TOP EVENTS AND CATALYSTS

This week’s key macro events are China’s inflation numbers for November tonight; the consensus is looking for a modest acceleration in the CPI to +0.5% vs. +0.3% in October, China’s import/export figures for November Monday night. The RBA decision is Monday night; rates are expected to stay on hold); the most watched US report will be the US CPI for November Wednesday. Consensus is looking for a small uptick in headline to +2.7% vs. +2.6% in October, with a modest downtick in core to +3.2% to +3.3% in October. The Bank of Canada rate decision Wednesday; the consensus is expecting a ~50bps rate cut. Brazil’s rate decision Wednesday with consensus expecting a 75bps hike to 12%, the SNB rate decision Thursday with consensus expecting a ~37bps cut, the ECB rate decision is on Thursday morning; with a 25bps rate cut expected, and the US PPI for November on Thursday. In addition, China’s Central Economic Work Conference, at which officials will discuss economic targets and stimulus plans for 2025, will commence on Wednesday. The Fed will be in a quiet period ahead of the December 18 FOMC decision. Expect the WSJ whisper stories later this week after the CPI.

The important earnings reports for this week are: Monday postmarket: MDB, MTN, ORCL, TOL; Tuesday postmarket: ASO, AZO, OLLI; Wednesday postmarket: ADBE; and Thursday postmarket: AVGO, COST. This week’s major sell-side conferences include: Barclays Global Tech, Goldman Financial Services, and Raymond James TMT and Consumer.

Here are unlocked Currency and Commodity weekly notes. I’m unlocking for all in December. This is an add-on subscription that we give a big discount for current Hedge Fund Telemetry Subscribers of just $250 a year. These are great notes that take a considerable amount of time to analyze and put together and are easy to go through, and can help with not just a macro view but a micro view too with equity and bond market backdrops. There are also ideas on the notes that many have taken advantage of too. If you want to add these notes to your subscription, email us.

Weekend News

- Trump, in his NBC Meet the Press interview said he would extend the tax cuts from his first term, fulfill a campaign promise to impose tariffs, allow Powell to serve out his term as Fed chair, and vowed to leave entitlement programs untouched NBC News

- Rebel forces in Syria continued their stunning advance throughout the country, capturing Damascus on Sunday and effectively overthrowing the Assad government while delivering a major blow to its primary patrons, Iran and Russia.

- Trump called for an immediate ceasefire in Ukraine following his meeting with Zelensky in Paris, claiming Kyiv “would like to make a deal” ABC

- South Korea’s president survived an impeachment attempt Sat after the ruling party largely boycotted the vote, but Yoon Suk Yeol will no longer conduct the affairs of the state as talks take place on his exit from power FT

- APO (Apollo) and WDAY (Workday) will join the S&P 500 prior to the open of trading on Monday 12/23, replacing QRVO (Qorvo) and AMTM (Amentum); SMCI (Supermicro) received an extension from the Nasdaq and now has until February 25th to file its 10K.

Charts we are watching

The S&P monthly chart has new DeMark Sequential and Combo sell Countdown 13’s in play with RSI >80. The steepness of this move which has not had any meaningful correction creates a risk going forward with the elevated sentiment and positioning. This is an unsustainable steep upside move that gives me a lot of confidence going into 2025 for a contrarian. Everytime there has been 13’s on monthly time frame there has been periods of consolidation some moves larger than others. I added a DeMark retracement indicator on this chart and the 0.382 retracement is 3645. As much as that may seem completely impossible other times that level has been achieved. The TDST support is at 4546. I believe a balance under 5000 is very possible in 2025.

