THE BIG NEWS THIS WEEKEND

Crude oil, so far has been impervious to to new lockdowns in Europe and restrictions in several US states, but some things have occurred this weekend they may give it a pause.

UK

London is on tier 4 lockdown and has a new strain of the virus. They have also shut Tier 4 areas from travel outside of the area.

Tier 4 means:

”Non-essential shops, hairdressers, and leisure and entertainment venues must close, with a new “stay at home” message introduced.

People who need to travel for education or childcare are exempt, and exercise is unlimited. Where people cannot work from home, they will still be able to travel to work.

Under the measures, households are not allowed to mix, but one person is allowed to meet with one other person outside in a public space. Support bubbles and those meeting for childcare are exempt.

Those who are deemed clinically extremely vulnerable should not go to work and should limit time outside of their homes.

Tier 4 residents must not stay overnight away from home, and cannot travel abroad. “ -The Guardian

In response several countries including the Netherlands, Brussels, Italy, UAE, and possibly Germany have announced the suspension of all commercial flights to the UK, likely more will come. Unfortunately, this is another blow to the airline industry and jet fuel demand.

STIMULUS

Supposedly a stimulus bill will be voted on today. It is a $900 billion relief deal, which is expected to include $300 per week in jobless benefits, direct payments of $600 for individuals, $330 billion for small business loans, more than $80 billion for schools, and billions for vaccine distribution. “If” this bill passes in this form, I surmise the market, including the crude oil market will likely be initially disappointed. This has been passed off far too long, and people and business are on the brink, this will not put a dent in the need that has accrued.

CDC

The CDC has launched an investigation to the vaccine after 6 people had anaphylaxis (severe allergic reaction). Although this is no cause for alarm *yet*, a lot of hope on this vaccine has been baked into the market. This may make the oil market a bit nervous at the outset.

