POSITIONS DISCUSSED BELOW: I still like long: AR, SD, EUA Carbon futures, KRBN, and Natural Gas futures. A new long idea: XOP

BIG NEWS

HURRICANE IDA

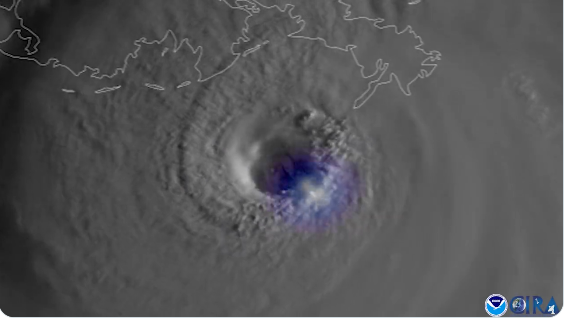

Ida continues to strengthen and now has maximum sustained winds of around 150 MPH with higher gusts and a minimum pressure of 935 mb (27.61 inches). It is poised to make landfall in a few hours, according to NOAA.

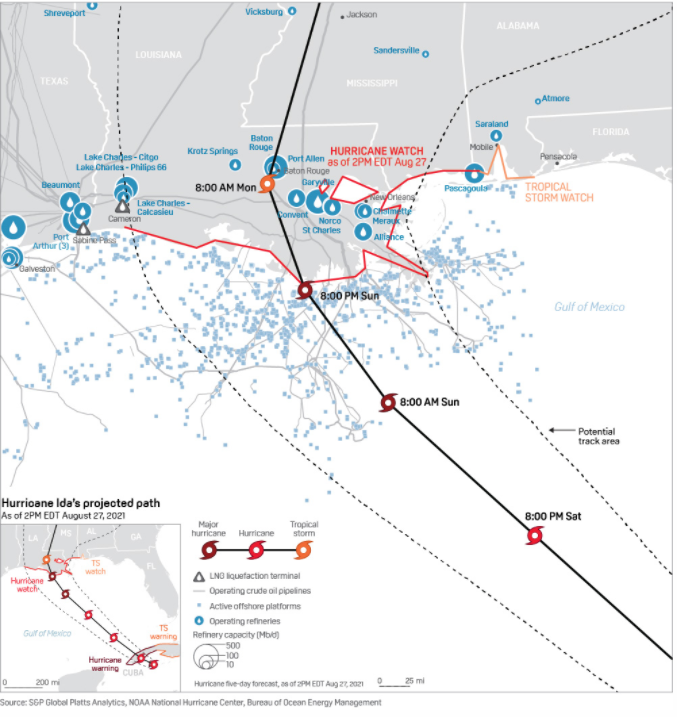

Projected path and refinery infrastructure

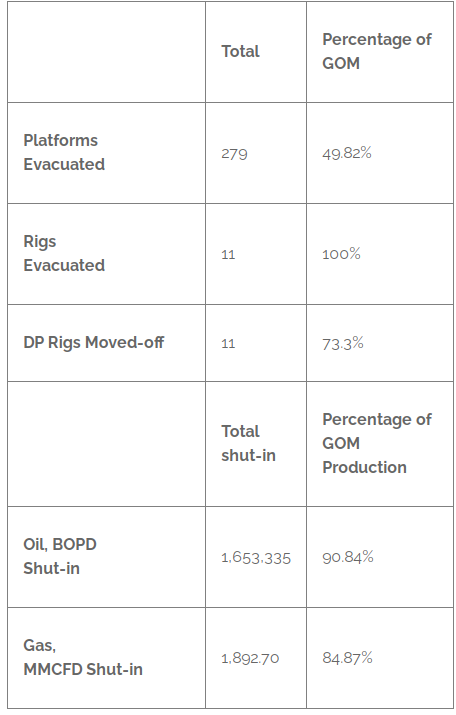

According to the Bureau of Safety and Environmental Enforcement (BSEE)

Based on data from offshore operator reports submitted as of 11:30 CDT yesterday, personnel has been evacuated from a total of 279 production platforms, 49.82 percent of the 560 manned platforms in the Gulf of Mexico. Production platforms are the structures located offshore from which oil and gas are produced. Unlike drilling rigs, which typically move from location to location, production facilities remain in the same location throughout a project’s duration. Personnel has been evacuated from 11 rigs (non-dynamically positioned), equivalent to 100 percent of the 11 rigs of this type currently operating in the Gulf. Rigs can include several types of offshore drilling facilities including jack-up rigs, platform rigs, all submersibles, and moored semisubmersibles.

A total of 11 dynamically positioned rigs have moved off location out of the storm’s projected path as a precaution. This number represents 73.3 percent of the 15 DP rigs currently operating in the Gulf. Dynamically positioned rigs maintain their location while conducting well operations by using thrusters and propellers. These rigs are not moored to the seafloor; therefore, they can move off location in a relatively short time frame. Personnel remain on board and return to the location once the storm has passed.

From operator reports, it is estimated that approximately 90.84 percent of the current oil production in the Gulf of Mexico has been shut-in. BSEE estimates that approximately 84.87 percent of the gas production in the Gulf of Mexico has been shut-in. The production percentages are calculated using the information submitted by offshore operators in daily reports. Shut-in production information included in these reports is based on the amount of oil and gas the operator expected to produce that day. The shut-in production figures, therefore, are estimates, which BSEE compares to historical production reports to ensure the estimates follow a logical pattern.