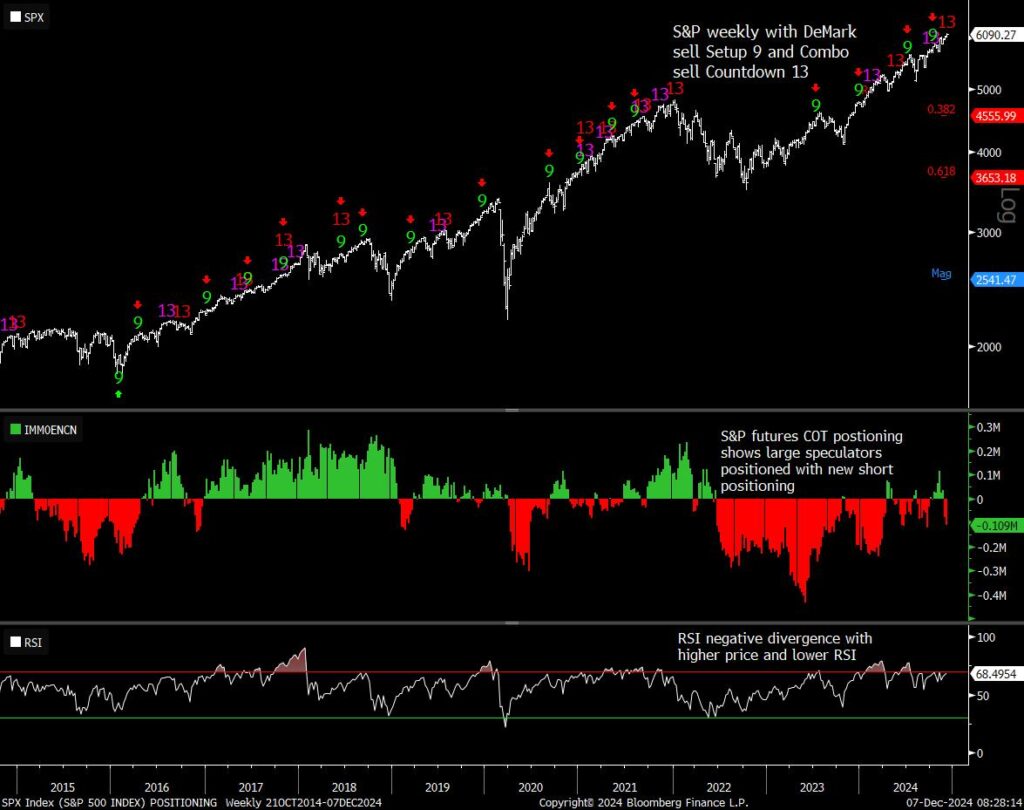

The S&P weekly also has a new Sequential and Combo sell Countdown 13’s. These sisngals have seen reversals albeit nominal and short lived. COT positioning with large specs have turned while the RSI has been lower – another divergence

I ran the DeMark retracement from the 2021 highs and the downside 0.382 retracement was achieved off the highs.

