BIG NEWS

Russia/Ukraine

I am only going to discuss this in terms of what it means to commodities: energy and agriculture. Going to do this in chronological order.

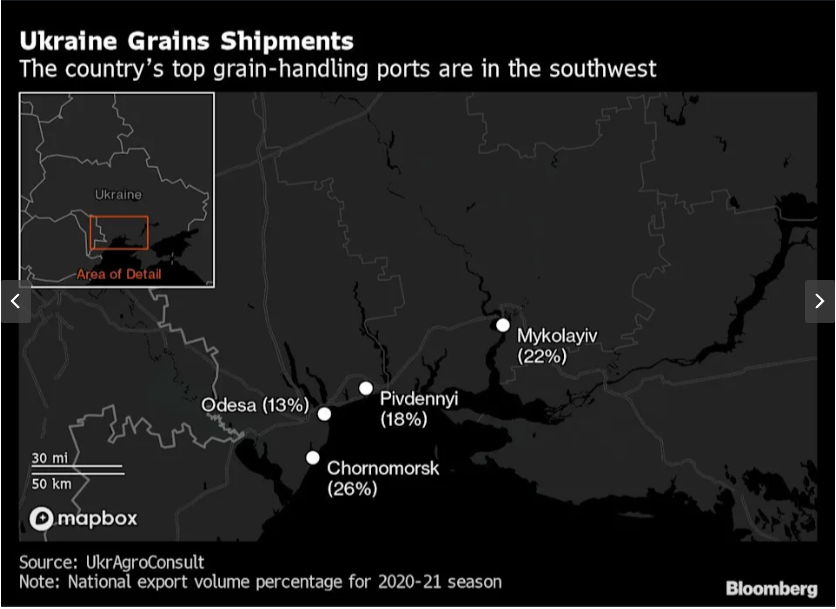

First, let us look at some maps

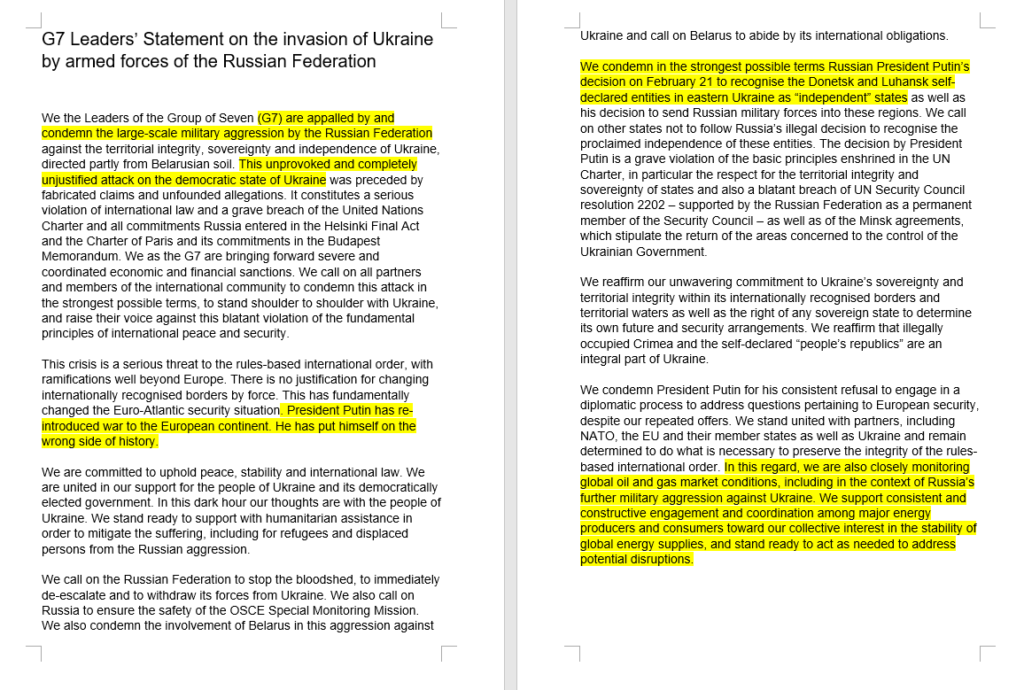

This week on Thursday, 24 Feb. the EU, UK, and the US placed sanctions on Russian banks and individuals. ALL energy transactions, including wood, were excluded from the United States sanction. We saw similar from the EU and UK.

