For a recap of the markets and a look ahead to next week check here. I will be doing this weekly.

BIG NEWS

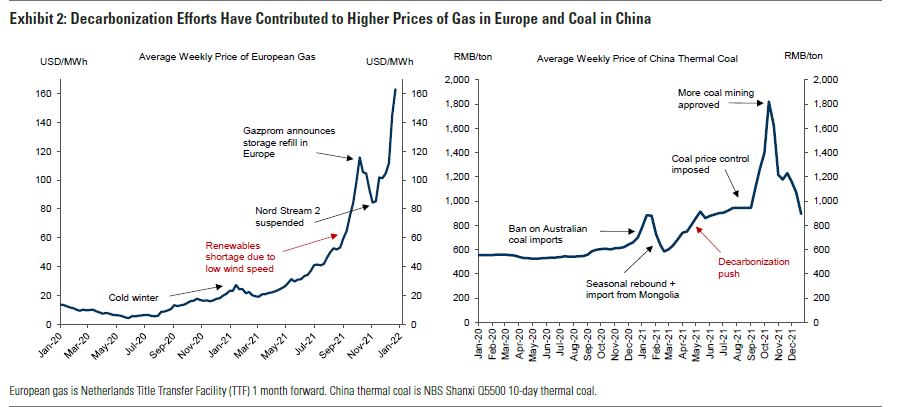

Europe’s energy crisis remains unabated.

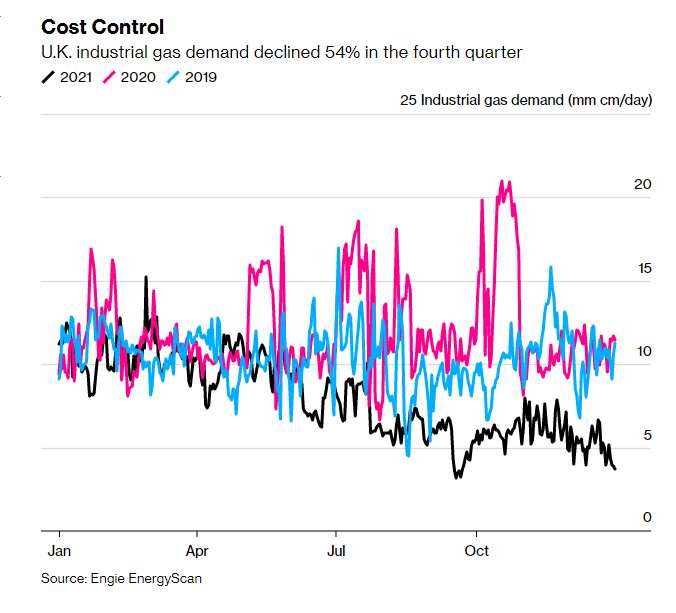

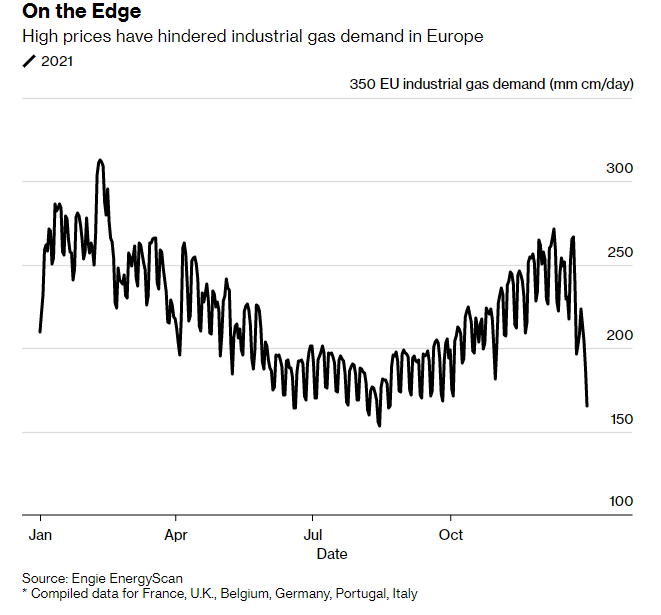

Natural gas demand among European industries has dropped by the most since the early days of the pandemic, with soaring prices prompting widespread output cuts and factory shutdowns.

Fourth-quarter industrial gas use in northern Europe fell by almost 5% from a year earlier, the biggest decline since the second quarter of 2020, according to Engie EnergyScan. Pressure on U.K. firms got so bad that demand there sank 54%, and a recent new wave of shutdowns suggests the trend will continue.

“As reports of factories shutting down or possibly not resuming operations after the end-of-year break are coming again, industrial demand destruction could resume in the first quarter,” said Julien Hoarau, head of the energy consulting firm.

“The cost burden for companies has reached record-highs,” said Jorg Rothermel, head of energy at the VCI German chemical industry association. The price surge “will sooner or later hit all companies.” -BBG

Meanwhile in Norway

“Norway has lifted its electricity subsidy for the 3rd time in two months. Initially, Oslo said it would pay 50% of the bills when power prices rose about a trigger level. Within days, it raised to 55%. And yesterday, it went to 80%

The total cost of the Norwegian electricity subsidy is now running at nearly $1.6 billion (or about 13.9 NOK), and that just covers December, January, February and March

It isn’t pocket money: an average detached house will get in January (note, just one single month) about $280 from the government to help pay the electricity bill, based on expected power prices. An average flat (with smaller consumption) will get about $115 in January” -Javier Blas

As all of this is happening….GERMANY

The German government on Saturday slammed plans by the European Commission to include nuclear energy and natural gas in its long-awaited green labeling system for investments in the energy sector.

Economy and Climate Protection Minister Robert Habeck and Environment Minister Steffi Lemke, both from the Green party, sharply criticized the Commission initiative, and Habeck — who is also German vice chancellor — said Berlin could not back the proposed scheme.

The controversial Commission push is part of the so-called “taxonomy” list, which will be crucial to channeling billions of euros in investments toward technologies needed to build clean power plants and decarbonize the bloc’s economy.

A draft delegated act, sent to EU countries on Friday, says “it is necessary to recognize that the fossil gas and nuclear energy sectors can contribute to the decarbonization of the Union’s economy.” -Politico

*note the vote is this week on whether to include gas and nuclear or not…say tuned!

NOTABLE: Incredible, that these people can not get out of their own way. The situation looks to be going from bad to worse.

