INFLATION HEDGE AND BACKWARDATION

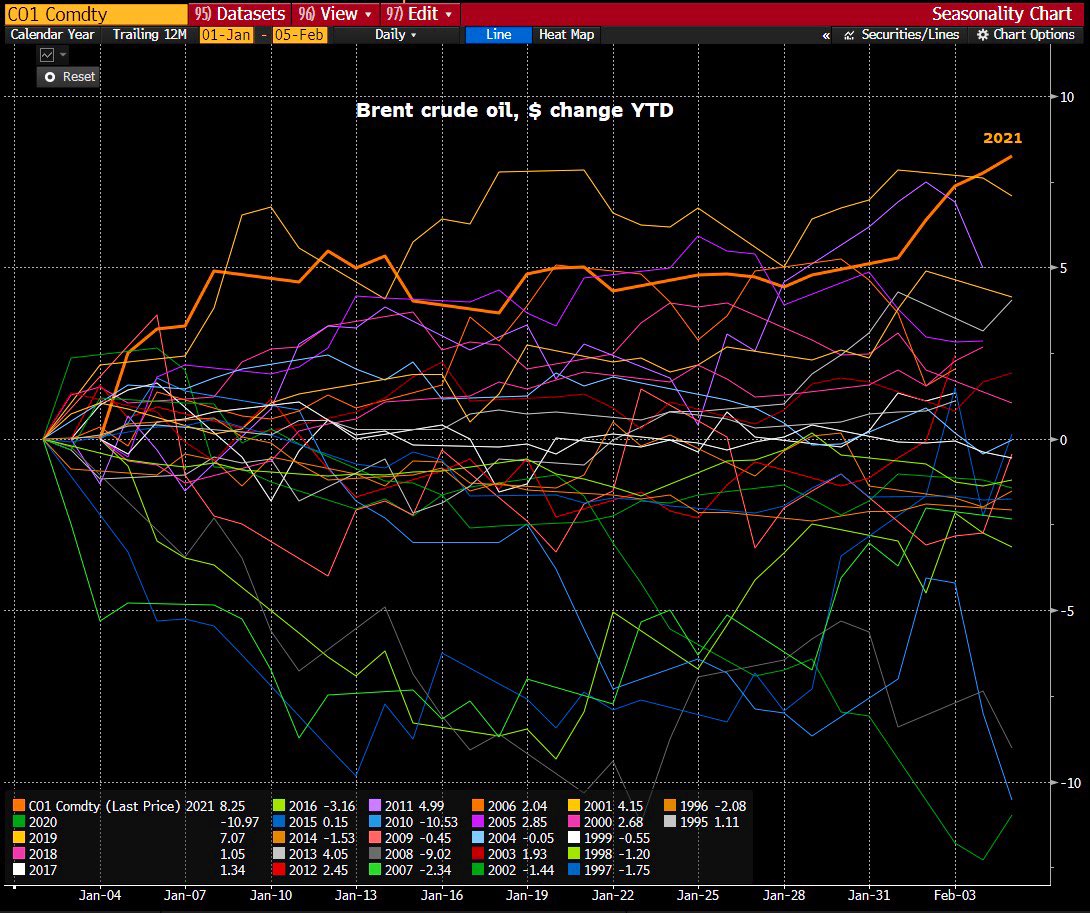

Brent crude has rallied nearly $8 year-to-date — it’s the best start of the year (in absolute terms) since the Brent futures was launched more than 30 years. In % terms, Brent is up ~16%, the best start of the year since 2001.

YTD

Exxon $XOM +21%*

S&P $SPY +4%

Bonds $TLT -6%

Bonds $LQD -3%

*7.0% divided vs. 1.50%, nice inflation hedge so far. – Lawrence McDonald

Brent and Dubai are now firmly in backwardation, as is most of the WTI curve. This means that on the oil futures side, with the market firmly in backwardation, investors are also collecting a nice roll-yield.

This is very bullish.

NINEPOINT CAPITAL

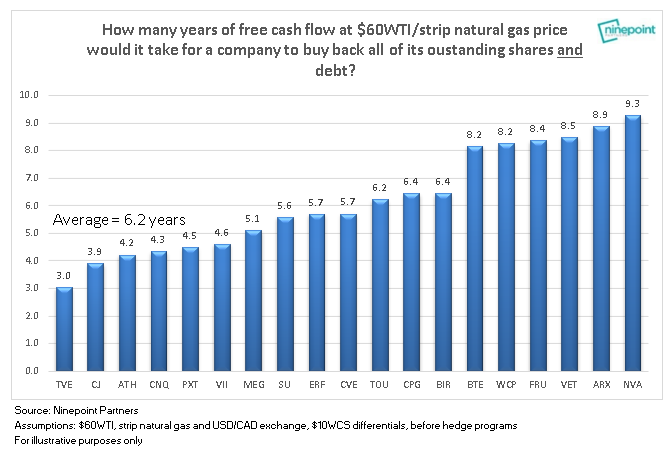

Eric Nuttall noted that generalists return en masse to the energy sector realizing that 40%+ free cashflow yields should not exist. Trading multiples re-rate from 2x-4x to 4x-6x and EV FCF yields fall to 10% or less. Many stocks go up 100%

