BIG NEWS

CHINA

The big news this week, and somewhat under the radar is China.

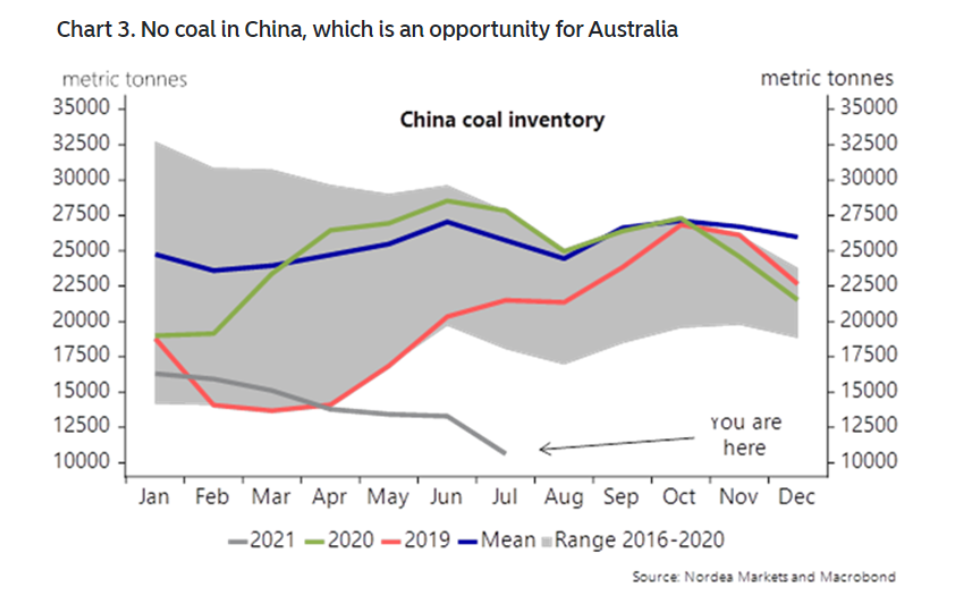

First, they dropped out of COP26, which is UN Climate Change Conference in Glasgow October 31-November 12-so much for keeping those climate change promises. I have said time and time again that China will not sacrifice growth on account of the climate. Rolling blackouts cutting manufacturing due to their energy crisis/crunch is just not their thing.

Second, China is going to let energy prices run.

China said it would allow the price of coal-fired power to rise more sharply, in the hope that market forces can address a power crunch that has threatened growth and caused ripple effects around the world.

The decision by the government’s economic planning arm amounted to an acknowledgment that price controls have warped the market. Power producers have been hit with sharply rising costs for the coal they need to fire their generators, yet government rules have largely prevented them from passing on those higher costs to their customers. -WSJ

NOTABLE: They admitted that price controls warped the market. Likely they let commodity prices run as well instead of trying to curb them as they did this past summer.

So, what did they do quietly over this past week?

Per the Chinese government website:

- Meeting on current energy status

“Given the considerable strains in meeting electricity and coal demand this winter and next spring, the meeting required putting people’s well-being first by prioritizing energy supply for people’s daily use and winter heating.

Coal supply for power generation and residential heating, especially winter coal and electricity supply in Northeast China, must be ensured. Gas supply for household use will be enhanced, and natural gas transmitted as appropriate from South China to the North to increase gas-powered residential heating in the North.

While ensuring workplace safety, coal mines with the potential to increase output will be urged to tap into their production capacity as soon as possible; approved and basically completed open-pit coal mines will be encouraged to enter into operation and run at full capacity at a faster pace; coal mines that have ceased operation for problems detected will be helped to advance the rectification process pursuant to laws and regulations and resume production as early as possible. Transport departments should give priority to coal transportation to see that coal is sent to where it is needed most in a timely manner.

The mechanism for coordinated supply of coal, electricity, oil, gas, and transportation services will be better leveraged, and market-based methods and reform measures effectively employed, to ensure electricity and coal supply.”

GOT THAT? They are increasing coal, nat gas, and oil production.

2. They quietly amended 14th 5-year energy plan.

Meeting of the National Energy Commission in Beijing

Participants at the meeting, including Vice-Premier Han Zheng, discussed reform and development in the energy sector. They also reviewed a plan for the country’s modern energy system in the 14th Five-Year Plan (2021-25)

Li asked for improvements in the efficiency of coal use, additional efforts in gas and oil exploration and strengthening research into energy technologies.

A “one-size-fits-all” approach in shutting down energy-intensive projects or “campaign-style” carbon reduction, which has been found in some areas, must be rejected, Li said. Measures should be taken to ensure people in northern parts of China have a secure power supply to ensure they keep warm over winter, he said.

Plan to vigorously promote clean coal. – China Daily

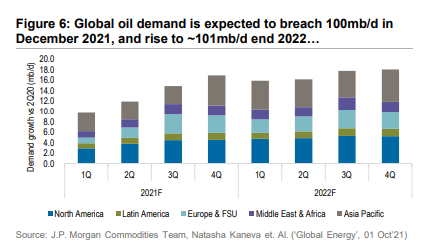

NOTABLE: As I discussed last week, much fossil fuel usage growth is set to come from the Asia Pacific, now that China seems to be backtracking on their climate goals, and stressing the need for more coal oil and gas, is even a bigger growth area.