After the storm has passed, facilities will be inspected. Once all standard checks have been completed, production from undamaged facilities will be brought back online immediately. Facilities sustaining damage may take longer to bring back online.

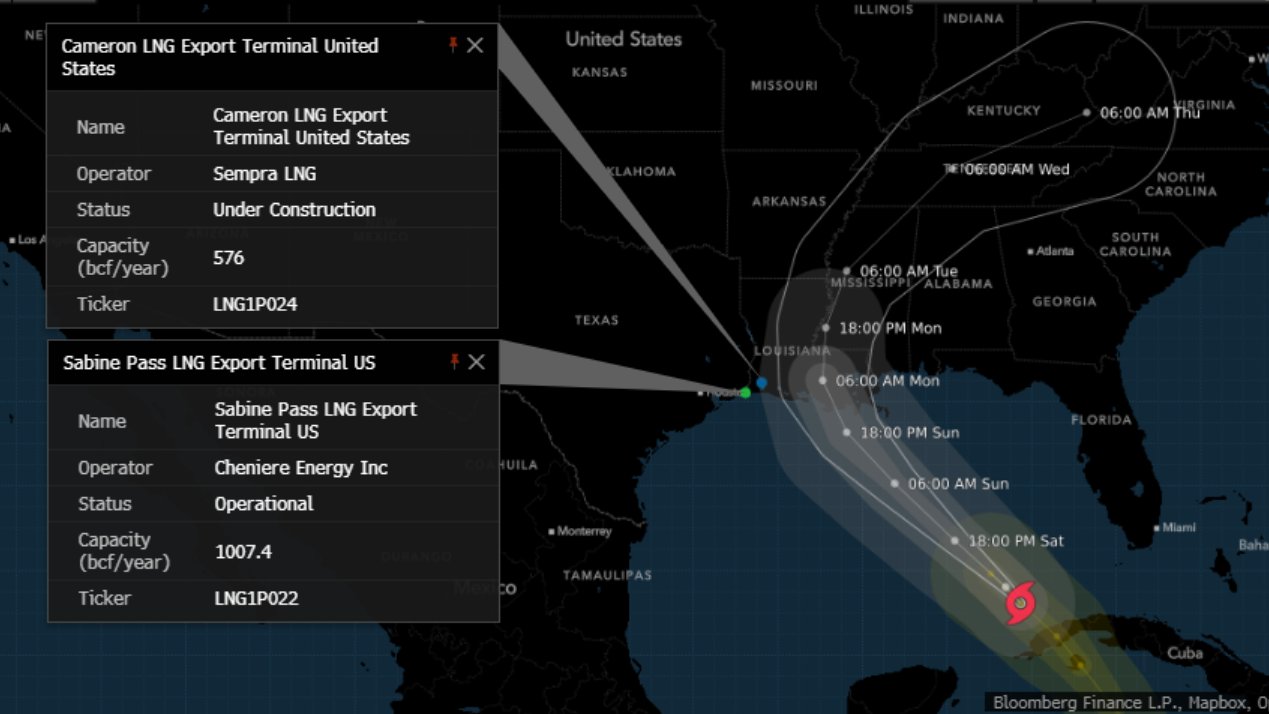

There are two nearby US LNG export facilities, which could be disrupted, but they are at the edge of the hurricane’s path and likely not to be disrupted

The Louisiana LOOP which is the strategic offshore crude oil port linking energy producers with refineries announcement:

“LOOP continues to implement its inclement weather plan and is working directly with shippers to minimize shipper storm-related impacts; deliveries will be temporarily paused until storm impacts subside”

Refining Capacity

Confirmed refinery shutdowns:

Shell shut down its 230,600 b/d Norco Refinery in Louisiana, as well as its Geismar petrochemical plant.

Phillips 66 closed its 255,600 Alliance Refinery in Belle Chasse, Louisiana.

Valero Sunday said its 215,000-bpd St. Charles and 125,000-bpd Meraux refineries in Louisiana were shut ahead of Hurricane Ida

PBF Energy’s 190,000-bpd Chalmette is shut in

Partial shutdowns:

ExxonMobil 503,000-BPD Baton Rouge, La. Refinery Sharply Reduced Ahead Of Hurricane Ida

TOTAL: 1.03 Mln BPD Of Refining Capacity Taken Offline Ahead Of Landfall

Other refineries in danger of suffering direct storm-related impacts include: Marathon Petroleum’s 565,000-bpd Garyville; Exxon Mobil’s 503,000-bpd Baton Rouge, Delek US’ 80,000-bpd Krotz Springs; Placid Refining’s 75,000-bpd Port Allen; and Calumet Specialty Products’ 57,000-bpd Shreveport facilities