TECHNICALS

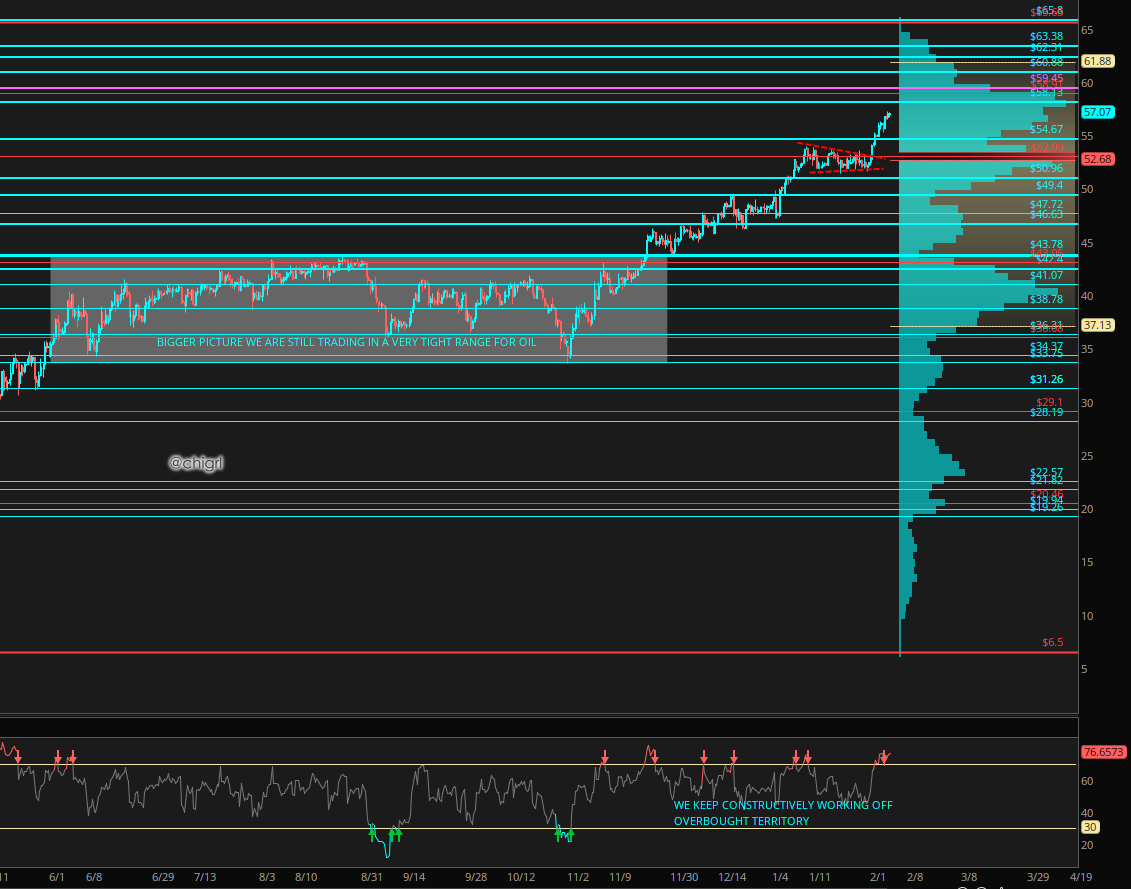

Lat week I thought we my see pullback due to seasonals, and a potential pullback in the broader market, however the symmetrical triangle broke to the upside. Again we are a bit overbought and headed into some resistance over head. This should cause the market to pause for a bit. Again, chart is bullish overall.

FUNDAMENTALS

INDIA: Peak oil demand is nowhere in sight. S&P Global Platts South Asia Commodities Virtual Forum was Feb. 4-5. Analysts cited that India’s peak oil demand will come much later than what the rest of the world might anticipate, creating enough room to pursue refinery expansions and secure crude supplies through diversification drives.

“India’s peak oil demand will be much later than what many analysts predict. So we will be seeing handsome demand numbers going into 2030s and 2040s, if not 2050s,” Debanjan Saha, who works in the commodities risk management team at Bharat Petroleum Corp. Ltd., or BPCL, told the forum.

“So we have some time to go before we see a real decline in products demand. This calls for sizable growth in refinery activity.”

Indian oil and steel minister Dharmendra Pradhan told the forum Feb. 4 that with the country’s oil demand expected to double by 2040, India would look to boost refining capacity from the current 250 million mt/year to 450 million mt/year.

Again, Asia and Africa will be the main drivers of oil demand growth well into the future. There is no way to read this as not bullish.

IRAN: I talked about the fact that reentering JCPOA or the like with Iran likely will not be the forefront of this administration. This week Iran is making noise again. On Monday they said:

Tehran has ruled out the possibility of bilateral negotiations with the United States, saying Washington needs to change course and begin to honor its commitments under the 2015 nuclear deal, officially called the Joint Comprehensive Plan of action (JCPOA).

