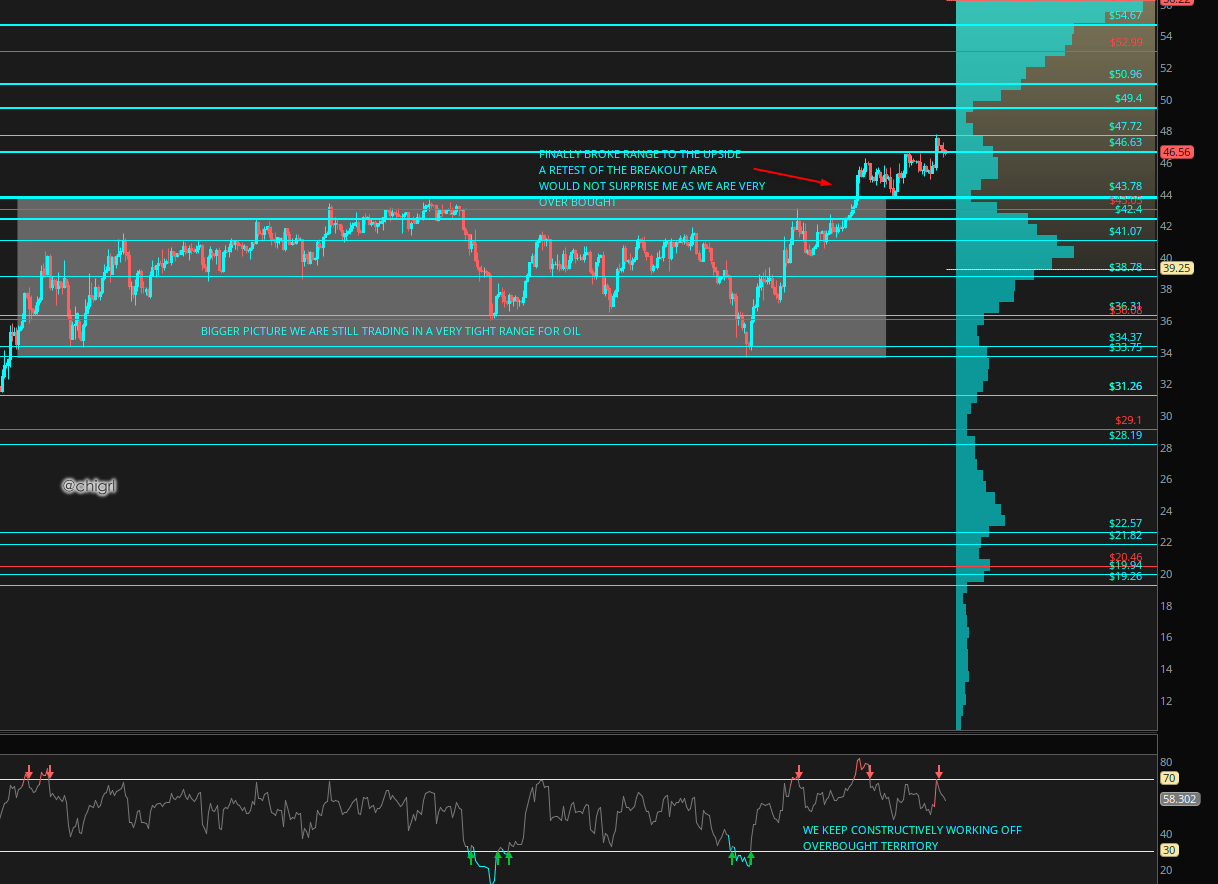

Crude oil has continued higher in a constructive manner this week. It is a global market, so although Europe has seen some lockdown extensions, growth in the Middle East and Asia is rebounding significantly. This is causing backwardation in the Brent curve, which is positively self-perpetuating because it gives longs a positive roll yield when rolling contracts. WTI, still in contango, has room to catch up. Trading activity in futures is always heavily concentrated on the front end, as more longs are being built all along the curve, this will cause much more activity at the front end because that is where the most action resides.