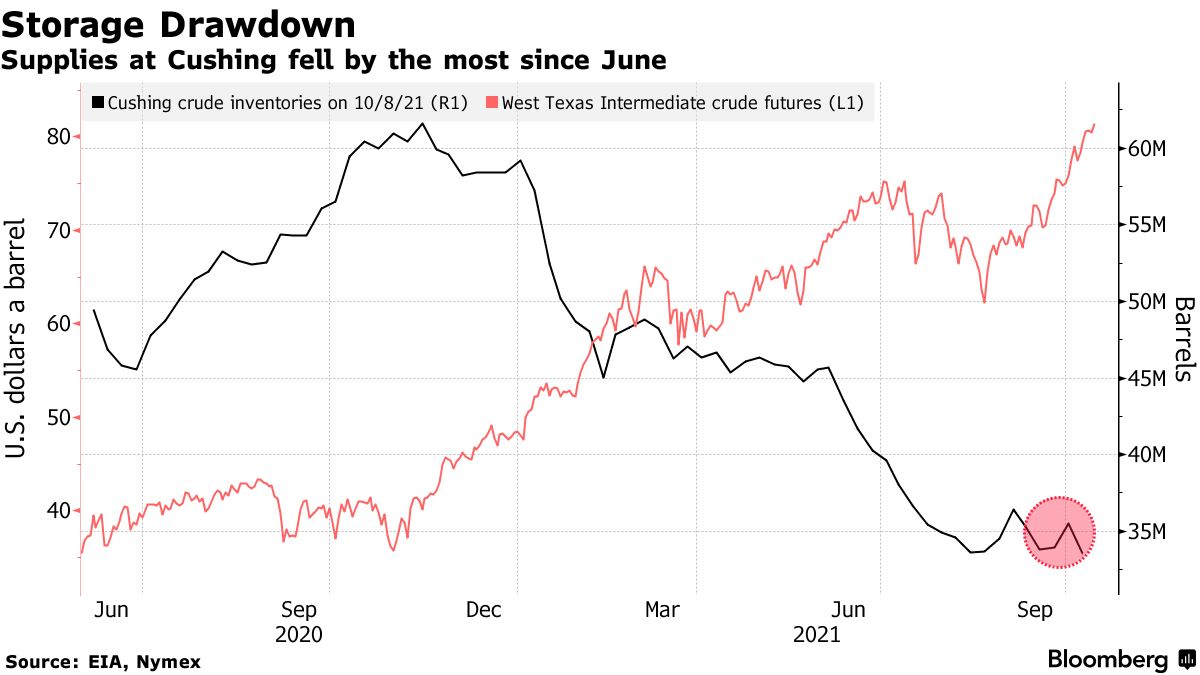

INTERESTING CHARTS THIS WEEK

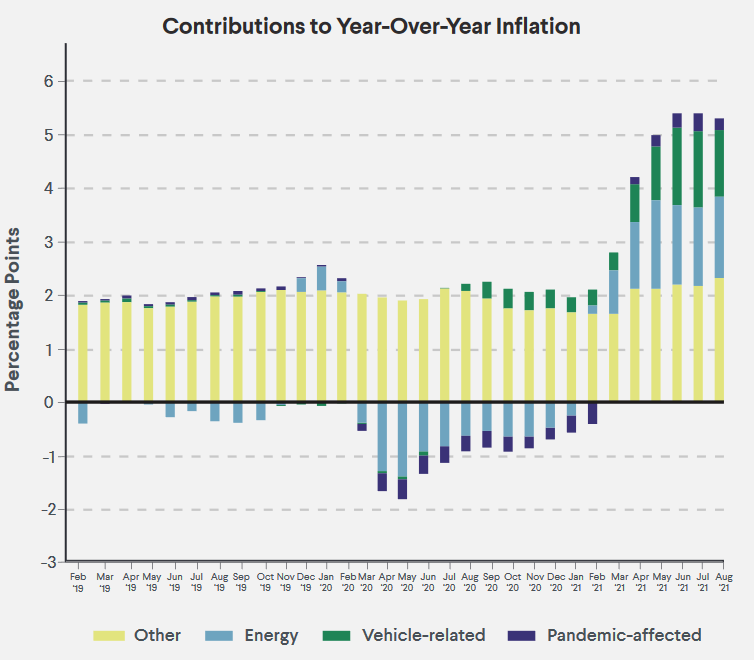

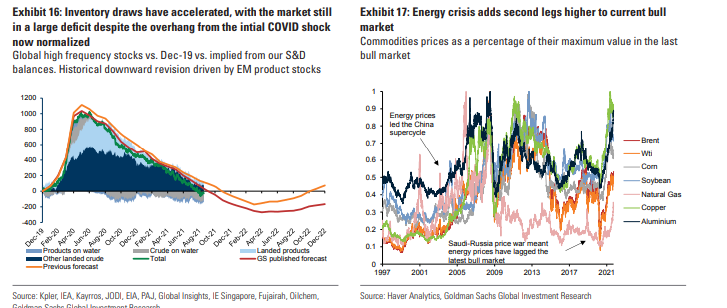

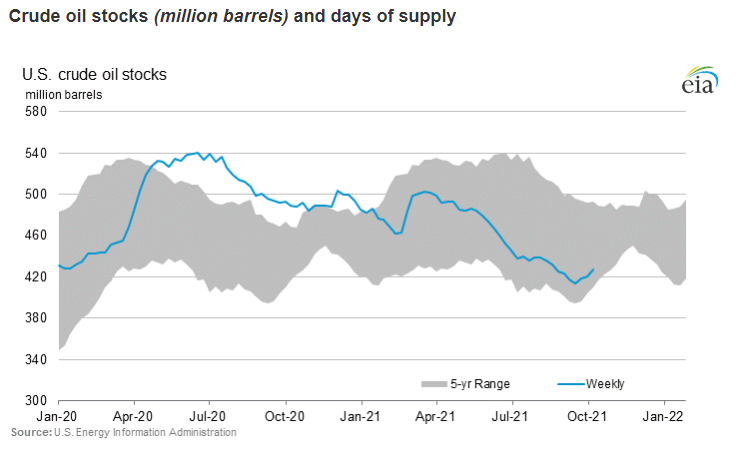

This is from IEA August, Sept is even better, preliminary data shows OECD industry stocks fell 23 mb in Sept to stand 210 mb below their 5-yr average & at their lowest level since March 2015

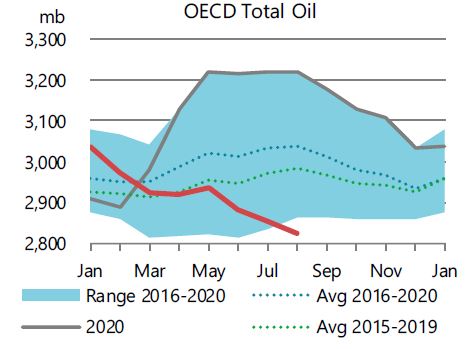

Additional oil demand could be boosted by 500K bpd this winter according to IEA (I think this is VERY conservative and likely to be more in the range of 1.5-2M)

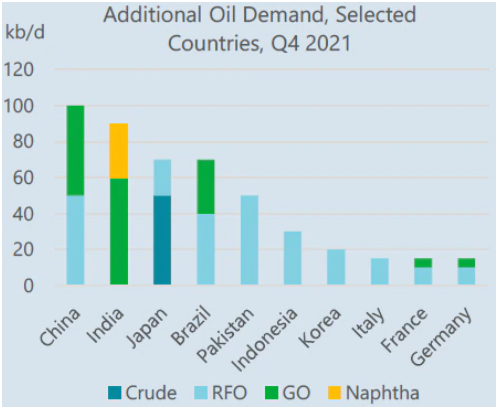

Cushing

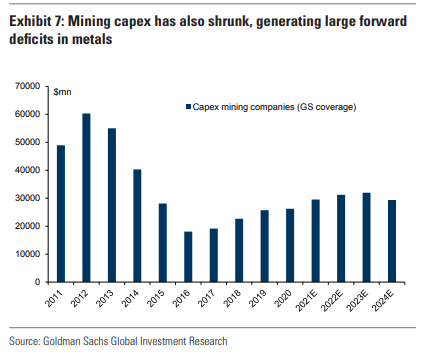

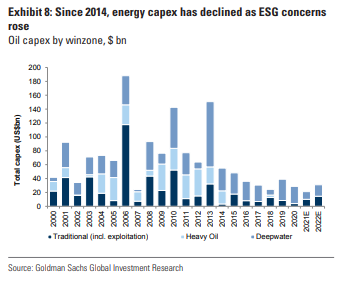

Mining Capex has shrunk, generating large forward deficits in metals

Metals

This is HUGE

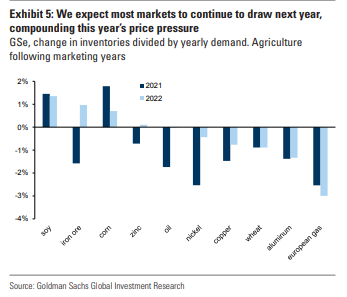

GS: Already facing a historical 4.5mb/d deficit, we expect oil to see inventories to fall to their lowest level since 2013 by year-end. This would place the oil market in a uniquely precarious position this winter, where the potential for a combined 2mb/d upside risk to demand could lead to a spike in prices to create oil demand destruction, the ultimate solution to widespread energy scarcity