“No bilateral negotiation with the US is necessary,” Foreign Ministry spokesman Saeed Khatibzadeh said at a press conference on Monday. “The US needs to return to its commitments, and if that happens, it will be possible to negotiate within the framework of the Joint Commission of the JCPOA.”

On Saturday:

“If (the U.S.) wants Iran to return to its commitments, it must lift all sanctions in practice, then we will do verification … then we will return to our commitments,” state TV quoted Ayatollah Ali Khamenei as saying.

In other words, this is not going anywhere soon.

In addition this week, Reuters reported that, the United States has filed a lawsuit to seize a cargo of oil it says came from Iran rather than Iraq, as stated on the bill of lading, and contravenes U.S. terrorism regulations.

The lawsuit filed with the U.S. District of Colombia on Tuesday alleges that Iran sought to mask the origin of the oil by transferring it to several vessels before it ended up aboard the Liberian-flagged Achilleas tanker destined for China.

Washington said the scheme involved multiple entities affiliated with Iran’s Islamic Revolutionary Guards Corps and its elite Qods Force, both of which have been declared as foreign terrorist organizations by the United States.

Tensions are still high between the two, and Iran threatening the US is not going to help matters.

LIBYA: After more than a year, Libyan parties on Friday agreed to a transitional government tasked with guiding them to national elections at the end of this year. Prime Minister-designate Abdul Hamid Mohammed Dbeibah now has 21 days to form his cabinet and present its work program to the country’s House of Representatives for full endorsement. According to a national road map, the new executive must also launch a national reconciliation process, implement a cease-fire agreement and tackle the country’s severe economic crisis.

This cease fire agreement is where we start to hit problems. A UN recon team is going to Libya and has 45 days to design a ceasefire monitoring mission. Focus is Sirte front. Ceasefire has mostly held since summer, but it has been tenuous.

In addition, Libya’s parallel eastern administration welcomed Friday’s announcement of a new interim government to unite the country, but added it would only cede power if the eastern-based parliament approved.

Saturday’s qualified statement of support – leaving scope to oppose the move later – illustrates the challenges that may face U.N.-led efforts to find a political solution to a decade of chaos, division and violence.

In other words, things are still far from stable.

US: Biden drilling ban leaves a majority of US production untouched. I have written about this in-depth the last couple of weeks. If you recall, the US is still issuing permits, despite the executive order halt. That said, this week, Rystad Energy noted that should the halt become permanent, the US would only lose 200K bpd of output of roughly 11M bpd by the end of the decade. This ban would be negligible in the near term.

In addition, Kathleen Sgamma, president of the Western Energy Alliance, told Energy Intelligence that it is “almost impossible” for operators to avoid federal lands even if they are drilling on state or privately held acreage, because most tight gas plays in the West cross into federal territory. “We’re focusing on our legal strategy,” she said. “They are not going to be persuaded by us yelling and screaming about the economic impact. They have too many of their environmental constituents to worry about. Our only effective recourse is the courts.”

In other words, should there be a permanent ban put in place, likely this will be caught up in the court system for years.

NATURAL GAS

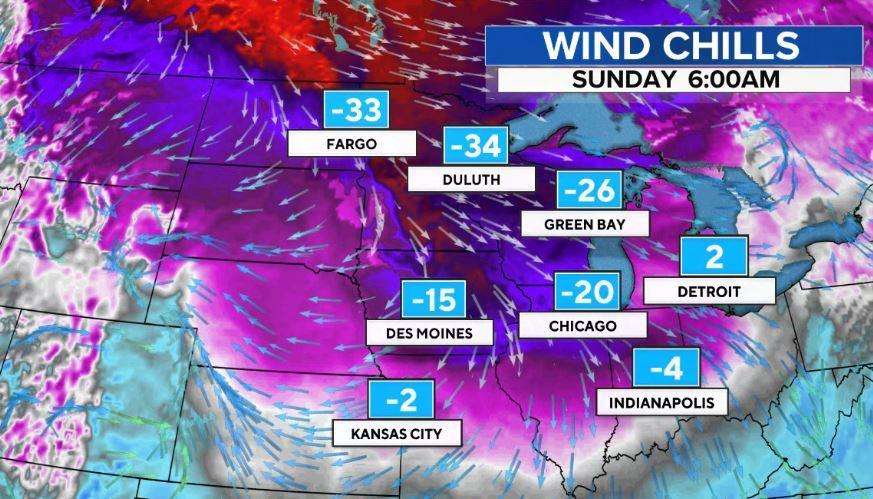

Polarvortex to bring brutal cold and snow this weekend Wind chills will range from a mind-numbing -30 to -40 degrees Fahrenheit in the Upper Midwest in places like Fargo and Minneapolis, to a bitterly cold -20 in Chicago.