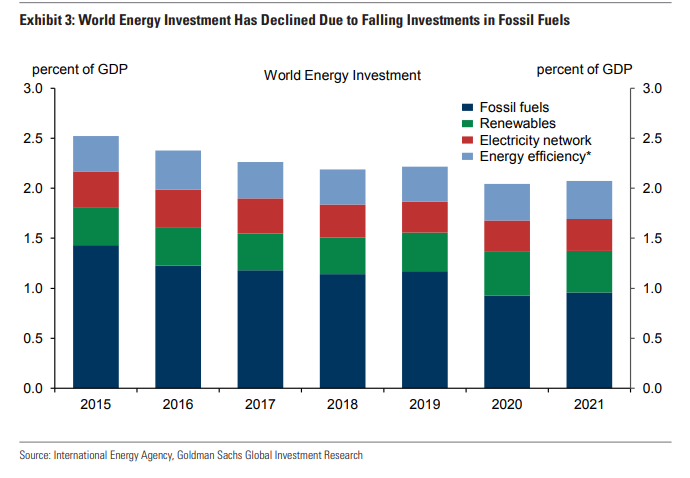

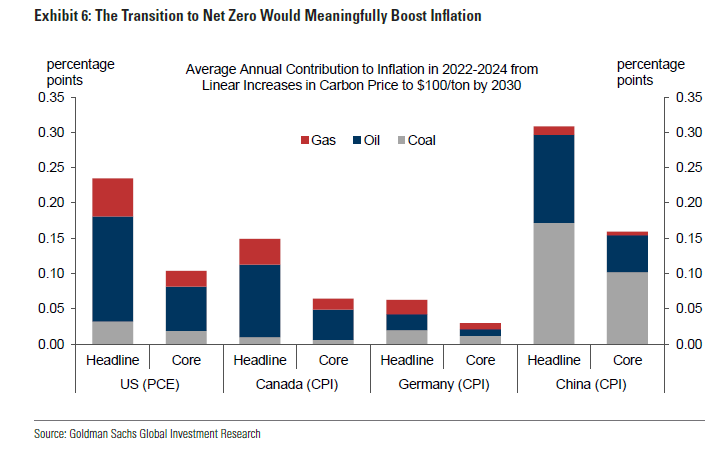

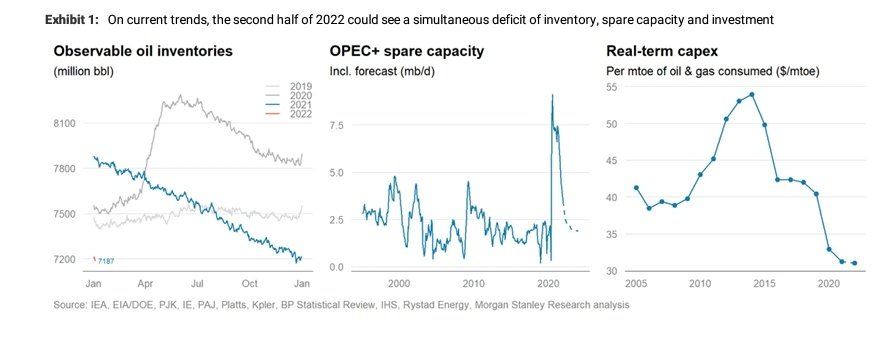

If we look at world energy investment, fossil fuels have declined, but renewable investment has stayed flat. We are going to need investment somewhere. Stay long fossil fuels. I can not stress this enough.

In addition, if German chemical companies are having to curb production, as mentioned in Bloomberg. I reiterate my long call from last year for Sasol (SSL) which has refining capacity in the United States. It is still buyable on dips.

CHARTS OF INTEREST THIS WEEK

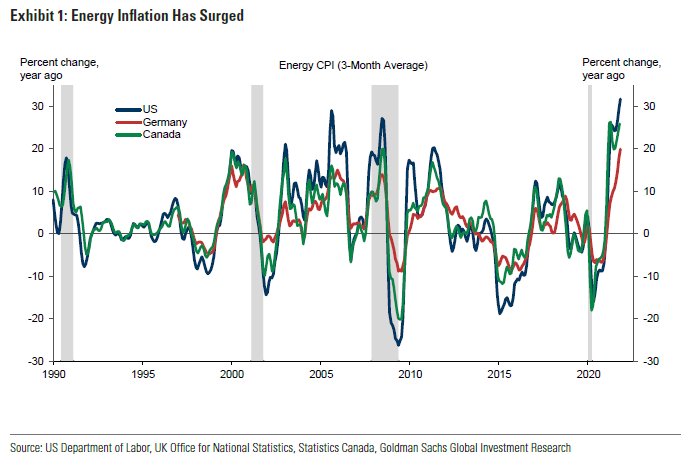

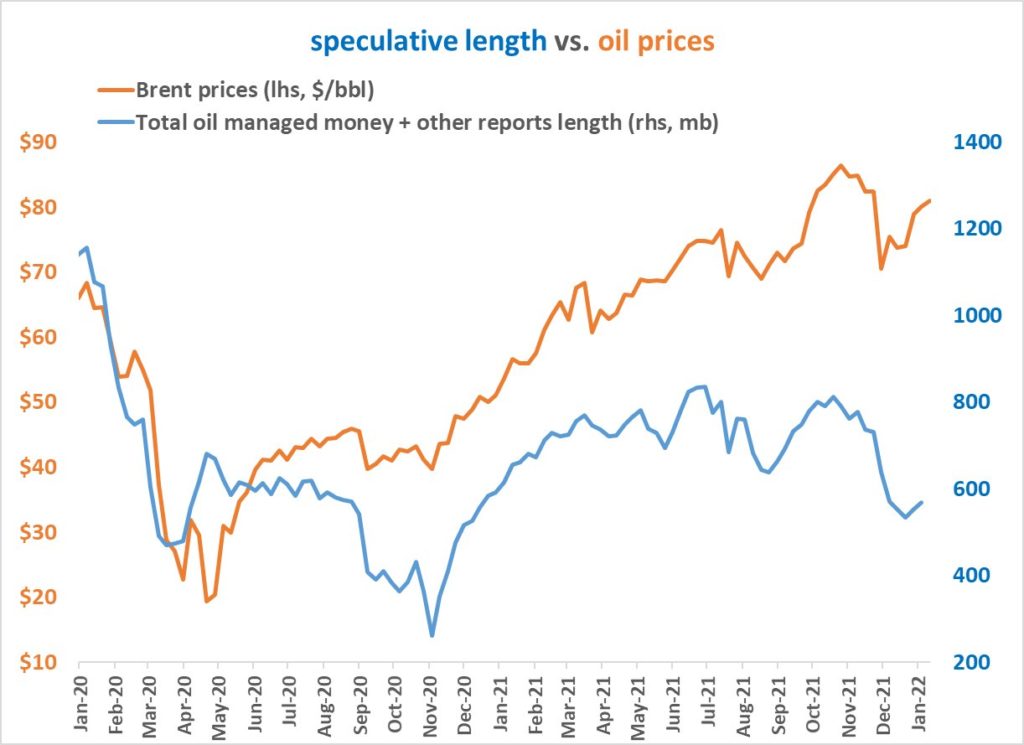

This is a very important chart!

