OIL AND MINING PERMIT HALT

The big uproar this week, aside from the initial executive orders that I covered in Thursdays note in depth, was the oil and mining permitting pause. So lets take a closer look.

Acting Interior Secretary Scott de la Vega, signed a Secretarial Order order that temporarily suspends delegated authority for 60 days until Deb Haaland is confirmed as Interior Secretary:

“a. To publish, cause to be published, or aid in the publication of any notice in the Federal Register, including, but not limited to, notices of proposed or final agency action and actions taken in accordance with the National Environmental Policy Act:

b. To issue, revise, or amend Resource Management Plans under the authority of Section 202 of the Federal Land Policy and Management Act as amended;

c. To grant rights of way. easements. or any conveyances of-property or interests in property, including land sales or exchanges, or any notices to proceed under previous surface use authorizations that will authorize ground-disturbing activities;

d. To approve plans of operation, or to amend existing plans of operation under the General Mining Law of 1872;

e. To issue any final decision with respect to R.S. 2477 claims, including recordable disclaimers of interest;

f. To appoint, hire, or promote personnel. or approve the appointment of any personnel. assigned to a position at or above the level of GS 13, but this does not apply to seasonal hires or emergency work force personnel:

g. To issue any onshore or offshore fossil fuel authorization, including but not limited to a lease, amendment to a lease, affirmative extension of a lease, contract, or other agreement, or permit to drill. This does not limit existing operations under valid leases. It also does not apply to authorizations necessary to: (1) avoid conditions that might pose a threat to human health, welfare, or safety; or (2) to avoid adverse impacts to public land”