Another big announcement this week was that Amazon (AMZN) has ordered hundreds of trucks that run on compressed natural gas as it tests ways to shift its U.S. fleet away from heavier polluting trucks They have ordered more than 700 compressed natural gas class 6 and class 8 trucks so far, according to the company.

I have long argued that natural gas is a better way to transition to alternative energies, as it is abundant and cheap. The technology exists to turn fleets (buses and trucks) over to natural gas relatively easily. I am very bullish on this space.

GOLDMAN SACHS, UBS, MORGAN STANLEY

All three banks, came out with bullish reports last week. All reiterating exactly what I have been writing about for weeks.

GOLDMAN SACHS: GS is forecasting a return to the global demand of 100M bpd (pre-pandemic levels) by August, must sooner than expected. Below are some highlights of the report:

Oil market rebalancing continues to beat the bank’s above-consensus expectations

Market expected an average deficit of 0.9m b/d during H1 of 2021, compared with a previous forecast of 0.5m

Data for late 2020 indicate a 2.3m b/d deficit in 4Q, driven by higher demand and lower non-OPEC+ supply

A tighter starting point for 2021 more than offsets a slower assumed recovery in demand, particularly for jet

GS still expects global oil demand to reach its pre-virus level of 100m b/d by August, despite remaining cautious on China’s recovery

1Q 2021 demand forecast at 93.8m b/d, only 0.7m b/d lower than previous estimate, despite longer European lockdowns and lower global jet demand as governments restrict travel

Lack of higher drilling activity at current price levels creates clear downside risks to bank’s non-OPEC+ production forecast; may help offset the potential for a slowed demand recovery in early 2022 should mutations reduce vaccine efficacy

UBS: Crude oil is likely to be a key beneficiary of increased mobility. Once a critical mass of the population is vaccinated this year, we think oil demand will rise further.

With oil demand climbing toward 100mbpd in 2H21, and with OPEC+ still trying to limit supply, we expect Brent to trade at USD 63/bbl in 2H21 and USD 65/bbl in 1Q22.

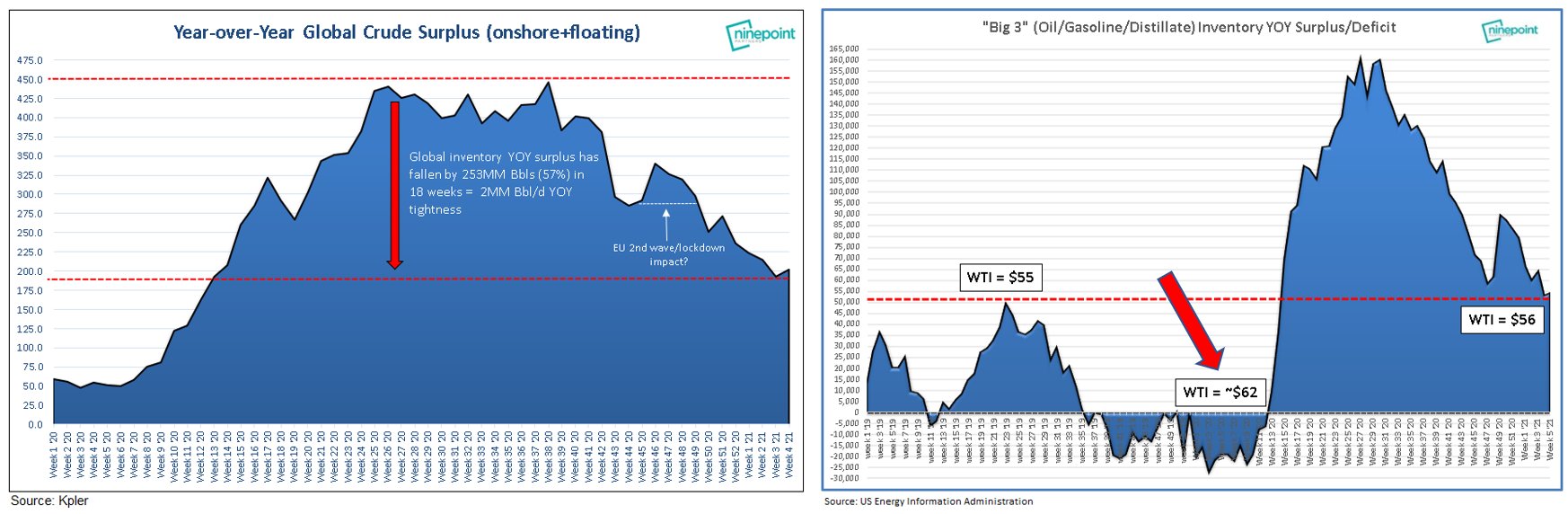

Visible petroleum (crude oil and oil products) inventories fell by about 290 million barrels in 2H20—a daily pace of 1.57mn barrels—according to the International Energy Agency. The inventory decline pace accelerated from 0.57mbpd in 3Q20 to 2.58mbpd in 4Q, driven by a larger drop in OECD oil product stocks and less emerging-market crude inventories following the buildup in 3Q.