That said, we immediately started seeing problems, on Feb. 25

OIL

Major buyers of Russian oil struggle with bank guarantees

The global oil market was thrown into chaos on Thursday after Russia invaded Ukraine, with top buyers of Russian oil struggling to secure guarantees at Western banks or find ships to take crude from one of the world’s largest producers.

At least three major buyers of Russian oil have been unable to open letters of credit from Western banks to cover purchases on Thursday, four trading sources said, citing market uncertainty after the Russian invasion. -Reuters

We also saw Russian Urals differentials hit an all-time low, dropping to a discount of $11 a barrel on Thursday as buying interest in northwest Europe evaporated-Reuters

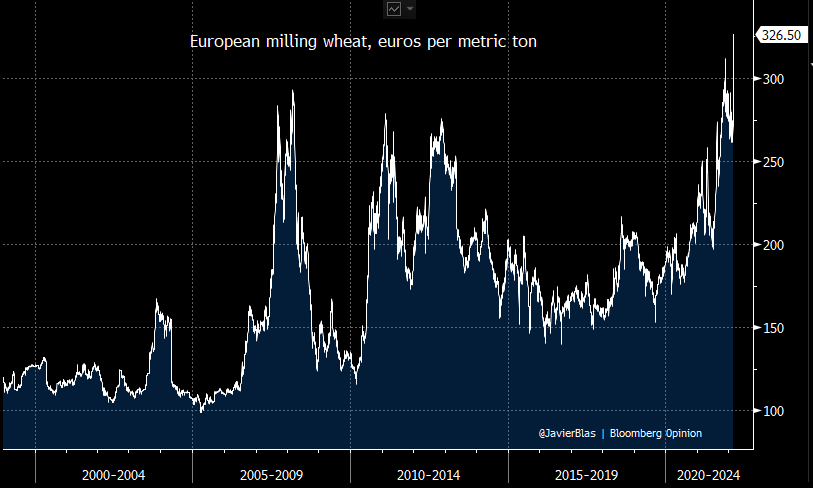

WHEAT

European high-quality milling wheat prices surged to an-all time high as Russia invades Ukraine. In Paris, the contract is up 13%

And both US wheat contracts (wheat and Kansas City wheat were limit up overnight)

By Friday things has calmed down and both crude and wheat ended the week well off the highs.

IEA Statement on Friday

RUSSIAN CENTRAL BANK

On Friday the idea of sanctioning CRB was first brought up as well. This could potentially have catastrophic effects on the Ruble.