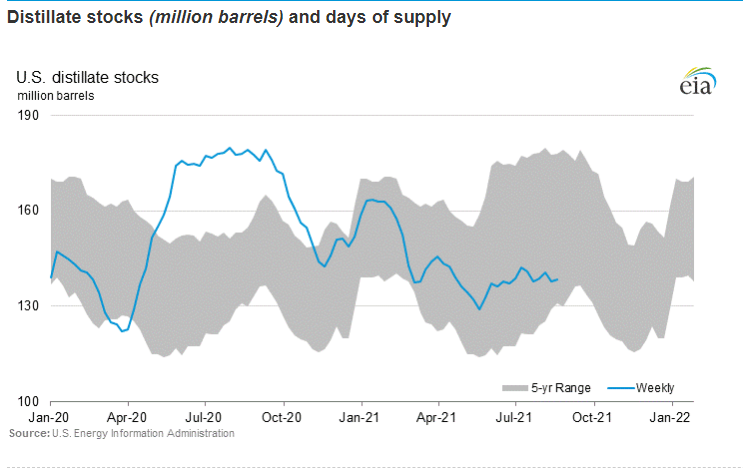

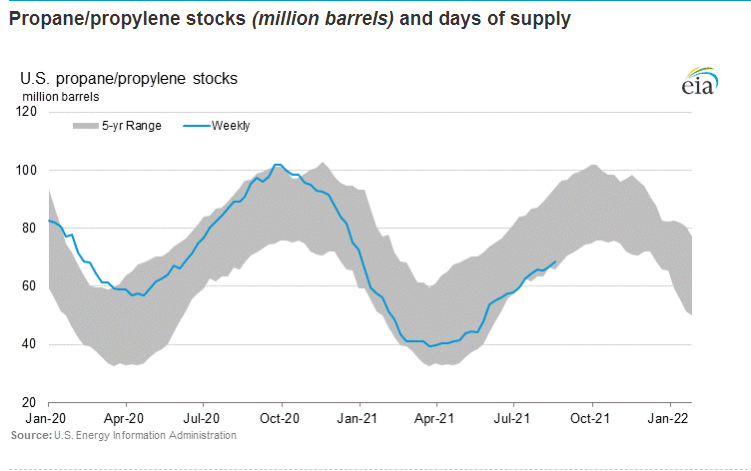

NOTABLE: Currently there is more production shut-in than refining capacity shut-in. As well, we have a lot of natural gas production shut-in, with minimal chance distribution facilities get disruption. This could cause some serious draws stock draws over the next couple of weeks for both oil and natural gas. Obviously right now we do not know the extent of what damage and how long production and/or refining will stay down.

Thoughts and prayers to all …stay safe!

*Note none of this will show up on this week’s inventory report. It will show up in the 8 January report.

OPEC PLUS MEETING

20th OPEC and non-OPEC Ministerial Meeting will be held on 1 September 2021 this week, so expect the usual headline craziness. It is worth noting that the Kuwait oil minister has suggested that they review the current increase schedule in light of the Covid Delta variant and slowdowns in some economies.

TECHNICALS

Look for resistance around 71.86-72.66

FUNDAMENTALS

NORWAY

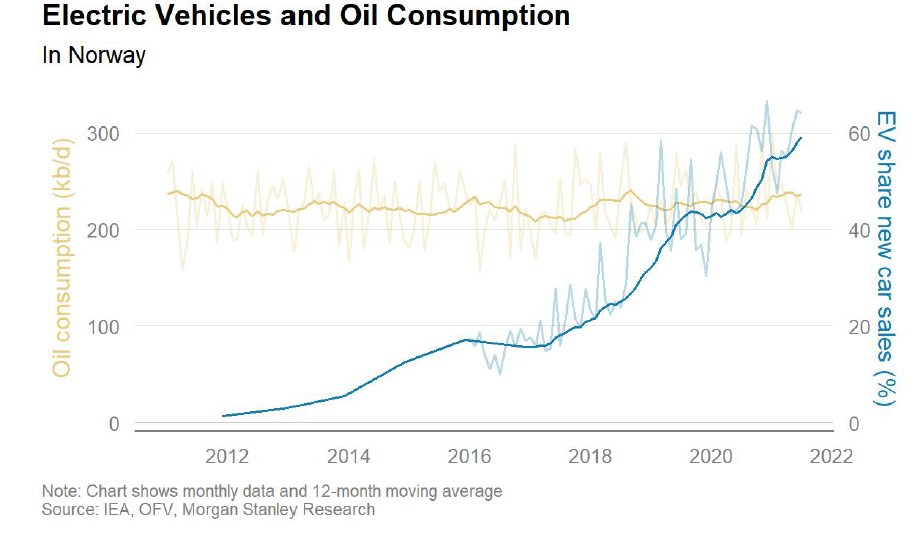

interesting note from Morgan Stanley looking at why in Norway, where electric vehicles made 64% of new car sales, oil consumption hasn’t declined:

Cars are only 20-25% of oil demand

Fleet turnover is slow

Diesel truck/van sales have grown

NOTABLE: I pointed out weeks ago, EV’s are a very small picture of overall fuel consumption demand. Here is a prime example.

UNITED STATES

Big win for the oil and gas industry this week. A federal judge blocked the Biden administration’s suspension of new oil and gas leases on federal land and waters that include the Gulf of Mexico. Although the administration is filing an appeal, by court order, they will open permits.

NOTABLE: No one is really looking to drill more right now. This is more of a symbolic win but an important one.