With OPEC and its allies (OPEC+) endeavoring to keep global oil production below demand, we expect petroleum inventories to keep falling as well this year. But the group does have room to increase production this year, as we estimate demand could rise from currently 93–94mbpd toward 100mbpd in 2H21, and given constrained production growth in non-OPEC+ producers like Brazil, Norway and Canada.

As such, we expect the oil market to be under supplied by 1.5mbpd this year.

MORGAN STANLEY: Oil Market Tightening Up The oil market is showing consistent signs of tightening: inventories are drawing, time spreads are rising and the CFD curve is moving deeper into backwardation despite a healthy North Sea loading program. With covid hospitalizations falling, the case for a further demand boost is getting stronger.

Inventories continue to trend lower. Over the last 30 days, identifiable stocks have fallen at a rate of ~1.0 mb/d. This excludes oil in-transit, which has declined by another 2.6 mb/d over the same period, bringing total observed draws to ~3.6 mb/d – far faster than balances from key agencies suggest.

Supply constrained: For now, supply declines are keeping the market tight. OPEC crude loadings have declined recently and are running ~4 mb/d lower year-on-year. Saudi Arabia’s crude loadings have fallen below 6 mb/d over the last two weeks, consistent with the additional 1 mb/d voluntary cuts the country has committed to in Feb and Mar. Similarly, Russia’s and Iraq’s loading have fallen in recent weeks as well,and West African loadings are also unusually low. US production is now slowly rolling over, with Permian production on track to fall for the third consecutive month in January.

Outlook – strength ahead: The front-month Brent contract is now the one for April delivery,and with shipping and refining lags taking into account, this will be converted into products hitting the market in May/June. Therefore, oil prices are starting to reflect a period where mobility restrictions can probably be moderated and oil demand could start to pick up. Yet, there is little-to-no spare capacity in non-OPEC+ countries, which puts OPEC+ in the driver’s seat. We model a ~4 mb/d increase in demand by year end, which should allow OPEC to unwind much of its spare capacity and inventories to normalize at the same time.

OTHER NOTABLE NEWS

CANADA: Last couple of weeks I have discussed the Keystone KL pipeline cancellation. It seems Russia’s Lukeoil is said to be circling the Canadian oil patch.

Andrew McCreath from Bloomberg reports:

While it’s not news until it hits the tape, multiple senior sources in Calgary’s energy community suggest that Russian energy giant Lukoil PJSC, a behemoth that produces two million barrels of oil equivalent per day and sports a nearly US$53-billion market capitalization, is poised to take a significant stake in privately-owned western Canadian energy producer Velvet Energy Ltd.

Some of the chatter about this dance can be traced to Cormark Securities telling clients Thursday morning that Lukoil was set to acquire a position in Velvet. By Thursday night, Cormark had retracted that report. However, as a securities analyst at heart, the original comment piqued my investigative side. After more than a dozen phone calls and many email exchanges – and, arguably more importantly, messages and calls that were not returned — I’m convinced Lukoil’s interest in Canada’s energy heartland could extend far beyond Velvet.

Similar to many energy companies, Velvet – which produces roughly 25,000 barrels of oil equivalent every day, has struggled with debt issues over the past year. Sources suggest Lukoil will purchase the combined 48 per cent of Velvet that is shared between the Canada Pension Plan Investment Board (CPPIB) and Warburg Pincus LLC of New York. When reached by email, representatives for CPPIB and Warburg Pincus declined to comment. “I have no further comments to make,” is what a spokesperson for Velvet Energy told BNN Bloomberg via email.

Obviously if true, it’s provocative to think a Russian oil major would make its first foray into the Canadian energy patch by in effect purchasing a controlling stake in a small Canadian energy producer. However, it’s thought that the purchase of the stake in Velvet would be just one small step in a larger plan to become a major player in the richest oil and condensate window of the unconventional Montney play in Alberta’s Deep Basin.

This obviously would be a big deal for the Canadian oil patch, leaving many companies set to benefit, including Suncor and Canadian Natural Resources that I mentioned in last weeks report under actionable trade ideas.

CALIFORNIA: Watch what they do not what they say: Gavin Newsom’s administration has approved more than 8,000 oil and gas permits on state lands during his tenure so far. Newsom, despite his pledges, signed 1,709 oil and gas production permits in 2020.

Again, trying to phase out fossil fuels will take much longer than people think.

EUROPE CARBON MARKET: Hedge funds are betting on Europe’s carbon market to explode.

Brussels is enacting plans to eliminate carbon emissions by the middle of the century in a massive shift in how the European Union powers its economy. Forcing up the bloc’s carbon price, one of the key tools of EU climate policy, may be crucial. The higher the price, the more incentive companies have to make the hard decisions needed to tackle global warming.

“We’re very confident the price path forward is up,” said Casey Dwyer, an analyst at the energy and oil-focused hedge fund run by Pierre Andurand. “We have an aggressive target for where we think prices need to go.”