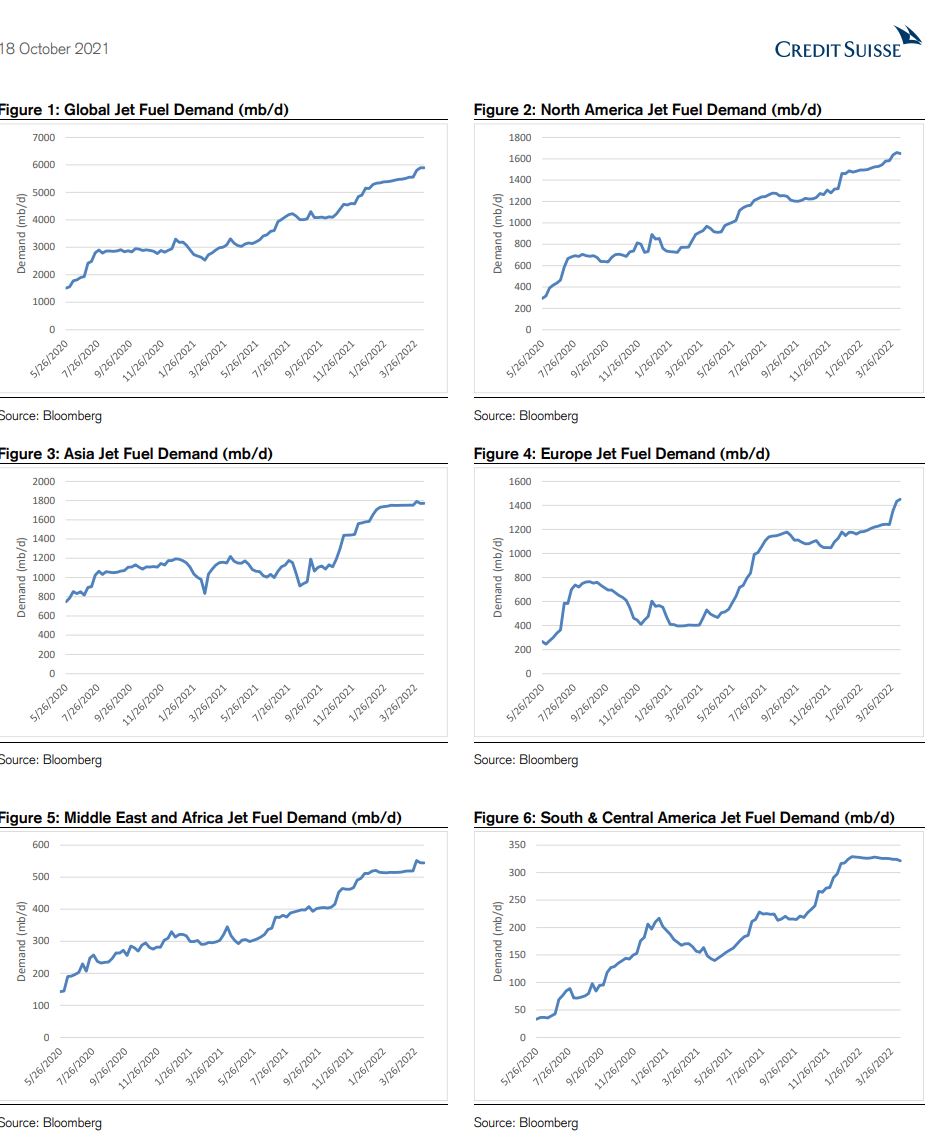

Jet Fuel demand is picking up

TECHNICALS

We are getting a bit oversold, should see a pullback, but we are constructively working off oversold areas

FUNDAMENTALS

OIL AND PRODUCTS

INDIA

India lifted all restrictions allowing airlines to operate at 100% capacity -Aviation Ministry

NOTABLE: Good news for jet fuel

India’s oil demand to rise 50% by 2030 against global expansion of 7%: Report

India’s oil consumption is forecast to rise from 4.8 million barrels per day (mbd) in 2019 to 7.2 mbd in 2030 and 9.2 mbd in 2050, as per the IEA’s key scenario based on stated policies. The projection shows the centrality of oil in the Indian economy over the next three decades and runs counter to BP’s forecast last year that estimated the country’s oil demand to peak in 2025. -Economic Times

NOTABLE: Obviously this is great news for longer-term demand. We should see the most demand coming out of Asia Pacific

NORWAY

Norway to keep searching for oil and gas, the new center-left government says

Norway will continue to explore for oil and gas in the next four years, with most new drilling permits to come in mature areas of the sea, the incoming center-left government said on Wednesday.

A minority coalition of the Labour Party and the rural Centre Party will take power on Thursday after defeating the Conservative-led government in last month’s election.

“The Norwegian petroleum industry will be developed, not dismantled,” the two parties said in a joint policy document, adding that it will maintain the existing system of handing out exploration licenses.-Reuters

NOTABLE: Smart move, bodes well for Equinor and Norway. Oil and gas are not dead.

CHINA

Desperate factory owners in China are increasingly turning to diesel generators to keep their businesses going during a power crisis that is threatening both the country’s economic growth and its green ambitions. -FT

NOTABLE: Likely we see this across Europe as well if we see rolling blackouts this winter.

JET FUEL

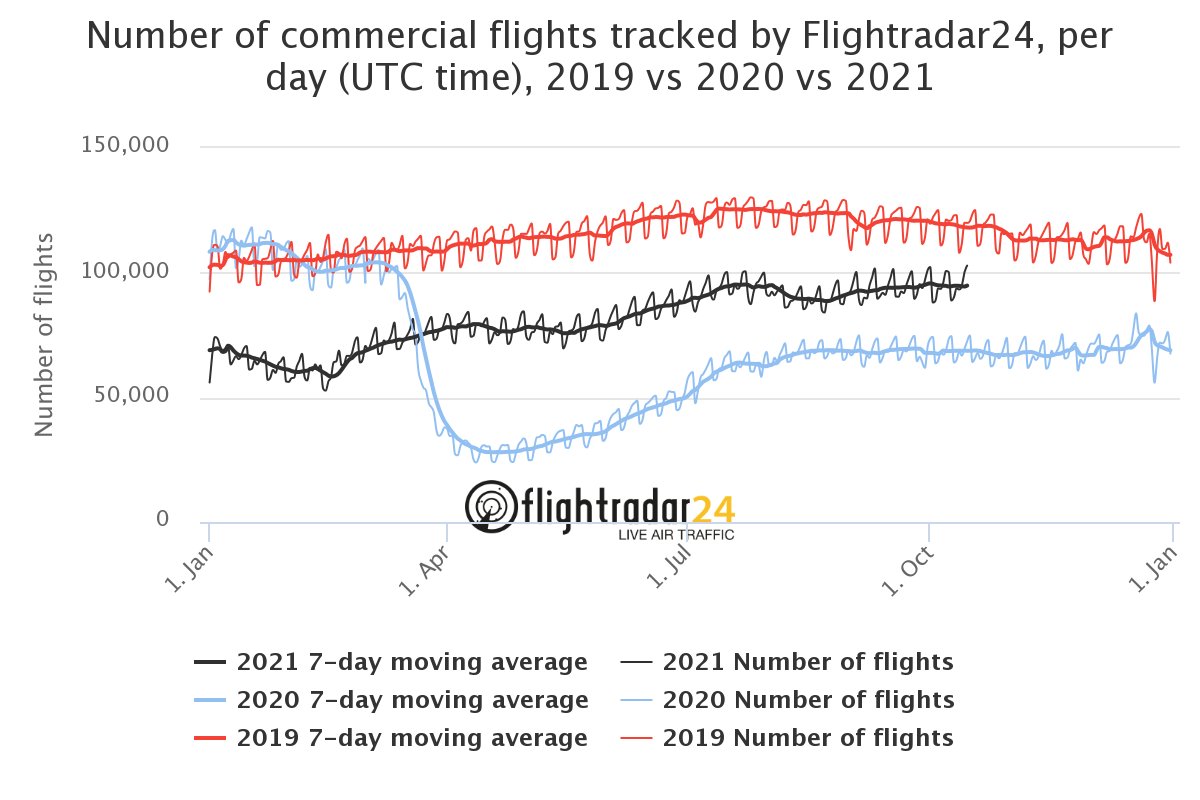

The recovery in global aviation continues (slowly). According to @flightradar24, there were 102,836 commercial flights yesterday, setting a new post-pandemic peak (higher than Aug-July levels). Still, the number of flights lagging 2019 level by ~20%.

NOTABLE: Slowly but surely! Saudi Arabia also just announced today that airports will be allowed at full capacity starting today. The United States is opening up international travel to vaccinated passengers on November 8th. This is great news for jet fuel refiners: MPC, VLO, XOM, PSX, and CVX.

