TOP EVENTS AND CATALYSTS

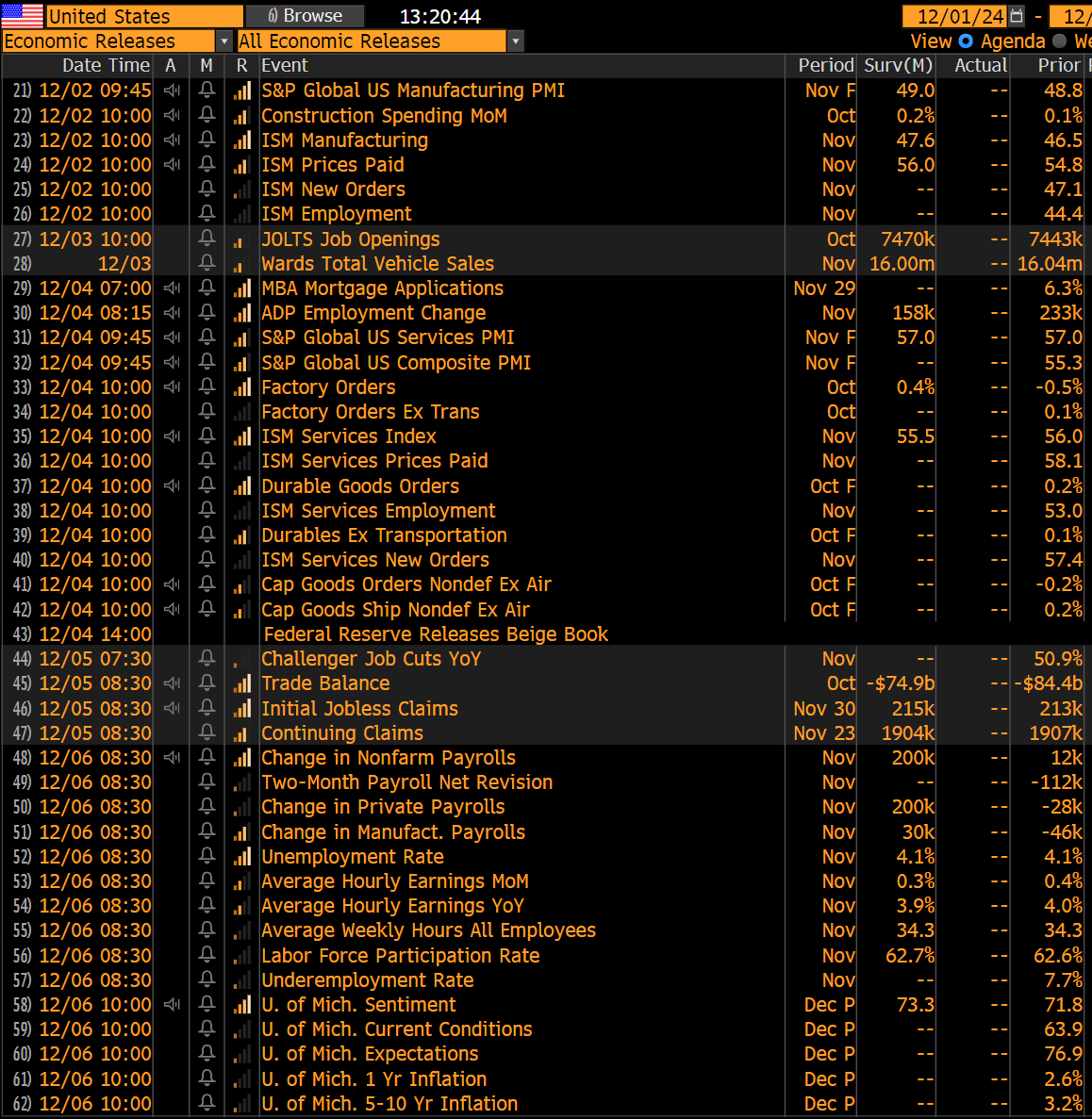

The week ahead will be very busy with the main macro events scheduled for this week: the US manufacturing ISM for November on Monday, the US services ISM for November on Wednesday, the US Beige Book on Wednesday, the OPEC+ meeting on Thursday, and the US jobs report for November on Friday. This week’s US economic data will determine if the Fed cuts again in December. As of now, I believe the Fed will pause, especially with the equity markets frothy and bond yields moderating off recent highs. The markets have it a little above a 50% odds of a cut.