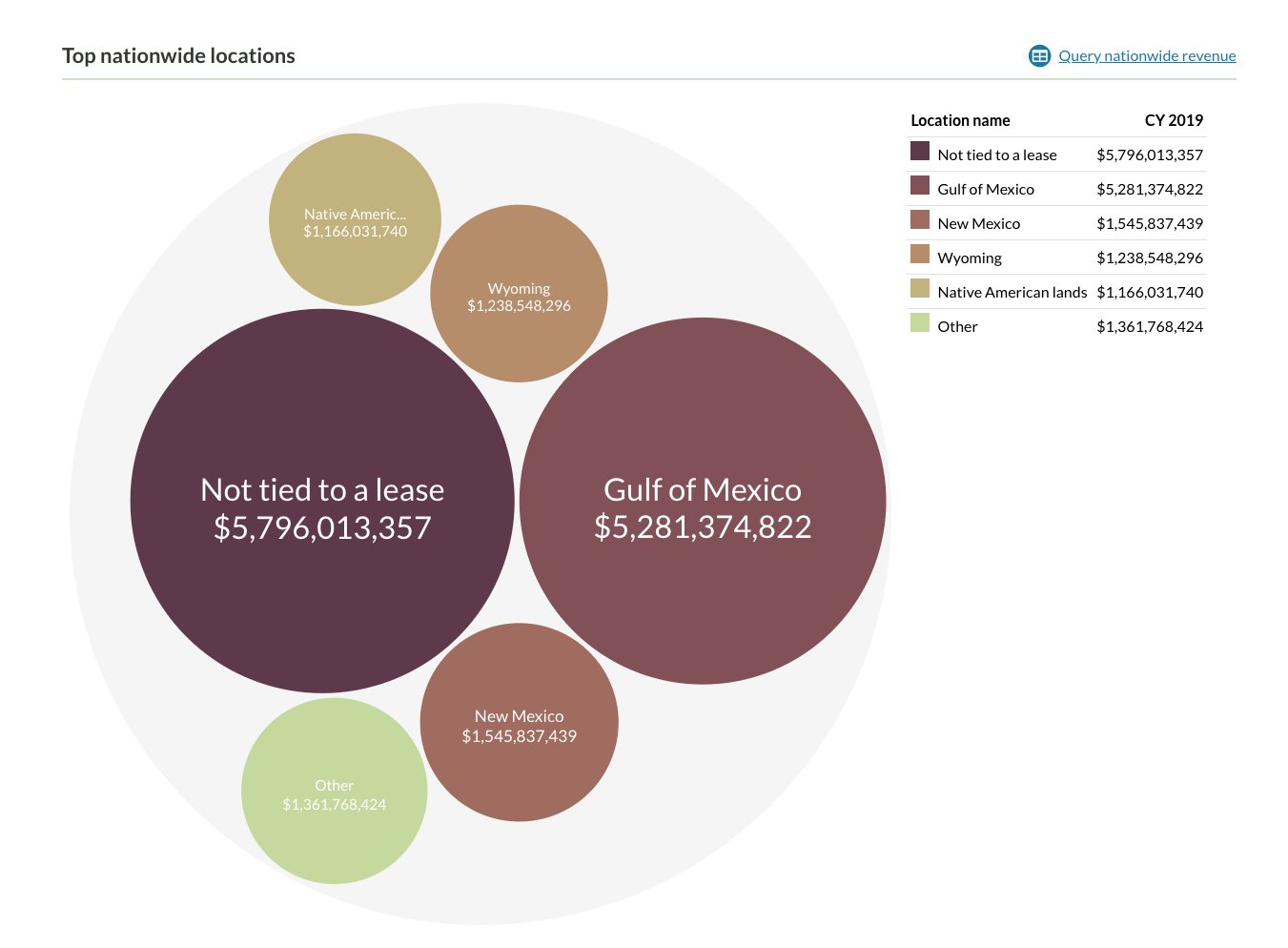

So what does this mean exactly? Basically it suspends the ability of Interior employees even at the most senior levels, from pushing ahead with any new leasing or drilling permits. It also blocks any new major mining actions. The order does not impact existing ongoing operations under valid leases or seek to limit existing operations. The 60-day timeline also pauses a number of other actions at Interior, including any promotions for department staff or transfer of public lands back to the states. The order does impact both onshore and offshore leases, including the Gulf of Mexico, a small part of the Permian Basin, New Mexico, and Alaska’s North Slope.

The Interior Department is said to be readying a more permanent moratorium for new sales of oil, gas and coal leases for federal lands as early as next week, Bloomberg reported Friday. However, that might be difficult to accomplish by fiat given expected legal challenges, warned Washington lobbyists.

In fact, already this order already facing backlash from The Ute Indian Tribe of the Uintah and Ouray Reservation, which has run an oil-and-gas operation on its 4.5 million-acre reservation for more than 70 years. They sent a letter to the Department of the Interior requesting to have the order immediately revoked saying “Your order is a direct attack on our economy, sovereignty, and our right to self-determination.”

The more backlash this receives, will be a determining factor in if this becomes a permanent order or not.

In itself, the 60-day moratorium should have minimal impact on production volumes. Many oil and gas producers with operations in federal areas had already stockpiled drilling permits before Biden took office in preparation for this very scenario, as I discussed in my September 28, 2020 note entitled “WOULD A BIDEN WIN SPELL DISASTER FOR ENERGY/MATERIALS SECTOR?”. However, should this become permanent, that would mean that the US likely has to depend on more oil imports, just as we were beginning to be a net exporter.

Anecdotally, I spoke with a good friend of mine, Dr. Ellen Wald, a senior fellow at the Atlantic Council, about this. Her take “ if they are serious about banning production on Federal lands, they could just propose legislation that could not be undone by the next administration, being that they control both House and the Senate. It seems that they do not really want to take such a strong stand or make their people have to take a stand on the record. At the very least, if they really meant it, they could say ‘this is a temporary measure as we prepare legislation to submit to Congress.’”