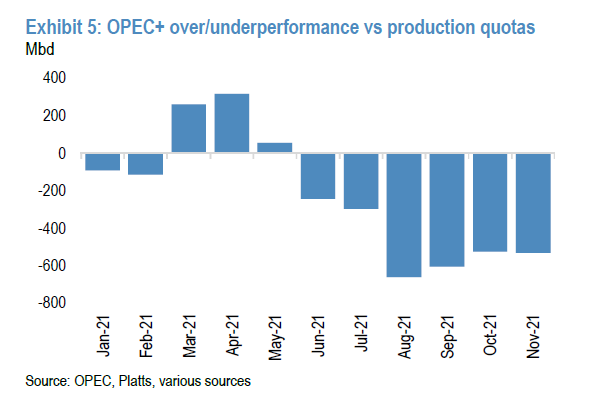

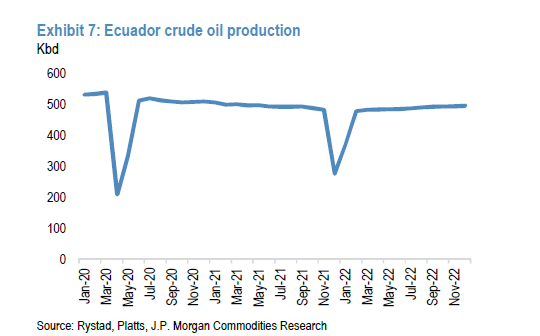

OPEC+ also did not make quota in December. So, again an added 400K in January is meaningless, as likley they will not be able to hit the target.

Ecuador’s oil production problem seems to be “fixed” for now. That still leaves -700K from Libya offline and -200K from Nigeria.

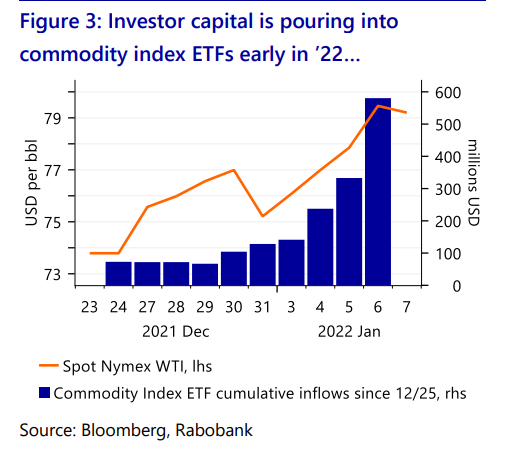

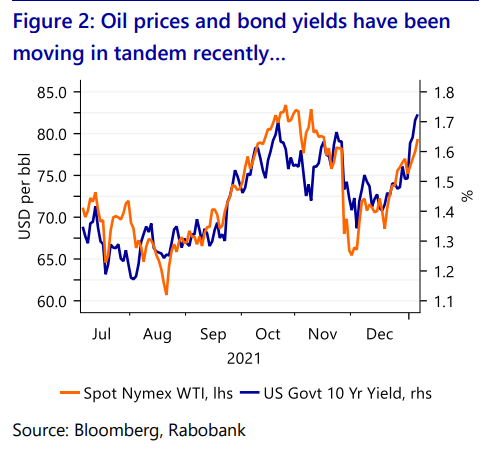

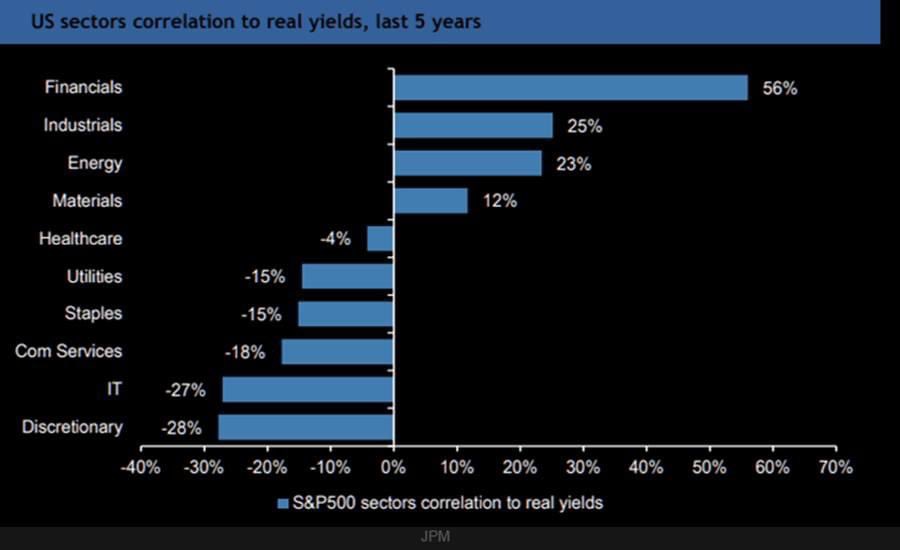

I have been stating for over a year now that oil is being used as an inflation hedge and is more correlated to rates than gold.

The likelihood for rising yields is a threat to bond returns given their inverse

relationship and the tech-heavy equity indices are also vulnerable should rates rise.

2022 greets us with a COVID outbreak at the Chinese port of Ningbo. Trucking capacity in the area is reduced by over 90% as drivers are quarantine. This is what the vessel backlog looks like. Do not expect supply chain problems to abate anytime soon.