A bunch of Fed speakers are on the calendar this week, the most important of which could be Waller on Monday at 3:15 pm ET (Goolsbee, Hammack, and Daly are due to deliver remarks after the jobs report on Friday, and then the FOMC will be in a quiet period ahead of the 12/18 decision). The Street anticipates OPEC+ deferring its planned production increase once again, given tepid demand and plentiful non-OPEC supplies.

For earnings, the significant reports include: Monday postmarket: ZS; Tuesday postmarket: CRM, MRVL, OKTA; Wednesday premarket: CHWY, CPB, DLTR, FL, HRL; Wednesday postmarket: AEO, FIVE, PVH; SNPS; Thursday premarket: DG, KR; and Thursday postmarket: DOCU, GTLB, HPE, LULU, ULTA, VEEV, VSCO. Several analyst meetings are on the calendar this week, including Tuesday AFL and AT&T, Wednesday EW and HOOD, and Thursday CSGP and TSCO.

Several sell-side conferences are scheduled, including Citigroup Basic Materials, Citigroup Global Healthcare, Morgan Stanley Consumer Retail, Piper Sandler Healthcare, UBS Global Industrials & Transports, and UBS Global TMT, providing an opportunity for companies to give an update on CQ4 business trends. In addition, the Amazon re:Invent conference takes place Dec 2-6 (investors should expect Amazon to talk up its proprietary AI chips along with the firm’s recent Anthropopic partnership).

Weekend News

- Republicans like Biden’s Inflation Reduction Act as it funnels money into red states and as a result, there likely aren’t enough votes in Congress to repeal it (and the Chips Act isn’t going to be scrapped either) WSJ

- Canadian PM Justin Trudeau flew to Mar-a-Lago on Friday for a meeting with Trump in an effort to ease trade/tariff tensions with the incoming US administration WSJ

- China’s NBS PMIs for November were mixed, with manufacturing coming in a bit better at 50.3 (up from 50.1 in October and ahead of the consensus forecast of 50.2) while non-manufacturing dipped to 50 (down from 50.2 in October and below the consensus forecast of 50.3) WSJ

- Zelensky suggests he is willing to allow Russia to keep the territory it presently controls in Ukraine in exchange for Kyiv being admitted into NATO Sky News

- Alphabet was the subject of negative profile article in the WSJ, with the report detailing the multitude of competitive threats facing the firm’s core search franchise, not the least of which is share loss to Amazon, AI products, and others WSJ

- Trump’s Plans Risk Inflating Bullish Stock Market Into a Bubble Bloomberg

- Stellantis CEO Tavares to Step Down From Jeep, Fiat Maker

Monday’s note will focus on all the major sector ETFs. Tuesday’s note will have one sector with five longs and five short ideas. We’re changing some of the formatting and scheduling you’ll notice starting this week. More to come throughout December.

Here are unlocked Currency and Commodity weekly notes. We will have them unlocked all of December. They really are easy to get through and give a decent macro view of the landscape. One of our subscribers stated that they have helped him identify moves in other macro markets like equities and bonds. We have offered these add-on subscription for just $250 a year, a discounted rate that more and more people have requested we add to their subscriptions. Just send an email and we’ll take care of it for you. Thank you for your support.

Charts we are watching

A longer term look at the S&P futures 240 minute time frame with pending Sell Setup possible for the 9 on Monday. Several 9’s have worked well at recent inflection points.