BLOOMBERG OIL DEMAND MONITOR

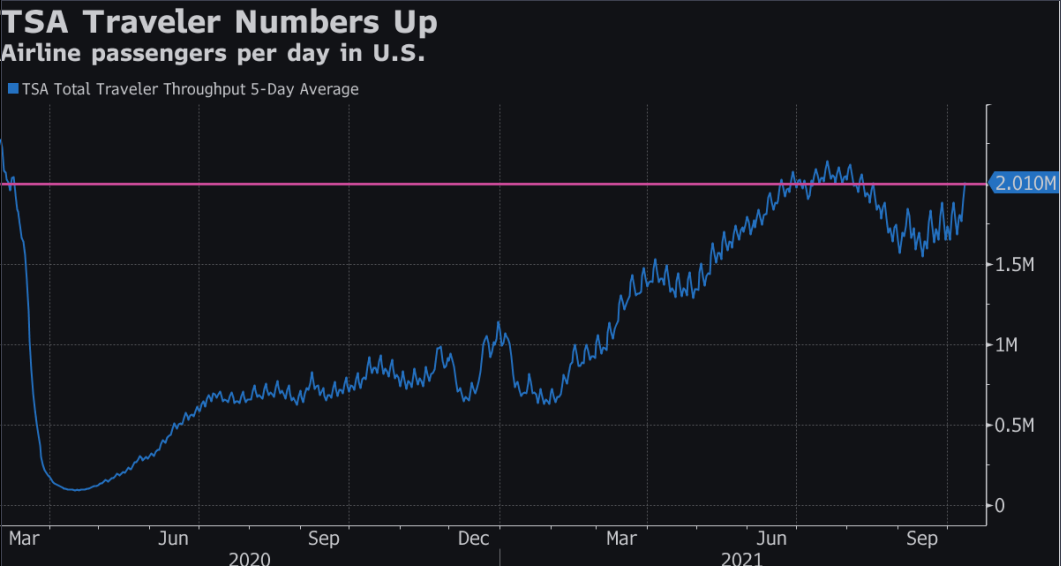

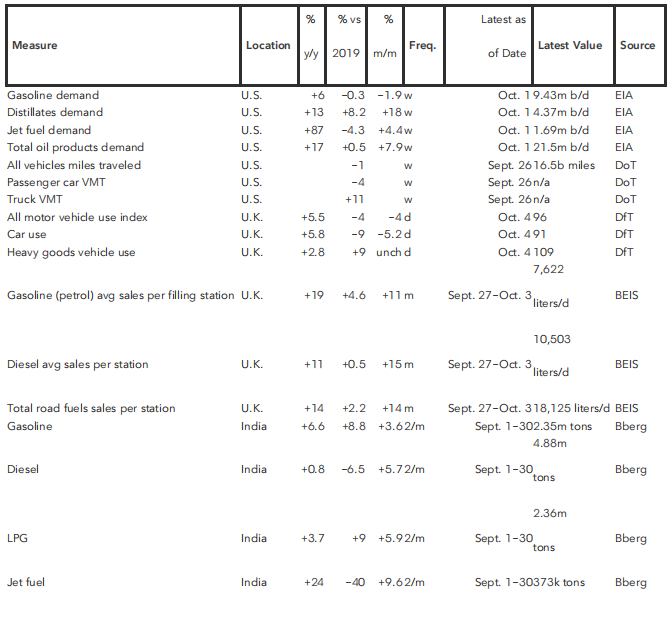

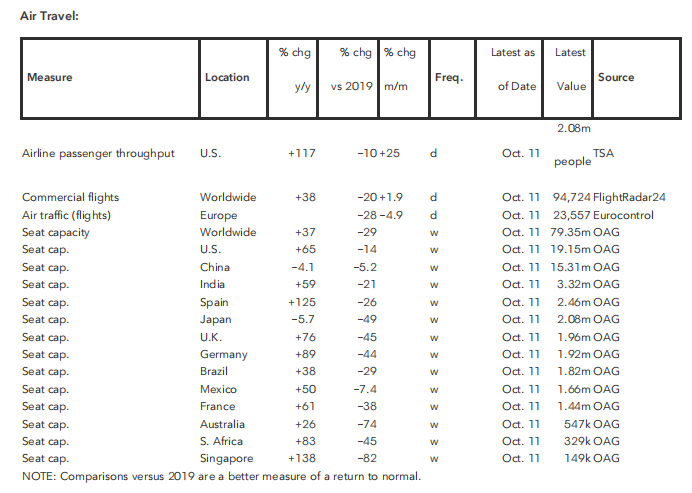

U.S. Air Travel Recovery Swifter Than Europe

Europe air traffic down 28% vs 2019; global figure down 20%

Rome traffic levels swelled Monday to unusually high levels

Air travel has recovered gradually in the U.S. and is almost back to normal while the more fragmented European airline industry is taking longer to claw its way back to pre-pandemic levels, according to high-frequency data.

A five-day average of the number of passengers passing through U.S. airport turnstiles surpassed 2 million a day for the first time since mid-August, and the level on Oct. 11 was only 10% below the equivalent weekday in 2019, government data showed. Separately, an Energy Information Administration estimate of jet fuel demand in the U.S., which can often be volatile, was just 4.3% below pre-pandemic levels in the week ended Oct. 1.

Compare that with European air traffic that still lagged the equivalent period of 2019 by 28% as of Oct. 11, according to Eurocontrol, a flight-monitoring agency for nations on the continent. For the world as a whole, the number of commercial flights is 20% less than two years ago, according to the latest daily estimate by FlightRadar24

The number of seats offered by airlines, as measured weekly by OAG Aviation, also shows European nations trailing behind the U.S., Mexico, and India when comparing the latest levels against 2019. On that basis, China remains top, with capacity only about 5% less than two years ago, while the U.S. is down 14% and the U.K. and Germany are both down by about 45%

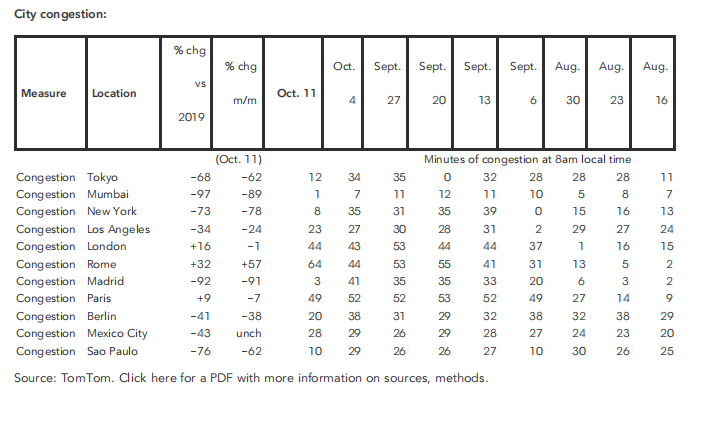

Busy Roads in Rome

Traffic levels within major world cities were somewhat erratic on Monday, according to TomTom NV data. Congestion at 8 a.m. local time soared in Rome while collapsing to very low levels in Mumbai, Madrid, New York, Tokyo, and Sao Paulo. Holidays in the U.S. and Brazil probably contributed in part.

In the Italian capital, congestion leaped to 107%, meaning that a journey that would take one hour on empty roads now had an extra 64 minutes, for a total trip time of two hours and four minutes. That level of added congestion time was about a third more than the typical amount in 2019 for that time of the week.

London and Paris also had more congestion than before the pandemic on Monday while other cities regularly watched in this monitor had less.

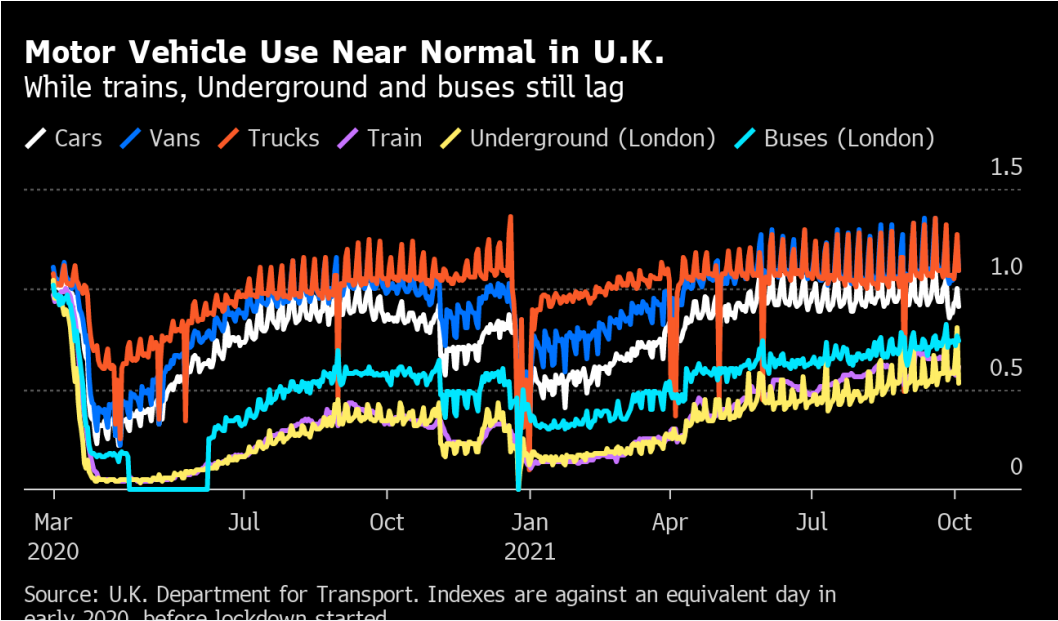

Motor vehicle activity in Britain is back to 96% of what it was before the pandemic hit in early 2020, with more trucks and vans on the road and slightly fewer cars, according to daily measurements by the Department for Transport. Commuters are less fond of mass transit though, with the London Underground, nationwide trains, and London buses ranging from between 53% and 74% of pre-pandemic levels.