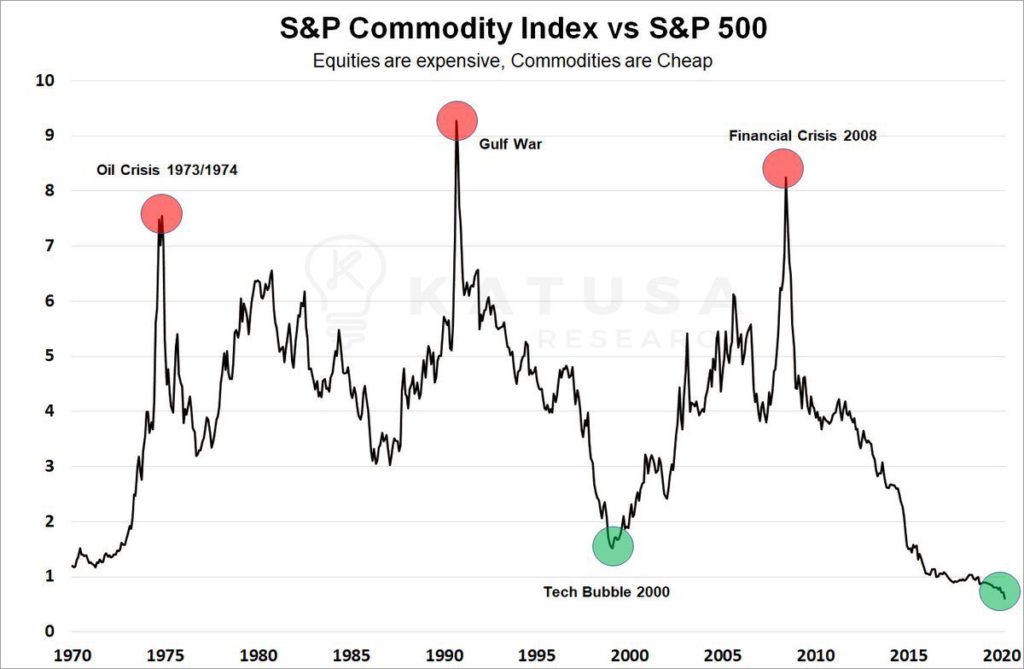

Room to Run

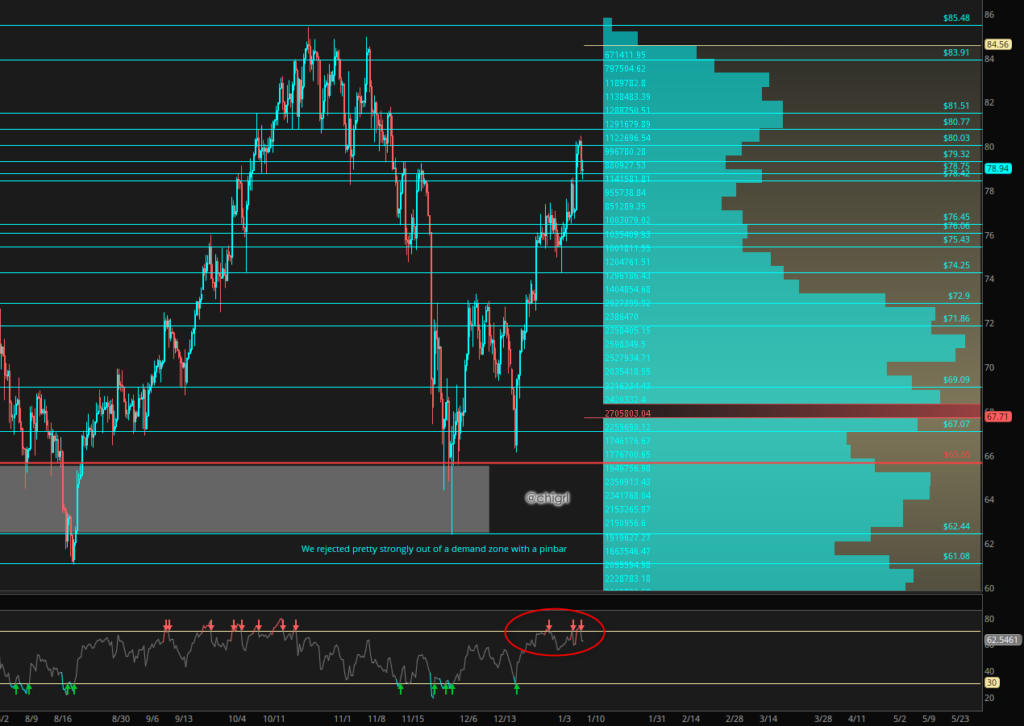

TECHNICALS

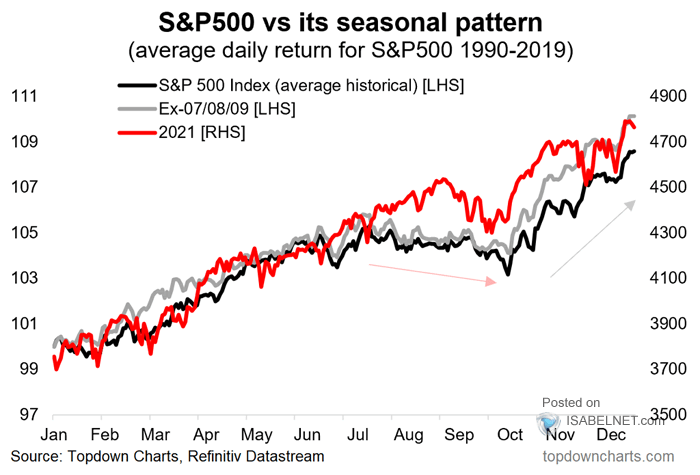

We did a good job of calling the RECENT lows. That said this market is over-extended. A pullback would be nice and OK. There were many factors leading to this rally this week, which I went over in the link at the beginning of this report. Overall the chart still remains constructively bullish.

Also, a pullback in oil prices does not mean a pullback in oil equities this week.

OIL AND PRODUCTS

OPEC MEETING

No surprises at this meeting. OPEC+ kept the 400K increase.

NOTABLE: As I stated last week, this is not a big deal. They have been struggling as a group to meet targets.

