Noted in this report: I remain long: AR, AD, EUA futures, KRBN

New trade ideas: Siemens Aktiengesellschaft (SIEGY), EnBW Energie Baden-Württemberg AG (EBK.F), Delek Group (DLEKG.TASE), iShares Global Timber & Forestry ETF (WOOD)

HURRICANE IDA UPDATES

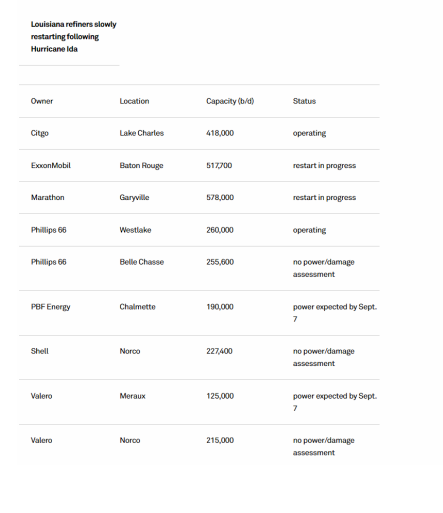

Regional catcracking (FCC) outages in the US Gulf ballooned to 622,600 barrels per day (bpd), or 20.34% of regional capacity, vs 136,000 bpd last week on the back of multiple refinery shutdowns due to Hurricane Ida’s arrival Sunday. Marathon Petroleum’s 145,000-bpd FCC at its 565,000-bpd Garyville, La., refinery remains shut amid power supply issues. PBF Energy shut Sunday its 76,000-bpd FCC at its Chalmette, La., refinery. Partial power was restored overnight to the plant begin recovery with the boiler house. Placid Refining was forced to shut its 25,000-bpd catcracker after its plant-wide shutdown and may require at least a week to gradually restart. Phillips 66’s 105,000-bpd FCC at its Belle Chasse, La., refinery remains shut amid flooding and no power. The Belle Chasse plant may need a month to begin recovery. Shell Norco will require up to two weeks to begin to restart its 119,000-bpd FCC. The 56,000-bpd FCC Chevron Pasadena remains idled indefinitely. CATALYTIC REFORMING: The regional capacity shortfall shot up to 473,000 bpd, versus 72,000 bpd last week in the wake of Ida. This represents about 25.26% of the total production capacity. Marathon Petroleum’s reformers, rated 130,000 bpd in total, at Garyville remain offline. Chalmette’s 43,000-bpd in reforming capacity remains idle. Placid Refining was forced to shut its 11,000-bpd reformer. Phillips 66 shut the 44,000-bpd reformer at Belle Chasse. Shell Norco will require up to two weeks to begin to restart its 40,000-bpd reformer. The reformer at Valero’s Corpus Christi refinery remains out of service.

MPC: Marathon said a restart was initiated at Garyville after a full-plant shutdown following landfall Sunday by Ida. “The Garyville refinery is now receiving a reliable electric power supply and the initial stages of restart are underway. Our terminal facility in Garyville continues to provide fuel to customers, business partners, and local emergency responders. We are leveraging the MPC network of pipelines, terminals, marine, and truck transportation assets to move fuel to where it is needed most,” the company said in a statement. Garyville was among numerous refineries forced offline as Ida approached.

PBF Energy said overnight Entergy began restoring power to Chalmette, La., confirming Energy News Today reports. “The utility is only providing a limited amount of electricity, which is re-energizing a small section of the refinery,” a PBF official said. Energy News Today reported this will allow recovery to begin with the boiler house, which will require a few days to restore critical steam power for unit operation. The entire facility shut Aug. 29 due to a power outage after Ida made landfall as a Category 4 hurricane. Depending on power reliability and post-storm issues, a sequential restart may occur during the next one to two weeks, industry sources said. “We will continue to work with Entergy to restore power as more of their system gets up and running. However, we are unable to provide a forecast on restoration to a full load,” according to the company.

The US Department of Energy (DOE) authorized the Strategic Petroleum Reserve (SPR) to conduct an exchange of 300,000 barrels of crude oil from the Bayou Choctaw storage site to Placid Refining Co. LLC’s refinery, near Baton Rouge, La. This exchange is being made to ensure that the areas affected by Hurricane Ida are able to quickly and easily access the fuel they need to support recovery activities. The move comes one day after DOE authorized a similar exchange for ExxonMobil’s Baton Rouge plant, involving the release of 1.5 million barrels of crude to the company. The SPR’s ability to conduct exchanges is a critical tool available to refiners during emergencies like Hurricane Ida. The SPR is the world’s largest supply of emergency crude oil, and the federally-owned oil stocks are stored in underground salt caverns at four storage sites in Texas and Louisiana. Capacity is 797 million barrels.

Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, said it “conducted an initial flyover of our assets in the path of Hurricane Ida. During this initial flight, we observed damage to our West Delta-143 (WD-143) offshore facilities. When it is safe to do so, we will send personnel offshore to provide a closer inspection of these facilities to understand the full extent of the damage and the degree to which our production in the Gulf of Mexico will likely be impacted. The WD-143 facilities serve as the transfer station for all production from our assets in the Mars corridor in the Mississippi Canyon area of the Gulf of Mexico to onshore crude terminals. Our Perdido asset in the southwestern Gulf of Mexico was never disrupted by the hurricane, and our floating production, storage, and offloading vessel, the Turritella (also known as Stones) is currently back online. All of our other offshore assets remain shut in and remain fully evacuated at this time. At the early phase of assessment and recovery, approximately 80% of Shell-operated production in the Gulf of Mexico remains offline. In our initial flyover, we did not observe any visible structural damage to the rest of our offshore assets. When we are able to safely deploy personnel offshore to these assets, we will conduct additional inspections and work to restore production as soon as possible. The WD-143* platform, owned by Shell Offshore Inc. (71.5%) and BP (28.5%), is operated by Shell Pipeline Company, L.P. The Mars corridor consists of Shell-operated tension leg platforms Mars, Olympus, and Ursa. Mars and Olympus ownership is: Shell Offshore Inc. (71.5%) and BP Exploration & Production Inc. (28.5%), respectively. Ursa ownership is: Shell Offshore Inc. (45.3884%), BP Exploration & Production Inc. (22.6916%), ExxonMobil Corporation (15.9600%), and ConocoPhillips Company (16.9600%).” -ENT

About 88%, or 1.6 million barrels per day (bpd), of crude oil production and 83%, or 1.8 billion cubic feet per day, of natural gas output, remains shut in the U.S. side of the Gulf of Mexico, the Bureau of Safety and Environmental Enforcement (BSEE) said on Sunday. Cumulative loss since Aug 27 is now ~16.3m barrels.