*None of these are a trend reversing event at this juncture

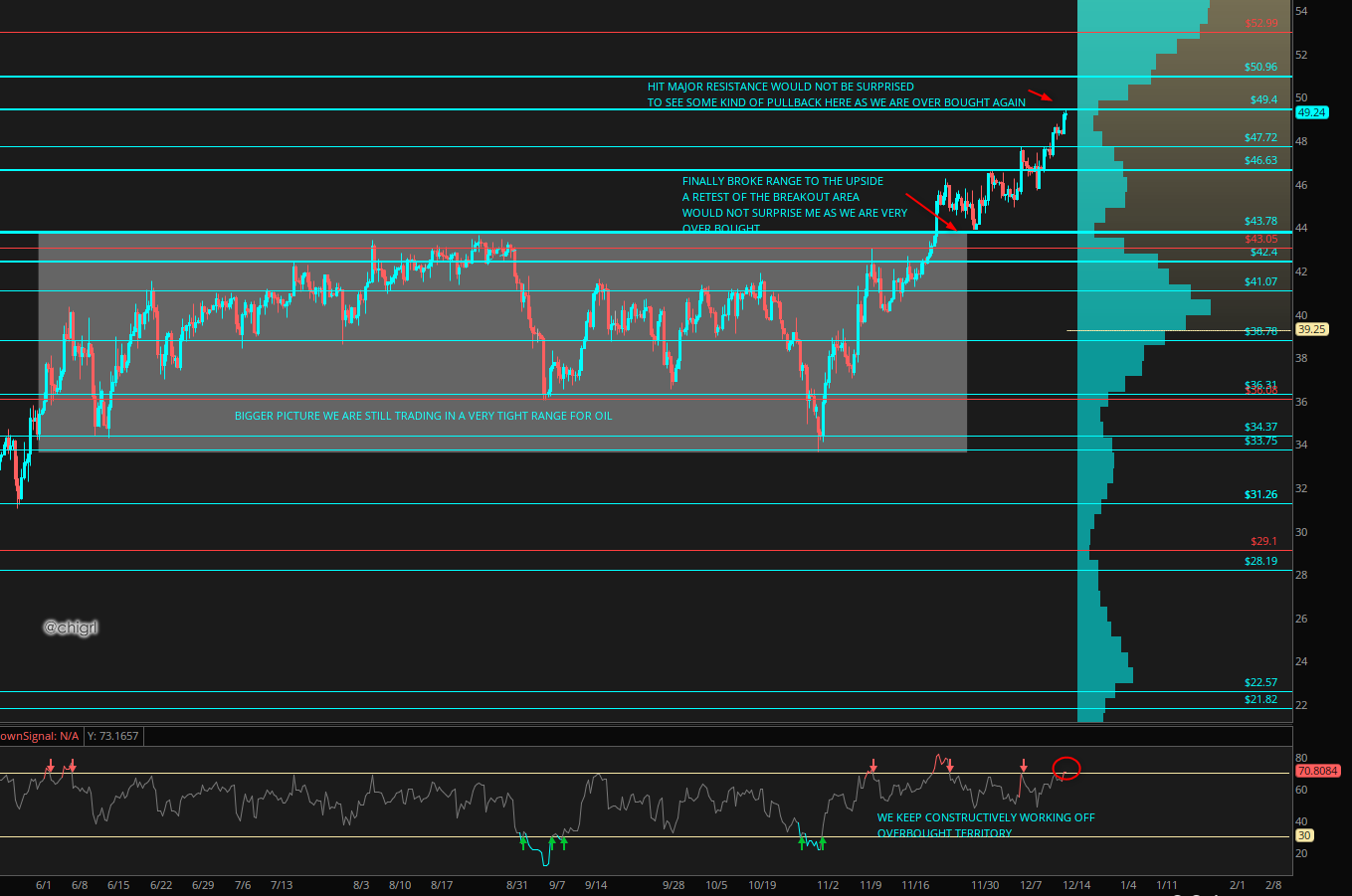

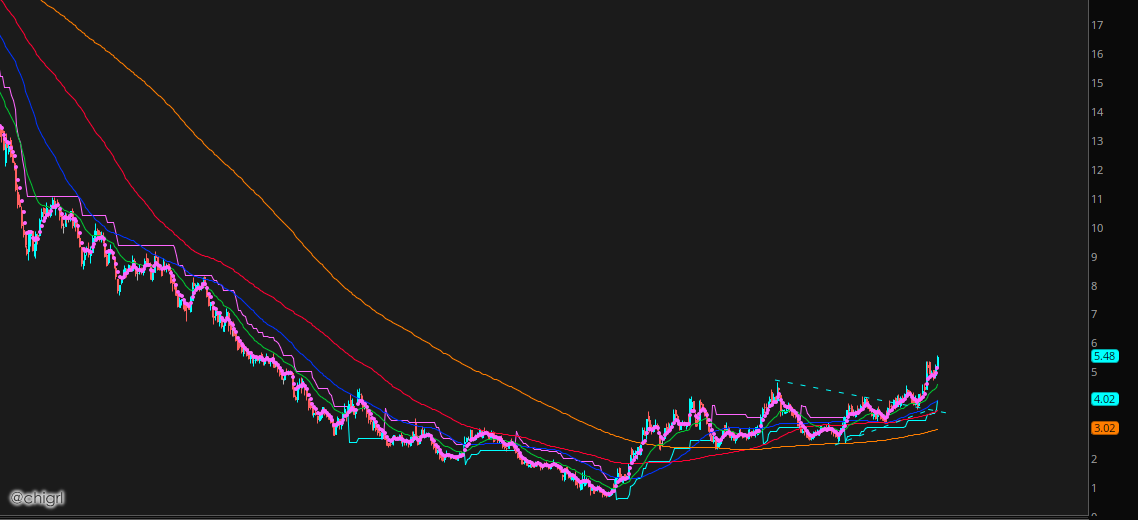

CRUDE OIL CHART – see my two actionable stock ideas below

NOTEWORTHY EVENTS THIS WEEK

SECRETARY OF TRANSPORTATION: This week, Biden announced Pete Buttigieg was his nominee for Secretary of Transportation. At the press conference, Buttigieg’s remarks highlighted Biden’s priority to infrastructure.

