BIG NEWS

This weekend was the passing of Ruth Bader Ginsburg

Albert Marko, top political strategist, in Intelligence Quarterly wrote: “Regardless of your personal politics, the passing of Ruth Bader Ginsburg is a loss to the nation. She was a titan in American history and her relationship with her ideological counterpart should be a model of how American politics should operate.That said, her passing is a seismic event in an already dramatic year. With tensions already at a high level, there will certainly be weaponization of RBG’s death on both sides of the aisle to boost voter turnout.”

We are in store for some tumultuous times ahead and this will have broader implications on the markets in the coming week.

WEEKLY RE-CAP

Last week was all about the FOMC!Last week the Federal Reserve stayed the course. Rates remained unchanged, which came as no surprise. However, markets seemed to be wanting an announcement of some sort of further stimulus, instead Jerome Powell kept repeating the need for fiscalstimulus. In fact, he repeated the words “fiscal stimulus”, well over a dozen times. He also basically announced the FED would allow the US economy to be scorched with inflation. The markets in kind, reacted by selling off sharply, and we saw a rise in gold and oil (inflation hedges). However, the market did not totally believe the inflation story as USD rose and TIPS sold off intermediately following the press conference.

Fundamentally , this market will be hard pressed to get very excited without some sort of stimulus bill passed by Congress.

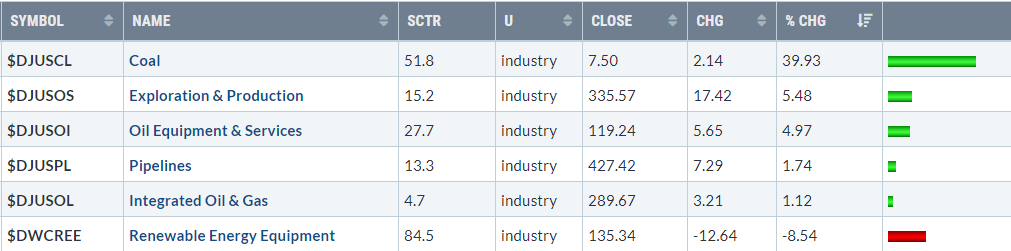

Overall, the energy sector did quite well last week, despite the broader markets sell off. Seems we are seeing the beginnings of a rotation from growth to value, as the tech sector was blown out by the FED and the election grows near.

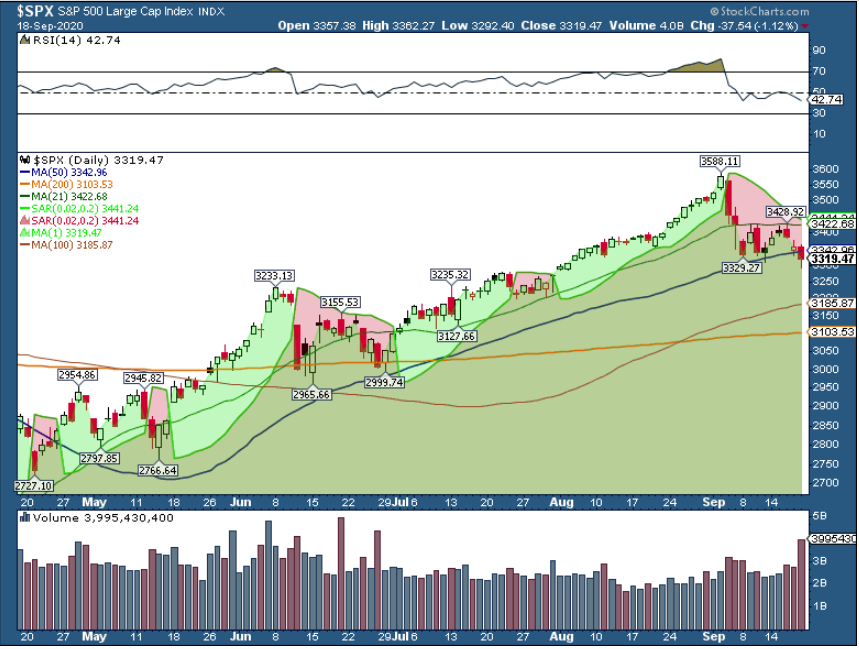

Starting with the broader market $SPX is on a daily Parabolic SAR sell signal, closing below the 21 day and the 50 day.