Some oil market observers are speculating that demand, especially in Asia, will receive a boost because high natural gas prices are forcing consumers and power producers to diversify to other fuels, and this sometimes includes diesel or fuel oil. In the coming winter season, such switching may add as much as 500,000 barrels a day of extra oil demand, according to Facts Global Energy analysts.

NATURAL GAS

UNITED STATES

In the cluster that is current US energy policy…..

White House looking at options to improve energy supply around the U.S.

President Joe Biden and the National Security Council are closely tracking the issue of rising oil prices and looking at options to improve energy supply around the country, White House press secretary Jen Psaki said on Thursday.

“I would say that part is a supply issue…but part is also a logistics issue of being able to move supply around the country,” Psaki said. -Reuters

NOTABLE: I have one sentence for these people: QUIT STOPPING PIPELINE PROJECTS!!!!! Logistics issue solved

And on the heels of this press conference….what happens???

High court rejects natural gas company’s pipeline appeal

Chief Justice John Roberts has rejected a Supreme Court appeal by the St. Louis-based natural gas company Spire Inc. to allow it to keep operating a pipeline through Illinois and Missouri.

“Shutting down the Pipeline could potentially lead to widespread, prolonged, and life-threatening natural-gas service disruptions for residents and businesses in the greater St. Louis region,” Smith said. “Spire STL Pipeline will continue to fully cooperate with the FERC and other stakeholders to keep this critical infrastructure in service to ensure continued access to reliable, affordable energy for homes and businesses in the greater St. Louis region.” – AP

You just can not fix stupid…moving on

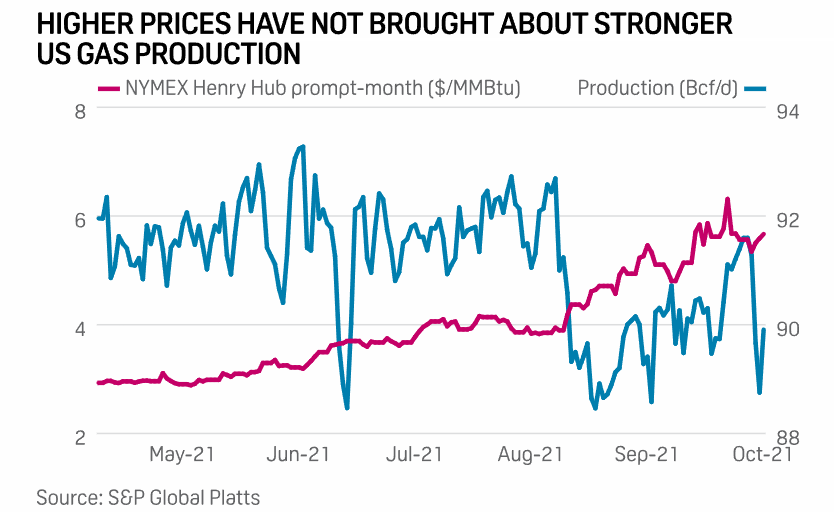

Henry Hub could reach $12-$14 this winter as capital discipline limits supply growth: Platts Analytics

“If this capital discipline remains, you are talking about $12/MMBtu, $14/MMBtu gas to incentivize either curtailing LNG exports or curtailing exports to Mexico,” Simon Thorne, head of generating fuel and power analytics at Platts Analytics, said

Even as the NYMEX Henry Hub prompt-month contract climbed above $5/MMBtu into heights last sustained in 2009, US gas supply has not been ramped up in tandem.

The focus for many US gas producers has shifted from increasing volumes to paying down debt and maximizing shareholder returns, driven in part by a tougher financial landscape. Some investors have shied away from sinking money into oil & gas exploration and production, influenced by mounting pressure to divest from fossil fuels and uncertain returns on investment.

“While shale used to be the solution for quick capital response to the shortage of supply, the larger players are becoming less attracted to shale as a long-term play,” S&P Global Platts Analytics’ Global Director of Analytics Chris Midgley told reporters.

“What we see is that all the rig count increases are coming from the small players, but they don’t have anywhere near the same sort of productivity of the larger players,” Midgley said. -PLATTS

NOTABLE: The biggest takeaway is that increases in rig counts are coming from smaller players not larger ones, in addition to years of lack of CAPEX in the industry. Staying long AR, SD, and LNG.

EUROPE

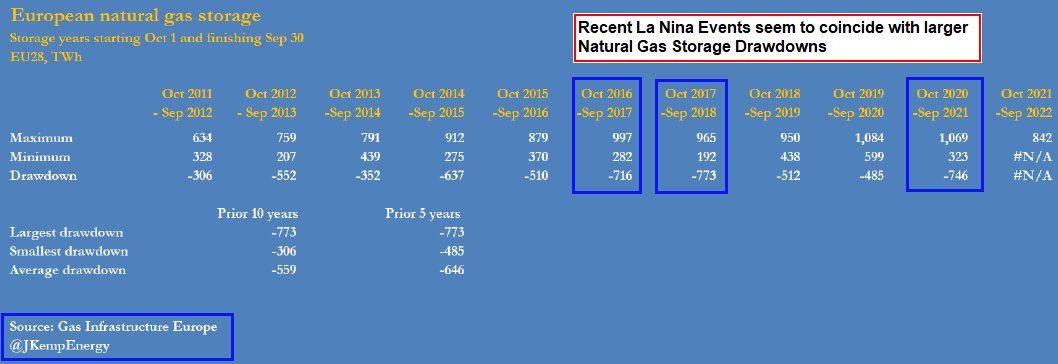

La-Nina is back

Europe uses 55% more gas (based on the drawdown) in La-Nina years than non-La-Nina years Odds of a warm European Winter are fading

ISRAEL

Local Chevron Head: We see a great opportunity to grow natural gas in Israel

“We are excited to be in the energy industry in the eastern Mediterranean, especially in Israel,” said Ewing. “We see great opportunities to grow the natural gas business in the region, which is becoming even more important as natural gas is seen as a key transition in the low-carbon strategy for the environment.” He noted that natural gas currently comprises 22% of the world energy supply, and it will increase in the coming years. Ewing added that Chevron wants to diversify its portfolio and grow its position in the region. -The Jerusalem Post

NOTABLE: I have mentioned the Southern Gas Corridor and the TAP pipeline more than once. I noted last year that this could be very beneficial to Europe as an alternate source for natural gas. Still long Delek via DELEKL:TA. CVX is an excellent play for this as well.