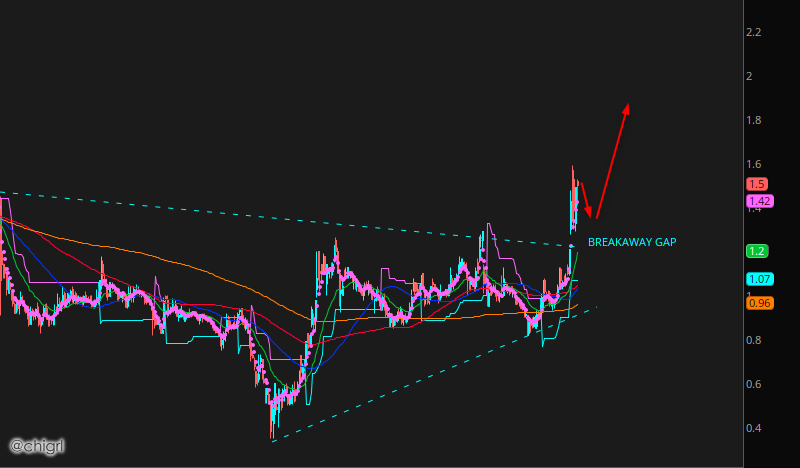

WTI

NEWS THIS WEEK

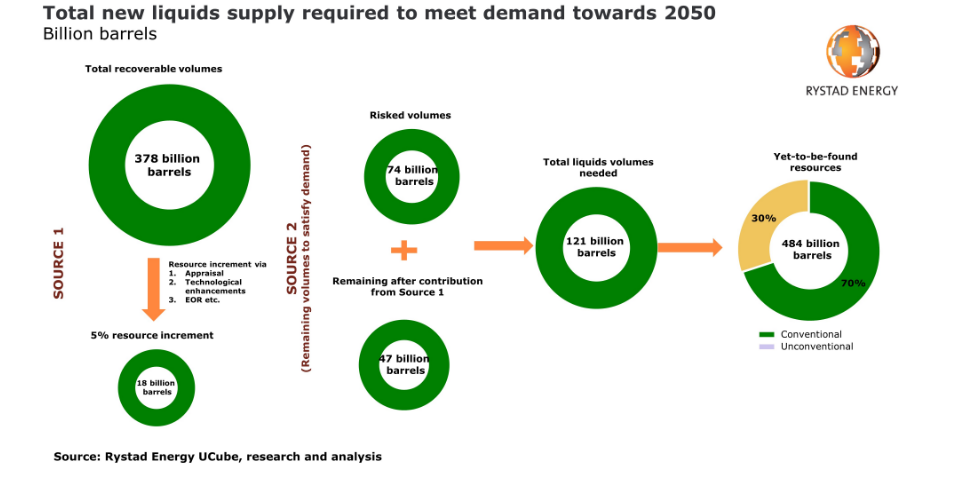

RYSTAD: Rystad this week came out with a press release saying EXACTLY what I have been talking about for months now. But here it is:

The world is on track to run out of sufficient oil supplies to meet its needs through 2050, despite lower future demand due to the Covid-19 pandemic and the accelerating energy transition – unless exploration speeds up significantly and capital expenditure of at least $3 trillion is put to the task.

To meet the global cumulative demand over the next 30 years, undeveloped and undiscovered resources totaling 313 billion barrels of oil need to be added to currently producing assets. Rystad Energy calculates that to match this requirement, exploration programs will have to discover a worthy-to-develop resource of 139 billion new barrels of liquids by 2050, an impossible task if this decade’s low exploration activity levels persist.

The target is high because not all existing discovered volumes are profitable to develop. In theory, the total undeveloped supply would amount to 248 billion barrels of oil between 2021 and 2050. However, when we dive deeper into these discoveries and look at their discovery decade and current status, we find that about 74 billion barrels are highly unlikely to materialize and need to be replaced by new discoveries.

