Parliament of Azerbaijan declares state of war against Armenia

The announcement that Devon Energy is in talks to acquire WPX Energy

Sunday, heavy fighting erupted between Azerbaijan and Armenia in the separatist Nagorno-Karabakh region with both civilian and combatant casualties. The region is recognized as part of Azerbaijan but controlled by ethnic Armenians. Conflicts began in 1988 when the Karabakh Armenians demanded that Karabakh be transferred from Soviet Azerbaijan to Soviet Armenia. The conflict escalated into a full-scale war in the early 1990s. In 1994 a ceasefire was signed and there was relative stability until 2010. The last major clash was the 4 Day War in 2016. It is not immediately clear what started the fighting, but heavy shelling was reported in the region followed by Armenia claiming they had shot down two helicopters and three tanks. Azerbaijan then ordered martial law and curfew on some regions, followed by an all-out declaration of war against Armenia. Russia has a military base in Armenia and a full-out war could draw it into conflict with Turkey.

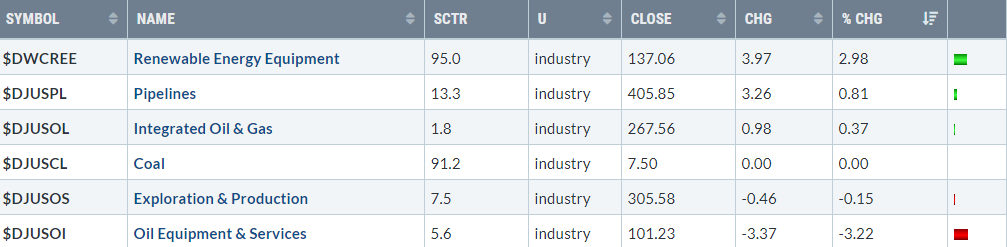

Azerbaijan is a small oil and gas producer but is the main hub for natural gas transport. The BP-owned project called the SPCX forms the first link in a chain of pipelines creating a Southern Gas Corridor that brings Caspian gas and oil to Europe. If Armenia feels that Azerbaijan has escalated too far, it could attack these pipelines, likely sending Dutch and UK natural gas futures (ICE contracts TFM and M) spiking (US natural gas futures may get a sympathy bid as well CME contract NG).

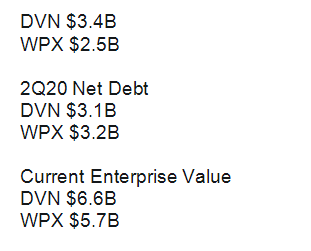

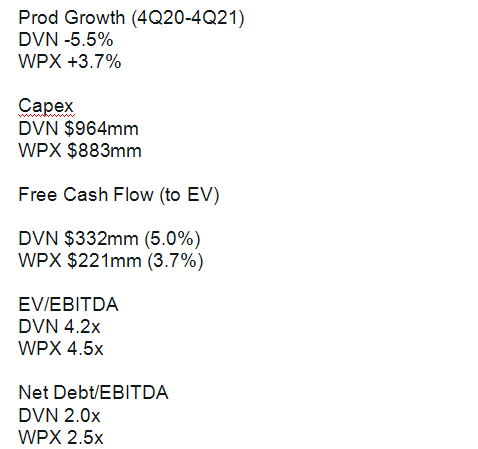

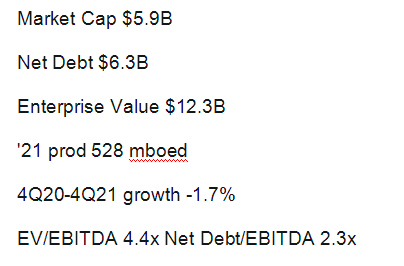

DEVON (DVN) and WPX (WPX)

Devon Energy is in talks to acquire WPX and a decision could come as soon as Monday or Tuesday.

9/25/20 Market Cap

2021 CONSENSUS

COMBINED

TRADE IDEA:

LONG WPX

CHEVRON (CVX) AND NOBLE ENERGY (NBL)

In July, Chevron announced that it was in a definitive agreement with Noble Energy to acquire all outstanding shares of Noble in an all-stock transaction at an enterprise value of $13 billion. This will enhance Chevrons shale portfolio with de-risked acreage in the DJ basin and 92K largely contiguous and adjacent acres in the Permian. Although, the true aim for this acquisition was Noble’s Eastern Mediterranean assets, in particular it low capital, cash generating offshore assets in Israel. The recent peace deals between Israel and its Arab neighbors will strengthen Israels energy roll in the region, therefore making Noble East Med assets even more valuable.

On Friday October 2, is the Special Meeting of Shareholders to approve the pending combination with Chevron.

TRADE IDEA:

LONG CVX ON FRIDAY

SENTIMENT CHECK

Last week the oil sector fared okay considering the weakness in the broader markets, with oil holding steady around $40. Also noteworthy is that oil held steady in face of a rapidly rising US dollar.