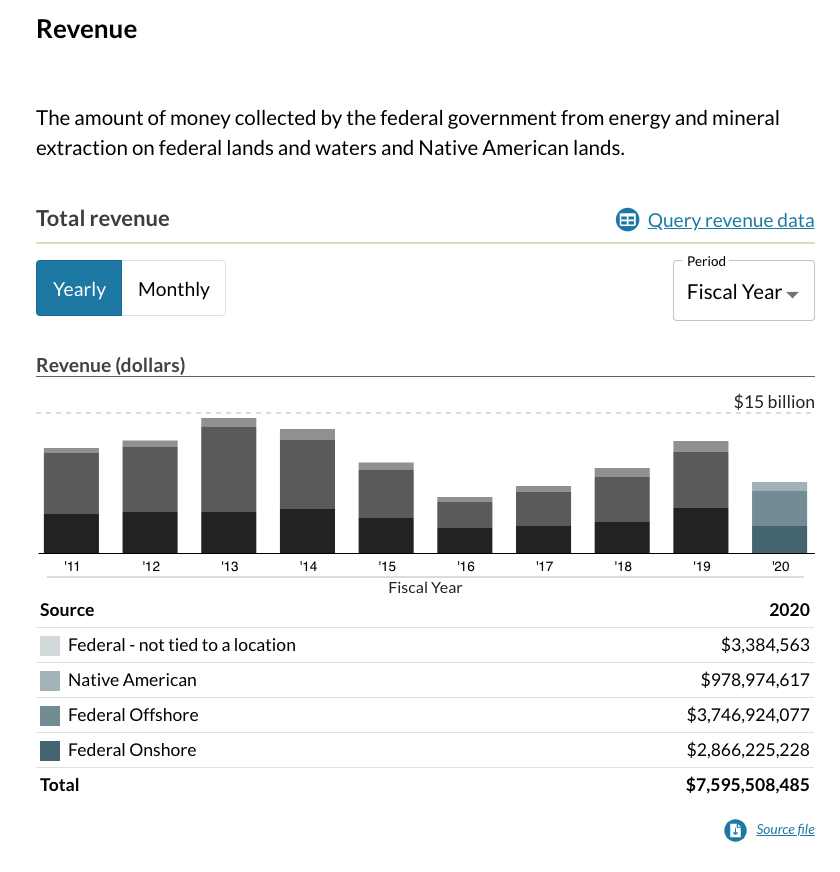

Federal land and revenue/royalties offshore bigger than onshore

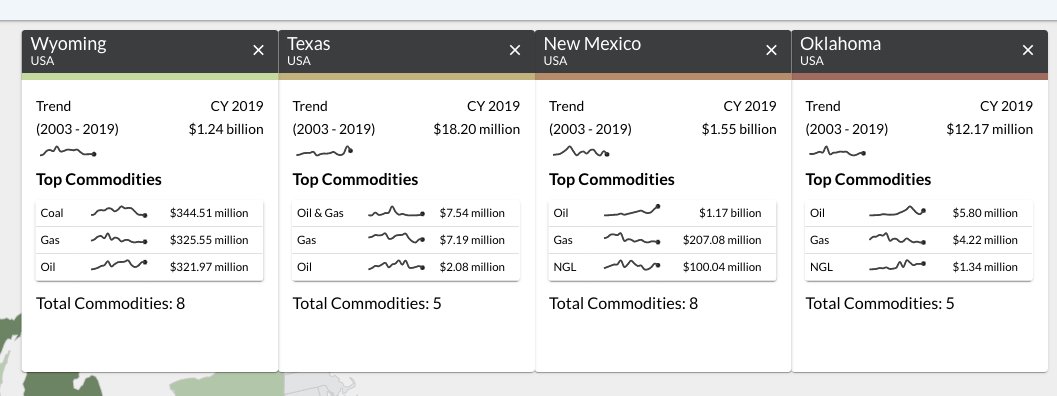

WY and NM biggest state exposure

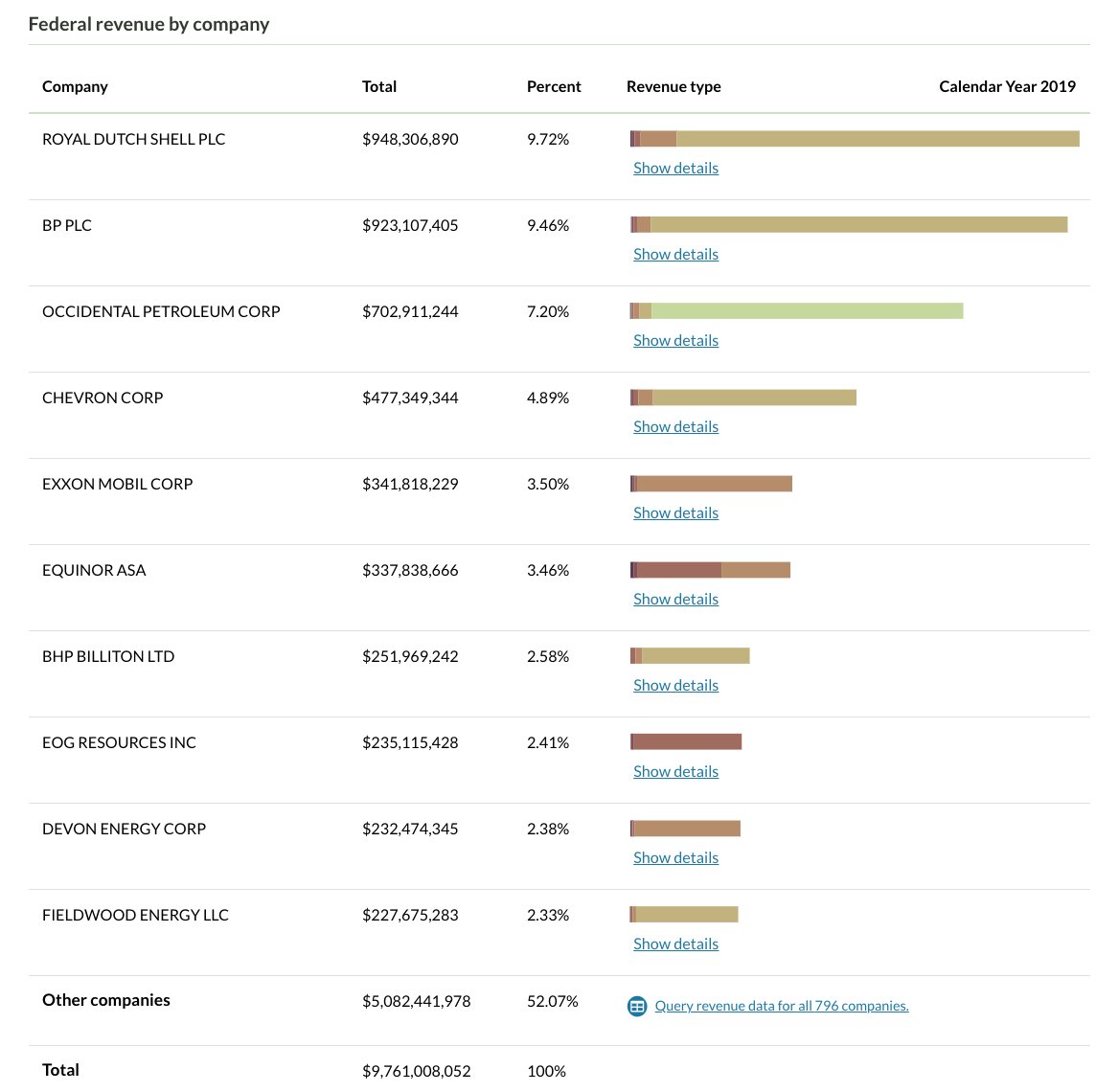

RDS, BP, OXY, CVX, XOM biggest company exposure

OK and TX have next to 0 exposure, based on DOI revenue numbers

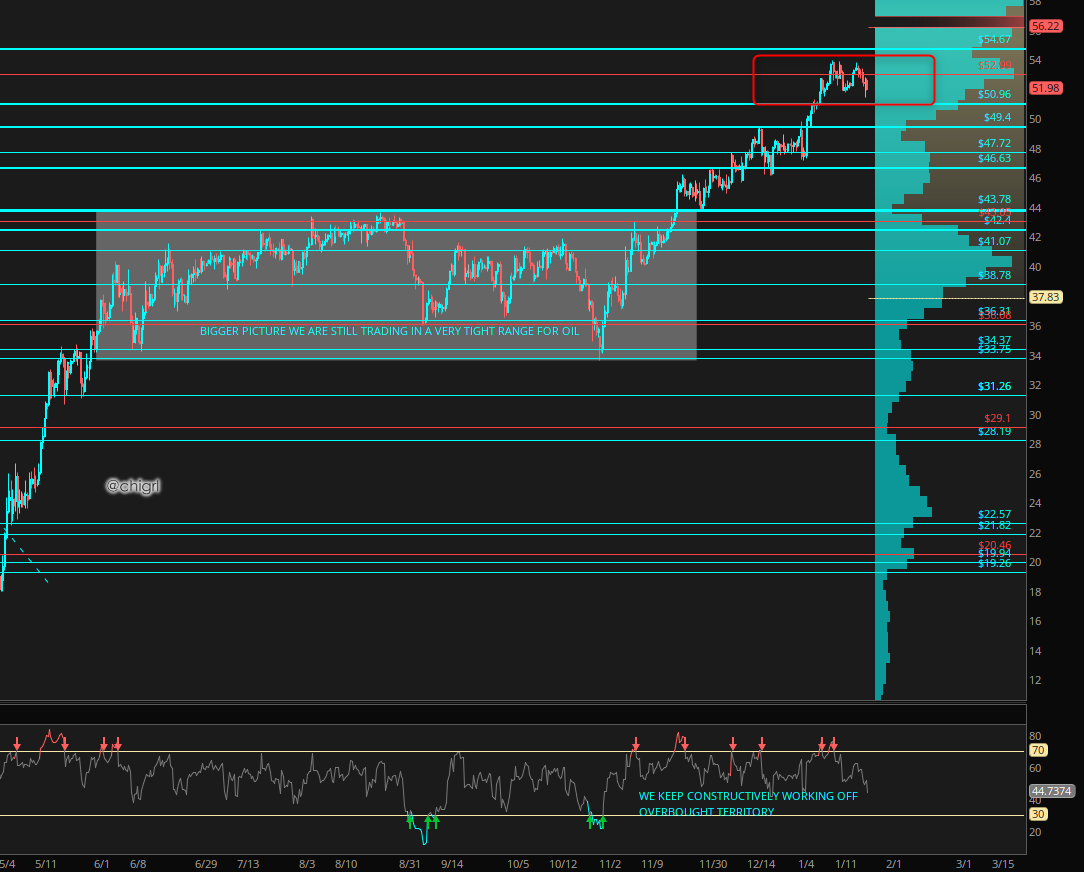

TECHNICALS

