WHAT A WEEK

JUST ANNOUNCED!!!!

NEW YORK CITY TO CLOSE SCHOOLS IN SOME NEIGHBORHOODS DUE TO RISING COVID CASES SCHOOLS,

BUSINESSES TO CLOSE IN PARTS OF BROOKLYN AND QUEENS AS CASES SPIKE

INDOOR AND OUTDOOR DINING ALSO TO BE CLOSED IN 9 ZIP CODES

Another volatile week in the markets, with no stimulus bill and the Friday news that Trump has COVID. Markets will likely remain volatile into the election and beyond. It seems we are getting closer to a stimulus bill and pressure will be on Congress more than ever right now with Trump’s illness. I expect some sort of resolution on stimulus next week, which normally would be a huge positive for the energy markets, however, this may be dampened by the recent lockdown announcements in Europe. Spain, France, UK, and the Czech Republic, and today New York have all announced some form of a lockdown or more stringent social distancing rules which will weigh on oil prices, especially as we are in a seasonal soft season.

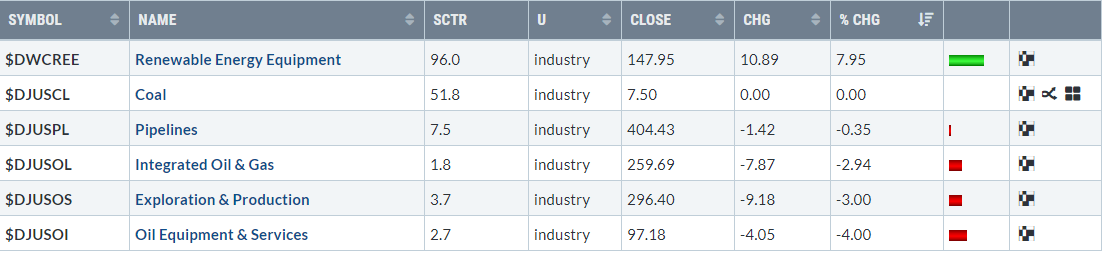

ENERGY

Energy equities, outside of renewables, performed poorly, not surprising with the steep drop in oil prices

The upside is over the last week, we have seen some insider buying for the first time in weeks:

Continental Resources (CLR)

Phillips 66 (PSXP)

Sandridge Permian (PERS)

NuStar Energy (NS)

Ranger Energy (RNGR)

PBF energy (PBF)

Southwest Gas Holdings (SWX)

MATERIALS

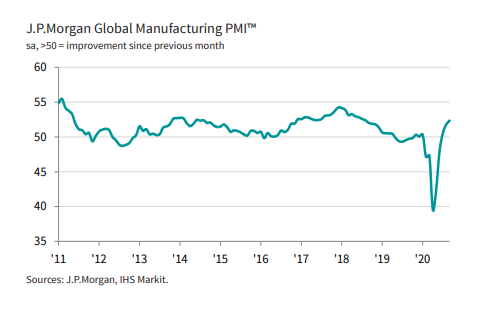

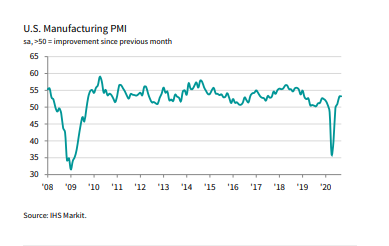

Materials Sector on the other hand performed well last week buoyed by strong Manufacturing PMI data both globally and in the US.

From IHS Markit:

“The upturn in the global manufacturing sector continued during September. Output and new orders both rose for the third successive month, while new export business expanded for the first time in over two years. Business sentiment hit its highest level since May 2018.”

IHS Markit US:

“September PMI data from IHS Markit indicated the sharpest improvement in operating conditions across the U.S. manufacturing sector since early-2019. Overall growth was supported by a faster expansion in production and a solid rise in new orders. As a result, firms continued to broaden their workforce numbers, as hiring increased following further upward pressure on capacity”

Market Sentiment heading into next week

Data Next Week

Monday: Services PMI, ISM non-manufacturing employment

Tuesday: Trade Balance, JOLTS job openings, API inventories

Wednesday: FOMC minutes, EIA crude inventories

Thursday: Jobless claims

Friday: WADSE Grain Report