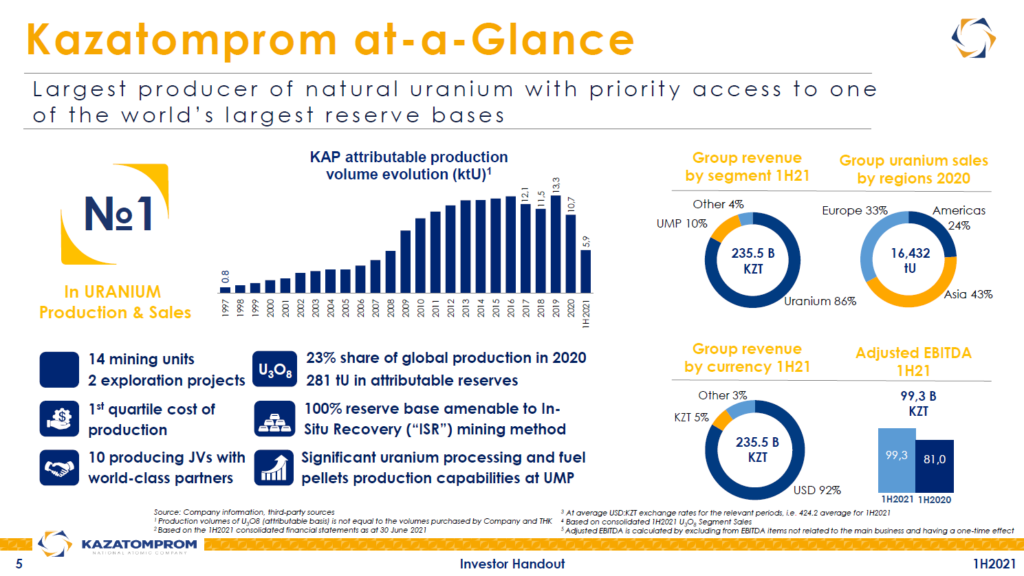

KAZAKHSTAN

Huge protests in Kazakhstan this week with anger sparked by the rise in fuel prices.

It is important to note that the rise in fuel prices was just the SPARK, this country has been under repressive socialist rule for 30 years.

This country produces 1.6M bpd of oil and is the world’s largest supplier of Uranium. This helped boost the prices of both commodities this week.

So far no disruption for either oil or uranium and the protests seem to be squelched.

The country has already rolled back the price increases.

A Russian-led security alliance sent “peacekeeping” forces into the country.

This is a very complicated web. So, I offer you this for reading to really grasp what is going on:

Putin Stamps Out the Fire in Kazakhstan

And this Twitter thread from Clint Ehrlich -credit to Capitalist Exploits

But just for reference, this chart is interesting…remember, natural resources are KEY going forward. Battle lines will be drawn over countries rich in these assets.

RUSSIA

Russia December Oil Output Flat, Signaling Lack of Capacity

Russia failed to boost oil output last month despite a generous ramp-up quota in its OPEC+ agreement, indicating the country has deployed all of its current available production capacity. -BBG

NOTABLE: Again, I have been talking about this since the webinar last month. If you missed it here is the replay.

CHINA

China PMI is on the rise again. December came in at 50.9 vs 49.9 in November, This is good news for fossil fuels.

LIBYA

Libyan crude output falls below 800,000 b/d

Output is now around 780,000 b/d, down from 880,000 b/d in late December, according to a source at Libyan state-owned oil firm NOC. The current output is 30pc below Argus’ estimate of Libya’s average production in November.

Libyan oil flows have been sharply curtailed since 20 December, when branches of the Petroleum Facilities Guard (PFG), which protects NOC assets and infrastructure, shut down supply from the 300,000 b/d El Sharara and 90,000 b/d El Feel fields, along with the smaller Hamada field and the Wafa condensate project. This prompted NOC to declare force majeure on crude exports from the Zawia and Mellitah terminals, which load the Esharara grade and Mellitah blend respectively. Mellitah is a mix of Wafa condensate and El Feel crude.-Argus