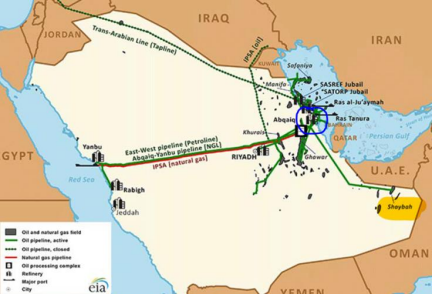

*WD-143 is a key GoM platform as it’s a bottleneck for the Mars, Ursa, and Medusa pipeline systems, with ~300,000 b/d of flows. It signals more lasting damage to crude production.

Refinery updates

This means there is 1.013M bpd still offline and 1.095M bpd in process of a restart... which is still a ton of capacity offline

NOTABLE: We still have significant production down, and it looks to be that way for a while especially with the Shell WD-143 platform down. The platform directs mostly heavy oil, which we do not have much of in the SPR and is essential for refining the heavier crude products.

Javier Blas from BBG noted that “the US learned nothing from the Katrina crisis. It keeps a vast crude reserve but nearly zero refined petroleum products — at the difference of European nations, which keep products. So when refineries are down (as with Katrina and now with Ida), the SPR probes useless”

I will add to that by saying the SPR release of 1.8M barrels (1.5 to XOM and 300K Placid refining) does not fix the product problem. At 92% refinery utilization rate, we can not squeeze much more capacity from the refineries that are currently still operating. Also, 1.5M barrels is a joke. The US alone consumes ~ 20M BPD …1.8M buys us ~45 min

In addition, the FCC outages are bad. FCC is the conversion process used in refineries to convert the high-boiling point, high-molecular-weight hydrocarbon fractions of crude oils into more valuable products like gasoline, so refining capacity remains majorly hindered. I expect we see higher gasoline prices and the crack spreads to get blown out next week, which ironically should be good for refiners.