MISSISSIPPI RIVER

No one has really talked about the Mississippi River (the spine of US commerce) with regards to shipping disruption due to IDA…about 35% of commerce passed along the river begins or ends in Louisiana

NOTABLE: This will cause disruption from everything to grains, metals, oil, fuel, coal, lumber…you name it commodities wise

INDIA

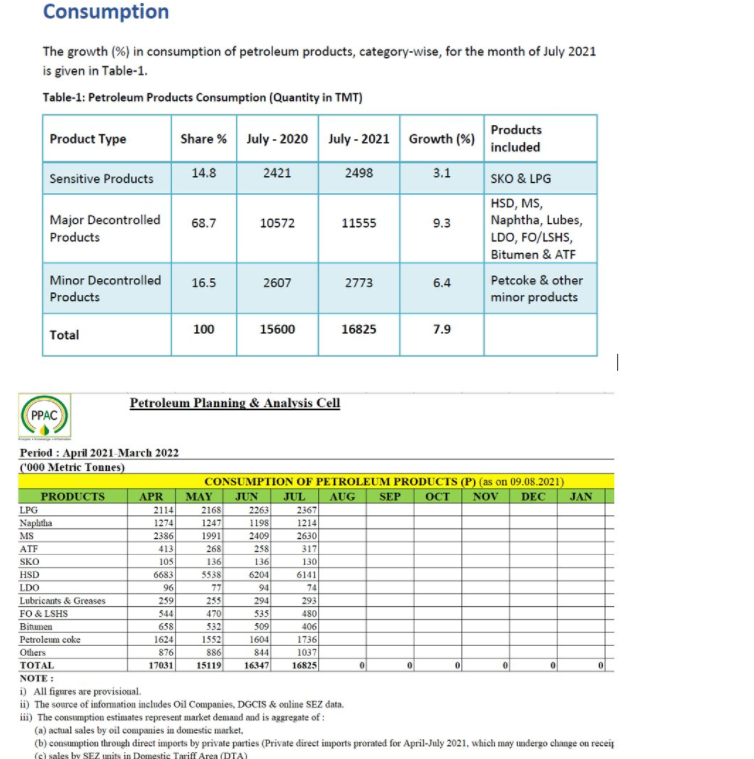

India is on the rebound!

Indian refiners’ crude throughput in July bounced to its highest in three months, as the easing of coronavirus restrictions boosted economic activity and fed demand for fuel.

Provisional government data on Monday showed refiners processed 4.58 million barrels per day (19.38 million tonnes) of crude oil last month, about 1.9% higher than 4.50 million bpd processed in June.

On a year-on-year basis, refiners’ crude oil throughput in July jumped about 9.6%, while crude oil production fell about 3% to 602,000 bpd (2.55 million tonnes), the data showed. -Reuters

Notable: Delta is in waves, demand lost is demand gained somewhere else.

LIBYA

There is some major stuff going on there…production could go to zero. That said, things are in flux, I will write up a separate report in the coming days.

BLOOMBERG OIL DEMAND MONITOR

The spread of the coronavirus delta variant has already taken a swipe at the aviation fuel market and

analysts are now trying to assess how bad it may dent a broader recovery in demand for oil-based fuels.

Falling mobility in Asia led analysts at Australia & New Zealand Banking Group Ltd. to cut their third-quarter oil demand forecast for Asia excluding China by 300,000 barrels a day, even as global inventories tighten.

“This is taking the shine off an otherwise positive backdrop elsewhere,” ANZ analysts Daniel Hynes and Soni Kumari said in a research note. “Demand in Europe and the U.S. remains robust, as mobility continues to improve.”

Goldman Sachs Group Inc. is more upbeat, saying oil prices are currently “oversold,” given that the delta variant is a “transient event to oil demand” while the ongoing supply-demand deficit is more persistent. Regional mobility indicators outside of the Asia-Pacific region remain “robust,” according to Goldman

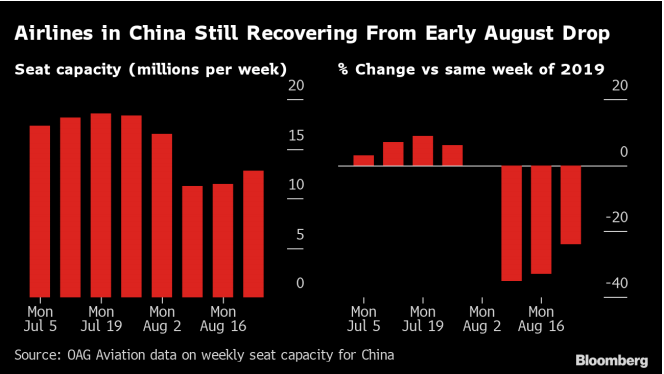

China had been leading gains in airline seat capacity until new travel restrictions led to a plunge in early August, from which it is still recovering.

Among the largest markets, only Mexico is catering for a similar number of passengers as it did in the year before the pandemic. Mexico’s seat capacity for this week was only 3.3% less than the same week of 2019 whereas China was down 24%, according to data compiled by OAG Aviation. The U.S, India, and Spain were down by 12%, 27%, and 26%, respectively.

