OIL MARKET

Crude prices were boosted this week by hurricane Delta in the Gulf of Mexico in which 1.6M bpd was offline and Norway workers strike curbing 330K bpd. The swift rise in oil also sent treasury yields higher this week as oil is a proxy for inflation, even more so than gold, sending investors to shed treasuries. Oil has an asymmetrical effect on inflation given that energy has an 8% weighting in the consumer price index (CPI) and the sector’s prices have greater volatility than other CPI inputs. The end result is an outsized impact on that measure of inflation.

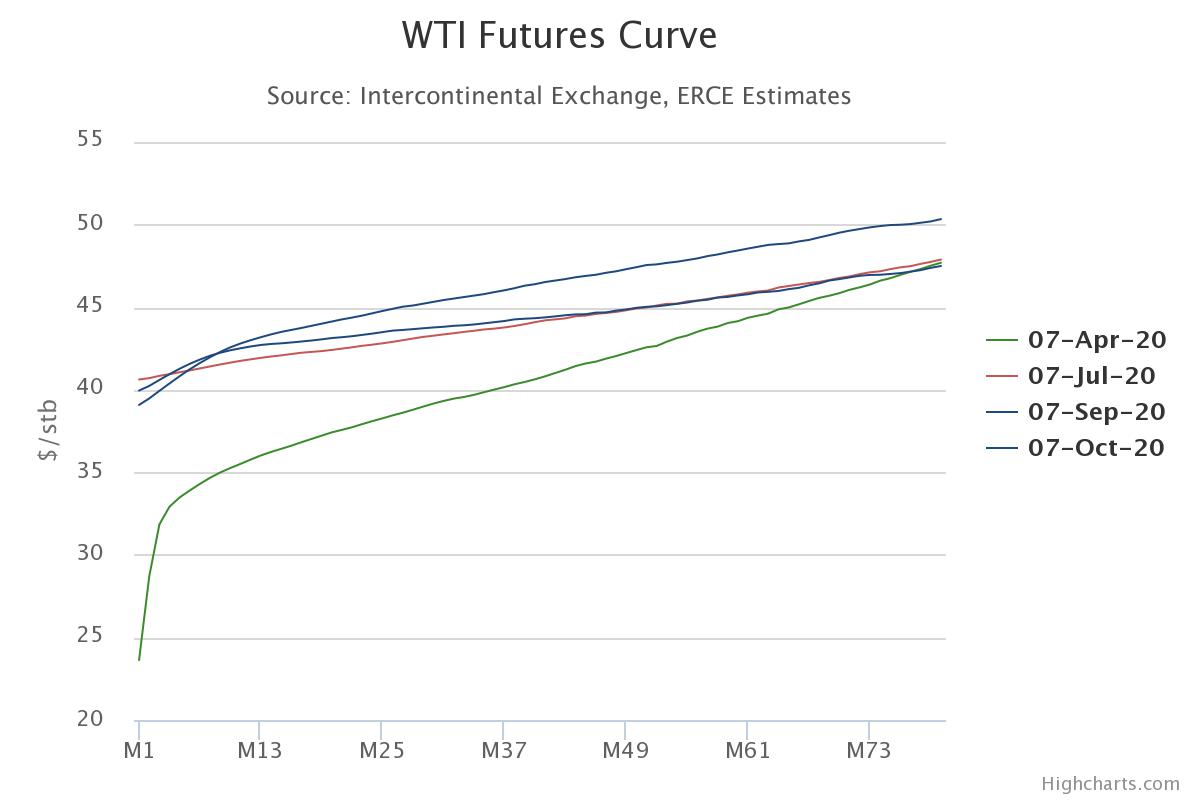

Looking ahead to this week, Gulf of Mexico operators are restarting operations as of this weekend. That said, several refineries are still offline and in need of repair, that timeline has yet to be established. Likely this will affect inventory numbers this week, we should see a bigger draw in gasoline, but a negligible draw to a build in crude stocks. End of the day Friday, Norway workers came to a resolution and will be back online this week. In addition, Libya listed the force majeure of its largest oil field, Sharara, and will begin pumping oil from that field starting with 40Kbpd to a max capacity to 300Kbpd over the next 10 days. All of this coupled with a lack of a stimulus bill (as of writing this) presents some headwinds for the crude market heading into this week. A major sell-off would be positive for treasuries particularly the long end. However, the oil curve has significantly flattened over the last few months, so it is difficult for me to get overly bearish at this point. Should we see a stimulus bill this week, it would be positive for the crude market as well.