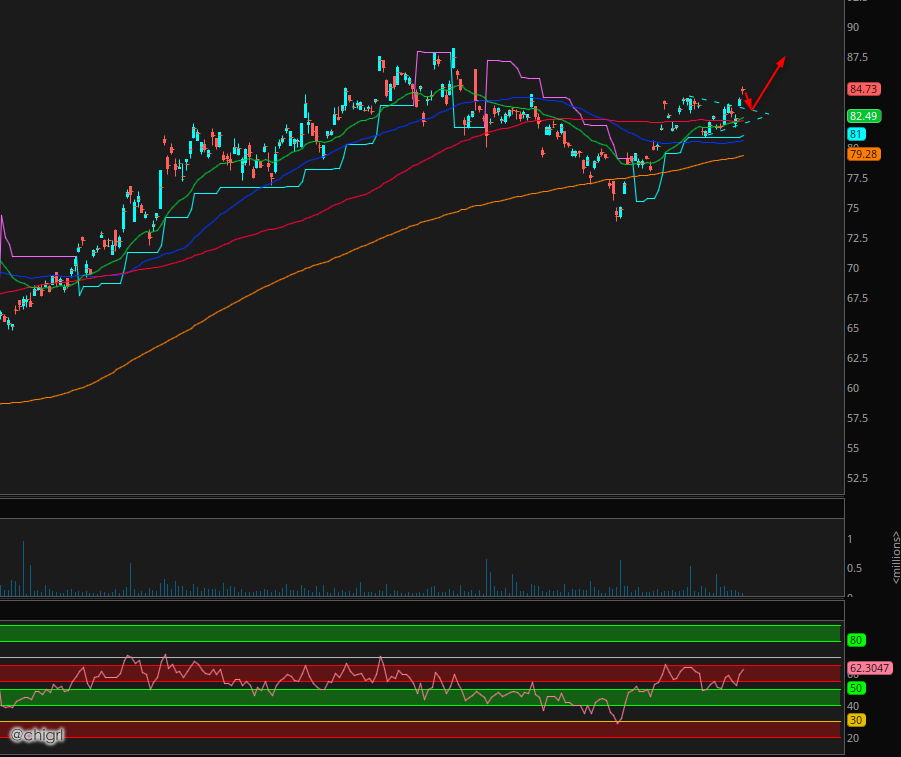

CHART OF THE WEEK

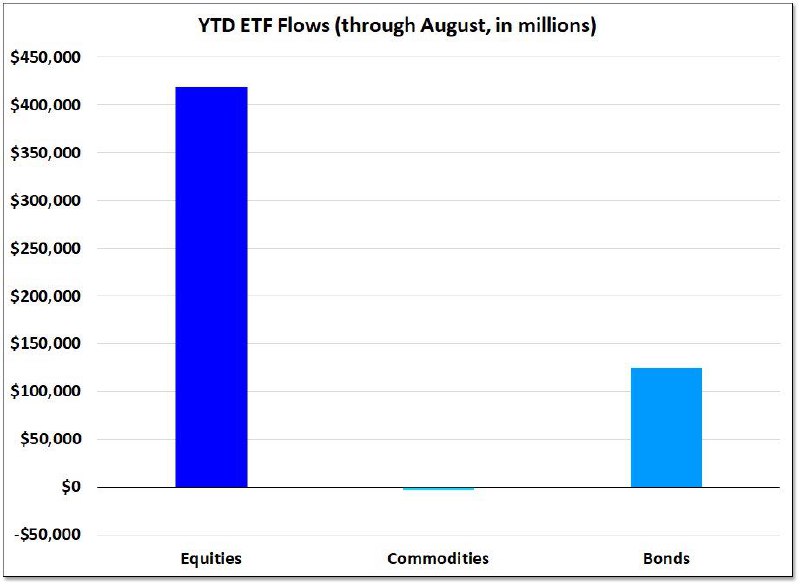

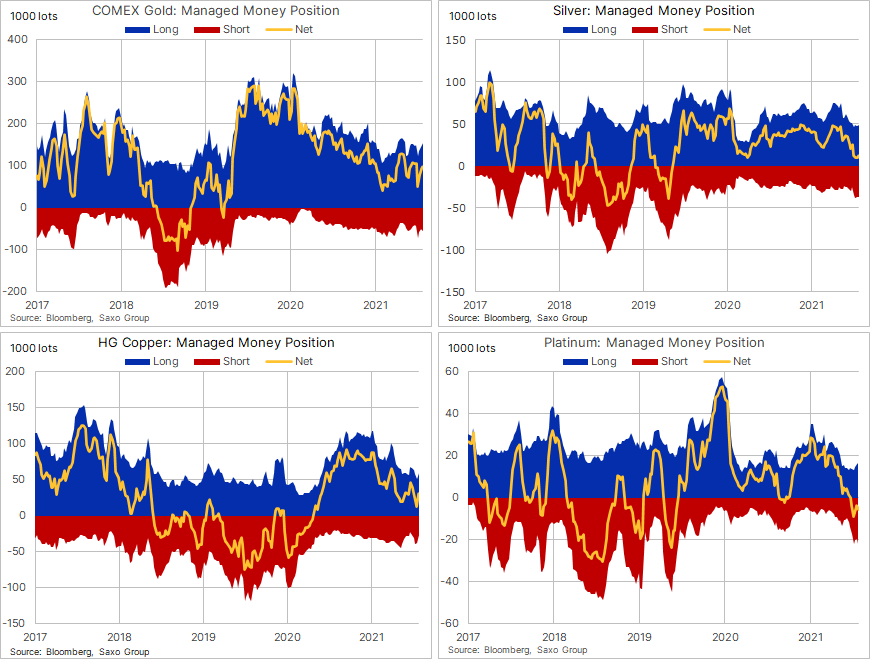

NOTABLE: This chart makes me giddy. Fund flows have been weak into the commodity sector, despite higher prices, which means this sector has room to run.

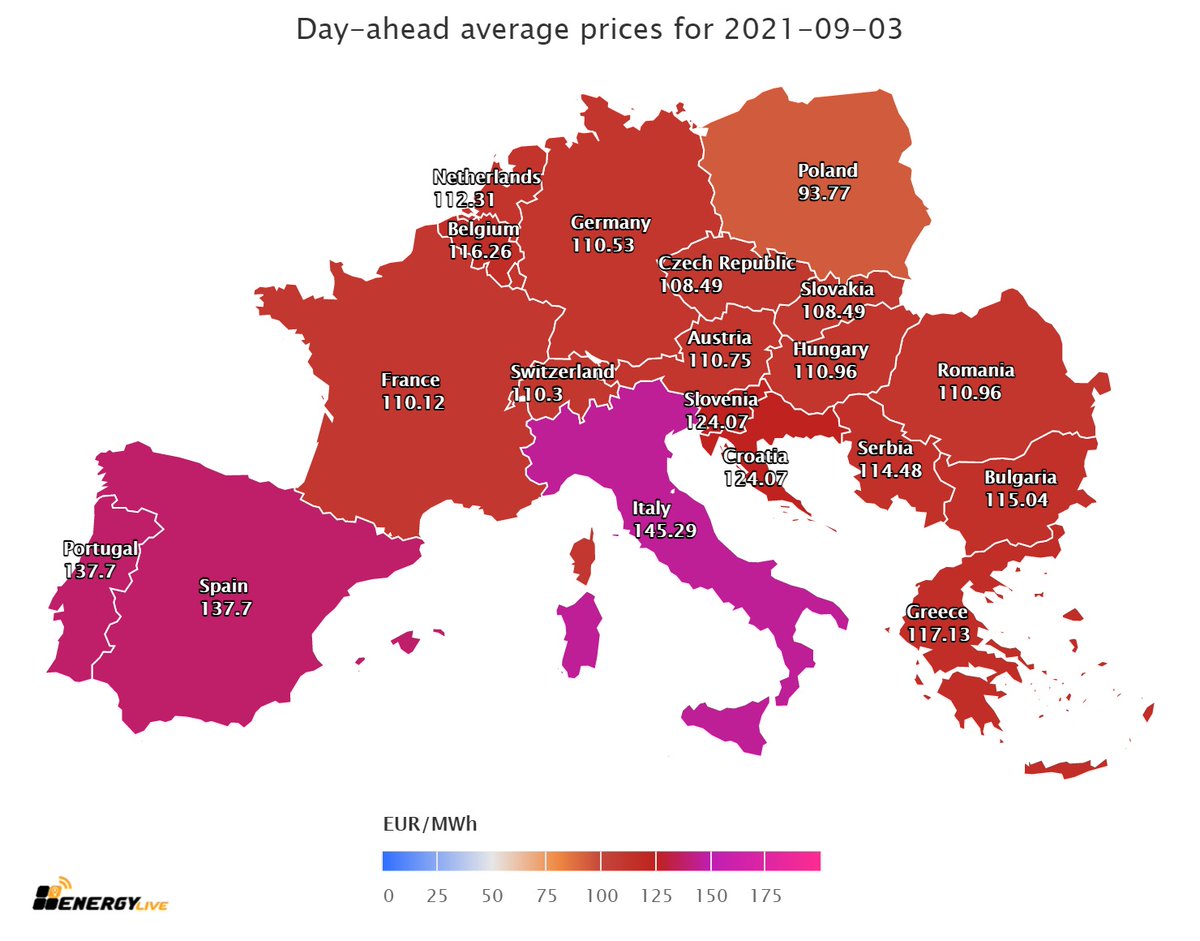

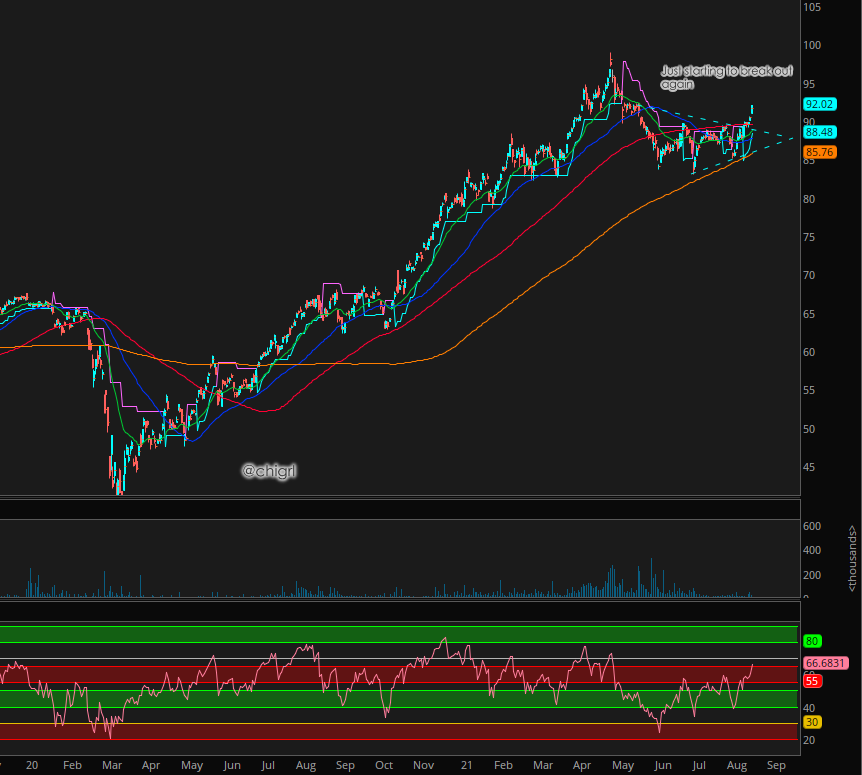

TECHNICALS

This chart is still constructively bullish. I still think we are sideways into 2022, but that said this structure is positive/supportive for oil and gas equities.