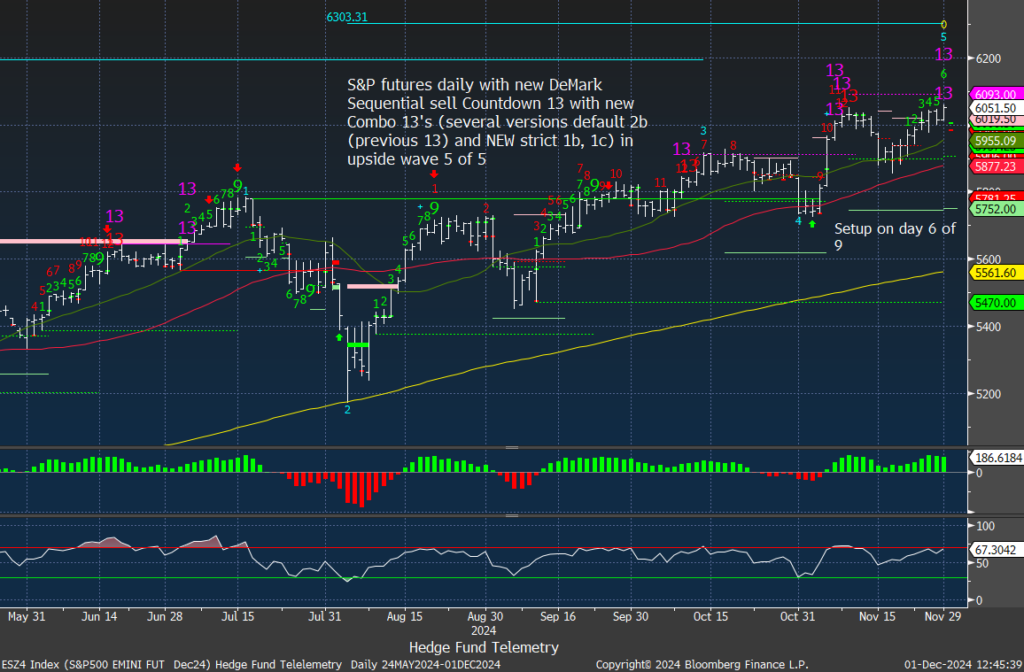

S&P futures daily did qualify the 13’s with the two most strict versions of the Combo indicator on Friday. I believe Tom DeMark was anticipating these 13’s with the non-default Combo setting.

Nasdaq 100 futures 240 minute time frame shows a new sell Setup 9.

Nasdaq 100 futures remain below recent highs.

Advance decline data spiked higher and reversed late in the week.

The percentage of S&P stocks above the 20 and 50 day remain elevated and the biggest frustration and shock to me has been the lack of oversold readings with the 20 and 50 day all year. This is very odd action that I can’t recall happening… ever.

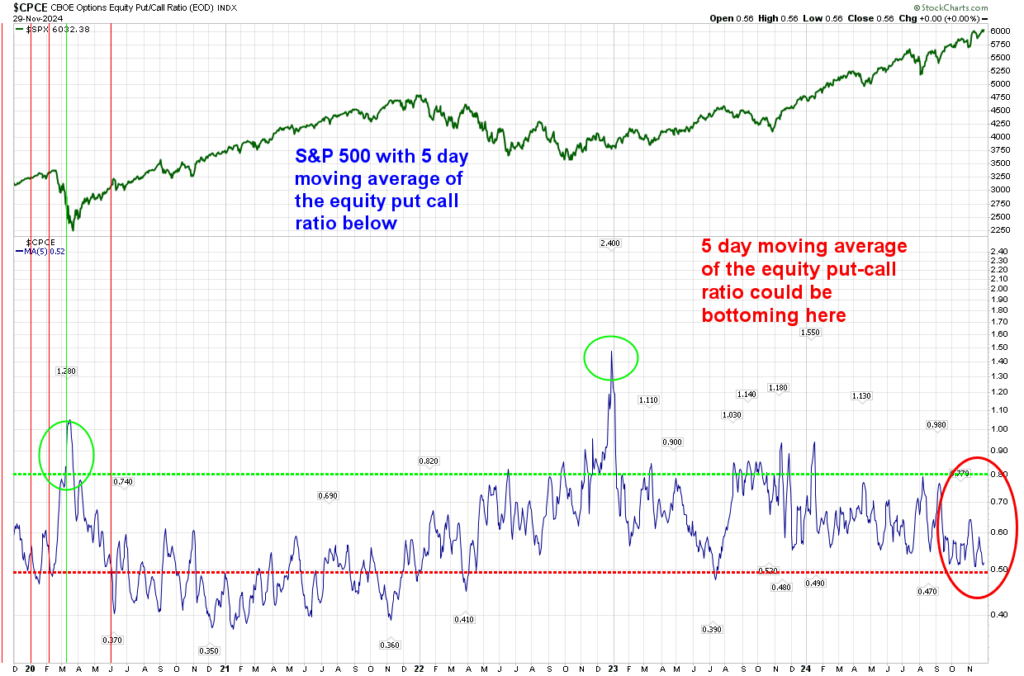

The equity put call ratio 5 day moving average continues to show heavy call buying and this isn’t ideal place to be adding new long exposure. I would like to see a spike in put buying for a better buying opportunity.