“America has given this administration a mandate to build back better. And step one in building it back better, literally is to build. Americans shouldn’t settl for less than our peers in the developed world when it comes to our roads and bridges, our railways, and transit systems. The US should lead the way and I know in this administration, we will.”

Link to full press conference HERE

Back in September I wrote “WOULD A BIDEN WIN SPELL DISASTER FOR ENERGY/MATERIALS SECTOR?” and I highlighted that his infrastructure plan would be very bullish for oil and materials markets.

Here is a snapshot of the critical parts of the plan. Link to full plan HERE. All of these projects are highly energy and materials intensive.

HOUSE ENERGY AND COMMERCE COMMITTEE: Kathleen Rice beat out AOC for the coveted seat on the House Energy and Commerce Committee

This is a win for the oil industry as this means that moderates are in charge.

SAUDI ARABIA/RUSSIA: Russia Energy Minister Novak met with Saudi Minster Prince Abdulaziz bin Salman.

“Today, my friend and colleague and I discussed cooperation in the OPEC+ multilateral format, and joint action and coordination in the international market. We reaffirmed our commitment to the agreements, which are in effect to date, and to our cooperation, which is, first and foremost, aimed at the market recovery at the soonest possible time and at reaching a balance,” -Novack.

Although this is not new and was already emphasized at the OPEC meeting at the beginning of the month, this merely serves as reinforcement to the market and a show of unity.

In addition, Russia and Saudi Arabia agreed on a new cooperation roadmap, which will be signed in the first half of 2021. This will add to an existing list of 30 projects worth $2.5 billion, including 24 initiatives in oil, gas and nuclear energy.

“We have 74 new initiatives and we will show what we achieve at our next meeting at the end of March,” Prince Abdulaziz said.

At present, the Russian-Saudi trade increased by 60% on the year despite the pandemic. The total volume should reach $5 billion by 2024.

The market is still skeptical of this alliance, and with good reason. It was just last March when the OPEC+ fell apart, sending Saudi Arabia to flood the market, during a pandemic, leading to negative oil price in April. I believe, this trade cooperation initiative says OPEC+ alliance secured, and should alleviate some of the worry.

The next full OPEC+ meeting will be on January 3-4th to assess the market. They are hyper-aware of what is going on in Europe right now, but as I have discussed in prior weeks, so far, demand in Asia is by far offsetting the lack thereof in Europe.

ARAMCO ATTACKS: On Monday, an official spokesman at the Saudi Ministry of Energy said that a fuel transport ship, anchored in the fuel terminal in Jeddah, was attacked by explosive-laden boat in the early hours of the morning. The attack resulted in a small fire, which emergency units successfully extinguished. The incident did not result in any casualties, and there was no damage caused to the unloading facilities, nor any effect on supplies.

This is the third attack within a month. The first was oil tanker that came under attack while at a Saudi Arabian terminal in the Red Sea about 125 miles north of the country’s border with Yemen. It wasn’t clear who launched the attack and no one claimed responsibility. A few hours after the incident, state TV reported that Saudi-led coalition forces were destroying an explosives-laden boat and a commercial vessel was damaged in the process. The second a low-level attack, in which Yemen’s Houthis fired a missile at a Saudi Aramco fuel depot in Jeddah, the kingdom’s second-biggest city. The resulting blaze was extinguished in 40 minutes.

It should be noted that none of these were near a production or export facility and had zero effect on Aramco’s ability to produce or export oil. I bring this up merely because I think we will see an uptick in the Middle East activity as the US transitions from one administration to the other. This is often the case as regimes like to “test” the regime change with regard to foreign policy.

And as I am writing this:

BREAKING NEWS: At least 3 Katyusha rockets target US embassy in Iraq’s Green Zone, US defense missiles were activated. No casualties. This is also the second time within a month, the first being on November 17th.