OIL

Bearish news for next week

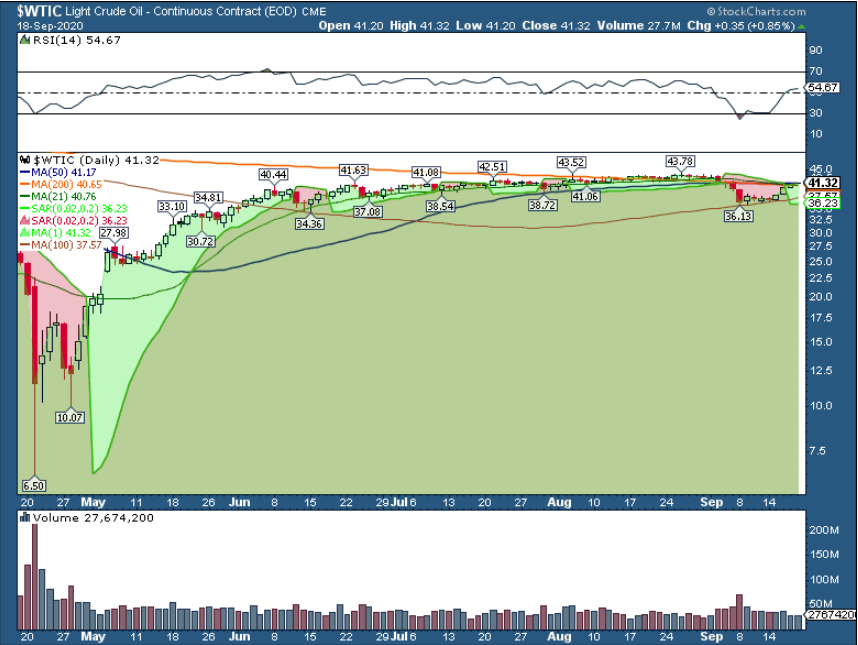

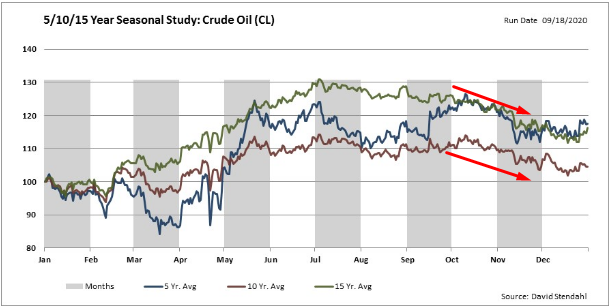

This weekend we have Libya announcing a lift of the oil blockade in fields that are not under Wagner control of other militias. Right now it is not too concerning as we have seen this happen too many times in the past, only to unravel, but the market may pull back on Sunday open in light of this news. Several countries have announced additional lock-downs over the last 4 days, which make cause the oil market some skittishness, but in absence of full lock-downs, this is merely a caution for the market. Also, last week, Thursday was options expiration and this Tuesday is futures expiry, some of this bullish price action could be related to roll shenanigans. This rally was also stopped at the 200 day, failure to break above could result in a pullback as seasonality sets in.

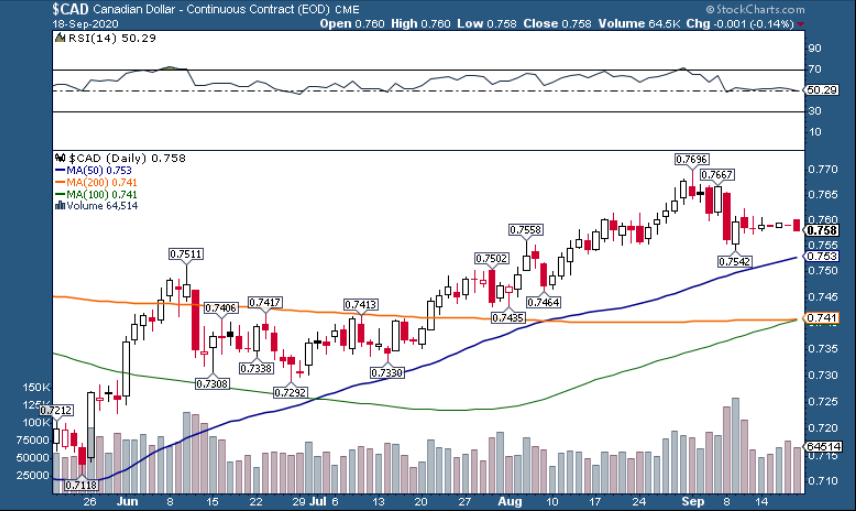

CAD (Canadian dollar) is also not confirming this move up in oil currently

TRADE IDEA

Short crude futures on the Sunday night open at 41.32 or better for a move to 36.80

NEXT WEEK

All eyes on USD in the upcoming weeks as it looks to be carving out a bottom and the daily is bull flagging. A move over 94 would solidify a new trend and a move under 91.75 would indicate a continuation of the trend . USD strength, especially a move over 94 would put significant pressure on indices that are already showing weakness

TRADE IDEA

Long USD futures at on the Sunday night open at 92.96 or better for a move to 94.79