“Australia is also winding back capacity this week as the ongoing lockdowns continue to hamper domestic travel,” OAG said. Seats withdrawn from the schedule this week have taken “Australia back down to just under a quarter of 2019 capacity levels.”

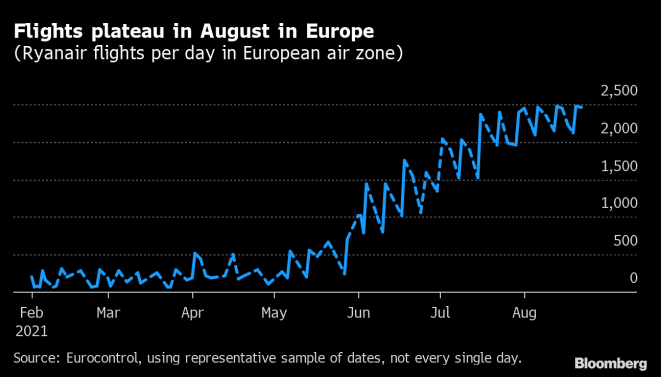

Europe’s air space had been getting busier since early May, steadily reducing the deficit versus two years ago. However, that progress appears to have stagnated in August with air traffic holding at about 30% below the same time in 2019, according to Eurocontrol, an agency that helps coordinate traffic.

For instance, the region’s highest-volume carrier, Ryanair, is leveling out at just under 2,500 flights per day on its busiest day of the week after growing steadily from about 500 a day in early May.

Putting it all together, the number of global commercial flights is currently 29% lower than it was at the same point in 2019, a wider margin than the 24% gap seen in mid-July, and worldwide seat capacity is down 34%, according to estimates from FlightRadar24 and OAG.

Road Fuel Strength

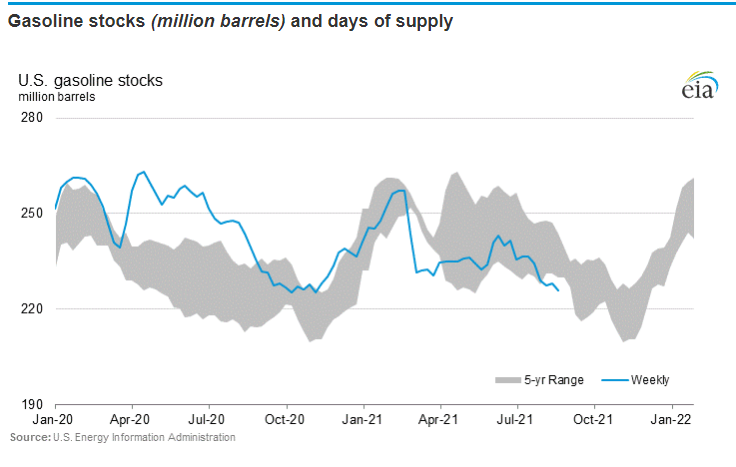

Broader measures of oil demand appear more robust. Total oil products demand in the U.S. in the week ended Aug. 13, which includes gasoline and diesel as well as jet fuel, was 2.2% higher than in 2019, and also up 4.3% from a month earlier, according to estimates from the Energy Information Administration. Data for the week ended Aug. 20 will be published on Wednesday.

Direct measurements of road fuel usage usually take longer to compile. Spain and Portugal, for instance, have reported data on gasoline consumption for the month of July which was 3.1% higher and 5.2% lower, respectively, compared with July 2019. Diesel demand was running about 5% below the pre-pandemic period in both countries.

Another positive sign for road fuel demand is an increase in congestion levels in Chinese cities such as Beijing, according to real-time traffic data from Baidu. Berlin is also seeing much heavier congestion in recent weeks even as other European cities thin out for the summer holiday season, data from TomTom NV show.

NATURAL GAS

Natural gas prices continue to press higher in the UK and the US.