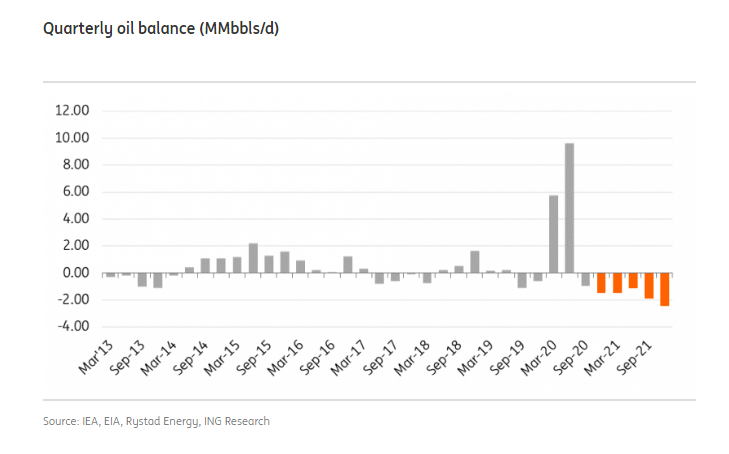

ING: added to this saying that “ We hold a constructive view on oil. OPEC+ cuts, along with a continued recovery in demand, should mean that the market draws down inventories over 2021”

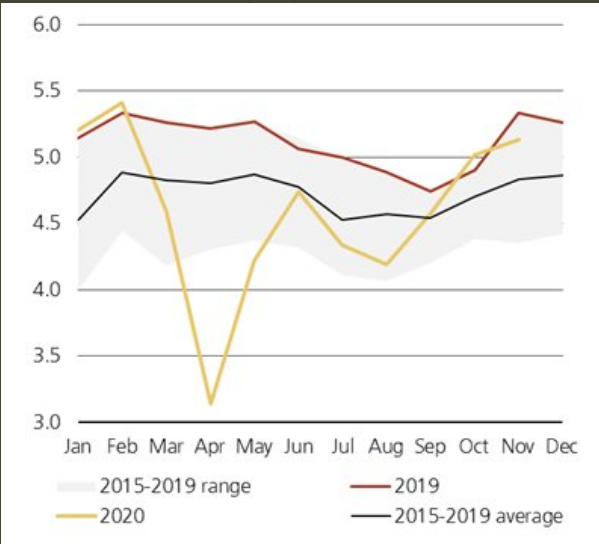

INDIA: India’s oil demand recovery is the star. Run rates have risen from 88% in October and 99% in November as fuel demand returns to pre-Covid levels, IOC said. Gasoline sales rose by 4% from a year earlier in November, while diesel use fell by 9pc. LPG demand increased by 1.4% but jet fuel sales fell by 45% over the period-Argus

India’s No.1 state-owned refiner Indian Oil Corp. has been running its plants at full capacity since early November as demand for fuels except jet reached pre-coronavirus levels. IOC’s processing demand for gasoline and diesel reached the pre-coronavirus level by the end of October.

India’s Mangalore Refinery and Petrochemicals Ltd. is running at 90% as demand for diesel and gasoline increased in the South Indian retail markets with the unlocking of the economy, company officials said Nov. 27. In October, MRPL recorded a 57% run rate compared with 66% in September, according to the oil ministry update. MRPL ran at 71% in August, 60% in July, 51% in June, 44% in May, and 54% in April.

India’s state-owned refiner Bharat Petroleum Corp. Ltd. has returned operation levels at its Kochi and Mumbai refineries to near full capacity, a company source said Nov. 16.

India’s Chennai Petroleum Corp. Ltd-owned Manali refinery is operating at a run rate of 95% following an improvement in demand after the fifth phase of the unlock of Asia’s third-largest economy. -Platts

INDIA OIL DEMAND

PHILIPPINES: Philippines’ Petron plans to maintain the operating rate at its 180,000 b/d Bataan refinery at 100% of capacity in November after it restarted some of the units in September and resumed “normal” run rates in October, a source close to the company said. The high run rate was attributed to a steady recovery in oil product demand. The facility had shut its units in May for prolonged maintenance work, to mitigate the impact of low fuel demand and poor refining margins. -Platts

FUJAIRAH: We saw a disappointing jump in Fujairah stocks, similar to the US, I will be looking to see if this is a one off, or if it persists. Stockpiles of oil products at Fujairah jumped 12% in the week to Dec. 7, the biggest rise since February amid signs of slowing exports from the UAE port, according to Dec. 9 data from the Fujairah Oil Industry Zone.