Last week I mentioned that we may see a pullback or consolidation for the last two weeks in January. This last week we saw just that. I expect this to continue this week, unless something really starts to spark off in Libya (I talk about below).

FUNDAMENTALS

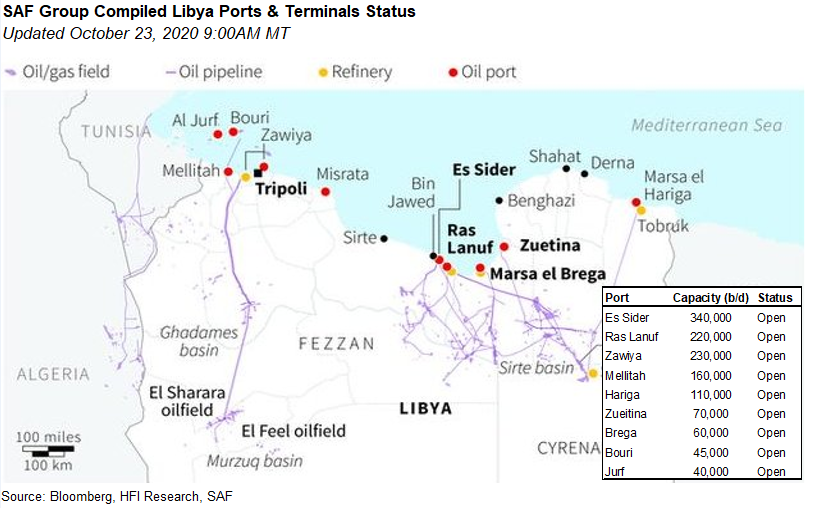

LIBYA: I have been discussing the problems with Libya for months now.Last week I discussed that Libya Waha oil output was curtailed by 200K BPD, due to a pipeline leak. That maintenance has been completed.