FUNDAMENTALS

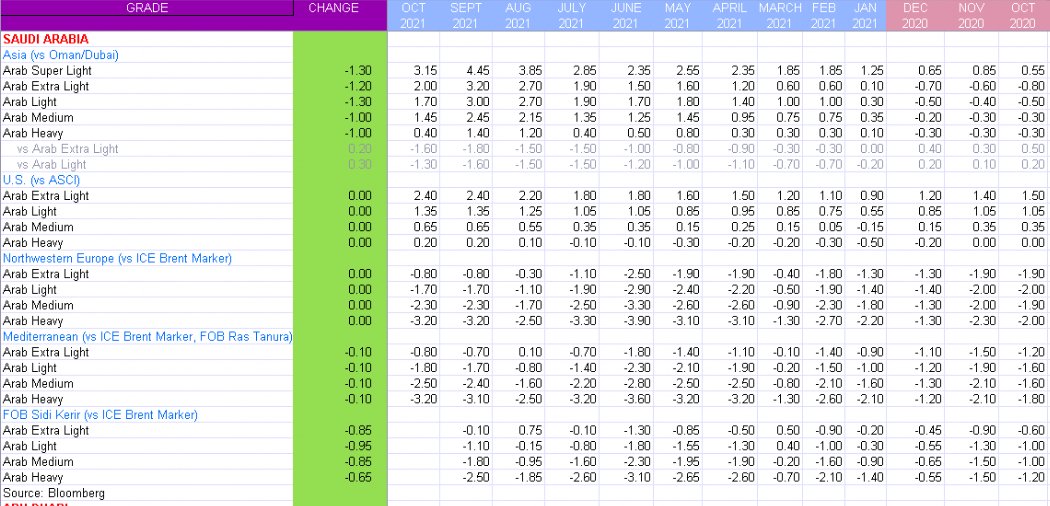

SAUDI ARABIA

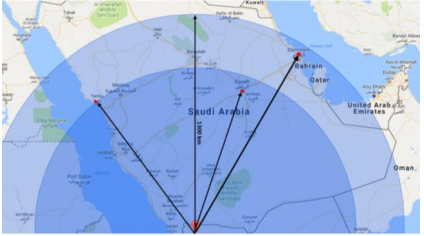

The power vacuum left in Afghanistan is creating instability in the region (more so than usual). Although Houthi attacks on Saudi Arabia have been ongoing since 2015, it has been pretty quiet this year until this weekend.

Saudi Arabia says it has intercepted a ballistic missile fired by Yemen’s Houthi rebels, which sent debris crashing down over a neighborhood near Dammam that wounded at least two children.

The Houthis launched three bomb-laden drones and three ballistic missiles in the attack, military spokesman Brig. Gen. Turki al-Malki said.

Houthi military spokesman Yahia Sarei said in a tweet the rebels launched a military operation deep in Saudi Arabia. In a statement later Sunday, the rebels claimed they sent at least eight explosive-laded drones and fired one ballistic missile on Aramco facilities in the city of Ras Tanura, about 55 kilometers (34 miles) north of Dammam.

The Houthis also claimed they targeted Aramco facilities in the cities of Jeddah, Jizan, and Najran with five ballistic missiles and two explosive-laden drones.

The rebels did not offer evidence supporting their claims.

The U.S. Consulate in nearby Dhahran sent an alert to American citizens warning them about the attack, which it described as targeting the area around Dhahran, Dammam, and Khobar.

‘Stay alert in case of additional future attacks,’ the consulate said. -AP

NOTABLE: Aramco facilities are well guarded and these attacks did not damage any oil installations, therefore oil prices will not be impacted by this event. That said, Houthis do have long-range missile capabilities so, it is definitely back on the radar.

Houthi long-range missile capacity

Saudi Arabia Major Oil and Natural Gas Infrastructure

Saudi Arabia Lowers OPS Prices to Asia, but not to Europe or the US

Asia continues to see a mixed recovery in oil demand, with fuel imports by Southeast Asia and

Australia remaining thin, while India and Japan took more crude, according to Vortexa Ltd.

NOTABLE: Saudi realizes that Asia demand has been weaker in more areas than Europe or the US, by lowering prices, they are hoping to entice more buyers.

EUROPE

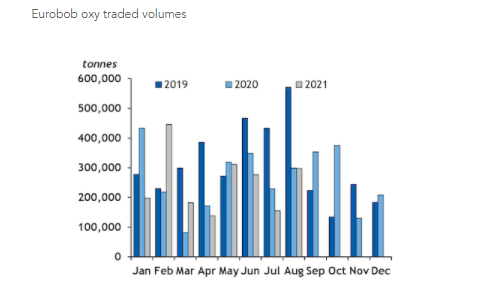

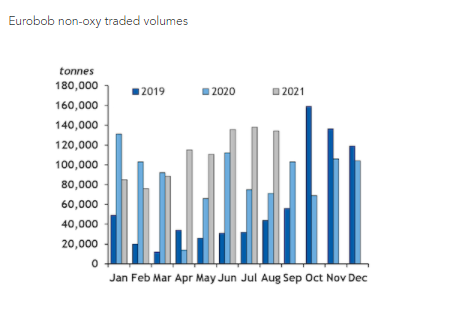

Good news for European gasoline demand, Eurobob gasoline volumes are at a six-month high.

Argus Eurobob gasoline volumes reached a six-month high of 431,100t in August, up from 293,000t in July and 370,000t a year earlier. Demand for the benchmark oxy grade nearly doubled on the month as the peak summer driving season drew to a close, while non-oxy volumes were largely stable. -Argus

Eurobob oxy traded volumes

Eurobob non-oxy traded volumes

IDA PIPELINE LEAK

Gulf oil spill

Divers at the site of an ongoing oil spill that appeared in the Gulf of Mexico after Hurricane Ida have identified the apparent source as a one-foot diameter pipeline displaced from a trench on the ocean floor and broken open.