Decent reversal with US 10 year yield (other durations look similar as I have shown recently)

US economic data for a very busy week

KEY MARKET SENTIMENT

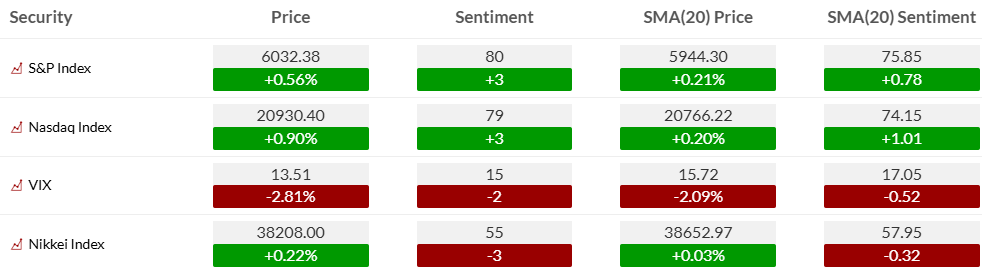

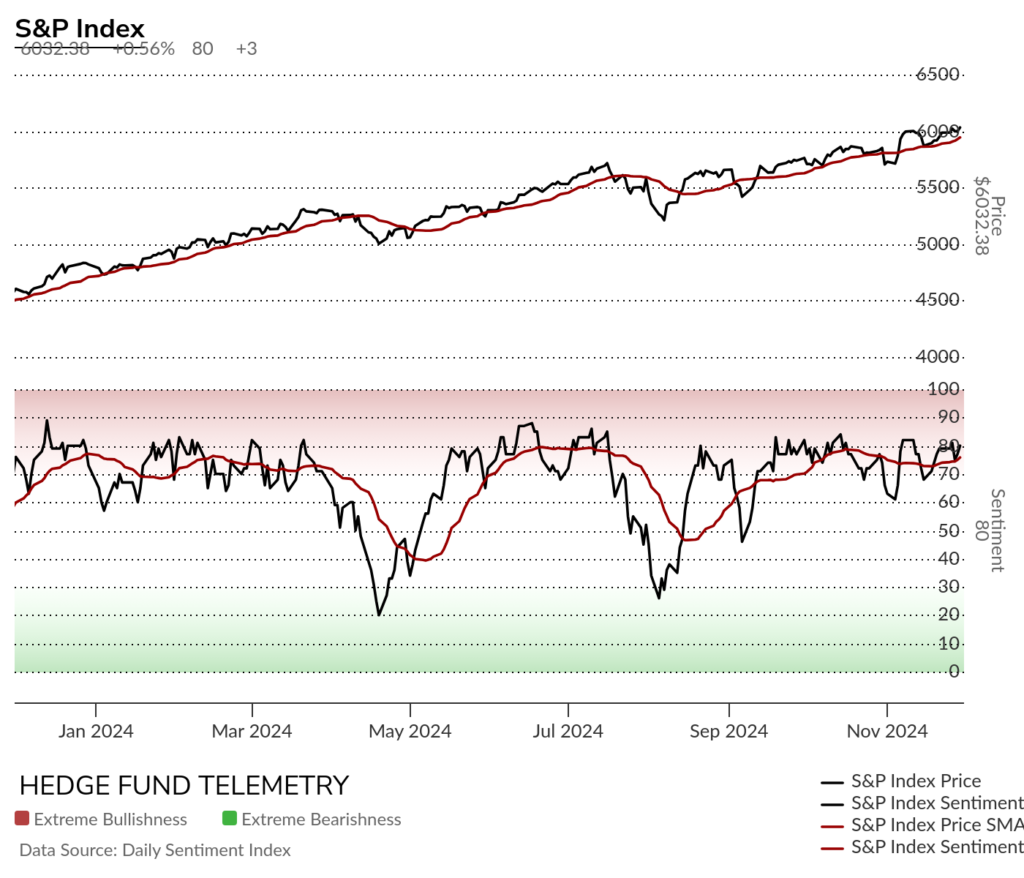

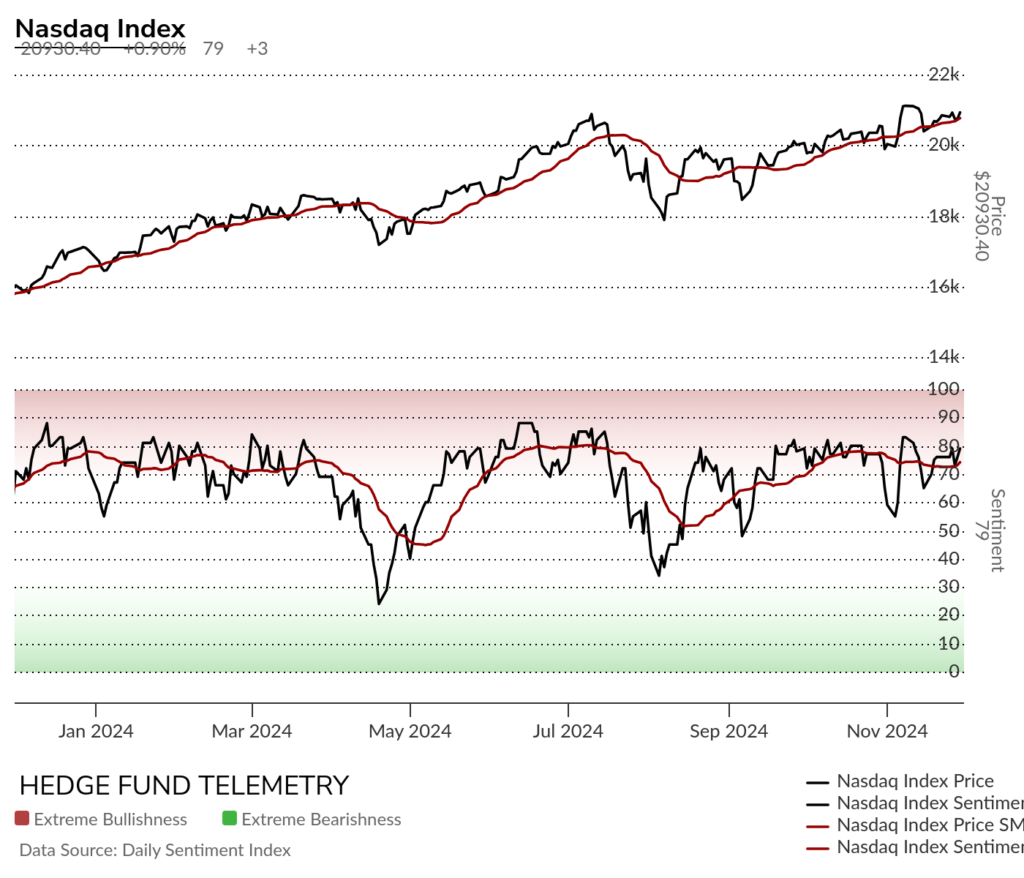

Equity bullish sentiment remain extreme/elevated.