OPEC AND IEA MONTHLY REPORTS

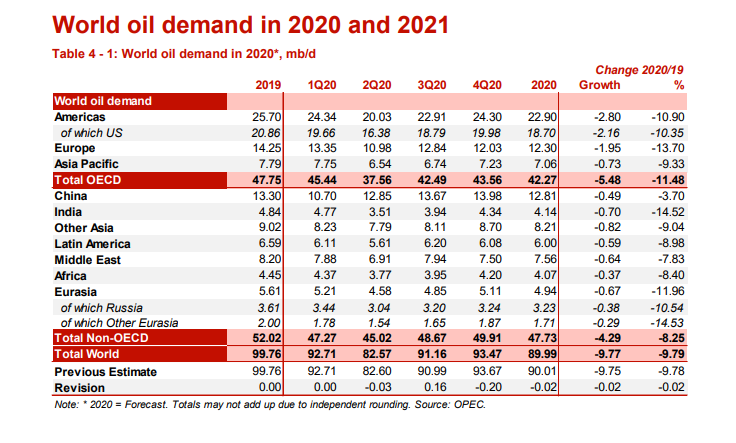

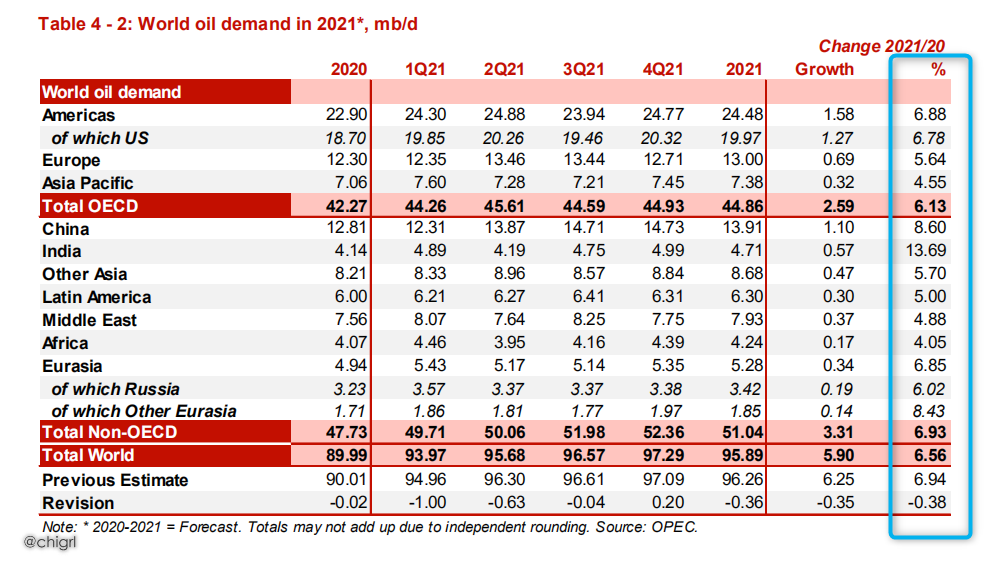

OPEC: World oil demand for 2020 is expected to decline by 9.77 mb/d, marginally lower than in last month’s assessment. Weaker-than-expected data in the OECD in 3Q20, mainly due to lower transportation fuel demand in the US and OECD Europe, led to a downward revision of around 0.18 mb/d for the OECD group. However, this is mostly offset by an upward revision to the non-OECD, by 0.16 mb/d. Better-than-expected oil demand in China, amid a steady recovery across various economic sectors, and improving oil demand from India support this upward revision. Total oil demand is estimated to reach 89.99 mb/d in 2020. For 2021, world oil demand growth is revised lower by 0.35 mb/d, to growth of 5.90 mb/d. This is due to the uncertainty surrounding the impact of COVID-19 and the labour market on the OECD transportation fuel outlook for 1H21. Petrochemical feedstock and industrial fuels are forecast to gain momentum on the back of improving economic activities, with total oil demand projected to reach 95.89 mb/d in 2021.