Talos Energy, the Houston-based company currently paying for the cleanup, said in a statement issued Sunday evening that the busted pipeline does not belong to them.

The company said it is working with the U.S. Coast Guard and other state and federal agencies to coordinate the response and identify the owner of the ruptured pipeline.

Two additional 4-inch pipelines were also identified in the area that is open and apparently abandoned. The company’s statement did not make clear if oil was leaking from the two smaller pipelines, but satellite images reviewed by The Associated Press on Saturday appeared to show at least three different slicks in the same area, the largest drifting more than a dozen miles (more than 19 kilometers) eastward along the Gulf coast.

Talos said the rate of oil appearing on the surface had slowed dramatically in the last 48 hours and no new heavy black crude had been seen in the last day.

So far, the spill appears to have remained out to sea and has not impacted the Louisiana shoreline. There is not yet any estimate for how much oil was in the water.

NOTABLE: This should not affect pricing, as it looks pretty contained, but I thought I should mention it.

BLOOMBERG OIL DEMAND MONITOR

No report this week

NATURAL GAS

COLD WINTER AHEAD ???

The Farmer’s Almanac came out with its 2021-2022 Winter Outlook this week

Some highlights: Winter is going to be a season of flip-flop conditions with notable polar coaster swings in temperatures

January

Winter’s chill will start gradually. In January, temperatures will start out mild for much of the country but will trend toward colder conditions during the middle to the latter part of the month. But overall, the month will be stormy, especially along the Atlantic Seaboard where an active storm track will lead to a stretch of precipitation in various forms: rain, snow, sleet, and ice.

The Great Lakes, Midwest, and Ohio Valley will have more than their fair share of cold and flaky weather in January. The Northern Plains and the Rockies will also experience Old Man Winter’s wrath with stormy weather culminating in a possible blizzard later in the month.

February

In sharp contrast, February will average out to be a much quieter month in terms of storminess across much of the nation. In the eastern third of the country, for example, we calculate that on average there will be 57% fewer days of measurable precipitation compared to January, a significant drop-off. But that doesn’t necessarily mean that storminess will be completely absent.

We’re forecasting a “winter whopper” for parts of the Northeast and Ohio Valley toward the end of February. Another “atmospheric hemorrhage” from the Pacific could lash most of the far West, with everything from strong winds to heavy rains and snow.

NOTABLE: If they are right, it will be a strong winter for natural gas and heating oil. Stay long natural gas equities SD and AR

EUROPE

European natural gas and power prices are surging and it is not even winter yet.

Just going to highlight some factors here, then look at how we can take advantage of this.

Let’s start with Russia. NordStream 2 should fix the EU gas problem, right?

Answer NO. It won’t

Gazprom PJSC needs to store nearly as much natural gas at home to keep Russians warm this winter as it currently ships to its top customer Western Europe every day.

The Russian gas giant has just two months to build its depleted inventories to the record levels it’s targeting, a goal the Energy Minister Nikolay Shulginov expects Gazprom to meet. That will require pumping into underground storages sites in Russia supplies equal to about 80% of daily exports to Western Europe. -BBG

UK

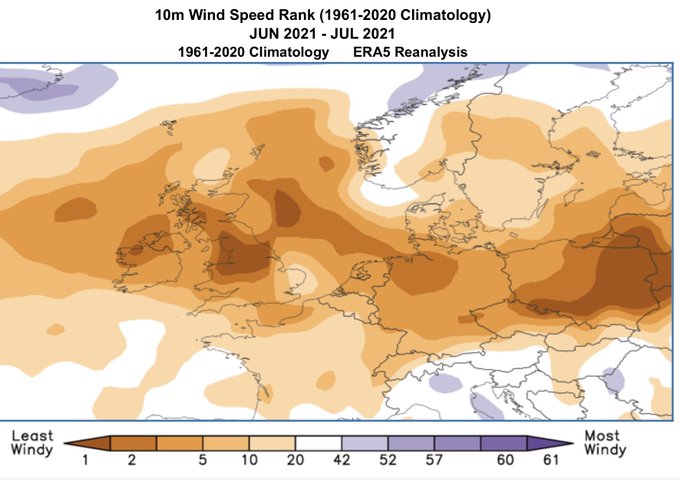

The UK has paid a power plant this morning a record high £4,950 per MWh ($6,850 per MWh) to fire up on short notice for 30 minutes to keep the lights on after wind generation plunged. The plant is gas-fired. -Javier Blas, BBG

Interesting to note here, that climate change (or weather pattern changes), also means much less wind in Europe in this current cycle. So, this has massive implications for any future energy policy.

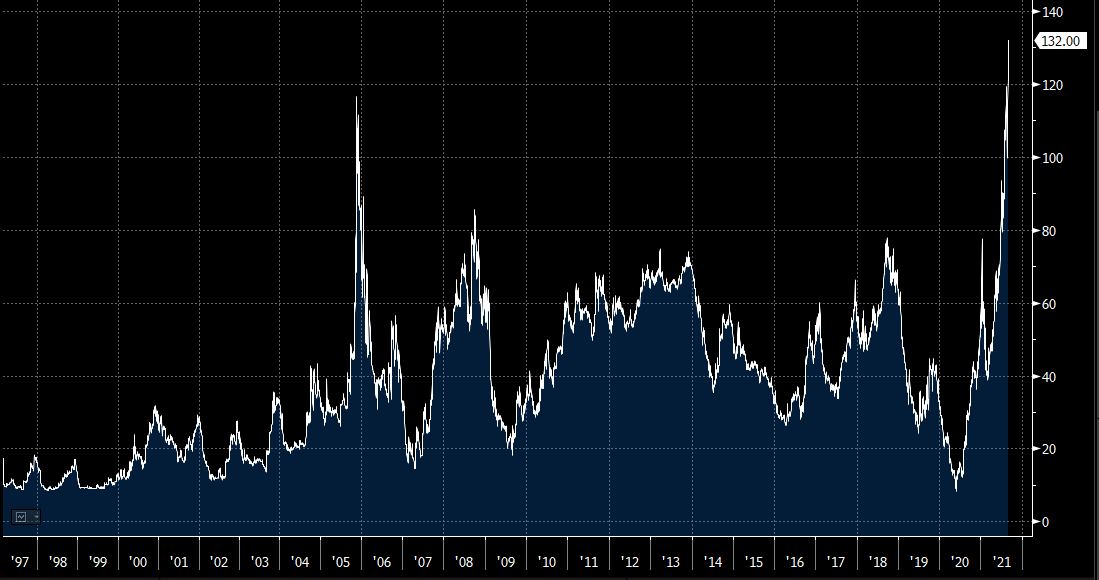

CHARTS

UK NBP and Dutch TTF gas benchmarks closed at a fresh all-time settlement high

UK day-ahead electricity prices have surged to an all-time high of £219 per MWh, that’s more than quadruple the average 2010-2020 price. Multiple factors affecting, including sky-high gas and CO2 prices, low nuclear and super-low wind