Dwyer expects it will hit 100 euros ($121) per metric ton of carbon emissions, possibly as soon as later this year, from about 33 euros now. Andurand, one of the best-performing hedge funds in 2020, is joined by Lansdowne Partners LP and Northlander Commodity Advisors in predicting a surge this year. Some of Europe’s biggest banks are also signaling demand for credits will grow in coming years. -BBG

*ACTIONABLE TRADE IDEA: LONG DEC 22 ICE ECX EUA Futures or long calls

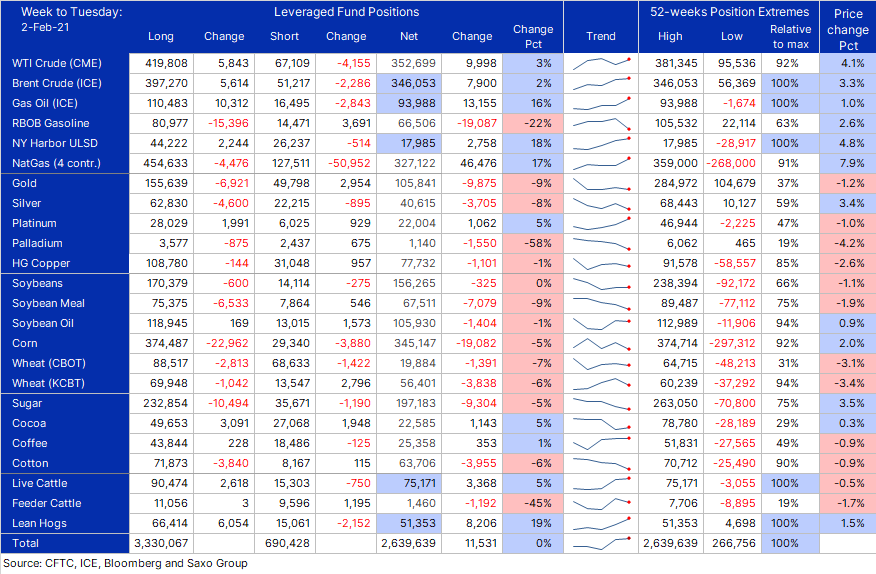

CFTC COMMITMENT OF TRADERS

COT on commodities in wk to Feb 2 saw specs maintain a record long exposure across 24 major commodity futures. Strong buying of crude oil, natgas and hogs more than offsetting selling of gasoline, gold together with a broad reduction in agriculture led by corn and sugar.