S&P and Nasdaq bullish sentiment continue to hold recent lows ~60%

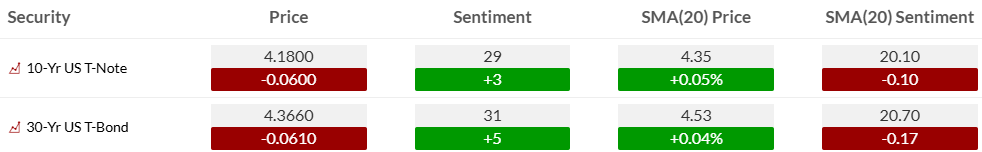

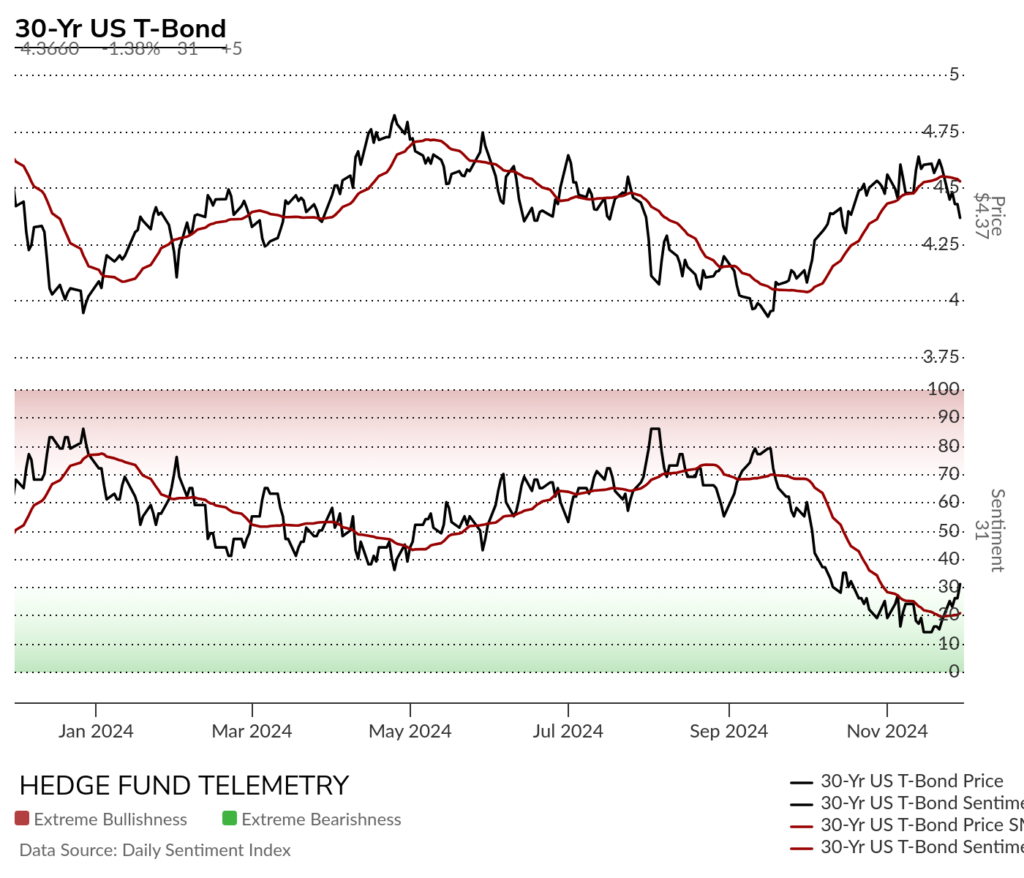

Bond bullish sentiment continued to reverse higher. Good for our 5% long bond weighting.

Currency bullish sentiment with US Dollar bullish sentiment backing off with decent reversals on Dollar crosses too after extreme sentiment readings. More on the Currency weekly note.