IEA: We forecast that oil demand will fall by 8.8 mb/d y-o-y in 2020, a modest 50 kb/d downward revision from our previous Report. Our 2021 demand forecast was revised down by 170 kb/d. This is mainly because of another downgrade for jet fuel/kerosene demand, which will account for around 80% of the overall 3.1 mb/d shortfall in consumption in 2021 versus 2019. In 2021, demand for both gasoline and diesel is projected to return to 97-99% of their 2019 levels.

At face value, both of these reports look pretty dismal. The oil market did initially react poorly to the OPEC report, losing about $1.50 but had recovered by the end of the day. One thing we have to remember is that these are merely forecasts. The same day as the OPEC report, Goldman and JPMorgan increased their global demand forecasts.

If we take a look at the actual OPEC charts the percent demand increase globally, depending on region is from 4-13% which is quite good. India being the clear leader. (I have discussed India in prior weeks) This is a pretty spectacular rebound, given the circumstances, and coupled with OPEC cuts plus declines in US production, the market still looks pretty solid.

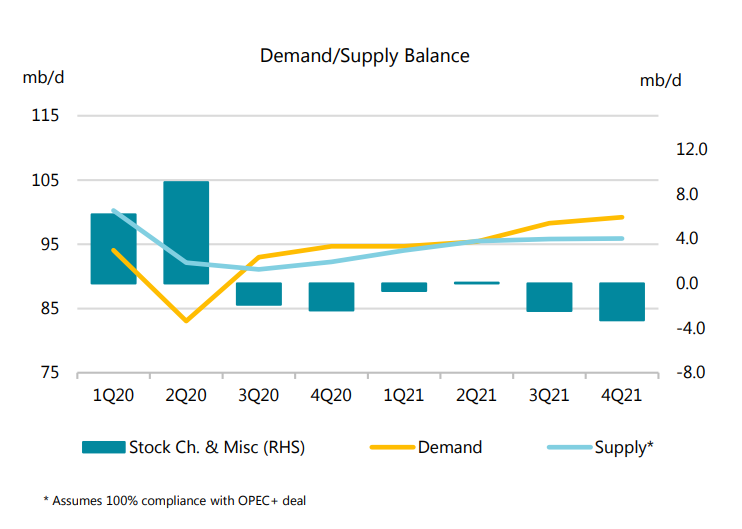

Even IEA sees demand outstripping supply into 2021.