However another problem has arisen this weekend, the Petroleum Facilities Guard (PFG) have made calls to halt loading operations at Libya’s eastern Es Sider, Ras Lanuf and Marsa el-Hariga terminals amid strike action over unpaid wages, but the timing of the shutdown is likely linked to the wider political/military situation in the country. This could lead to shut ins of production, or halts to exports entirely.

The eastern branch of the PFG is closely linked with the Libyan National Army (LNA) forces of Khalifa Haftar, and participated in an eight-month January-September blockade of ports in Libya’s east-based hydrocarbon-rich ‘oil crescent’ region last year.

Foreign fighters were meant to leave Libya this week, but the construction of an enormous trench across Libya, dug by Russian-backed mercenaries Wagner, indicate that they plan to stay. The trench and fortifications appear designed to impede or stop a land attack on LNA controlled areas in the east, running through the populated coastal areas of Libya that have seen the most clashes since the 2011 fall of the regime of Moammar Gadhafi.

CNN quoted a US intelligence official saying, “we see no intent or movement by either Turkish or Russian forces to abide by the UN-brokered agreement. This has the potential to derail an already fragile peace process and ceasefire. It will be a really difficult year ahead.”

Long/short, a complete breakdown could take 1.2M BPD off the market quickly, and obviously bullish for the market.

JAPAN: Japan’s power prices fall back to reality. The spot rate for Jan. 25 (Monday) fell 48% to 12.1 yen/kWh, the lowest in a month Snow isn’t forecast for tomorrow, and the temperature outlook is above average. The lower price indicates that the supply crunch is subsiding. The decline appears to be weather-driven. Sunny weather is seen for most of the country, which will also help boost solar output. But gas-fired power generation is still lower than last year due to weak LNG stocks. If there is another cold snap, then we could see power prices spike again. – Stephen Stapczynski from BBG

IRAQ: The ultimate laggard, Iraq said it would compensate for its OPEC production breach from the summer.They said they will pump around 3.6 million barrels daily for the two months, according to Ali Nizar, the deputy head of SOMO. That would be the lowest level since 2015 and compares with around 3.85 million in December, according to data compiled by Bloomberg.

This would be great news, though I am hesitant to get overjoyed given their past performance.

NATURAL GAS: Elon announced that he would be drilling for natural gas near the SpaceX Texas lunch pad. While it’s unclear what exactly the gas would be used for, SpaceX plans to utilize super-chilled liquid methane and liquid oxygen as fuel for its Raptor engines. There are some disputes over wells and leases at this time (nothing new with Elon), but with Elon’s seeming magical tough, I believe this will be bullish nat gas in the short term.

In addition, we have storm Nathaniel sweeping across the Midwest and NorthEast, I would not be surprised if we see a gap up on the open this evening. I still have 16 April 21 UNG calls. Natural gas stocks should do well, great for our SD position.

US COMPLETED AND DRILLED WELLS – EIA

US wells completed:

2019: 14,362 (95% of drilled)

2020: 7,394 (down 49%) (112% of drilled)

US wells drilled:

2019: 15,089

2020: 6,625 (down 56%)

Even with rising rig counts, the US will not be back at 13.5M BPD at this pace any time soon, if ever.

US GASOLINE DEMAND

Great news! According to Pay with GasBuddy data, Friday gasoline demand jumped to its highest daily level since 11/20, also the second highest daily level since 10/31. It was up 5.7% from last Friday.

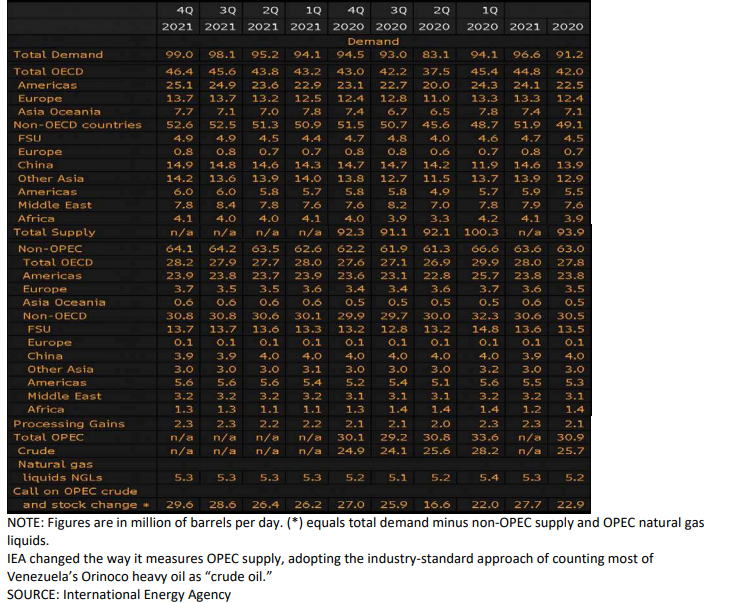

IEA MONTHLY REPORT

January report was out last week. Here are the highlights:

Global oil demand is expected to recover by 5.5 mb/d to 96.6 mb/d in 2021, following an unprecedented collapse of 8.8 mb/d in 2020. For now, a resurgence in Covid-19 cases is slowing the rebound, but a widespread vaccination effort and an acceleration in economic activity is expected to spur stronger growth in the second half of the year.