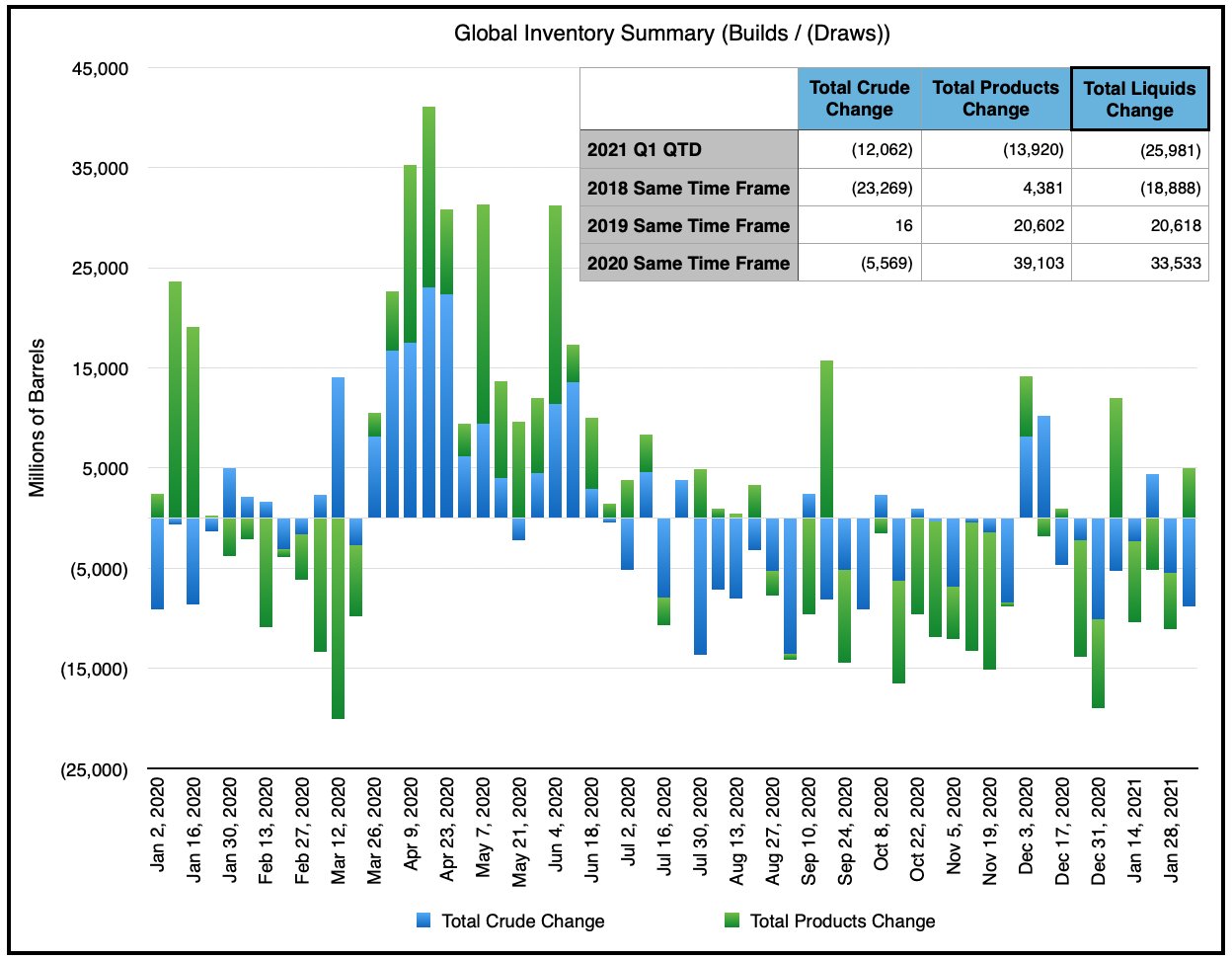

GLOBAL OIL INVENTORIES

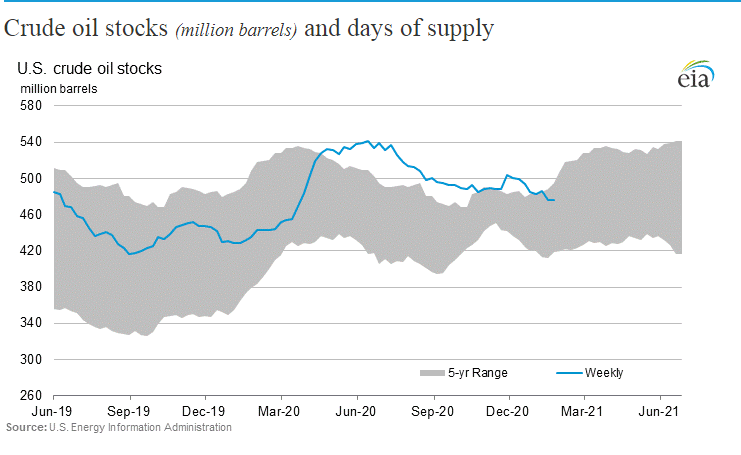

Weekly inventory for Jan 29. Draw, 3.8M barrels, crude drew 8M, but offset by 5M prod. build. US the culprit. Overall Jan was ~26M bbl total liquids draw, directionally confirms we’re drawing steadily.

COVID demand shock is officially behind us while its structural impact on supply begins to become more obvious to the masses with the lack of meaningful US shale growth.