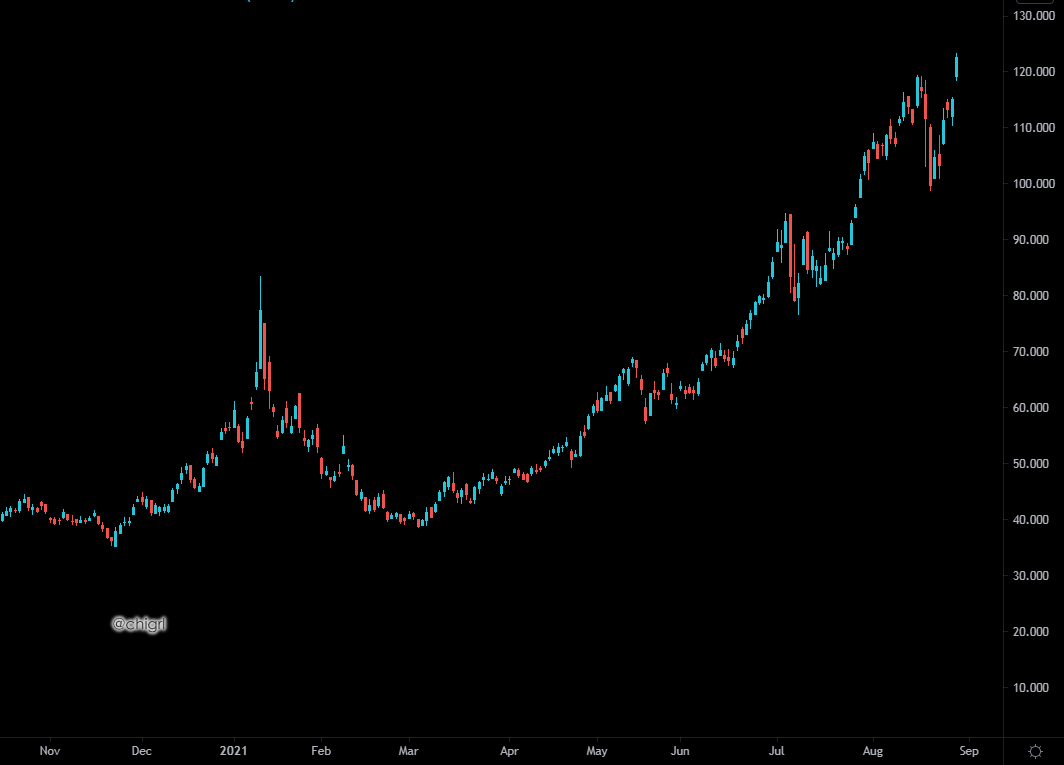

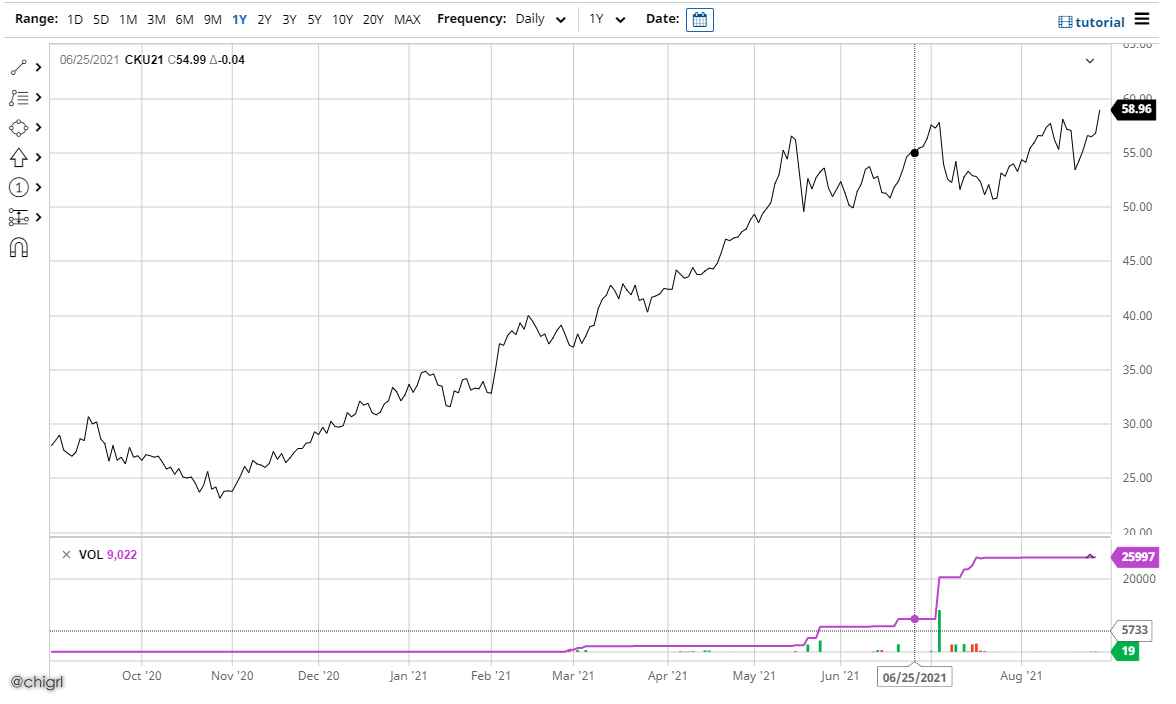

UK nat gas

US natural gas

NOTABLE: Stay long AR and SD

CARBON

Carbon futures continue to move higher….we got long in January …it is a hold for over 100, finally breaking out

You can also play this with an ETF such as $KRBN (as suggested back in April)

MATERIALS

BASE METALS

INTERESTING REPORT FROM ANZ

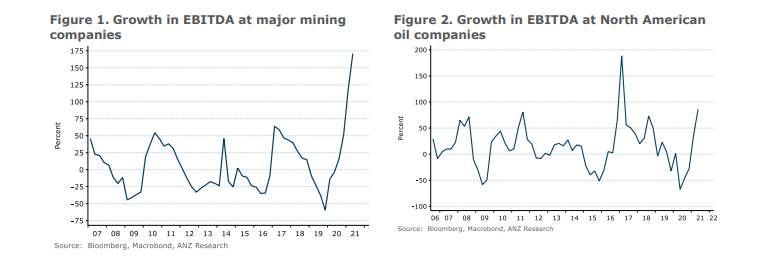

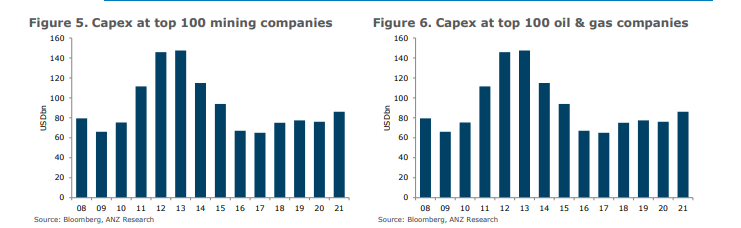

Growth in EBITDA for major base metal companies averaged

170% in Q2 2021. If maintained for the rest of the year, this would be the highest

level of growth for more than 30 years.