After falling by a record 6.6 mb/d in 2020, world oil supply is set to rise by over 1 mb/d this year, with OPEC+ adding more than those outside the bloc. There may be scope for higher growth given our expectations for further improvement in demand in 2H21. After holding flat at 92.8 mb/d in December, global supply is rising this month with OPEC+ due to ramp up during January.

Global refinery throughput is expected to rebound by 4.5 mb/d in 2021, after a 7.3 mb/d drop in 2020. Runs rose by 2.6 mb/d in November, the largest monthly gain in seven years, as refiners returned from peak maintenance. A cold snap in Europe and Asia boosted diesel and kerosene, but higher crude oil prices led fuel oil cracks lower, with an overall negative impact on refinery margins.

Observed global oil stocks fell by 2.58 mb/d in 4Q20 after preliminary data showed hefty draw downs towards year-end. In November, OECD industry stocks fell for a fourth consecutive month. A monthly decline of 23.6 mb (0.79 mb/d) left inventories at 3 108 mb, 166.7 mb above their five-year average. Products led the fall, with OECD industry crude stocks only 48.9 mb below a May-peak.

Oil’s rally accelerated, with Brent reaching $57/bbl on 12 January, a level not seen since February 2020. Despite rising Covid cases, crude prices are well supported by financial, economic and market fundamentals. Crude prices flipped into backwardation in December, and the 12 month time spread deepened to $2.50/bbl by mid-January. Freight rates fell after OPEC+ agreed cuts on 5 January.

Following is a summary of world oil supply and demand forecasts from IEA

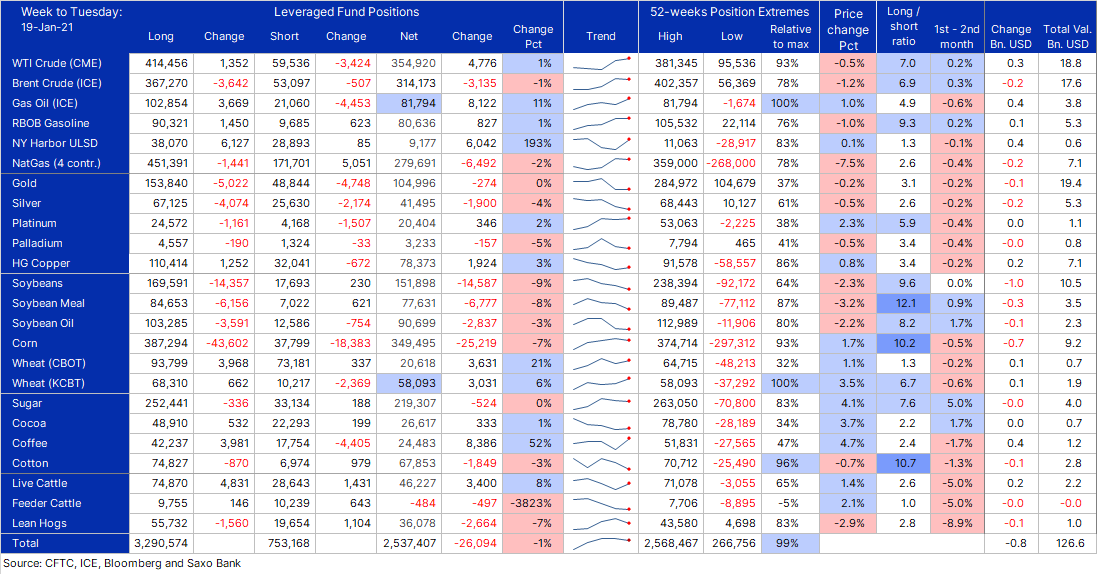

CFTC COMMITMENT OF TRADERS

COT on commodities in wk to Jan 19 saw specs make another small reduction from a record high. The net-long was cut by 1% to 2.5m lots with the biggest reductions seen in soybeans, corn, and natgas while buying supported fuel products (gas oil & diesel), wheat, and coffee -SAXO BANK