IEA Supply/Demand Balance

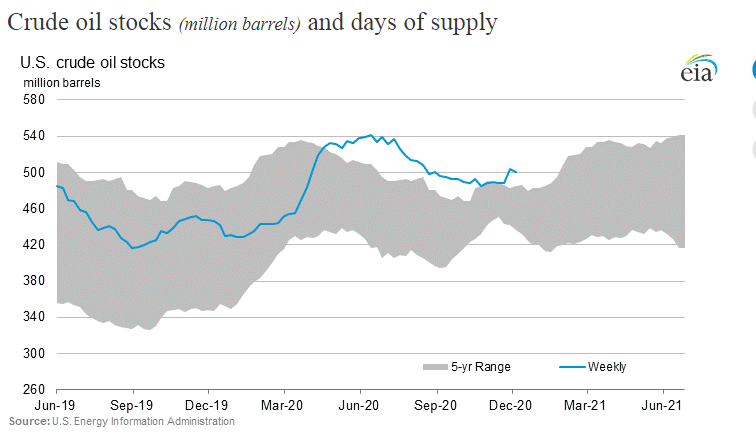

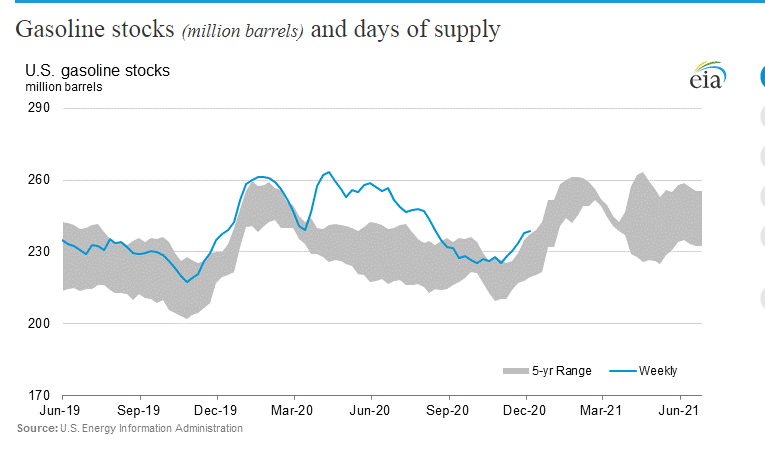

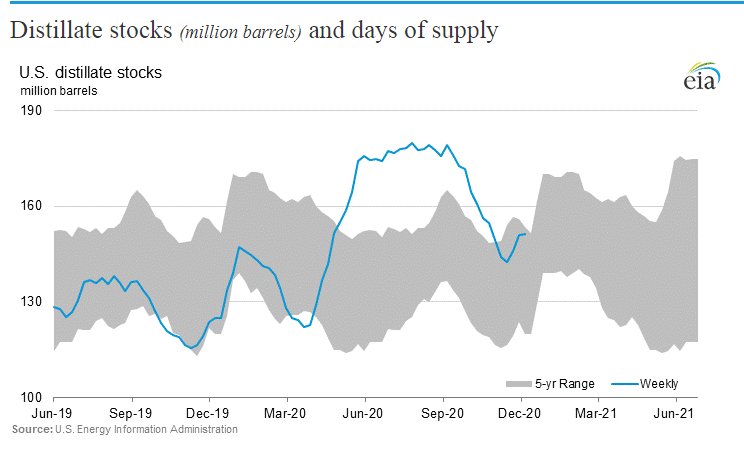

EIA OIL INVENTORY SNAPSHOT

Decent report this week with a -3.135M draw after a huge build the prior week. Gasoline stocks still near the 5-year average, and distillate stocks well within the 5-year average.

ACTIONABLE IDEAS

Long Antero Resources Corp (AR)

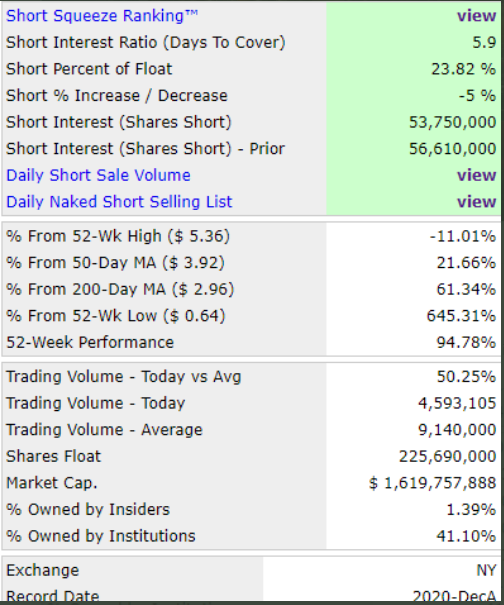

Natural Gas stocks have been truly hated, particularly this one with 56m shares short starting at the beginning of the week.

The last leg shorts were standing on was eliminated last week with this announcement:

Antero Resources Announces Launch of $500 Million Offering of Senior Notes

They are also fully hedged at higher prices.

Great read here on realities of nat gas pricing, : Appalachian Producers: Henry Hub Pricing Matters Less Than You Think

Technicals

After consolidating at the all-time lows for three months, this stock has started to break out of the daily/weekly wedge. This stock has room to run.

Long Antero Midstream Corp (AM)

This chart looks similar. I like this long, but I expect less of a move from the midstream arm. Still an excellent opportunity.

DAILY SENTIMENT GOING IN TO NEXT WEEK