The total stood at 23.088 million barrels as of Dec. 7, the highest since Sept. 14, according to the data provided exclusively to S&P Global Platts.

Heavy distillates including fuel for power generation and bunkers rose 18%, while middle distillates including jet fuel and diesel jumped 13% and light distillates such as gasoline and naphtha rose 3%. It was the first time since August that all three categories showed week-on-week gains.

CHINA: ICE vehicle sales continue on an upward trend. China’s rebounding vehicle sales are expected to total 25 million this year, narrowing the gap with last year to 2%, while in 2021, the upward trajectory will continue, with the market expected to grow to 30 million in five years. Meanwhile, EV vehicle sales are expected to reach 1.3 million this year, a nice chunk, but so far there is no competition.

AIR TRAVEL: This week we saw several of announcements regarding the resumption of flights; small steps, but noteworthy.

UAE and Turkey to Resume Flights for First Time Since Virus

Dubai-London flights bookings surge by 112% on travel corridor announcement

Gulf Air To Resume Daily Boeing 787 Flights To London Heathrow

IRAN: In news this weekend, Iran said it planned to roughly double oil production in the next year.Oil Minister Bijan Namdar Zanganeh told lawmakers on Saturday the government aims to pump 4.5 million barrels a day of oil and gas condensate, which is a liquid form of natural gas, during the next Iranian calendar year beginning on March 21, the state-run Islamic Republic News Agency reported. The BIG caveat being, that they are expecting Biden to lift sanctions by then.

Realistically, renegotiating JCPOA will likely take years, not months, and will not be at the forefront of priorities for this administration. I do not consider this to be a credible factor at this juncture.

MATERIALS

URANIUM: Uranium stocks got a bounce this week from a U.S. Senate subcommittee’s approval of a bill that could see the US spending a lot of money bulking up America’s strategic uranium reserves.

The US Senate Committee on Environment and Public Works (EPW) has approved a bipartisan bill that, among other provisions, advances the federal initiative to establish a US national strategic uranium reserve.

Under the American Nuclear Infrastructure Act (ANIA), the US Department of Energy will be restricted to only buy uranium recovered from facilities licensed by the Nuclear Regulatory Commission or equivalent agreement state agencies as of the date of enactment.

Uranium from companies owned, controlled, or subject to jurisdictions in Russia or China are excluded from participating in the program.

SEE BILL HERE

As a result, several Uranium stocks saw a boost this week. I particularly like Uranium Energy Corp (UEC) and Cameco Corp (CCJ) as a way to express this trade.

UEC

CCJ

FERTILIZER: Feeding the world is becoming an increasingly harder task with broken supply chains, and lack of workers due to COVID-19, coupled with the onslaught of ASV, Armyworm, locusts, and changing weather patterns.

According to Agriland, Fertiliser programme was key to winning crop awards’. Tim Lamyman won YEN medals in the highest cereal yield category, with 15.4t/ha and 15.6t/ha respectively, as well as a host of other gold and silver awards.

“Our farm’s approach is to produce resilient plants through the use of an advanced crop nutrition strategy,” he said.

I think fertilizers will become increasingly more important in the future.

The top 10 fertilizer companies in the world are: SAFCO (Saudi Arabia), K+S (Germany), CF Industries (US), BASF (Germany), Uralkali PJSC (Russia), Isreal Chemicals (Isreal), YARA International (Norway), Potach Corp. Of Saskatchewan (Canada), The Mosiac Company (US), Nutrien ( Canada)

From a technical standpoint, Mosiac (MOS), CF Industries (CF), and Isreal Chemicals (ICL) look the most interesting to me. (ICL is on both the Tel Aviv and NYSE exchanges)

MOS

CF

ICL

DAILY SENTIMENT