A similar situation is occurring in the energy sector. Quarterly EBITDA growth in the North American oil industry has hit its highest level since 2016.

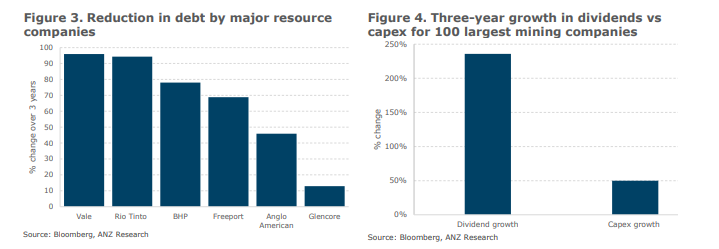

This comes as resource companies take a much more disciplined approach to capital

management. Rather than growth at any cost, senior management is now intensely

focused on improving shareholder returns.

Their focus has also sharpened. Many big miners are now reluctant to invest in fossil

fuels. This was highlighted by the recent decision by BHP to enter into an agreement

with Woodside to sell its oil and gas business. Most diversified majors have also

divested coal assets.

The copper project pipeline looks smaller than previous cycles. We have collated the

expected output of all projects likely to begin in the next three to five years. The lack

of investment has resulted in the current pipeline representing only 2.3% of the

supply base, compared with nearly 4% through the growth period of 2010–14.

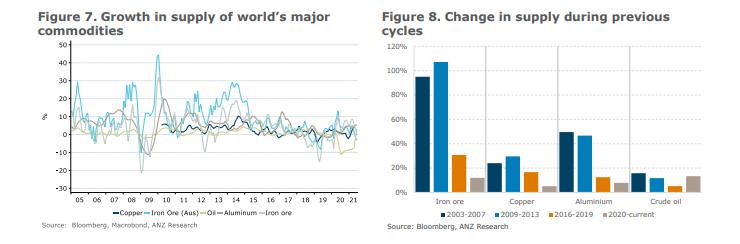

This is likely to lead to a material fall in the growth rates of many commodities.

In fact, growth in supply is already struggling to reach levels of previous cycles

.For commodities such as iron ore, copper, and crude oil, growth rates

rallied in the years prior to the 2009 crisis. Then stimulus measures saw that growth

again hit record highs. However, since then growth rates have been subdued.

During the China-led demand boom of 2003–08, monthly iron ore exports rose from

42m tonnes to about 82m tonnes, an increase of nearly 100%. The next cycle, after

the financial crisis, saw supply up 107%; but the 2016–19 cycle saw that fall to 31%.

The current cycle, starting in Q2 2020, has seen exports up only 12%.

This falling cyclical growth rate is mirrored across other commodities. Copper’s

trough-to-peak growth hit 30% in 2009–13 but has fallen to only 5% in the current

cycle. Only crude oil has bucked the trend, with the current growth rate hitting 13%,

but that is being driven by previously curtailed supply being released by OPEC.

With capital expenditure plans relatively low, we think growth rates will be subdued.

NOTABLE: Stay long metals and energy equities. If you are a new subscriber, there is plenty of room to go in our precious metals and metals miners trades. That said SPDR S&P Metals & Mining ETF XME is a good way to play this, it is on the verge of a breakout after 2 months of consolidation.

XOP also looks very interesting here, wedge break out and retest…over the 50 day and this has great potential for lift-off technically speaking

