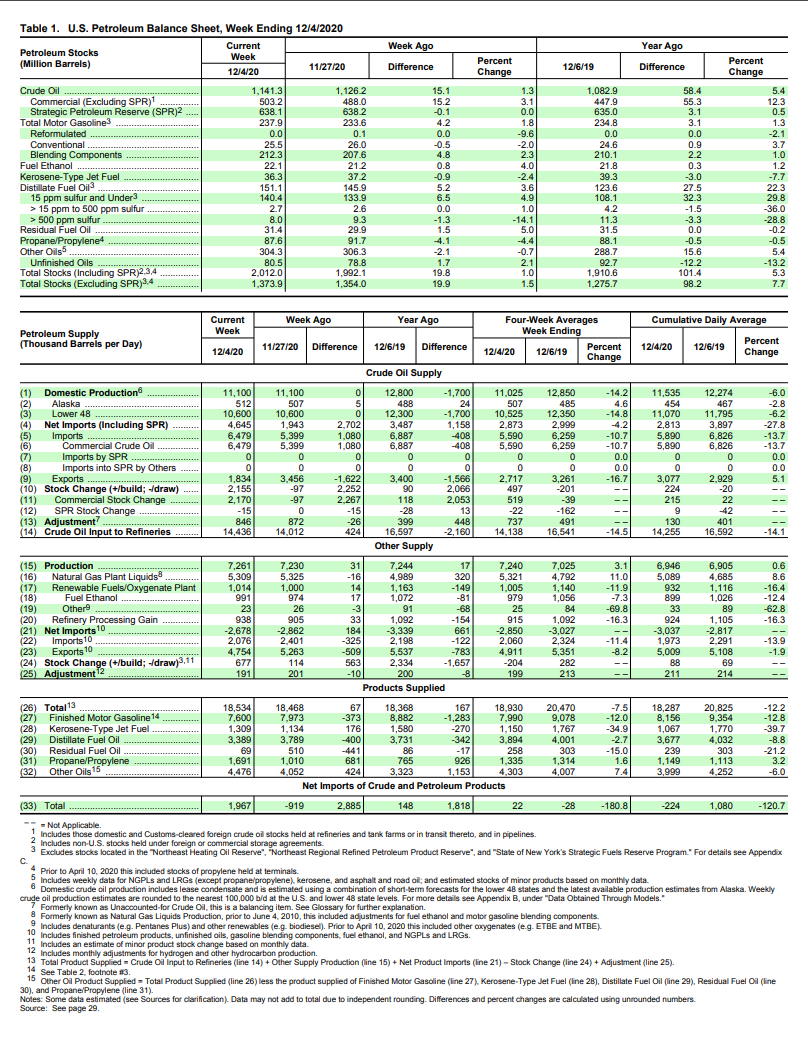

Crude: 15.189M

Cushing: -1.364M

Gasoline: 4.222M

Distillates: 5.222M

At the outset, this report looks pretty bad. Let’s take a closer look, as we had some anomalies this week. One being exports were down – 2.7M bpd which is 18.9M barrels total for the week, and imports were up +1.1M bpd or +7.7M barrels, that in an of its self counts for a lot of the build this week. The “adjustment” factor, which EIA adds or subtracts to counter margin of error was +873K bpd or 6.1M barrels for the week. Refinery utilization was up again to 79.9% which makes sense at the end of the year, as refiners need to get rid of barrels before the December 31st tax assessment date where they are taxed on the barrels they are holding. That said, gasoline demand due to shutdowns and seasonal weakness is also a factor in the gasoline build. The distillate build is slightly concerning, as imports were back to normal this week. The draw at Cushing, the actual WTI contract, is the bright spot on this report. As a result, crude oil bounced back after the initial sell-off, and oil equities remained firm. Petrochemical companies saw weakness, due to that distillate build.

