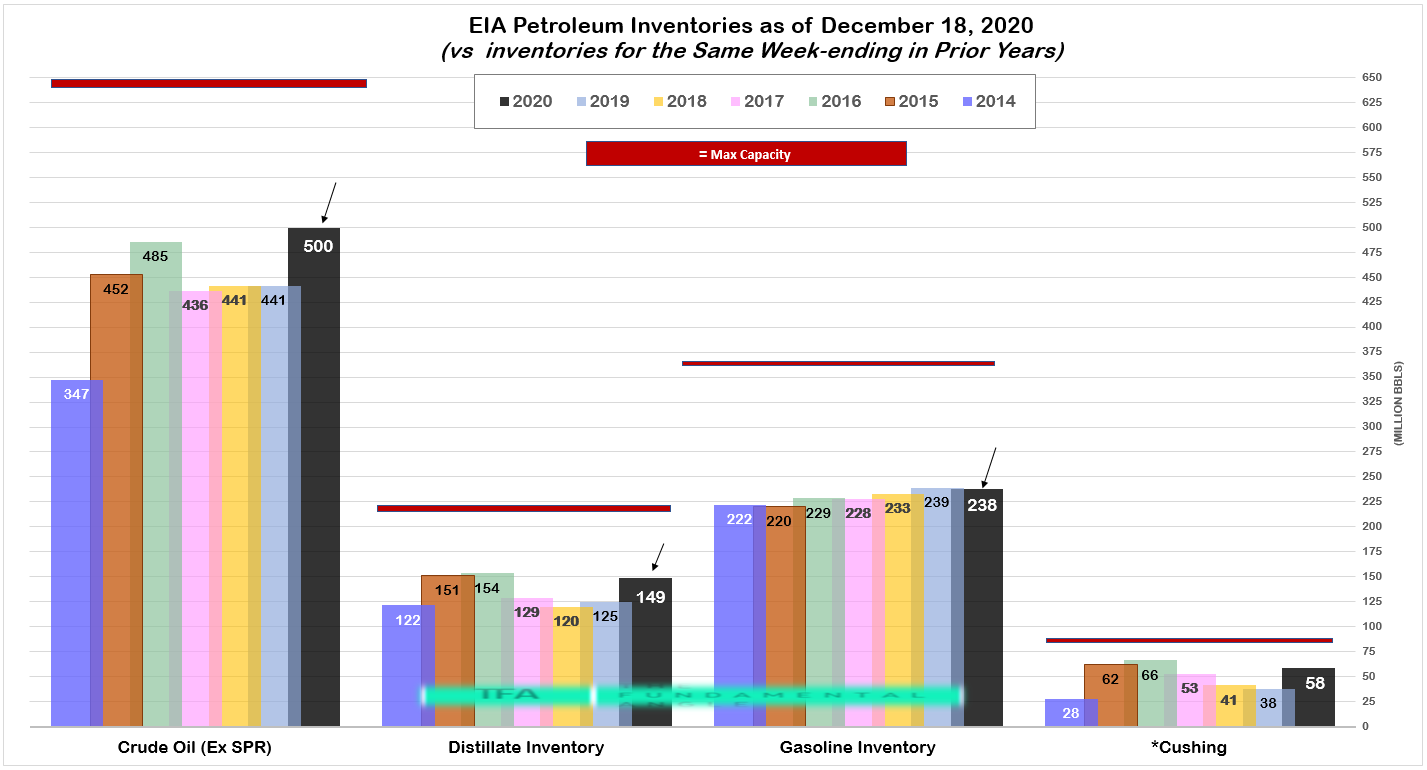

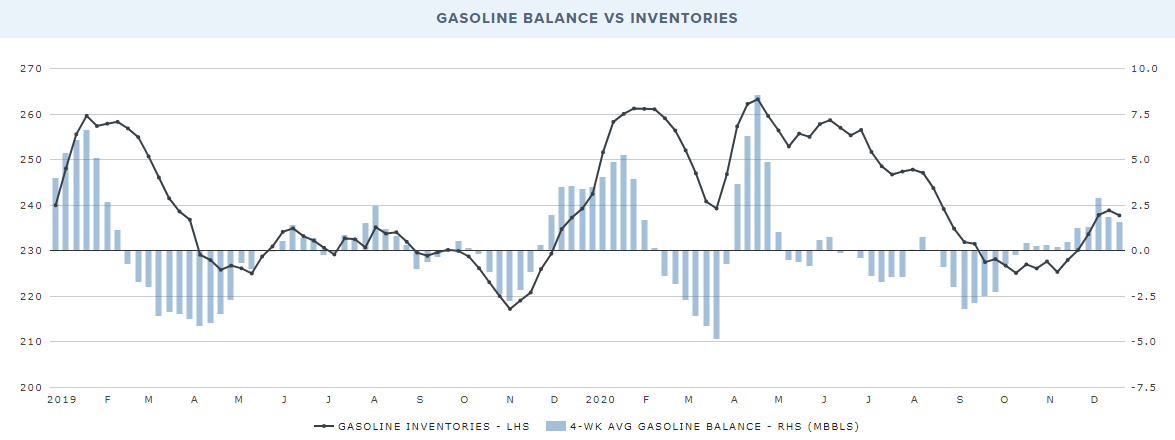

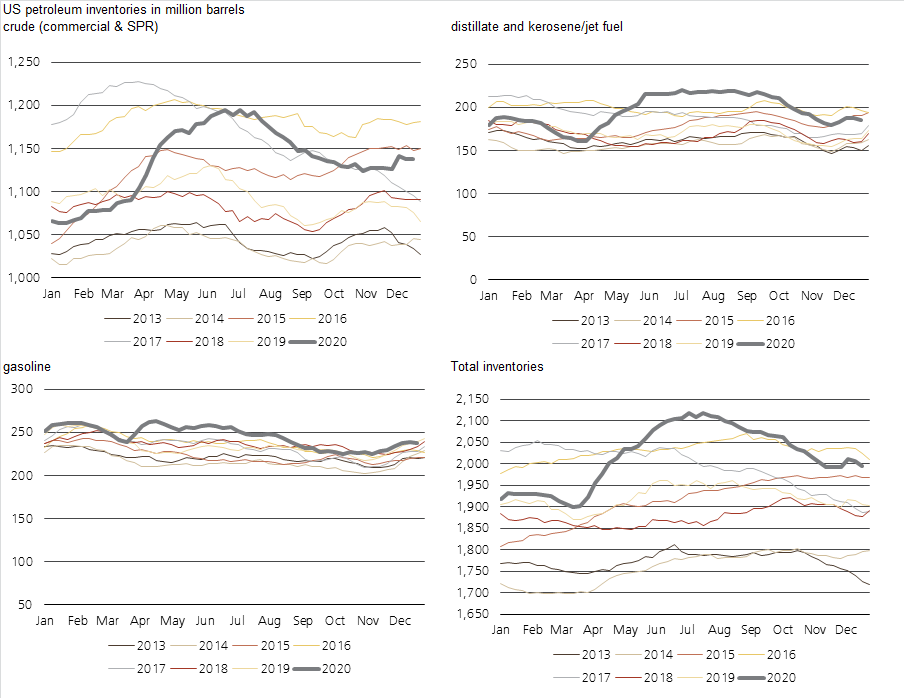

Solid report this week. I always like to see product draws. I have been writing about my concern that gasoline demand was rolling over the last few weeks, but it is starting to tick up again. I still remain cautious, as refinery utilization was slightly down about 1.5% from last week. Gasoline inventories are 4% above the 5 years average, not bad all things considered, especially during low demand season. Cushing inventories are a bit high compared to prior years, as usually producers and refiners look to offload as many barrels as possible before the December 31st tax assessment date. Interesting note, propane is still continuing to draw due to the surge in outdoor dining. Total commercial petroleum inventories decreased by 10.7 million

barrels last week.