NOTABLE: Again, OPEC+ can not make this shortfall up

CANADA

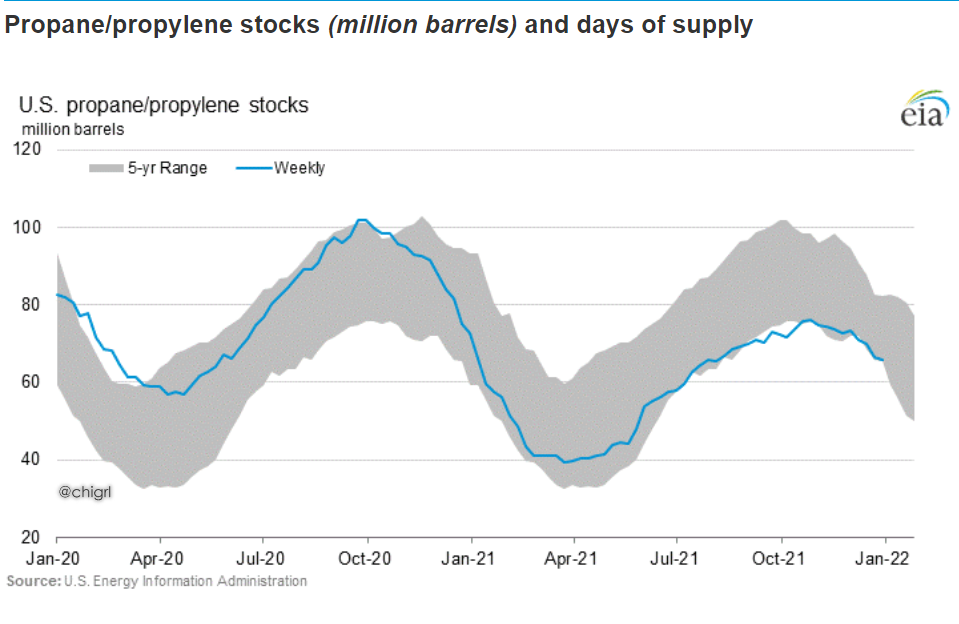

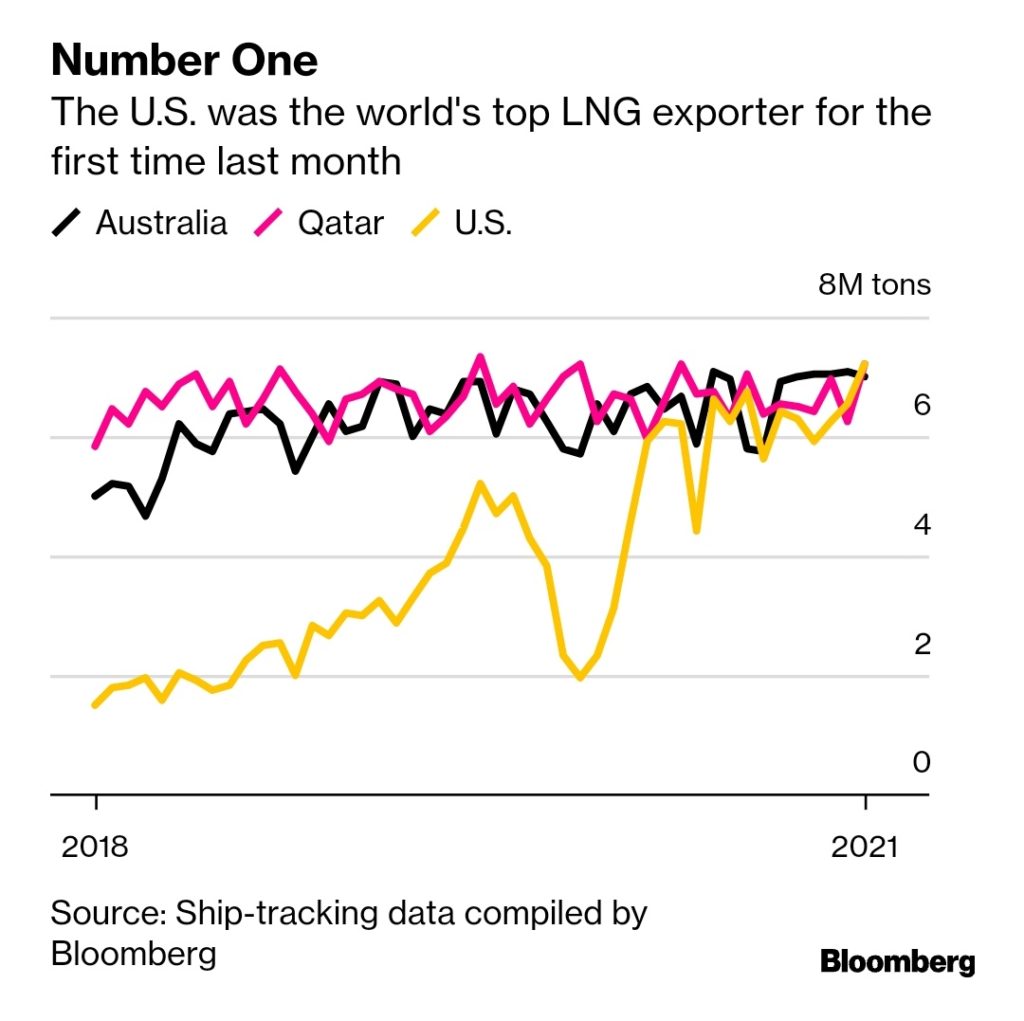

Canada seaborne LPG exports to increase

Export terminal capacity expansions on the country’s Pacific coast will drive much of the growth, writes Yulia Golub

Seaborne LPG exports from Canada are expected to rise in 2022 as more export terminal capacity comes online on the country’s Pacific coast.

Growth in Canada’s west coast export capacity will be led by upgrades at midstream companies Altagas’ Ridley Island and Pembina’s Prince Rupert terminals in British Columbia. At least 30,000 b/d (880,000 t/yr) is expected to be added in total, with another 30,000 b/d of capacity possible over the next few years.

Altagas intends to expand the Ridley Island propane export terminal to 80,000 b/d in the coming years from 58,000 b/d in the second half of 2021 and an initial 40,000 b/d following its opening in May 2019. The firm also exports around 50,000 b/d of propane and butane from its Ferndale terminal in the US state of Washington, having acquired a controlling stake in operating firm Petrogas in late 2020. Pembina is also contemplating an expansion of its 25,000 b/d Prince Rupert terminal, which it opened in April 2021, to 45,000 b/d. The company expects to make a final investment decision on the project in the first quarter.-Argus

NOTABLE: I’m starting to warm up to the idea that Saskatchewan may be a better inventment than Alberta.

INSTITUTIONS

Global exodus from fossil fuel holdings tops 1,500 institutions

More than 1,500 pension funds, universities, and other organizations around the world have announced that they will divest from fossil fuel assets, doubling from five years earlier and underscoring the surge in sustainable investing.

NOTABLE: GET LONG THIS SECTOR.

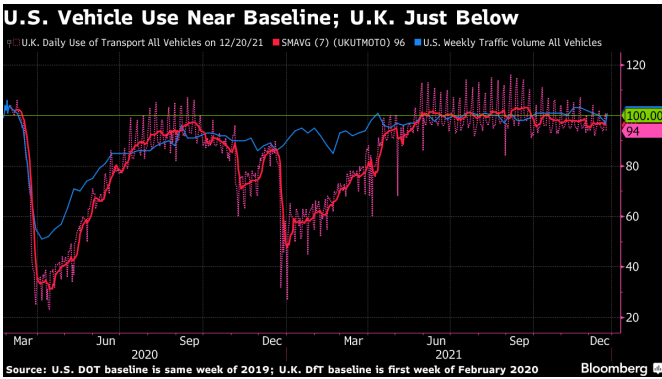

BLOOMBERG OIL DEMAND MONITOR

Gasoline sales remained above pre-pandemic levels in India and Spain in the full month of

December while the latest two weeks of mobility data in other regions is a mixed bag as holidays obscure clear trends.

Inner-city road traffic was subdued, as expected, through the holidays, data from TomTom NV showed. Congestion

dropped to negligible levels in London and Tokyo on Monday morning, and remained far below early December levels in all 13 world cities regularly tracked in this monitor.

Broader nationwide measures of vehicle use, however, find the weeks ended Dec. 20 in the U.K., and Dec. 26 in the U.S. were little different from earlier in December, even as infections from the omicron variant of coronavirus continue to surge in both countries. The government data shows U.K. vehicle use averaged over a week was 6% below a baseline of the first week of February 2020 while U.S. traffic volume — including cars and trucks — was 1%

above the same week of 2019.

Omicron hasn’t damped road traffic across Asia as yet, according to data compiled by Bloomberg using Apple Inc. mobility statistics until Dec. 27. Separately, full-month data for India showed sales of diesel — the country’s most widely used fuel — inched closer to pre-pandemic levels in December despite the threat posed by omicron, according to preliminary data from the refinery officials with direct knowledge of the matter. Diesel use trailed 2019 levels by 1.6% while gasoline was comfortably above, by 13%.

In Europe, Spanish fuel consumption data for the month of December, based on deliveries from the Exolum pipeline network, show increases from November for gasoline, diesel, and jet fuel, with gasoline deliveries 1.4% above the same month of 2019 and diesel 0.7% below. That’s been the same pattern since July — gasoline slightly above, diesel a little below. The more striking improvement has been in jet fuel use, which last month was 24%

below 2019 levels, compared with a deficit of 61% back in June.

Equivalent monthly consumption data for December isn’t yet available for France, Italy, and Portugal. Higher frequency sales data for the U.K. show deficits of 15% and 26% for gasoline and diesel in the last full week of December, though erratic traffic patterns around Christmas may have contributed to that weaker performance.