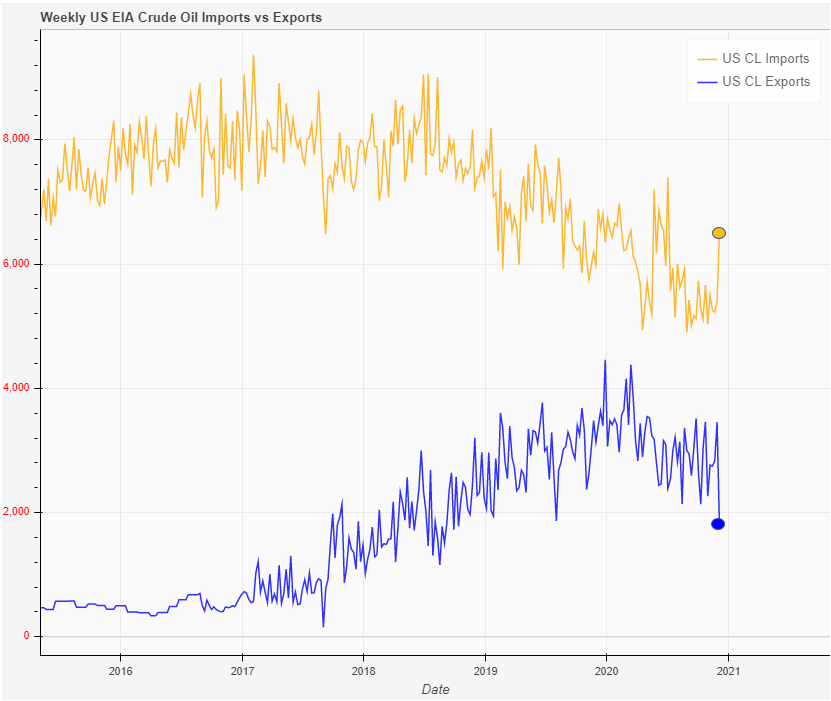

Here is the major problem this week. Imports v Exports.

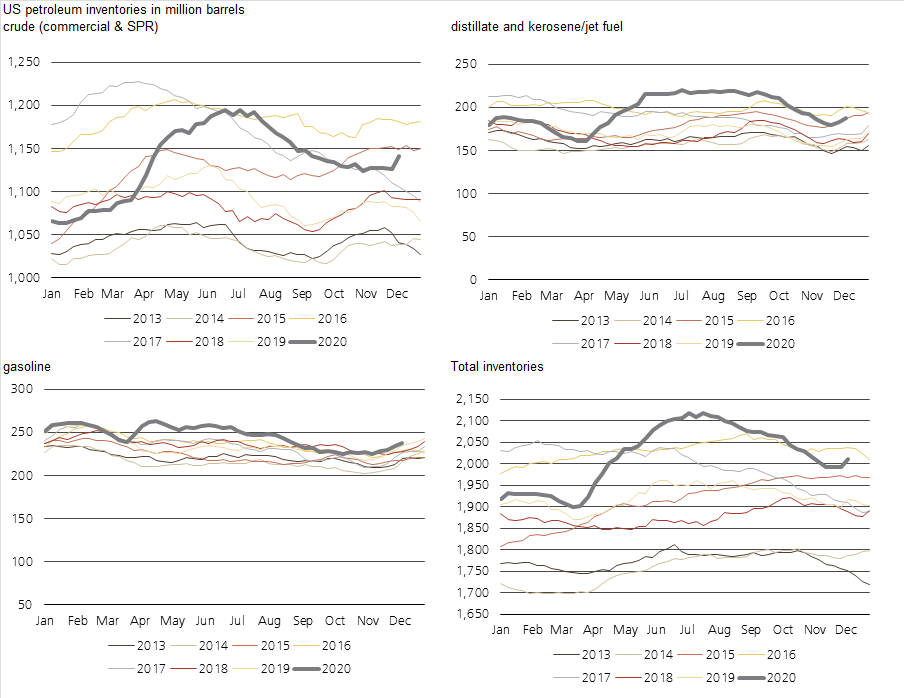

US petroleum inventories (in MB -EIA)

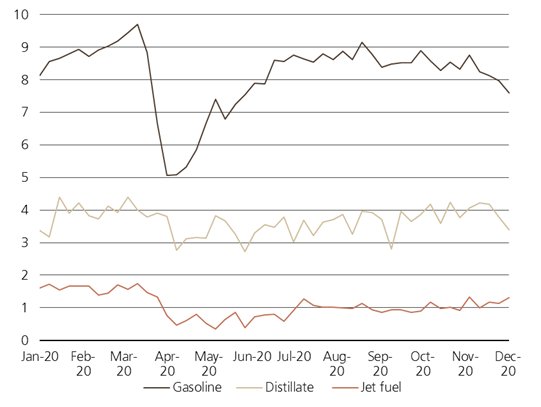

We still have to watch this gasoline demand weakness.

US product demand (in mbpd -EIA)

EIA

U.S. crude oil refinery inputs averaged 14.4 million barrels per day during the week ending

December 4, 2020, which was 424,000 barrels per day more than the previous week’s average.

Refineries operated at 79.9% of their operable capacity last week. Gasoline production decreased

last week, averaging 8.3 million barrels per day. Distillate fuel production increased last week,

averaging 4.7 million barrels per day.

U.S. crude oil imports averaged 6.5 million barrels per day last week, increased by 1.1 million

barrels per day from the previous week. Over the past four weeks, crude oil imports averaged

about 5.6 million barrels per day, 10.7% less than the same four-week period last year. Total

motor gasoline imports (including both finished gasoline and gasoline blending components) last

week averaged 789,000 barrels per day, and distillate fuel imports averaged 279,000 barrels per

day.