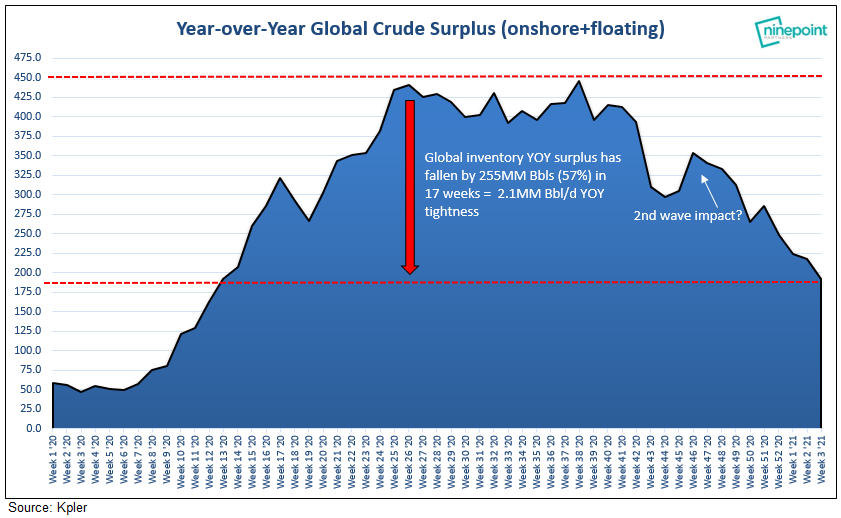

GLOBAL OIL INVENTORIES

Global inventories continue to draw down the surplus.

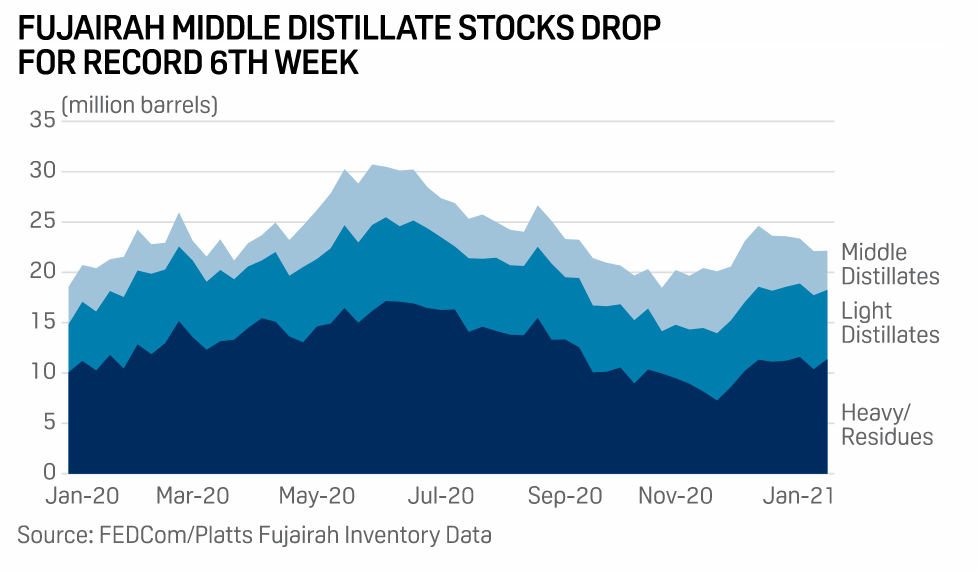

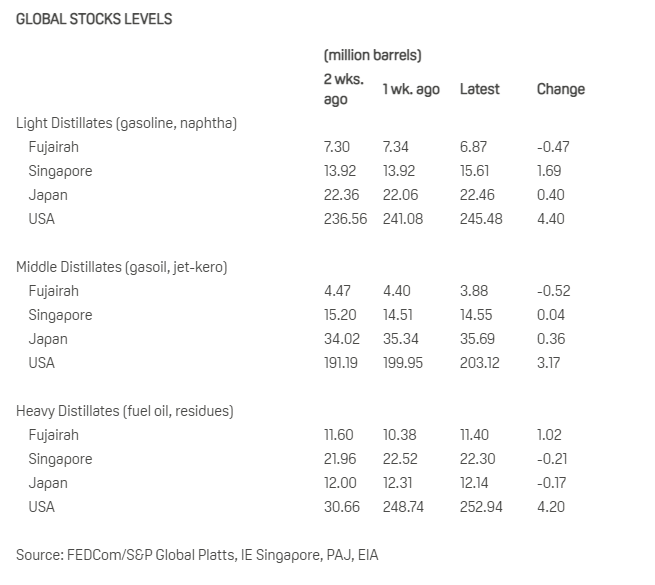

FUJAIRAH INVENTORIES

Total inventories as of Jan. 18 stood at 22.149 million barrels, up 0.1% from a week earlier and the first gain in five weeks, but still below the crucial 23M barrel mark, according to Jan. 20 data from the Fujairah Oil Industry Zone. Heavy distillates used in marine bunkers and for power generation jumped 10% to 11.399 million barrels after falling 11% a week earlier.