Toll road data from Atlantia Group was also mixed for the last full week of December. Italy, Spain, and France all saw strengthening from the prior week when measuring vehicle volume against the same week of 2019, yet only Italy had higher flows than the pre-pandemic period. Toll road traffic was comfortably above 2019 levels in Chile and Mexico, and marginally above in Brazil, the motorway data showed.

NATURAL GAS

RUSSIA

Gazprom Misses Own 2021 Gas Export Target After Flows Capped

Russian gas giant Gazprom PJSC missed its own “conservative” target for 2021 exports to Europe, and those capped flows contributed to the continent’s worst energy supply crunch in decades.

Gazprom delivered 185.1 billion cubic meters to its main clients abroad, including Turkey, China, and Europe, excluding the former Soviet Union nations, Chief Executive Officer Alexey Miller said in a statement on Sunday. That’s 3.2% above 2020 levels, but lower than 2018 and 2019, which were around 200 billion cubic meters. -BBG

NOTABLE: Interesting game here. Right now, I am holding off on Russian gas in favor of Russian oil companies.

PAKISTAN

The natural gas crisis is spreading to Asia. Pakistan is now experiencing a shortage and it is hitting the textile industry there.

Pakistan Textile Exports Hit by Gas Crunch

Pakistan’s natural gas shortage is hurting its crucial textile exports, according to an industry trade organization, putting even more stress on the nation’s struggling economy.

About $250 million of textiles exports were lost last month after mills in Punjab were forced to shut for 15 days, said Shahid Sattar, executive director of All Pakistan Textile Mills Association. Factories in the province are dependent on power generated from regasified imports of liquefied natural gas, while domestic supply is being diverted to other regions, he said. -BBG

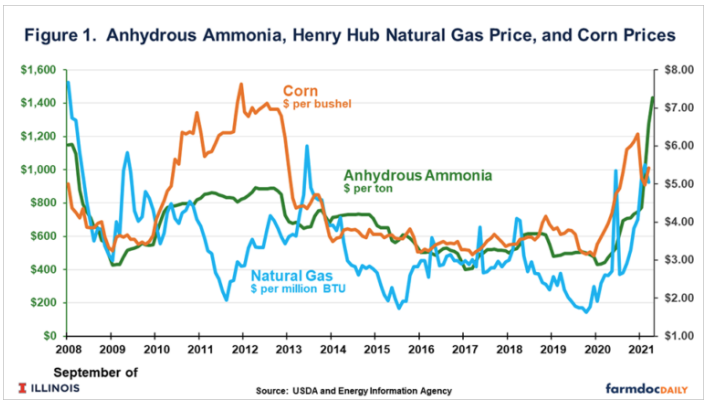

NOTABLE: Secondary and tertiary effects will continue during this energy crisis and it will spread. I maintain my top three investment themes for the next 5-10 years. Fossil fuels, metals, agriculture that I have been writing about for over a year now. I foresaw this coming long before this crisis even started. Luckily we have been positioning ourselves for over a year now since I began writing for Hedge Fund Telemetry.

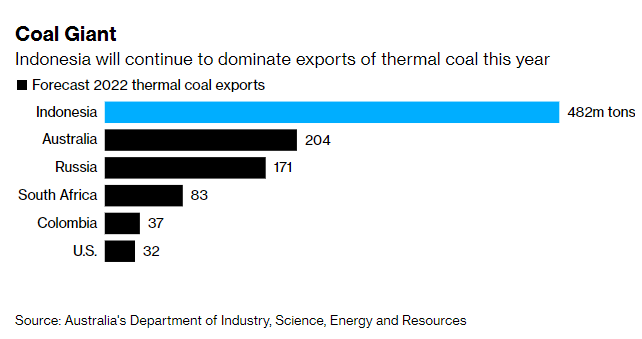

COAL

This week Indonesia threatened to halt coal exports.

Coal Prices Forecast to Surge Again if Indonesia Halts Exports

Any move by top thermal coal exporter Indonesia to temporarily halt shipments could send global benchmark prices surging again after the fuel notched a record in October.

There’s “meaningful upside” to a forecast that high-quality thermal coal at Australia’s Newcastle port will average $140 a ton in the first quarter if the ban is put in place, Morgan Stanley analysts including Marius van Straaten wrote in a note dated Monday.

“Losing 40% of the seaborne market overnight, in the midst of peak winter demand, could set us up for another coal price spike,” the analysts wrote. -BBG

NOTABLE: We are back in a full position of Peabody Energy (BTU) after having trimmed the position at 19.43. We re-added at 9.43 at weekly support. I still like this trade.

MATERIALS

FERTILIZER

The US Department of Commerce placed a 20% duty on Morrocco’s exports to the US this week. Morocco is the world’s largest producer and supplier of phosphate in the world. This means US farmers will pay more.

NOTABLE: Stay long Mosiac (MOS) and Intrepid Potash (IPI) that we entered last August.

LITHIUM

Battery costs rise as lithium demand outstrips supply

Carmakers scramble for raw materials in a bid to win global electric vehicle race

The price of batteries for electric vehicles looks set to rise in 2022 following a decade of sharp decline as supplies of lithium and other raw materials fail to keep up with ballooning demand.

While mining companies scramble to increase production from existing facilities and develop new sources of supply, benchmark prices of lithium carbonate ended 2021 at records. In China, the biggest battery-producing country, the price was 261,500 yuan (just over $41,060) a ton, more than five times higher than last January.

Other commodities used in cathodes, the most expensive part of a battery, have also been rising: The price of cobalt has doubled since last January to $70,208 a ton, while nickel jumped 15% to $20,045. -NIKKEI

NOTABLE: NEW trade idea. Long Piedmont Lithium Inc.(PLL) I am a buyer on dips to 46.50 with a stop at 42.00.

PAPER PRODUCTS

Some very interesting things going on in the cardboard market. I am very bullish on this market. Here is why:

Lumber, OSB, and timber prices continue to move upward

China pulp import prices are rallying

New York ban on polystyrene foam containers and loose-fill started January 1

NOTABLE: I started a new long position in Westrock Company (WRK) this week at 45.52. This has room to run.