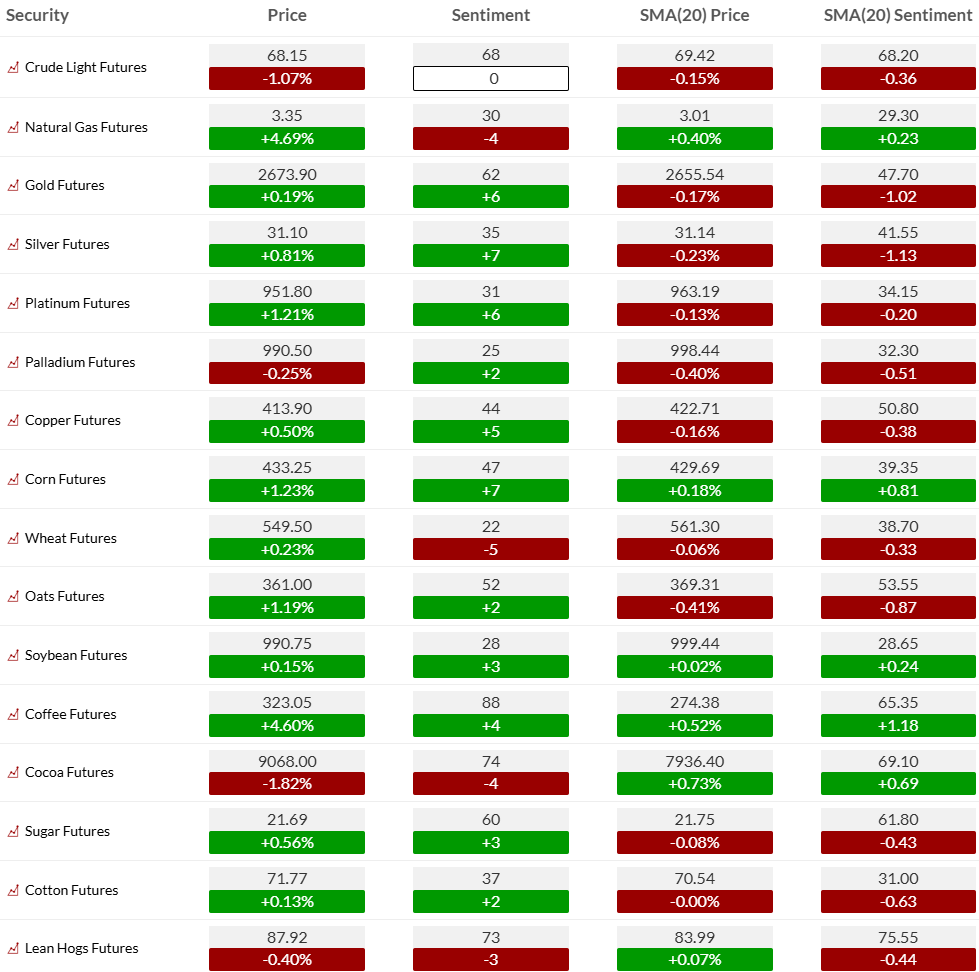

Commodity bullish sentiment mixed action. More detail on Commodity weekly note

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 02-Dec:

- Corporate:

- Earnings:

- Pre-open: IMPP

- Post-close: CRDO, ZS

- Analyst/Shareholder Events: APGE, NVTS

- Brokerage Conference:

- Radiological Society of North America Meeting

- BTIG Ophthalmology Day

- Citizens JMP Hematology and Oncology Summit

- Macquarie China Automation Day

- Scotiabank Mining Conference

- UBS Global TMT Conference

- WOOD Winter Wonderland EMEA Conference

- Berenberg European Conference

- Goldman Sachs Industrials and Materials Conference

- Earnings:

- Economic

- US: PMI Manufacturing Final, Construction Spending, ISM Manufacturing Index

- Europe: Retail Sales y/y, Retail sales y/y, Manufacturing PMI, SVME PMI, Unemployment Rate, GDP y/y

- Asia: CPI y/y

- Corporate:

- Tuesday 03-Dec:

- Corporate:

- Earnings:

- Pre-open: CNM, CTRN, DCI, REX

- Post-close: BASE, BOX, CRM, CURV, DSGX, MRVL, NOTV, OKTA, PSTG

- Analyst/Shareholder Events: AFL, THRY, ABUS, T, FBRX, HSII, PATK

- Brokerage Conference:

- Radiological Society of North America Meeting

- Macquarie China Automation Day

- Scotiabank Mining Conference

- UBS Global TMT Conference

- WOOD Winter Wonderland EMEA Conference

- Berenberg European Conference

- Goldman Sachs Industrials and Materials Conference

- BofA European Materials Conference

- Noble Capital Market Emerging Growth Equity Conference

- Wells Fargo TMT Summit

- UBS Global Real Estate CEO/CFO Conference

- Bank of America Leveraged Finance Conference

- Redburn CEO Conference

- Morgan Stanley Global Consumer & Retail Conference

- Citi Basic Materials Conference

- Citi Global Healthcare Conference

- Piper Sandler Healthcare Conference

- JP Morgan Brazil Opportunities Conferece

- Barclays Eat, Sleep, Play, Shop Conference

- Mines and Money Conference

- Evercore ISI HealthCONx Conference

- Earnings:

- Economic

- US: JOLTS, Redbook Chain Store, API Crude Inventories

- Europe: CPI y/y, Final GDP q/q, Unemployment Change, Final GDP y/y

- Corporate:

- Wednesday 04-Dec:

- Corporate:

- Earnings:

- Pre-open: CHWY, CPB, DAKT, DLTR, FL, GOTU, HRL

- Post-close: AEO, AVAV, CHPT, CULP, CXM, DLHC, FIVE, GEF, IDT, LAKE, NCNO, OOMA, PVH, S, SGU, SNPS, VRNT

- Analyst/Shareholder Events: HOOD, MARA, UNH, EW, CBT, AVNT, ACIC

- Brokerage Conference:

