I noted on the Sunday report that the WTI crude oil chart was constructively bullish, therefore supportive of oil equities. This OPEC meeting decision is complementary to what I was seeing in the charts and to the strengthening fundamental data that I have been noting since October.

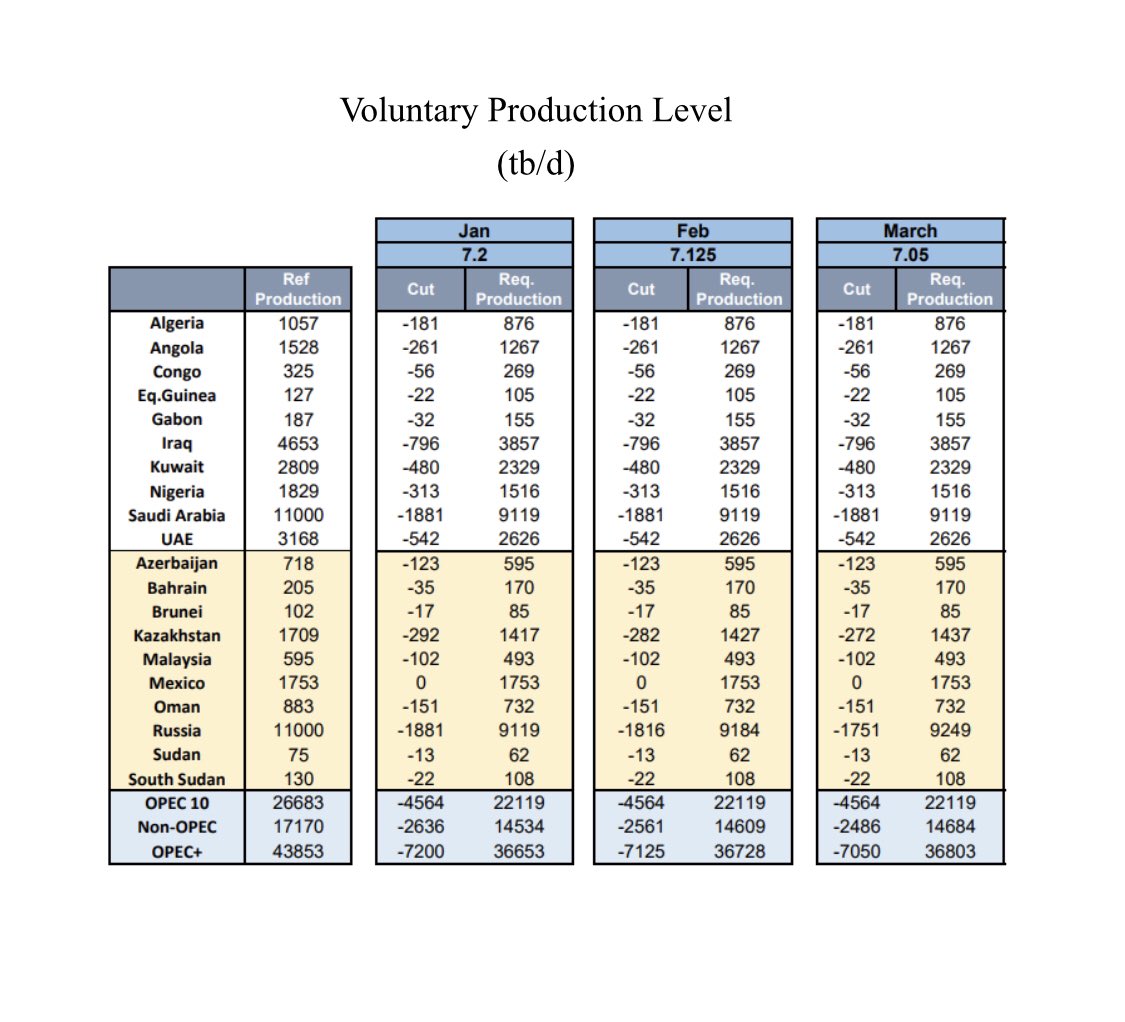

The OPEC meeting was extended one more day, as Russian and Kazakhstan did not want to hold January production over to February and March, they wanted a 500K bpd increase for the group. After many deliberations, the group decided on this breakdown:

RUSSIA: February: +65k bpd from January levels

March: +130K bpd from January levels

KAZAKHSTAN: +10K bpd from January levels

March: +20 bpd from Jan levels

SAUDI ARABIA: On a surprise maneuver at the OPEC presser announced an unprecedented cut of -1 Million bpd for February and March off January levels. Their production will be 8.125M for February and March down from 9.119M bpd.

There also will be an additional 425K cuts for both February and March from the countries that were overproducing this summer/fall in compensation cuts.

Total OPEC cuts: 1.425M bpd for both February and March.

Saudi Oil Minister, Abdulaziz bin Salman Al Saud, said this was to ensure that stocks continue to draw and that the Kingdom is committed to ensuring stability in the market. This is very positive news as the market is still fragile, especially with new lock-downs in UK and extended lock-downs elsewhere in the EU. There is also the risk of more stringent lock-downs in the US with the incoming administration, so this is a welcome cut for the industry.

Here is the schedule (with out the surprise cut from Saudi Arabia)

LINK TO FINAL OPEC COMMUNIQUE (without the Saudi Arabia announcement)