WRK

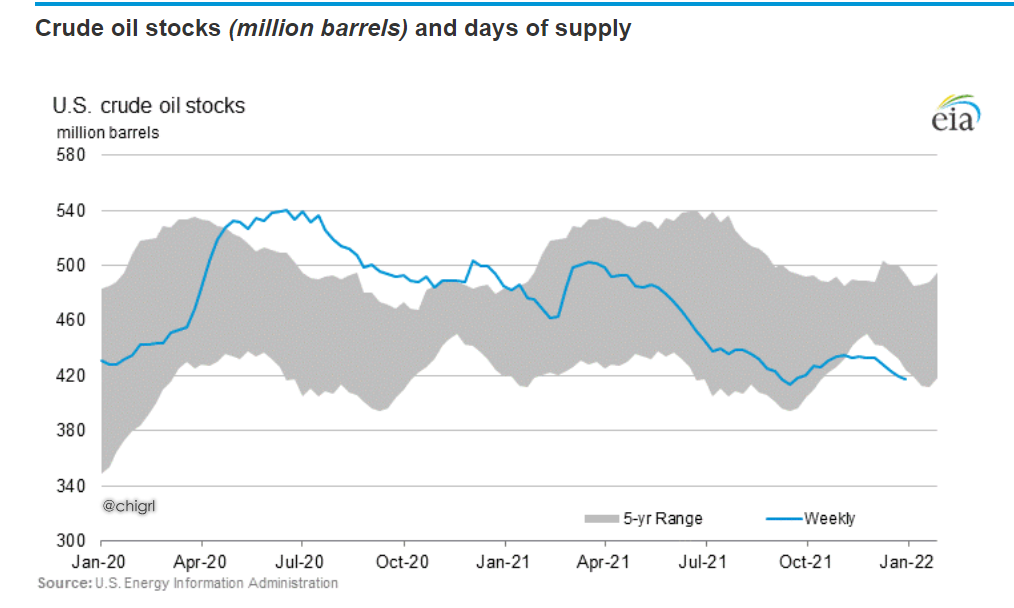

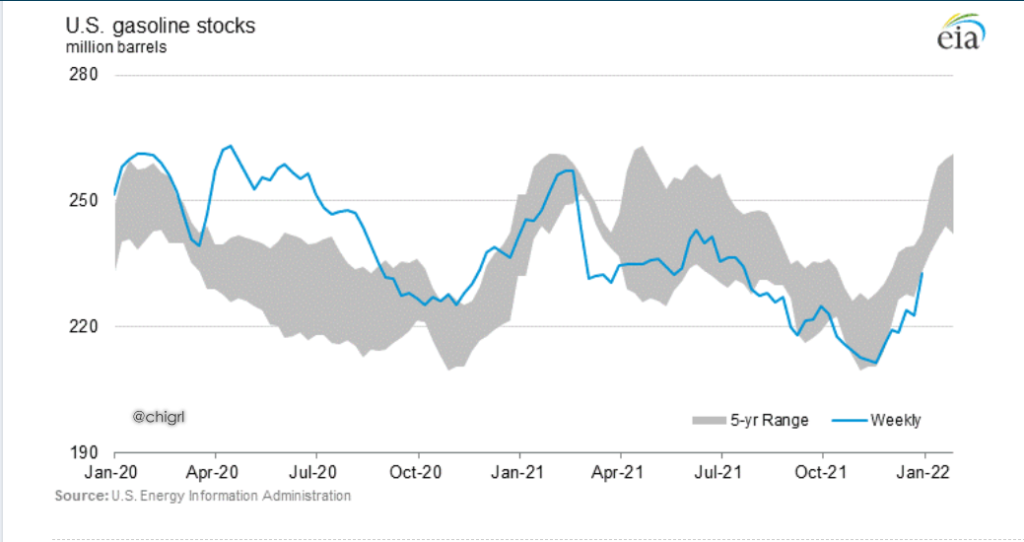

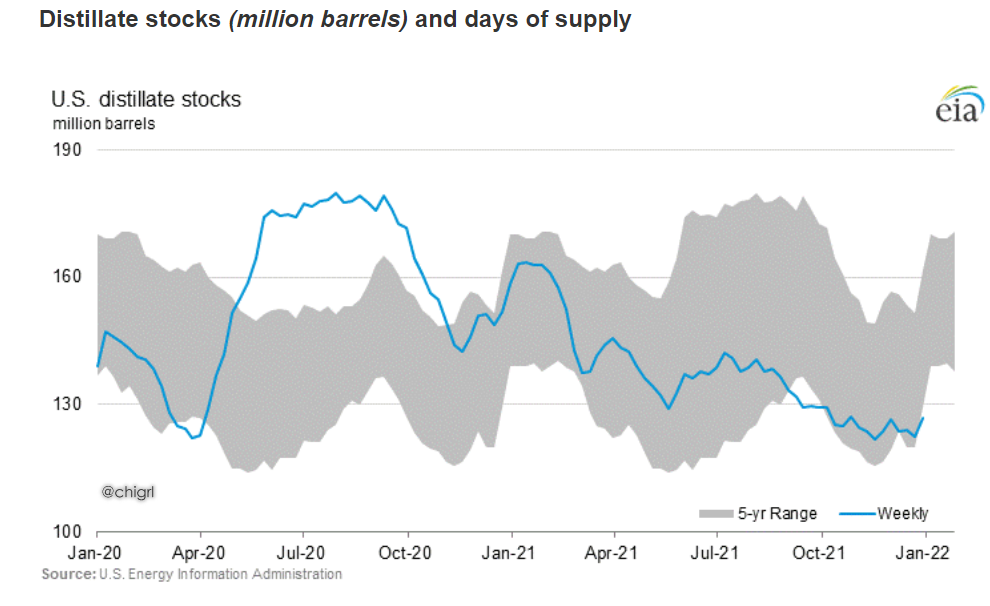

OIL INVENTORIES

GLOBAL OIL INVENTORIES

GLOBAL FLOATING STORAGE

Crude Oil in Floating Storage Rises 8.6% in Past Week: Vortexa

The amount of crude oil held around the

world on tankers that have been stationary for at least 7 days

rose to 97.32m bbl as of Dec. 31, Vortexa data show.

* That’s up 8.6% from 89.60m bbl on Dec. 24

* Asia Pacific up 22% w/w to 71.92m bbl

* Europe up 57% w/w to 7.16m bbl

* West Africa up 54% w/w to 6.76m bbl

* Middle East down 49% w/w to 5.58m bbl; lowest since

March

* North Sea up 436% w/w to 5.05m bbl

* U.S. Gulf Coast down 97% w/w to 59.00k bbl

* Company Exposure:

** Asia: Cosco Shipping Energy Transportation Co., HMM Co. Ltd.,

Mitsui O.S.K. Lines Ltd., Nippon Yusen KK

** Europe: Euronav NV, Frontline, Vopak

** U.S.: DHT Holdings, International Seaways, Nordic American

This is no surprise with recent lockdowns and restrictions. That said I’m not that worried about it in the broader context.

FUJAIRAH DATA

No data this week due to the holiday

EIA