TANZANIA

The Tanzanian government has restarted talks with energy giants with a view to exploring the country’s vast gas reserves. -All Africa

PAKISTAN

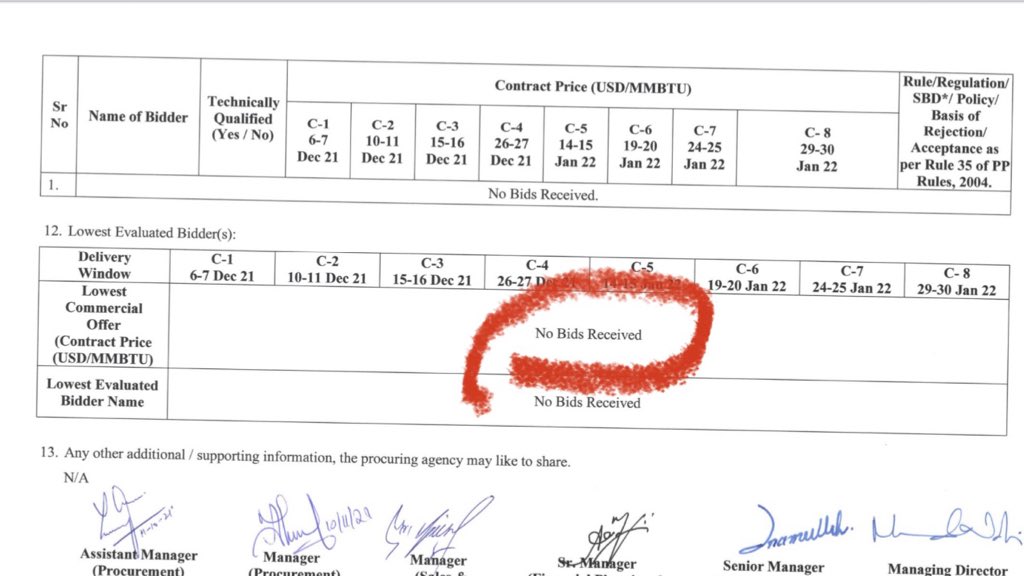

The global LNG shortage is so bad that Pakistan’s latest purchase tender received ZERO offers

Pakistan closed a tender this week seeking LNG cargoes for Dec.-Jan.

There is a growing risk that LNG buyers dependent on the spot market will be caught short this winter -BBG

NORDSTREAM2

NOTABLE: I have just one note on this: Nordstream2 still faces a 4-month review by Germany, then a 2-month review from the EU so this still will not help EU much for this winter.

COAL

UNITED STATES

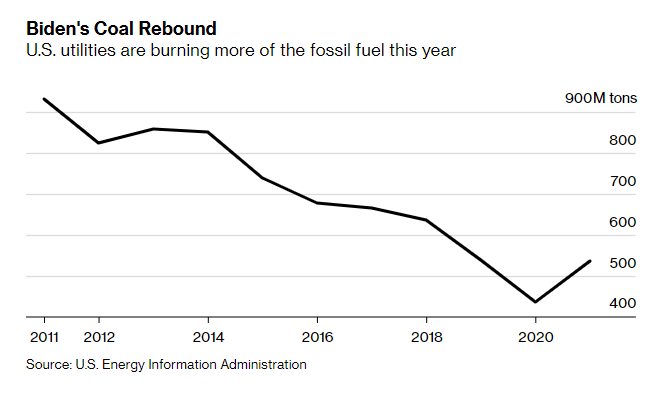

US utilities are on track to burn 23% more coal this year as the global energy crisis lifts demand for fossil fuels.

US power plants are on track to burn 23% more coal this year, the first increase since 2013, despite Biden’s ambitious plan to eliminate carbon emissions from the power grid. The rebound comes after consumption by utilities plunged 36% under Trump, who slashed environmental regulations in an unsuccessful effort to boost the fuel. -BBG

NOTABLE: When Chicago natty moves from $2.00 to $3.00, there is plenty of gas-to-coal switching available to help lower power. Chicago’s outright price for this winter pushed into $5.00/MMBtu. The only reason we are seeing a slight coal consumption increase this year, still an overall secular decline. That said, this is good news for BTU.

INDIA

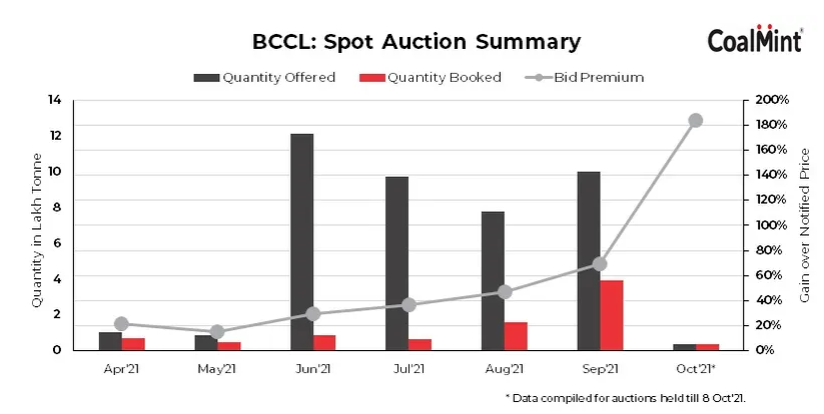

BCCL’s spot auction bid premium spurts 184% in Oct’21

Bharat Coking Coal Ltd (BCCL) has seen bid prices rising to record levels in the coal sales under the recent spot auction held on 8 Oct’21.

The company had offered 37,500 tonnes (t) of coal of which the entire volume except for 500 t from the Jogidih colliery was sold at a price realization of INR 9,829/t. The rise in bid premium was assessed to be up by 184% against the average notified price of INR 3,464/t. -CoalMint

CHINA

Self-explanatory

MATERIALS

LITHIUM

Lithium Deal Shows China’s Accelerating Race for Battery Metals

Lithium has gotten so hot that even China’s gold miners want a slice of the market, sky-high valuations and all.

Zijin Mining Group Co., a major Chinese gold and copper producer, announced on Friday its first foray into the booming lithium sector with its C$960 million ($770 million) purchase of Neo Lithium Corp. It’s just the latest in a series of recent acquisitions, mostly involving Chinese bidders for South American assets owned by Canadian firms, amid surging demand for the key ingredient used to power electric vehicles. -BBG

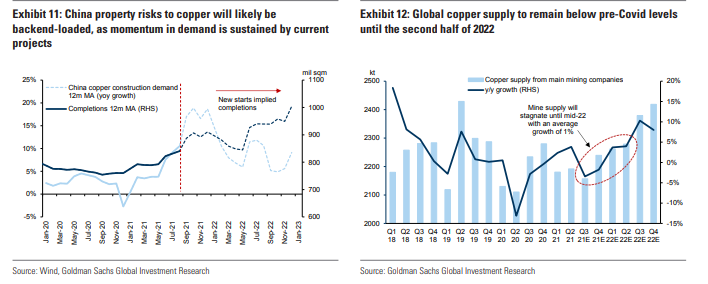

COPPER

Codelco Raises Europe Copper Premium by 31% in Bullish Signal.

Codelco offered to supply copper to European customers at a $128 premium over futures next year, signaling that the world’s biggest copper miner expects strong demand to continue even as growth headwinds swirl.

Codelco boosted its annual premium by $30 a ton, according to a person familiar with the matter who asked not to be identified discussing private information. The offer is $5 higher than the premium announced by leading European producer Aurubis.

The miner made its offer at the start of London Metal Exchange Week when producers, consumers, and traders convene in the U.K. capital to thrash out supply deals for the coming year. While copper demand has been booming, rampant inflation and the burgeoning global energy crisis are casting a pall over the growth outlook. Rising freight rates have also raised costs for suppliers like Codelco.-BBG

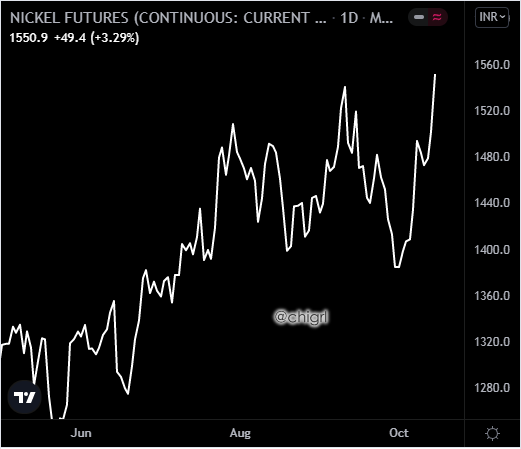

NOTABLE: Battery metals lithium, copper, and nickel will continue to be in high demand, not just in China, but also in the West. Miners should do very well.