Middle distillate stocks tumbled 12% to 3.879 million barrels, the lowest since Oct. 5 and marking a record sixth consecutive weekly decline. Middle distillates covered in the report are gasoil, diesel, marine bunker gasoil, jet fuel and kerosene. -Platts

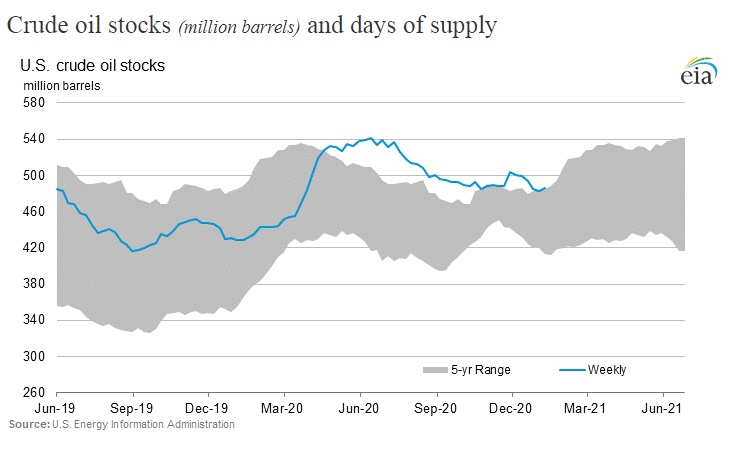

US CRUDE OIL INVENTORIES

We are just 8% above the 5 year average, as we are headed into February refinery maintenance season, when stocks tend to be a bit higher.

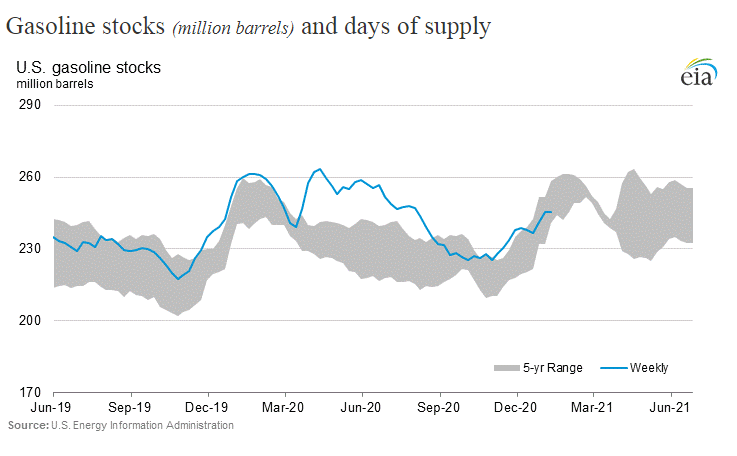

That gasoline draw put us in a nice position, firmly back in the 5 year average.

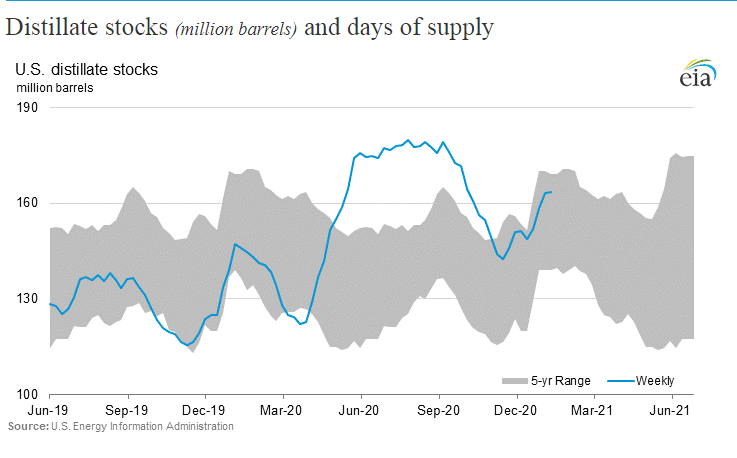

Distillates still firmly in the 5 year average, I would like to see this start drawing , end of February, beginning of March. This would be very positive.

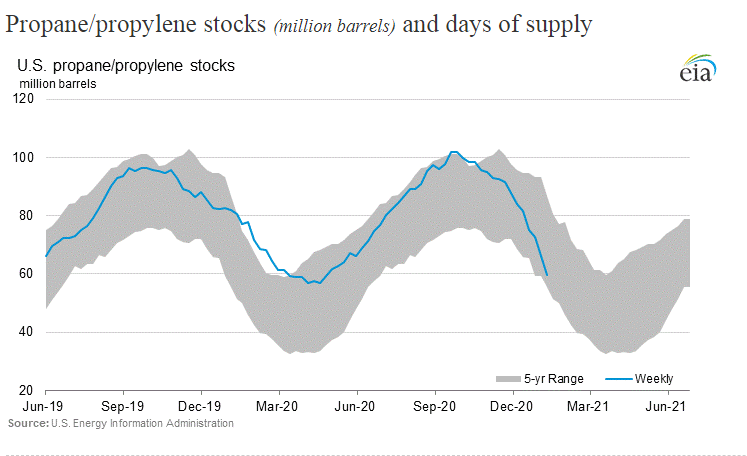

Another big draw in propane, again great for NGL producers and our AR position.

DAILY SENTIMENT INDEX (DSI)