- Radiological Society of North America Meeting

- Scotiabank Mining Conference

- UBS Global TMT Conference

- WOOD Winter Wonderland EMEA Conference

- Berenberg European Conference

- Goldman Sachs Industrials and Materials Conference

- Wells Fargo TMT Summit

- UBS Global Real Estate CEO/CFO Conference

- Bank of America Leveraged Finance Conference

- Redburn CEO Conference

- Morgan Stanley Global Consumer & Retail Conference

- Citi Basic Materials Conference

- Citi Global Healthcare Conference

- Piper Sandler Healthcare Conference

- JP Morgan Brazil Opportunities Conferece

- Barclays Eat, Sleep, Play, Shop Conference

- Mines and Money Conference

- Evercore ISI HealthCONx Conference

- UBS Global Industrials and Transportation Conference

- Bank of America European Chemicals Conference

- Nuvama PCG Emerging Ideas Conference

- International Investment Forum

- Emerging Growth Conference

- Reuters Energy Transition North America 2024

- Jefferies – Renewables & Clean Energy Conference – in person

- ROTH – 7th Annual Sustainability Private Capital Event

- Wolfe Research Small and Mid-Cap Conference

- Elara India Conference

- Jefferies Renewables & Clean Technology Conference

- Society of Urologic Oncology Meeting

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, ADP Employment Report, PMI Services Final, Factory Orders, ISM Non-Manufacturing Index, DOE Crude Inventories

- Europe: PPI y/y, Unemployment Rate

- Asia: Final GDP y/y

- Corporate:

- Thursday 05-Dec:

- Corporate:

- Earnings:

- Pre-open: BBW, BF.B, CAL, CRMT, CSIQ, DG, DLTH, GMS, HOFT, HOV, KFY, KR, LE, MEI, MOV, PDCO, SAIC, SIG, TOUR, WLY

- Post-close: AGX, AOUT, ASAN, COO, DOCU, DOMO, GTLB, GWRE, HPE, IOT, LULU, PATH, RBRK, SWBI, TLYS, ULTA, VEEV, VSCO, WOOF, ZUMZ

- Analyst/Shareholder Events: SHLS, CSGP, PRCH, TSCO

- Brokerage Conference:

- Radiological Society of North America Meeting

- Berenberg European Conference

- Goldman Sachs Industrials and Materials Conference

- Citi Global Healthcare Conference

- Piper Sandler Healthcare Conference

- JP Morgan Brazil Opportunities Conferece

- Barclays Eat, Sleep, Play, Shop Conference

- Mines and Money Conference

- Evercore ISI HealthCONx Conference

- Reuters Energy Transition North America 2024

- Jefferies – Renewables & Clean Energy Conference – in person

- ROTH – 7th Annual Sustainability Private Capital Event

- Wolfe Research Small and Mid-Cap Conference

- Elara India Conference

- Jefferies Renewables & Clean Technology Conference

- Society of Urologic Oncology Meeting

- Janney Clean Energy Investment Symposium

- Morgan Stanley Business Services, Leisure & Transport Conference

- Sidoti Small Cap Virtual Investor Conference

- IIFL Investor Conference

- OTC Markets Group Inc Small Cap Growth Virtual Investor Conference

- Jefferies GEMS Dubai Conference

- Jefferies Kyoto Summit

- Bank of America Clean Energy Symposium

- Earnings:

- Economic

- US: Challenger Job Cuts, Trade Balance, Ivey PMI, Initial Jobless Claims, Continuing Claims, EIA Natural Gas Inventories

- Europe: Unemployment rate (sa), Factory Orders m/m, Manufacturing Turnover (sa) m/m, Industrial Production m/m, Construction PMI, Retail Sales y/y

- Asia: Retail Sales Nominal NSA Y/Y, Real Household Consumption Expenditure y/y, Real Household Income y/y

- Corporate:

- Friday 06-Dec:

- Corporate:

- Earnings:

- Pre-open: GCO, KIRK, SNYR

- Analyst/Shareholder Events: CPRT, ASBFY, PINC, WNDLF, NOAH, ASBFF, HRGLF, VBVBF, VTRS, GRAB, AFBOF

- Brokerage Conference:

- Evercore ISI HealthCONx Conference

- Jefferies Renewables & Clean Technology Conference

- Society of Urologic Oncology Meeting

- Jefferies GEMS Dubai Conference

- Jefferies Kyoto Summit

- Bank of America Clean Energy Symposium

- Jefferies Renewables & Clean Energy Conference – Webinar

- American Epilepsy Society Meeting

- Wolfe Research Badishkanian Small Group/1×1 December Conference

- Earnings:

- Economic

- US: Nonfarm Payrolls, Unemployment Rate, Average Weekly Hours, Average Hourly Earnings, Employment, Michigan Consumer Sentiment (Preliminary), Consumer Credit

- Europe: Manufacturing Production (s.a.) m/m, Industrial Production m/m, Halifax House Prices y/y, Trade Balance, Retail Sales y/y, Final GDP y/y, GDP y/y

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.