LME COPPER

Copper inventories at warehouses registered with LME are on course for the biggest absolute monthly drop since Sept 19. Canceled warrants (below), which measures requests to draw on these stockpiles, jumped to the highest since 2018. Not enough copper going around.

In case the terminology is confusing: “Metal on warrant” represents inventories in-store at London Metals Exchange (LME) warehouse. Thus, canceled warrants represent metal earmarked for delivery — investors cancel their warrants because they want to take it out of the LME warehouse

CHINA COPPER

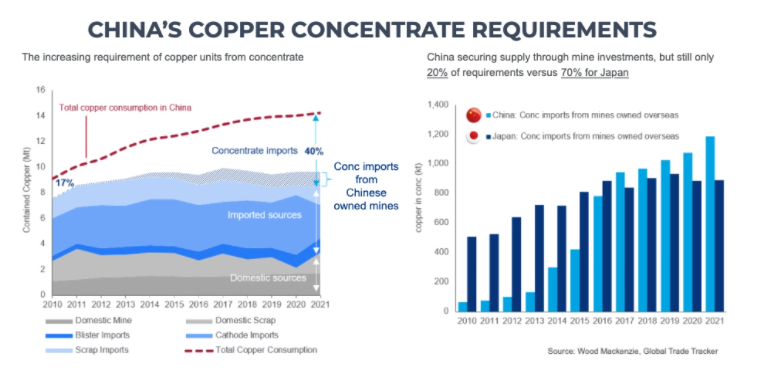

Chinese investment in overseas copper projects just beginning

China consumes nearly 14 million tonnes of copper each year – more than the rest of the world combined. But domestic supply last year was only around 2m tonnes, including scrap, and mined output has been stagnant for years.

But if China is to follow the Japanese model of securing long-term supply to feed its downstream industry — it has some work to do.

Japan has managed, through well-known companies like Sumitomo, Marubeni, and Mitsui acquiring minority interests and JVs in scores of projects, to own 70% of the copper in concentrate it imports.

NOTABLE: The are vast reserves in central Africa in the copper belt which makes this area attractive. Ecuador and Argentina in South America also look very attractive especially with the political hurdles going on in Chile right now. Other areas to watch are Zambia and Congo. I like FCX and BHP right now for copper plays.

BHP made a nice double bottom on the weekly and closed over 57.50 this week. This has room to run. Nice r/r with a stop below the recent low.

FCX is starting to break out of a weekly flag, this also has room to run.

NICKEL

NewCo Ferronikeli and Aldel halt production due to power crisis

Kosovo’s sole ferro-nickel producer NewCo Ferronikeli has reportedly closed production at nickel ore deposits due to higher power prices.

Europe and Asia are facing price surges for natural gas and power that have reached record highs due to multiple factors, including increasing demand and constrained supply.

NewCo Ferronikeli was cited by Reuters as saying: “Due to the continuous increase of electricity prices in European markets, the company NewCo Ferronikeli is forced to temporarily stop production.”

The firm, which is owned by Albani’s Balfin Group, expects production to stay halted until power prices ‘normalize’. -Mining Technology

NOTABLE: The power crisis continues, last week was zinc smelters, this week nickel producers. Between under-investment (see metals CAPEX chart in chart section) and power shortages, base, and industrial metals should continue their march higher.

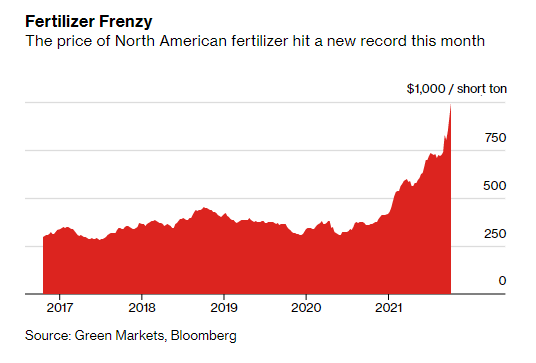

FERTILIZER

Fertilizer Crisis Piles More Pressure on World’s Future Food Supply

Warnings about the fertilizer crisis’s threat to global food security are coming thick and fast.

In Europe, the high nutrient prices have farmers questioning whether to curb plantings. Canadian authorities cautioned that growers may cut back on usage, while in corn powerhouse Brazil, there’s a risk that soaring fertilizer costs and less supply will limit crop yields.

The global fertilizer market had already been tightening before plants were forced to cut production on the back of the recent spike in the cost of gas, a key feedstock. That’s sent prices of nutrients crucial for growing staples soaring — to a record in some cases — risking smaller harvests or even more expensive food down the line. -BBG

NOTABLE: Nothing new here, been talking about this for over a year now, but the problem is not subsiding. Staying long MOS and IPI…they are still buyable on dips, as I believe this problem will persist long term.

OPEC MONTHLY REPORT

October’s monthly report was out this week.