Inventories 12/18/2020 vs last 5 years

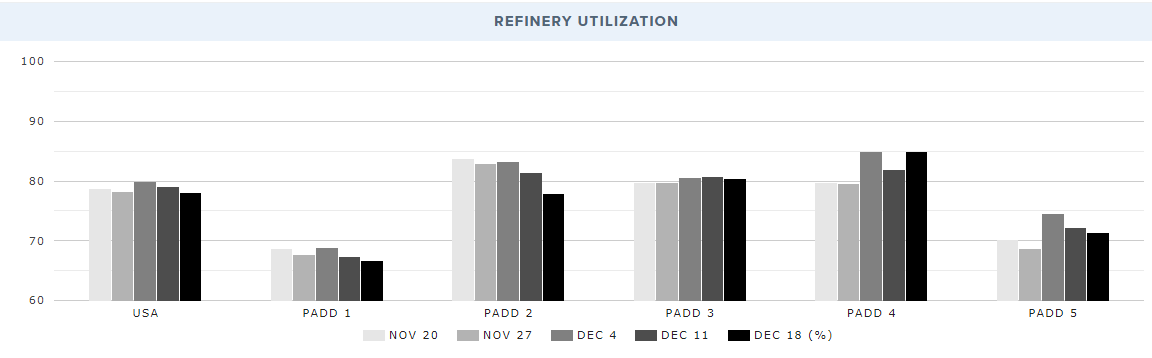

Refinery Utilization by PADD

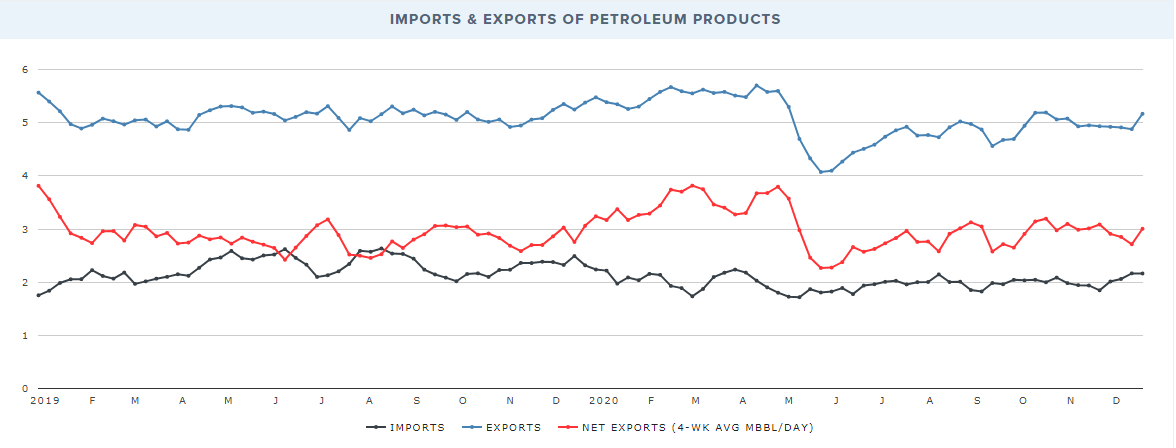

Imports were virtually flat exports ticked up

Cushing Inventories (the actual WTI contract)