MATERIALS SECTOR

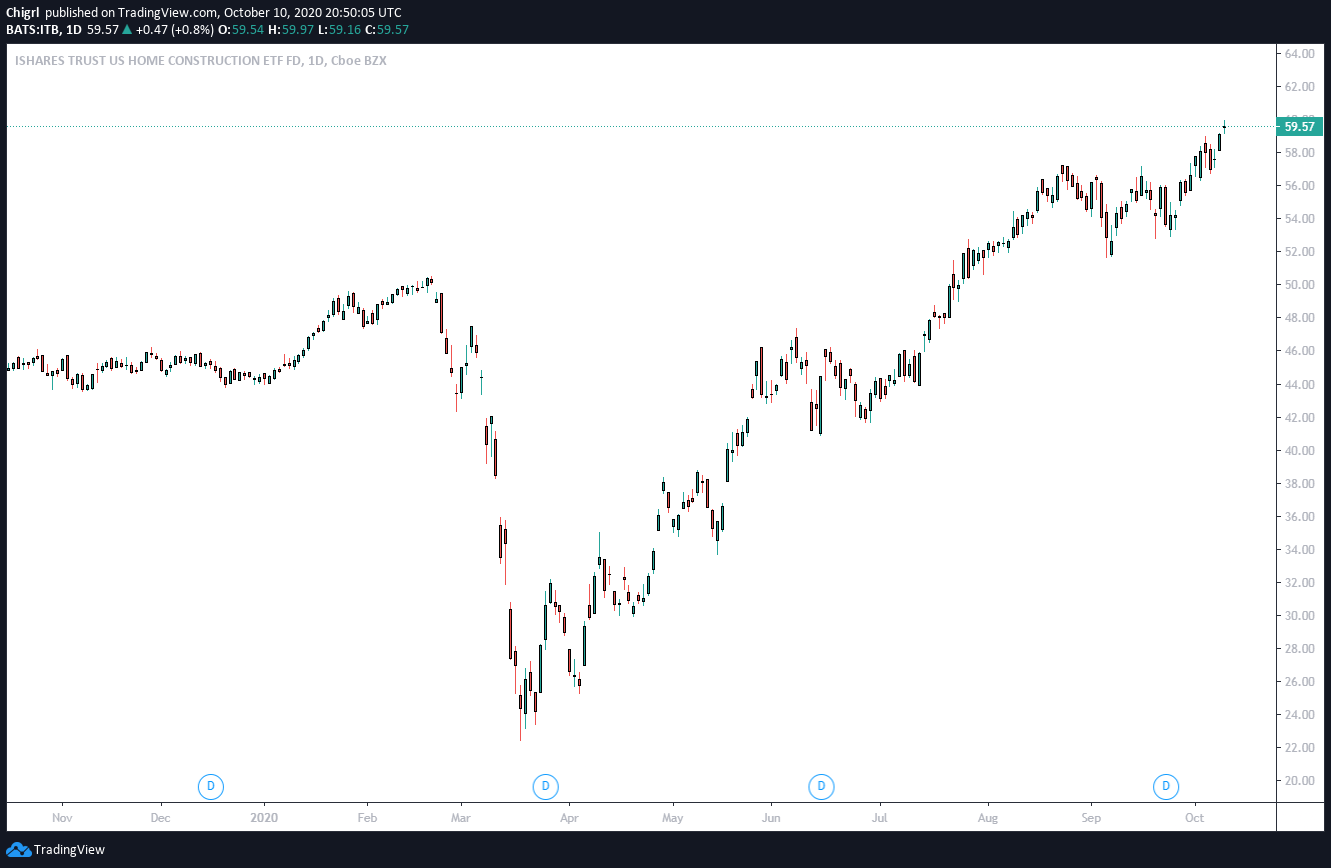

Lumber continued its slide this week while ITB (iShares US Home Construction) hit new highs. New home construction orders come out on October 20th.

From US Consensus Bureau for August:

“Housing Starts Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,416,000. This is 5.1 percent (±9.6 percent)* below the revised July estimate of 1,492,000, but is 2.8 percent (±10.3 percent)* above the August 2019 rate of 1,377,000. Single-family housing starts in August were at a rate of 1,021,000; this is 4.1 percent (±8.7 percent)* above the revised July figure of 981,000. The August rate for units in buildings with five units or more was 375,000.

Housing Completions Privately-owned housing completions in August were at a seasonally adjusted annual rate of 1,233,000. This is 7.5 percent (±14.2 percent)* below the revised July estimate of 1,333,000 and is 2.4 percent (±11.9 percent)* below the August 2019 rate of 1,263,000. Single-family housing completions in August were at a rate of 912,000; this is 4.4 percent (±19.1 percent)* below the revised July rate of 954,000. The August rate for units in buildings with five units or more was 312,000.”

We have somewhat of a disconnect here. Another drop or evidence of weakness in September numbers would likely send ITB lower as well and many builder equities.

DR. COPPER

Copper’s widespread applications in most sectors of the economy, from homes and factories to electronics and power generation and transmission, demand for copper is often viewed as a reliable leading indicator of economic health. This demand is reflected in the market price of copper.

After a large sell-off the week of September 28th. workers threatened to strike in Chile sending prices northbound again, especially toward the end of the week when it looked as though no resolution in sight. However, late Friday, it was decided that negotiations would continue this week. Should a decision be reached, likely we see a sell-off, given the high inventory volumes both at the LME and Shanghai. (see oil and copper note).

SENTIMENT GOING INTO NEXT WEEK

DATA FOR NEXT WEEK