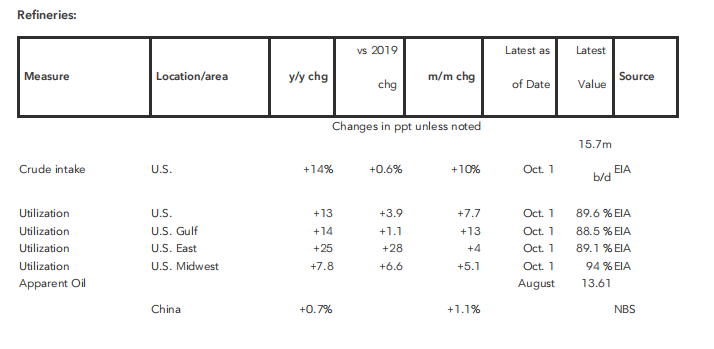

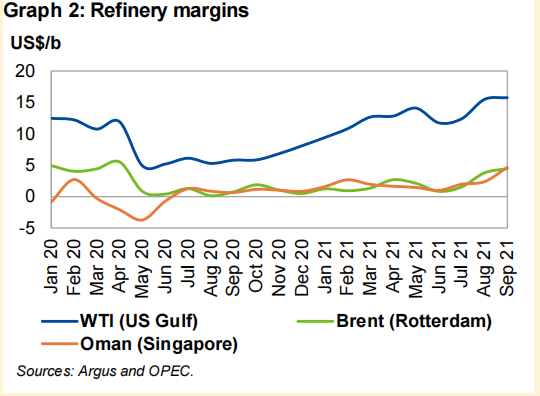

THE KEY CHART

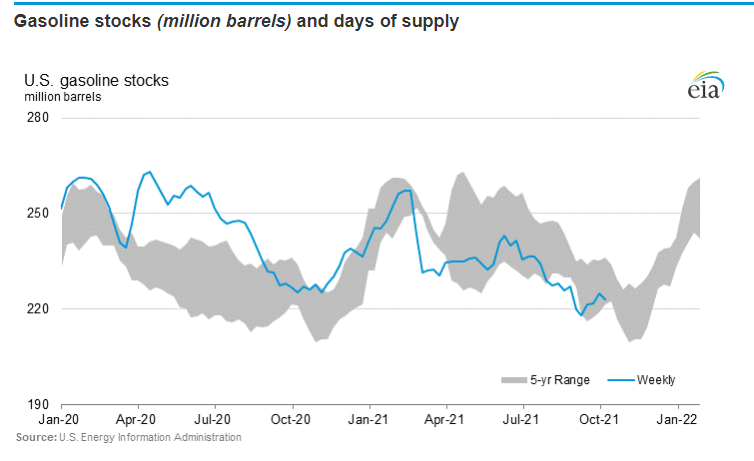

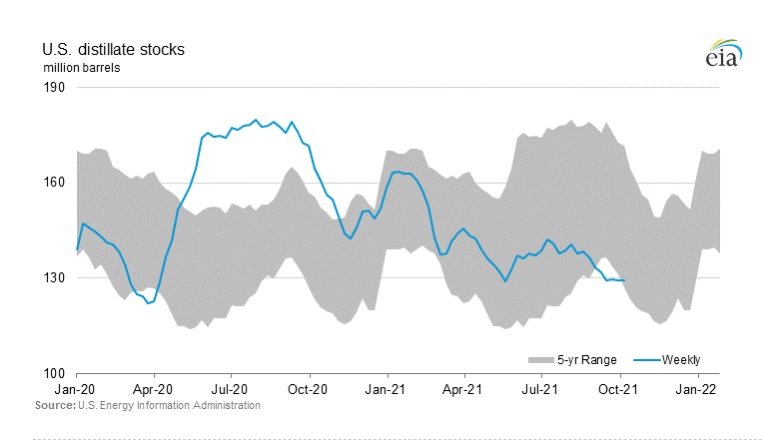

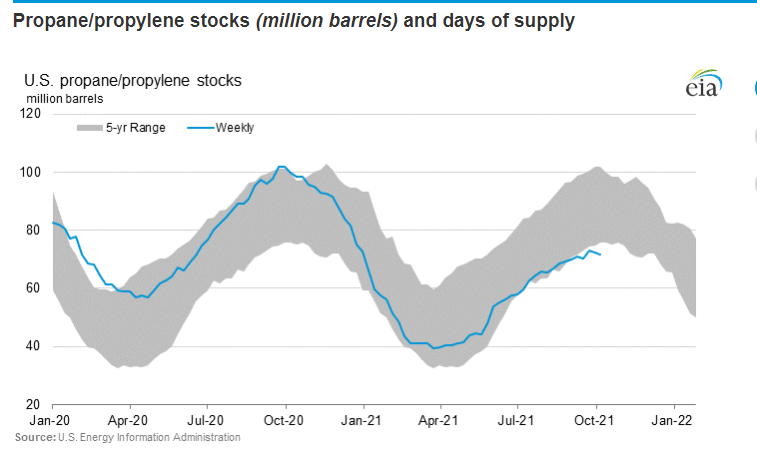

Refinery utilization rates in 2021 have been firmly supported by stronger product fundamentals with robust gasoline performance, mainly in the US and Europe, leading to strong conversion margins in recent months and, ultimately, solid improvement in refining economics

NOTABLE: Great news for refiners especially in the US

GLOBAL OIL INVENTORIES

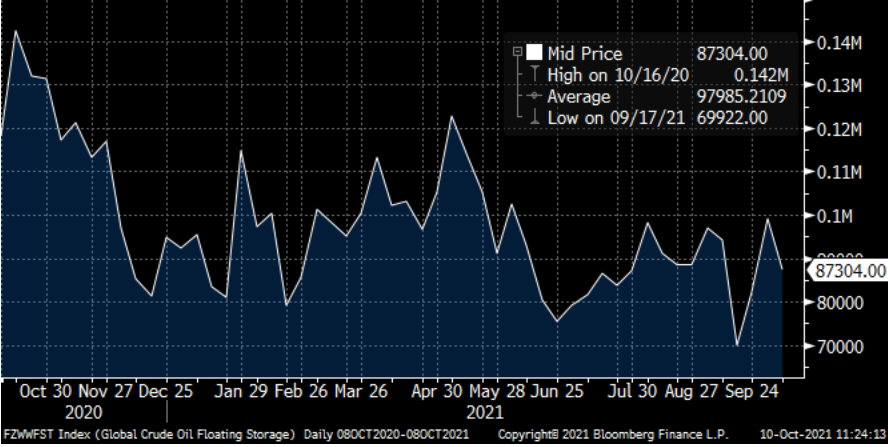

GLOBAL FLOATING STORAGE

Crude Oil in Floating Storage Falls 9.9% in Past Week: Vortexa

The amount of crude oil held around the

world on tankers that have been stationary for at least 7 days

fell to 89.70m bbl as of Oct. 8, Vortexa data show.

* That’s down 9.9% from 99.52m bbl on Oct. 1

* Asia Pacific down 9.1% w/w to 69.31m bbl

* West Africa up 63% w/w to 6.10m bbl

* Middle East down 31% w/w to 5.13m bbl; lowest since

March

* Europe down 54% w/w to 2.86m bbl; lowest since May

* North Sea down 53% w/w to 1.20m bbl

* Company Exposure:

** Asia: Cosco Shipping Energy Transportation Co., HMM Co. Ltd.,

Mitsui O.S.K. Lines Ltd., Nippon Yusen KK

** Europe: Euronav NV, Frontline, Vopak

** U.S.: DHT Holdings, International Seaways, Nordic American

Tankers, Teekay Tankers, Tsakos Energy Navigation

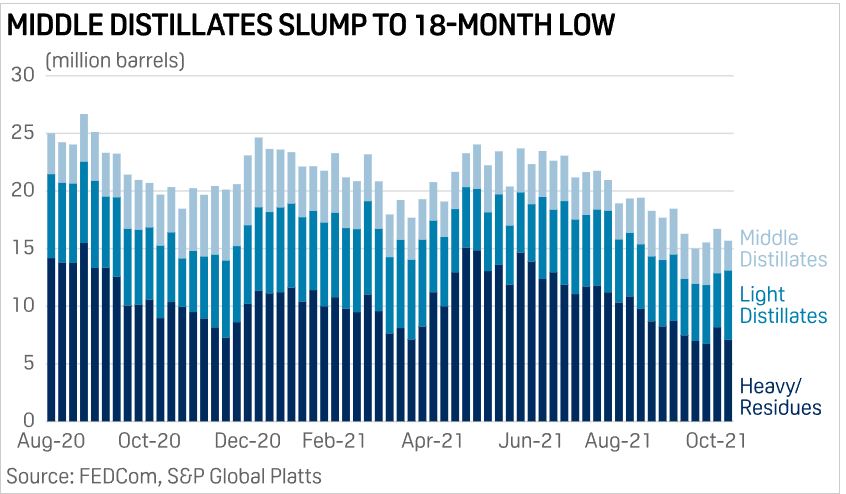

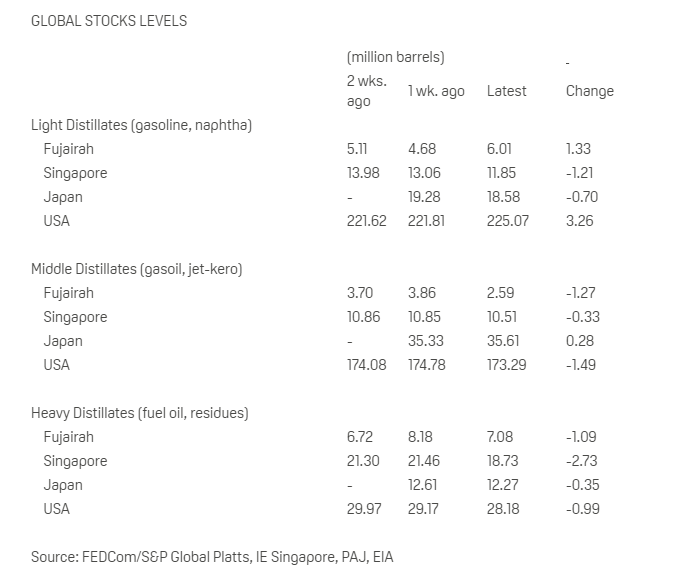

FUJARIAH DATA

Oil product stocks fall after middle distillates plunge 33%

The total inventory was 15.684 million barrels as of Oct. 11, down 6.2% from a week earlier and close to the record low of 14.998 million barrels set Sept. 20, according to Fujairah Oil Industry Zone data provided exclusively to S&P Global Platts on Oct. 13.

Heavy distillates used for power generation and marine bunkers dropped 13% to 7.083 million barrels, a two-week low.

Middle distillates such as gasoil, jet fuel, and diesel plunged 33% to 2.588 million barrels, the lowest since April 2020

Light distillates inventories, including gasoline and naphtha, jumped to 6.013 million barrels on Oct. 11, up 28% from a week earlier and the highest in 11 weeks.-PLATTS

EIA

HAVE A GREAT WEEK EVERYONE!!

SORRY FOR THE TECHNICAL DIFFICULTIES THIS WEEK WITH THE NEW SITE…BUT IT WILL BE WORTH IT!!