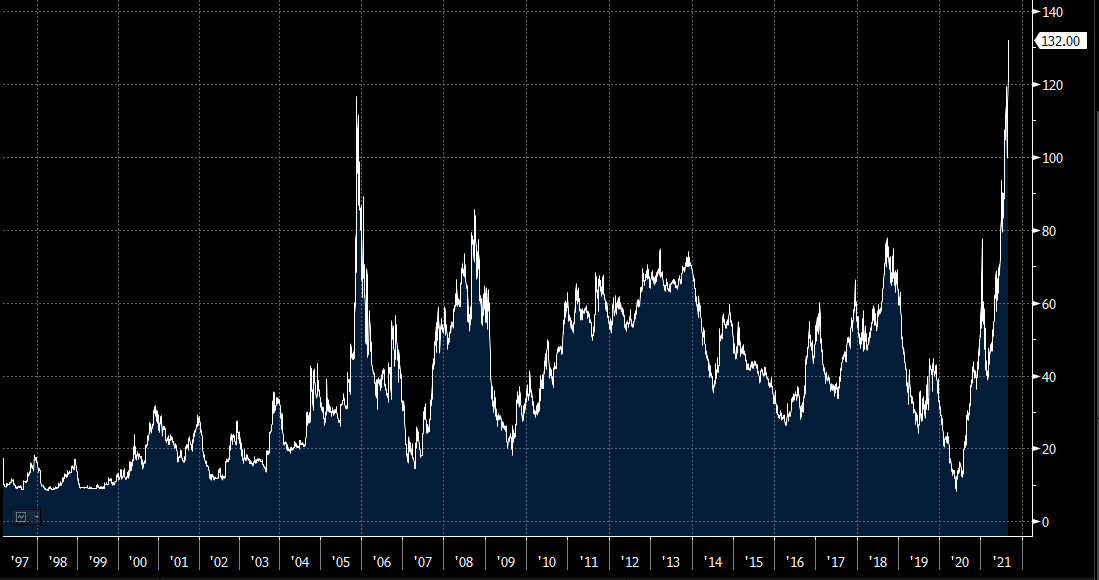

EUROPE POWER PRICES

Day-ahead per MWh: France: €110, Spain: €137, Italy: €145, Germany: €110, UK: £162 (the UK price is the highest ever for this time of the year)

you get the picture…….

NOTABLE: How do we play this? I like German utility companies and Southern Gas Corridor companies.

Some ideas

Siemens AG (SIEGY) -US

I would be a buyer here around 82.50 (retest of a breakout) with a stop below 81.00

EnBW Energie Baden-Württemberg AG (EBK.F)-Frankfurt

Poised for a breakout...utility prices are about to get more stupid

Delek Group (DLEKG.TASE) -Tel Aviv (natural gas play)

MATERIALS

LUMBER

Sinking Lumber Prices Force Canadian Mill to Curb Production

Conifex Timber Inc. said it will temporarily slow production at its sawmill in Mackenzie, British Columbia, due to an “unprecedented collapse in lumber prices.”

North American lumber companies may have added too much production, too quickly, as demand cools and prices for the construction material plunge. After more than quadrupling in 12 months to record highs, lumber has sunk about 70% since May. The crunch is particularly acute in Western Canada because of higher costs.

More mills will likely follow Conifex’s lead with additional curtailments in the near future. -BBG

NOTABLE: Timber prices are now higher than the cost of production. The rapid decline in lumber prices was merely due to overproduction, now that companies are going to make a concerted effort to curb production, I think we see a bounce. I like long the Lumber ETF WOOD for this play as the futures are basically illiquid.

I would love to see a retest of the 100 day at around 90.00 to get long, that said, I am willing to start buying on pullbacks here

COAL AND CARBON

Coal and Carbon futures continue to make new highs.

Coal

EUA carbon futures

NOTABLE: I remain long BTU, EUA carbon futures, and KRBN

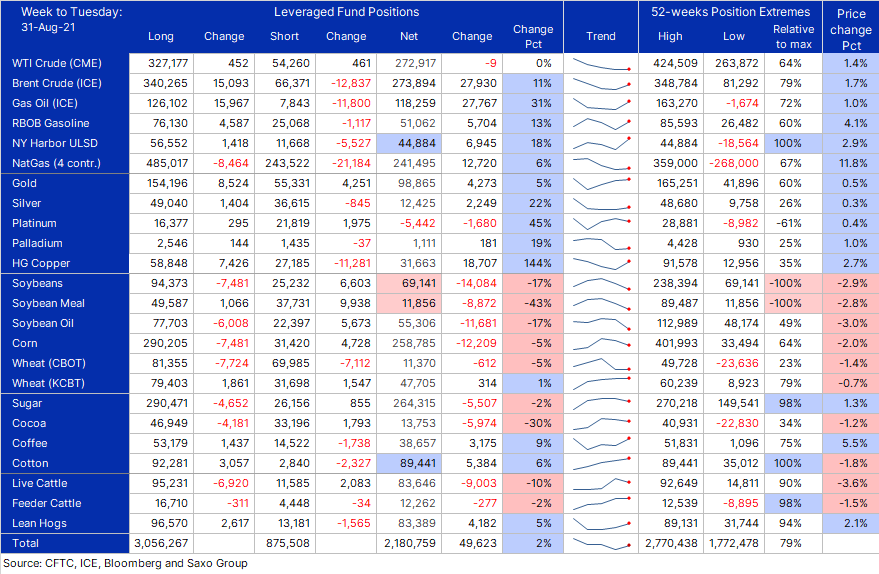

COMMITMENT OF TRADERS -as of Tuesday 31 August

COT on commodities in wk to Aug 31 showed money managers reaction to Powell’s dovish Jackson Hole speech and hurricane Ida. The result was selling in agriculture most noticeable soybeans, corn & sugar while buying lifted longs in Brent GasOil, natgas , copper & gold.- SAXO

COT on metals in wk to Aug. 31 saw net buying of all contracts as the USD weakened after Powell’s dovish Jackson Hole speech. Copper long jumped 144% to 31.6k, silver 22% to 12.4k, and gold a relatively small 5% addition to 98.9k, a four-week high. -SAXO