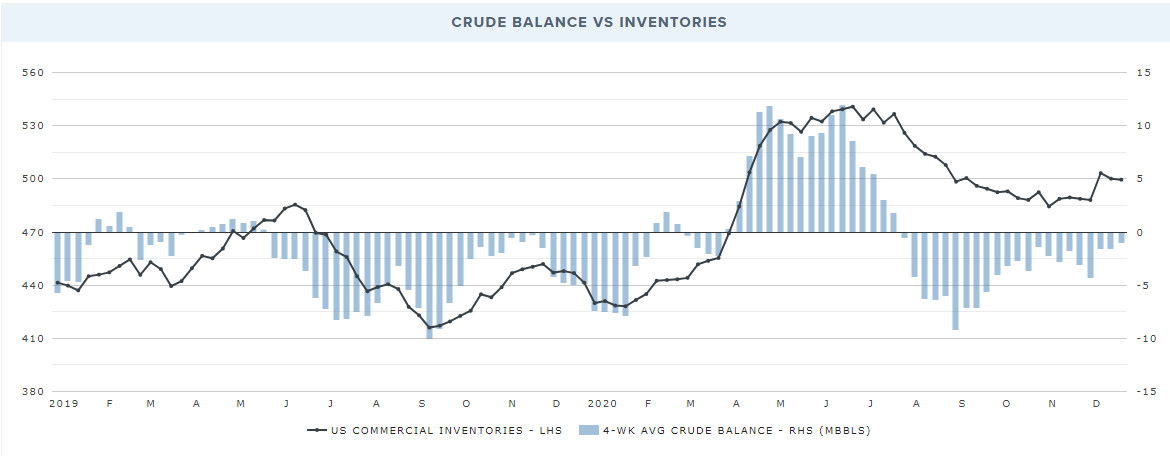

Crude Balance vs Inventories

Gasoline Balance vs Inventories

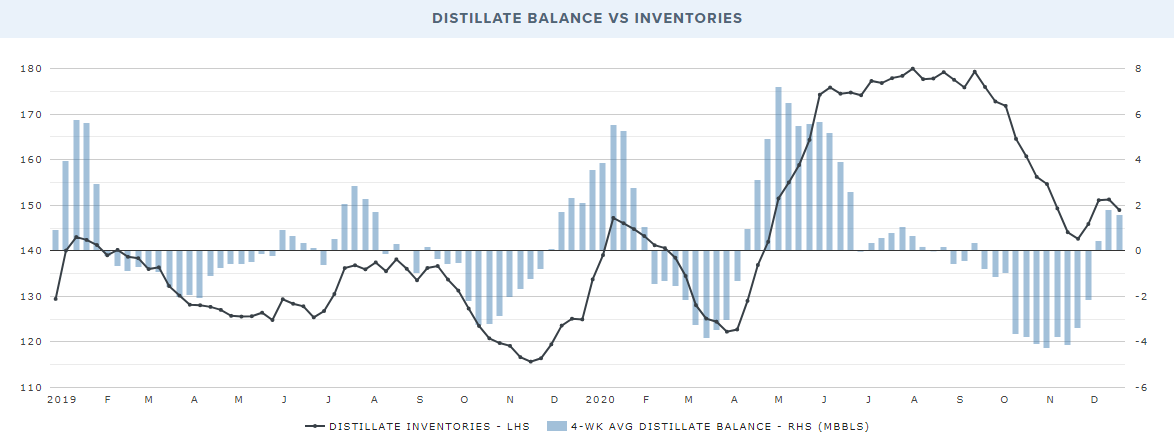

Distillate Balance vs Inventories

US inventories in million barrels

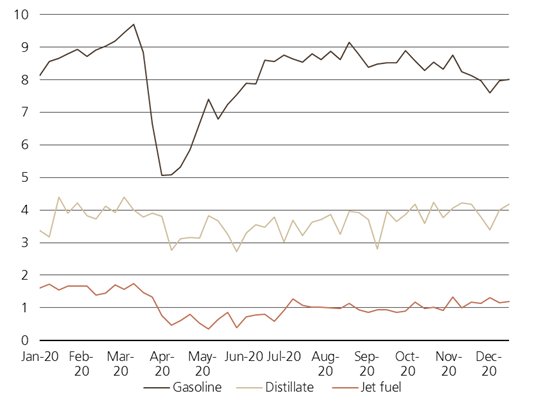

US products demand in mbpd-gasoline ticking back up

EIA

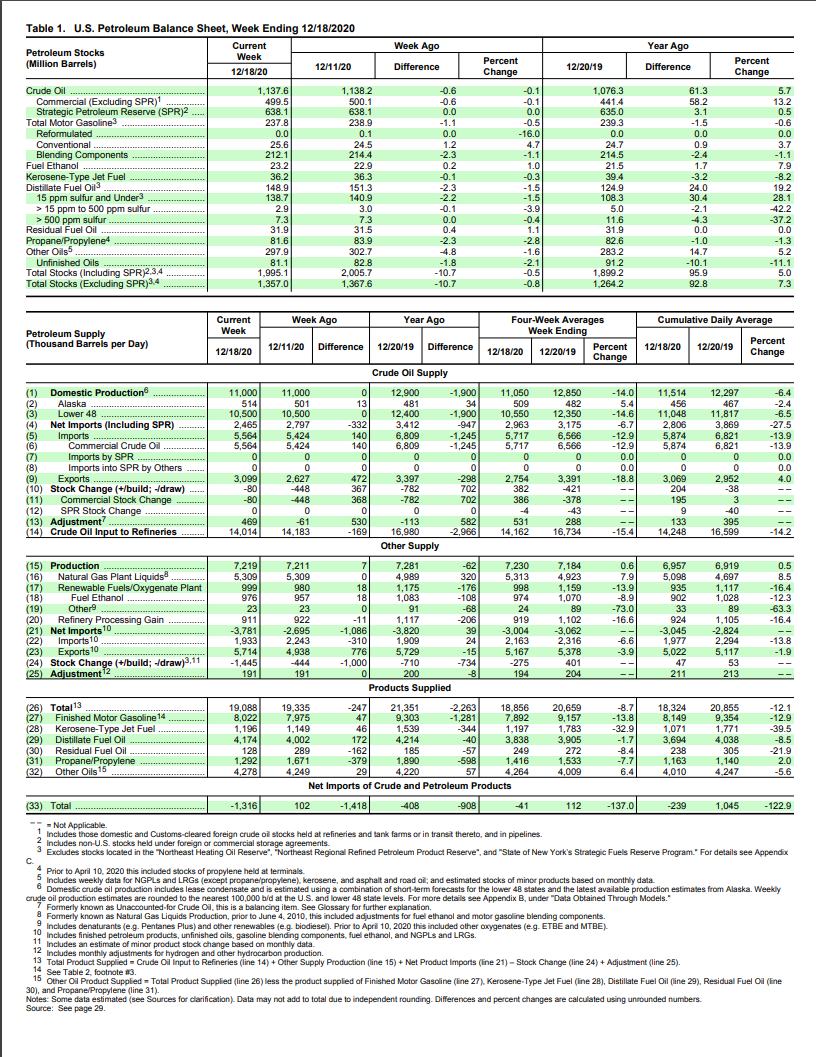

U.S. crude oil refinery inputs averaged 14.0 million barrels per day during the week ending

December 18, 2020 which was 169,000 barrels per day less than the previous week’s average.

Refineries operated at 78.0% of their operable capacity last week. Gasoline production increased

last week, averaging 8.8 million barrels per day. Distillate fuel production decreased last week,

averaging 4.6 million barrels per day.

U.S. crude oil imports averaged 5.6 million barrels per day last week, up by 140,000 barrels per

day from the previous week. Over the past four weeks, crude oil imports averaged about 5.7

million barrels per day, 12.9% less than the same four-week period last year. Total motor

gasoline imports (including both finished gasoline and gasoline blending components) last week

averaged 571,000 barrels per day, and distillate fuel imports averaged 444,000 barrels per day.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve)

decreased by 0.6 million barrels from the previous week. At 499.5 million barrels, U.S. crude oil

inventories are about 11% above the five year average for this time of year. Total motor gasoline

inventories decreased by 1.1 million barrels last week and are about 4% above the five-year

average for this time of year. Finished gasoline inventories increased while blending components

inventories decreased last week. Distillate fuel inventories decreased by 2.3 million barrels last

week and are about 10% above the five-year average for this time of year. Propane/propylene

inventories decreased by 2.3 million barrels last week and are about 4% above the five-year average for this time of year. Total commercial petroleum inventories decreased by 10.7 million

barrels last week.

Total products supplied over the last four-week period averaged 18.9 million barrels a day, down

by 8.7% from the same period last year. Over the past four weeks, motor gasoline product

supplied averaged 7.9 million barrels a day, down by 13.8% from the same period last year.

Distillate fuel product supplied averaged 3.8 million barrels a day over the past four weeks,

down by 1.7% from the same period last year. Jet fuel product supplied was down 32.9%

compared with the same four-week period last year.

FULL REPORT HERE