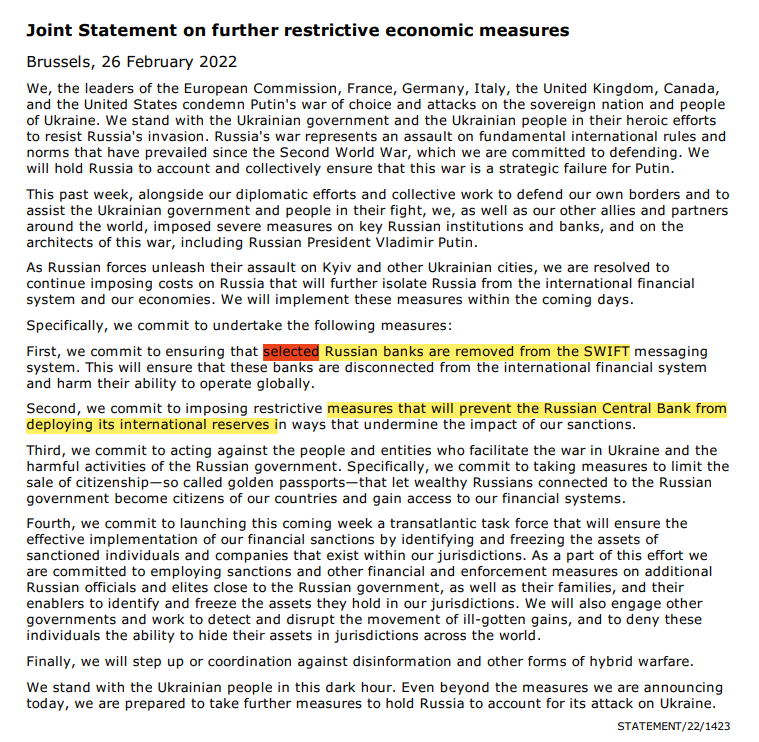

As things intensified. The idea of dropping Russia from SWIFT emerged on Saturday, Feb. 26th

EU, US, UK, and Canada announced that “selected” Russian banks will be disconnected from the SWIFT banking system. The statement doesn’t indicate names of banks, or whether this will stop oil and gas payments

The German government followed up with a statement that said it will only include banks that were initially sanctioned. (none of these included banks that process oil and gas transactions)

From Office of the Federal Government (BPA) in Germany

ALSO ON SATURDAY 26 FEB.

The West began to talk of sanctions against the CBR (Russian Central Bank)

Sanctions on Russia’s Central Bank Deal Direct Blow to Country’s Financial Strength

Targeting the reserves held by Russia’s central bank is potentially the most powerful weapon in the West’s financial arsenal, and takes aim at the heart of Russia’s financial system. It is a move with few precedents that amplifies other Western sanctions but also carries risks.

The U.S., Europe and Canada pledged Saturday to prevent the Bank of Russia from deploying its $630 billion stockpile of international reserve “in ways that undermine the impact of our sanctions,” they said in a joint statement Saturday. The move directly targets the war chest that President Vladimir Putin has built up in recent years to help insulate Russia’s economy from outside pressures. WSJ

Very notable comments from Bilal Hafeez of Macro Hive on this:

1) Sanctioning the Central Bank of Russia would be a very aggressive move. Sanctioning a central bank is very unusual but has been done before (Iran, Syria, Venezuela, N.Korea). CBR would lose the use of most of its FX reserves. Russian ruble could collapse

2. A SWIFT ban needs to be viewed with bans on Russian and correspondent banks. They need to go together to truly prevent Russia from making international payments.

3) The biggest uncertainty here is whether the EU/US will keep carve-outs for energy trade. If the energy trade is curtailed or frozen, then we could see a big oil shock. This could be a global risk-off event.

4) Russia has been mixed on cryptocurrency but the above actions could see Russia embrace crypto to evade sanctions. This could accelerate western regulation of crypto in response to this possibility.

5) A huge risk now is that a cornered Putin may decide to induce a global oil shock like the ones we saw in the 1970s to tip the global economy into a recession

Today, 27 Feb.

The west has been talking about the nuclear option. Sanctions on Russian oil. This comes from calls of Ukraine calling for an embargo on Russian oil.

From the Ukrainian Minister of Foreign affairs:

“We insist on a full embargo for Russian oil and gas. Buying them now means paying for the murder of Ukrainian men, women, and children. I welcome the first decisive steps by a number of European states in this regard and urge others to proceed resolutely and without delay.”

The United States even has growing calls to shut off Russian oil from several members of Congress. Jen Psaki even eluded to the fact that oil sanctions are not off the table today.

NOTABLE: Things are changing very quickly. Putin’s war against Ukraine is changing everything: we are seeing the focus of German and European energy policy is shifting rapidly. Berlin said it will help to build 2 LNG import plants and plans to buy more gas outside Russia and will

will establish strategic gas reserve Security of supply is becoming the dominant issue across the globe as Russia is in the top 3 producers and number 2 globally in exports.