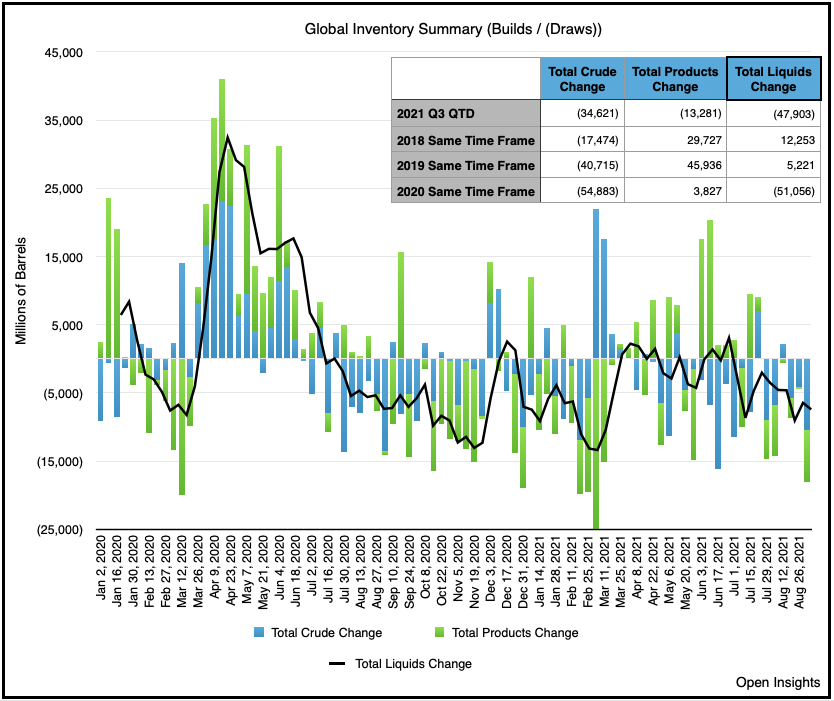

OIL INVENTORIES

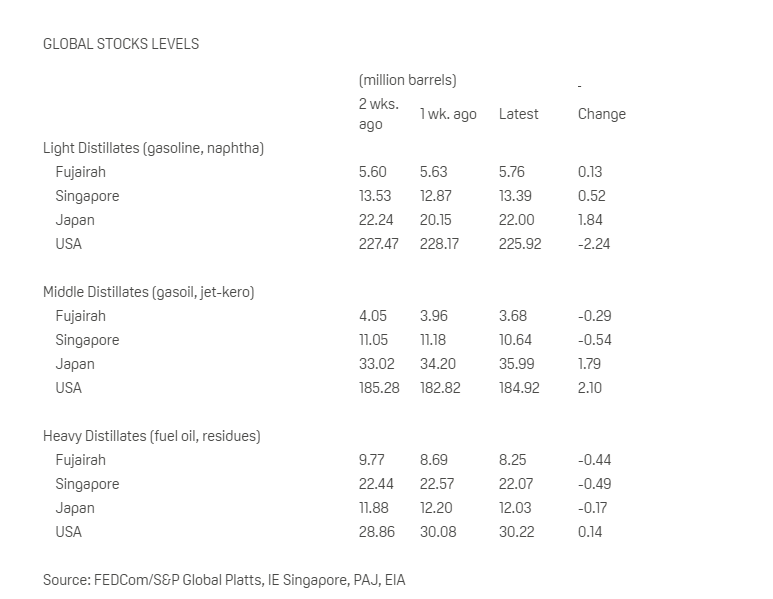

GLOBAL INVENTORIES

Global oil inventories past week are down by 18M bbls (crude by 10.4M / prod 7.7M bbls). The prior week was -4.3M (4M crude/300K prod). Average together=same trend as 4 weeks before that. So 6 weeks. of ~10M liquids draw. Big summer blowout. All before Ida!

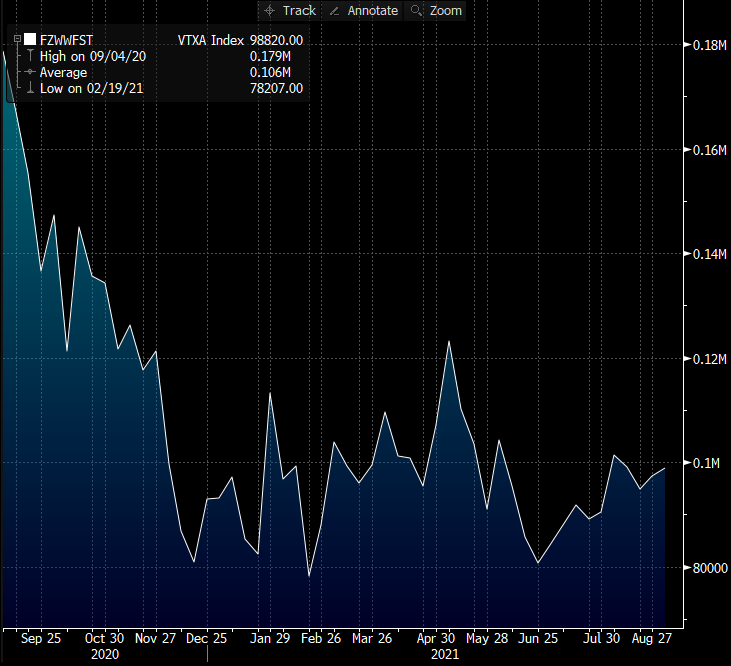

GLOBAL FLOATING STORAGE

The amount of crude oil held around the world on tankers that have been stationary for at least 7

days rose to 98.05m bbl as of Sept. 3, Vortexa data show.

*That’s up 0.8% from 97.28m bbl on Aug. 27

*Asia Pacific up 8.9% w/w to 76.29m bbl; highest since May

*West Africa up 36% w/w to 6.09m bbl

*Europe down 37% w/w to 4.66m bbl

*Middle East down 52% w/w to 4.04m bbl; lowest since April

*North Sea up 34% w/w to 2.47m bbl

Company Exposure:

*Asia: Cosco Shipping Energy Transportation Co., HMM Co. Ltd., Mitsui O.S.K. Lines Ltd.,

Nippon Yusen KK

*Europe: Euronav NV, Frontline, Vopak

*U.S.: DHT Holdings, International Seaways, Nordic American Tankers, Teekay Tankers,