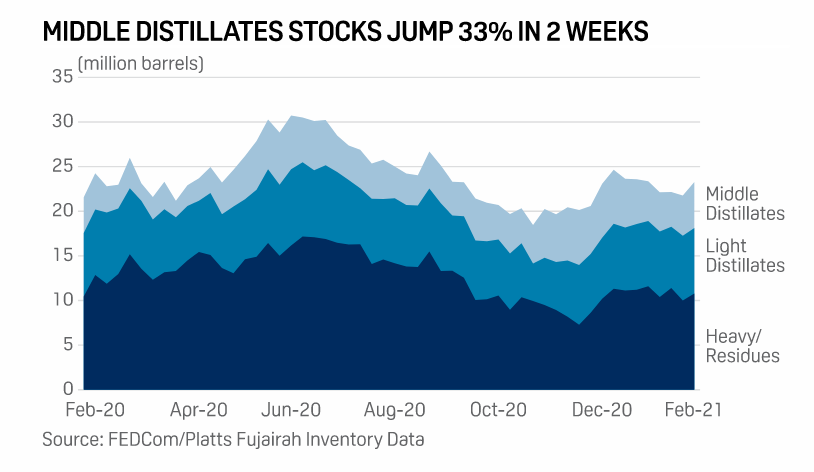

FUJAIRAH INVENTORIES

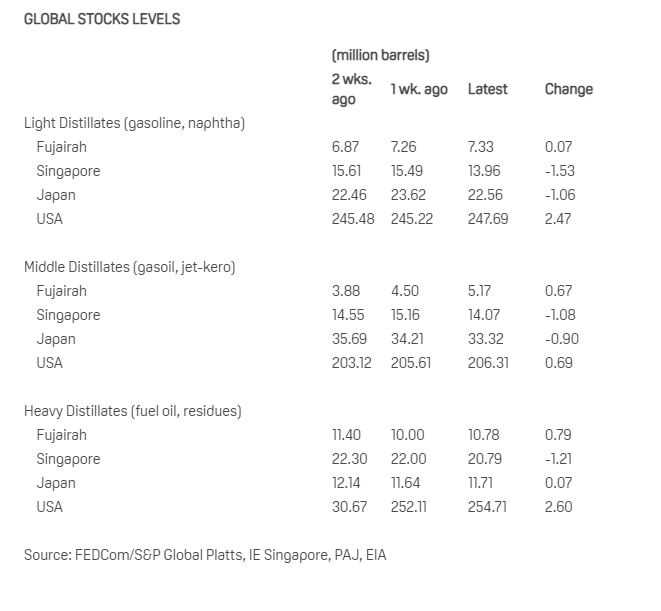

Oil products stocks climb across board for first time in 8 weeks. Oil products stocks climb across board for first time in 8 weeks. Total inventory stood at 23.282 million barrels as of Feb. 1, up 7% from a week earlier and the highest since Jan. 4, according to Fujairah Oil Industry Zone data provided exclusively to S&P Global Platts on Feb. 3. Middle distillates led the way, showing a 15% gain to 5.171 million barrels after rising 16% a week earlier. The 33% increase over two weeks puts middle distillates at a six-week high.

This is the first build in a while, keeping my eye on this, as I do not want to see this become a trend. That said, we are seeing big draws in Singapore and Japan. With China holiday next week, we may see a slow down in shipping, I will be watching Singapore stocks.

US INVENTORIES

Another nice draw this week, placing us firmly within the 5 year average.

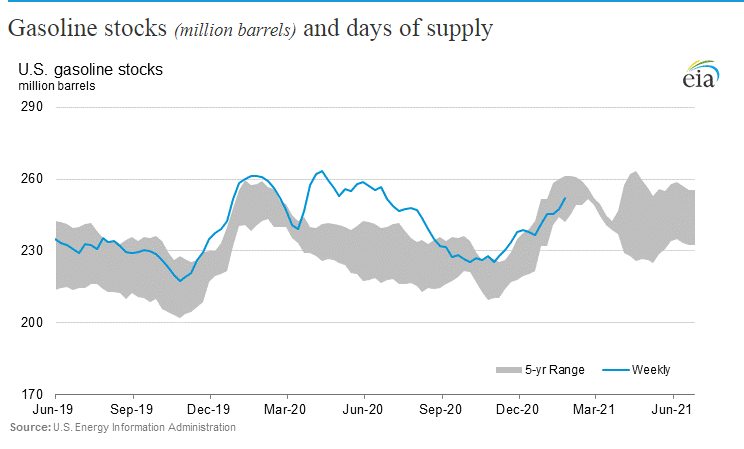

We had another gasoline build, but nothing unusual for this time of year.

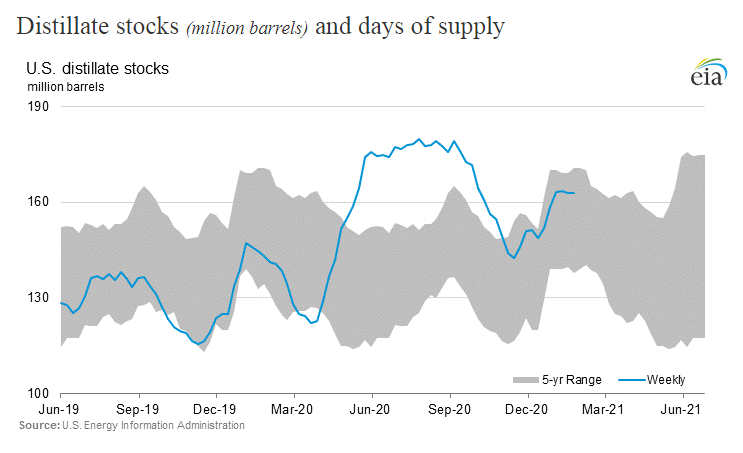

Distillates remained basically flat for the second week in a row. We are still within the 5 year average, but I would love to see a decent draw over the next couple of weeks.

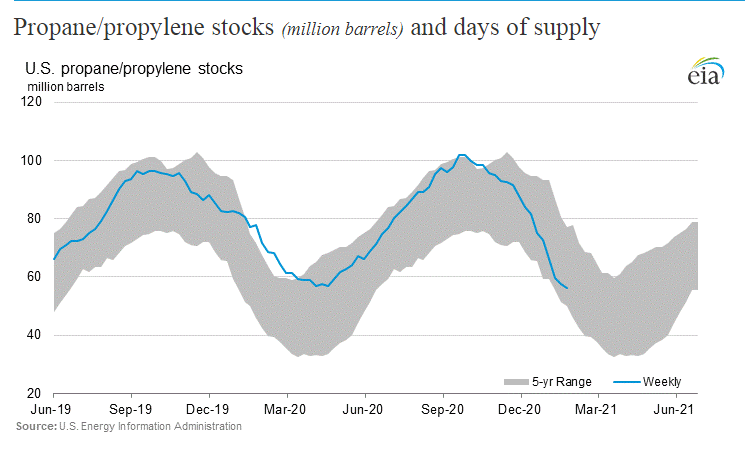

Propane is a beast. We are now at the lower bound of the 5 year average, again this is great for companies that produce NGL’s. This market remains strong.

DAILY SENTIMENT INDEX