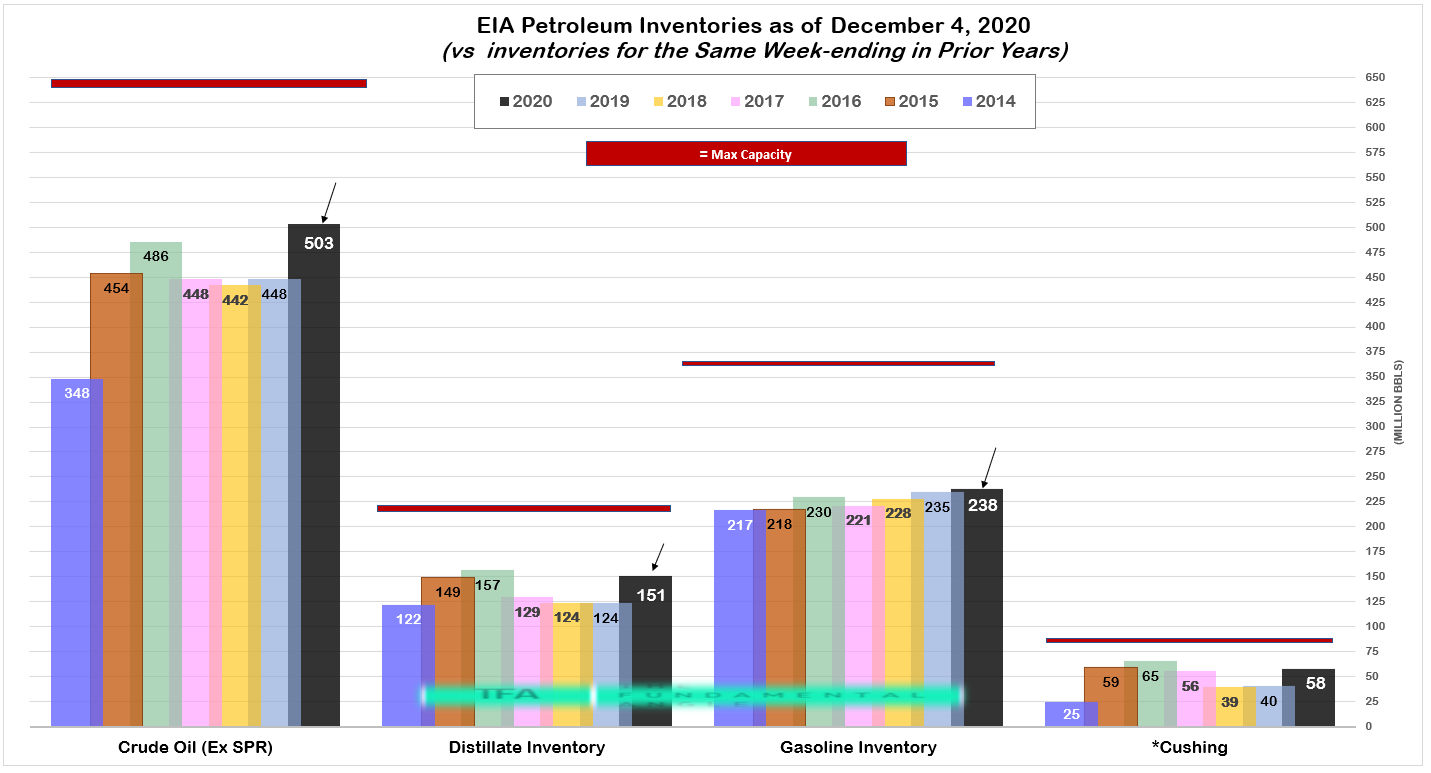

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve)

increased by 15.2 million barrels from the previous week. At 503.2 million barrels, U.S. crude

oil inventories are about 11% above the five year average for this time of year. Total motor

gasoline inventories increased by 4.2 million barrels last week and are about 5% above the five-year average for this time of year. Finished gasoline inventories decreased while blending

components inventories increased last week. Distillate fuel inventories increased by 5.2 million

barrels last week and are about 11% above the five year average for this time of year.

Propane/propylene inventories decreased by 4.1 million barrels last week and are about 4%

above the five year average for this time of year. Total commercial petroleum inventories

increased by 19.9 million barrels last week.

Total products supplied over the last four-week period averaged 18.9 million barrels a day, down

by 7.5% from the same period last year. Over the past four weeks, motor gasoline product

supplied averaged 8.0 million barrels a day, down by 12.0% from the same period last year.

Distillate fuel product supplied averaged 3.9 million barrels a day over the past four weeks,

down by 2.7% from the same period last year. Jet fuel product supplied was down 34.9%

compared with the same four-week period last year.

LINK TO FULL REPORT