OIL INVENTORIES

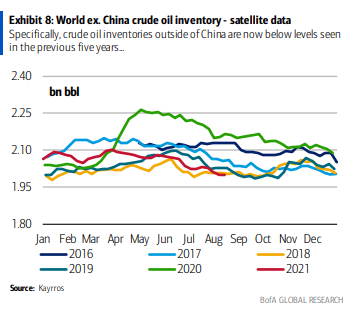

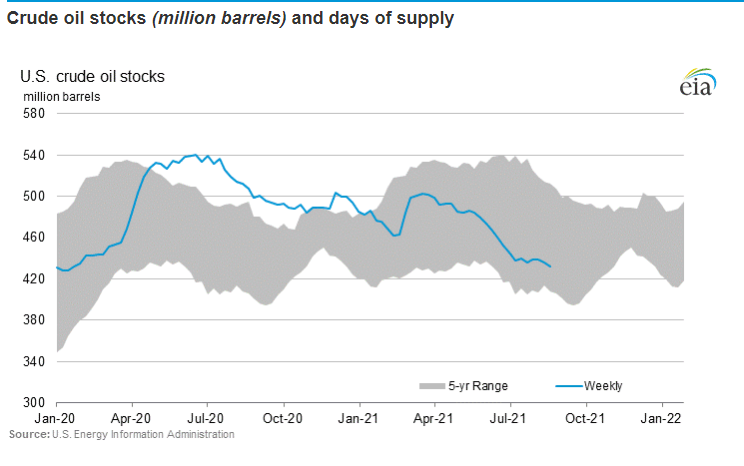

GLOBAL OIL INVENTORIES -EX-CHINA

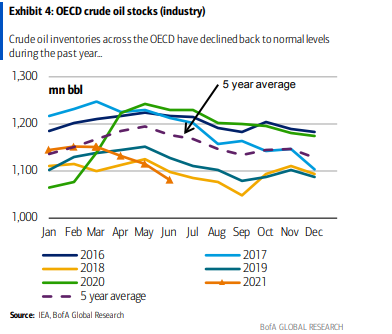

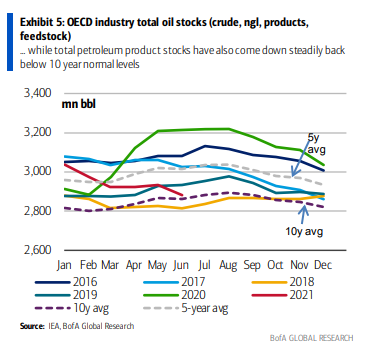

OECD OIL INVENTORIES

OECD TOTAL OIL STOCKS

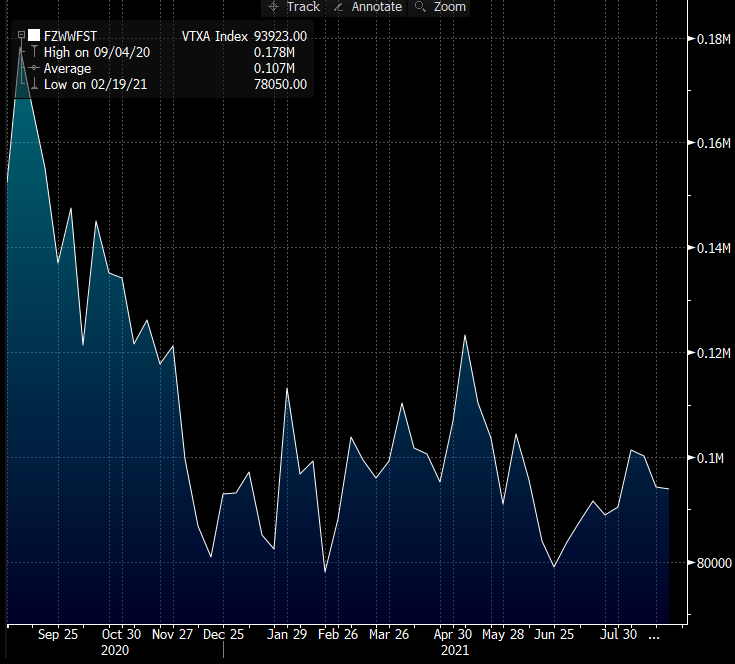

VORTEXA GLOBAL FLOATING STORAGE

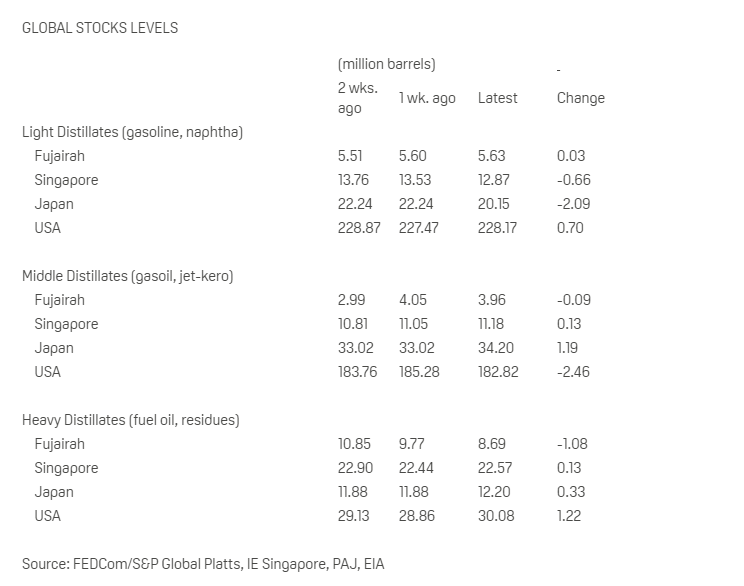

FUJAIRAH DATA

Oil product stocks fall to 5-month low as fuel oils decline 11% on the week

The total inventory was 18.278 million barrels as of Aug. 23, down 5.9% from a week earlier and the lowest since March 22, according to Fujairah Oil Industry Zone data provided exclusively to S&P Global Platts on Aug. 25

Heavy distillates, or the fuel oils, tumbled 11% on the week to 8.687 million barrels, the lowest since March 29.

Middle distillates, including jet fuel and diesel, declined 2.1% in the week to 3.96 million barrels as of Aug. 23, after a 35% jump in the previous week

Light distillates, including gasoline and naphtha, rose 0.5% to a four-week high of 5.631 million barrels. -PLATTS

EIA

HAVE A GREAT WEEK EVERYONE!