Tsakos Energy Navigation

FUJAIRAH DATA

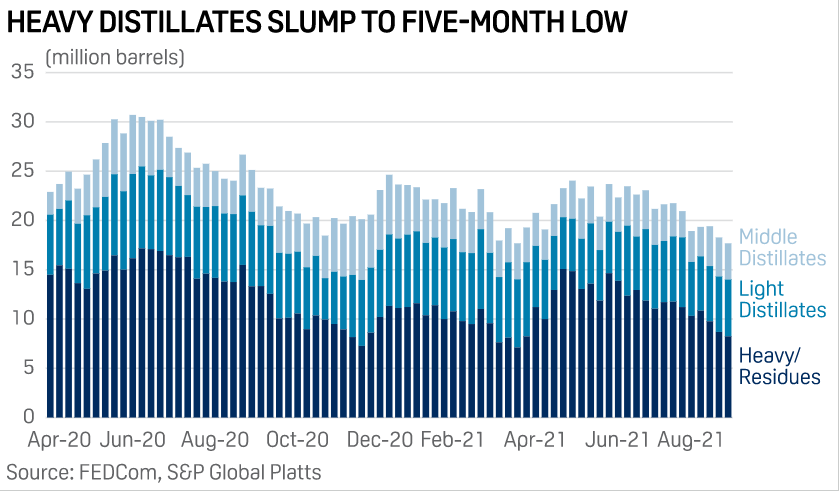

BOOM! >> Oil product stocks fall to pre-pandemic level for the first time

The stockpiles were at 17.68 million barrels as of Aug. 30, down 3.3% from a week earlier and the lowest since Sept. 9, 2019, according to the Fujairah Oil Industry Zone data provided exclusively to S&P Global Platts on Sept 1.

Heavy distillates, or fuel oils, dropped 5.1% on the week to 8.245 million barrels, the lowest since March 29. Heavy distillates dropped for the third straight week as of Aug. 30 and were down sharply by 46.8% compared with a year earlier.

Middle distillates including jet fuel and diesel declined 7.2% on the week to 3.675 million barrels as of Aug. 30, the lowest in three weeks.

Light distillates including gasoline and naphtha rose for a fourth consecutive week, climbing 2.3% to a five-week high of 5.762 million barrels. -PLATTS

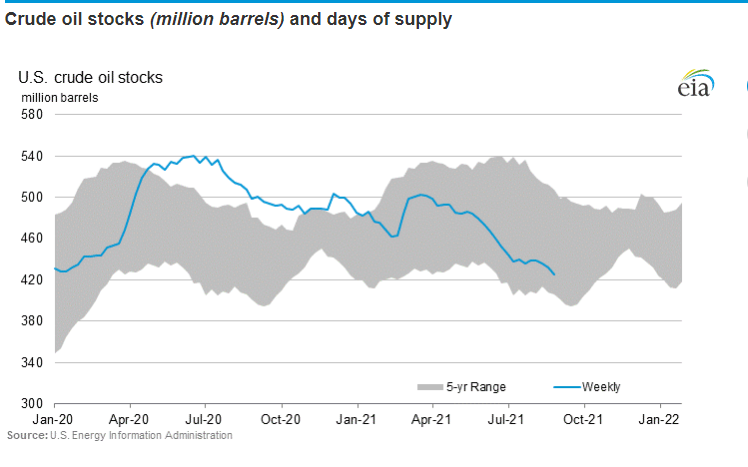

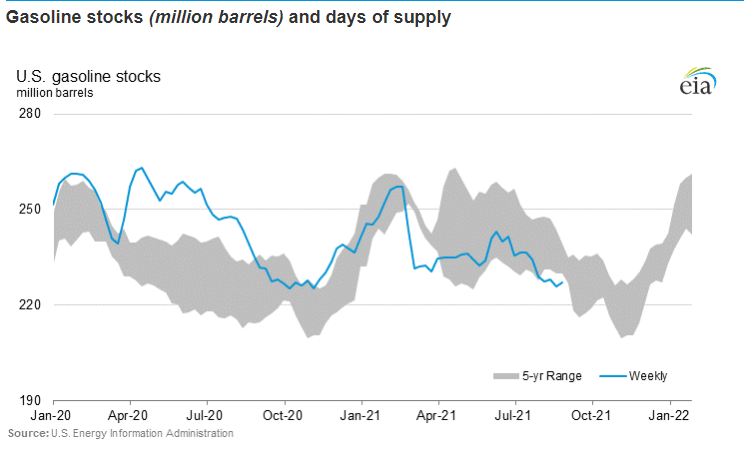

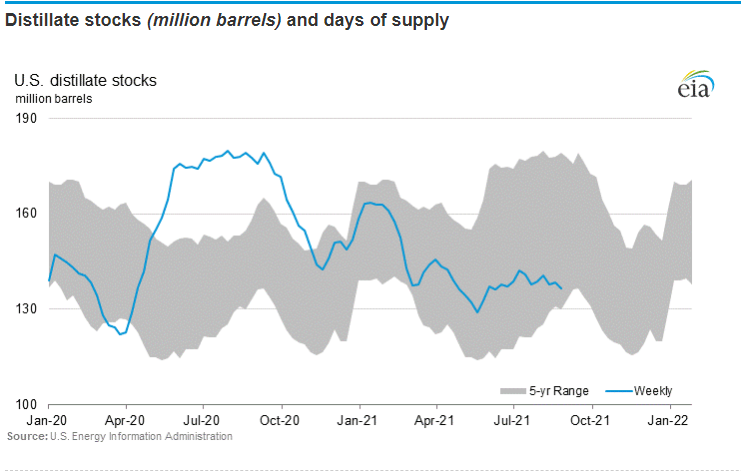

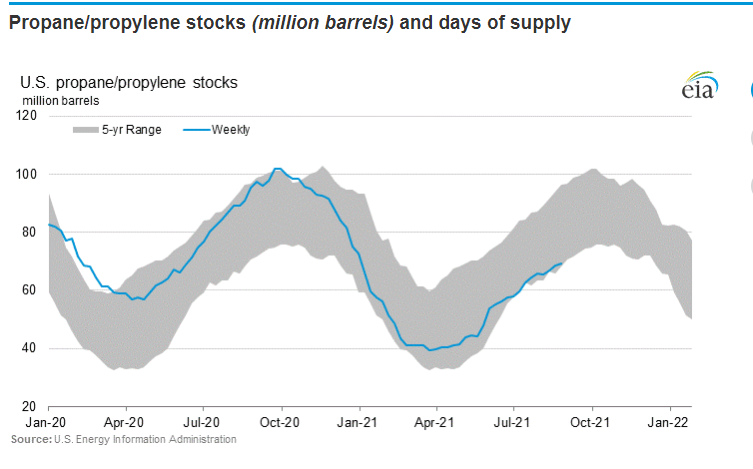

EIA

This is before IDA -eek!

HAVE A GREAT WEEK EVERYONE!!!