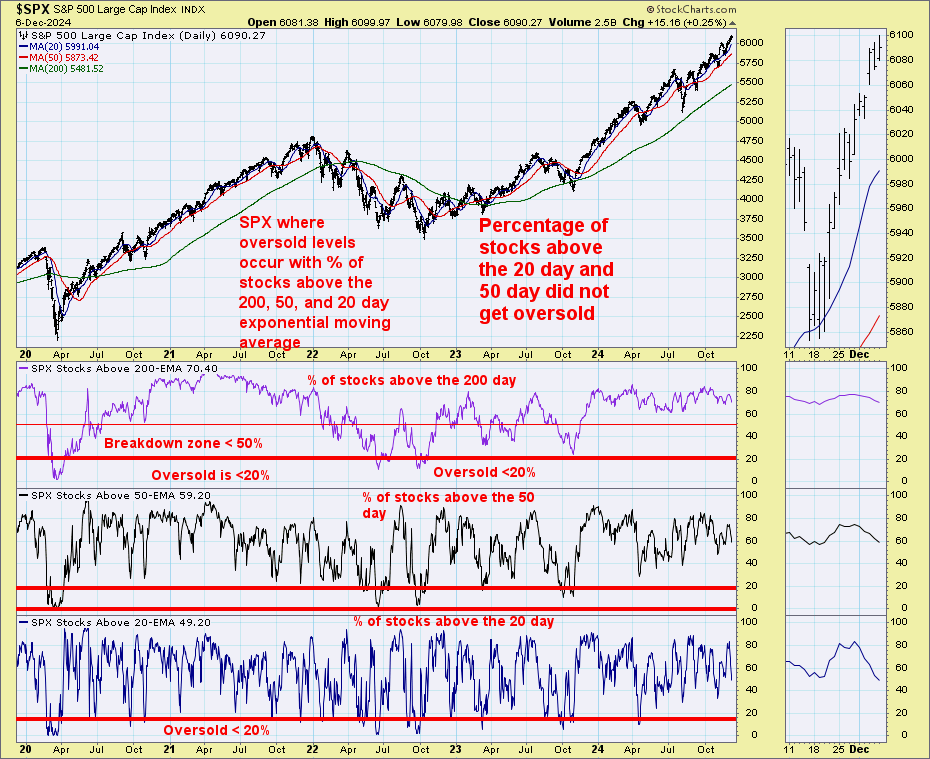

Two charts show internals weakening while the index increases. These divergences have been frustrating to watch,, but all markets find a balance.

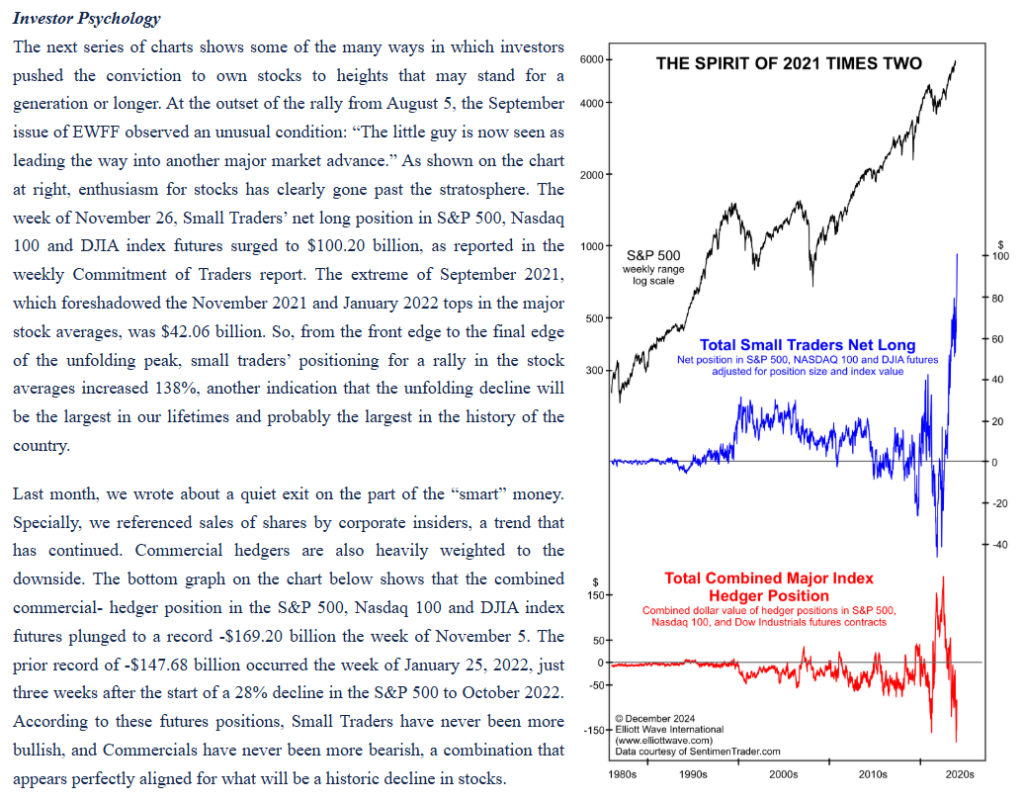

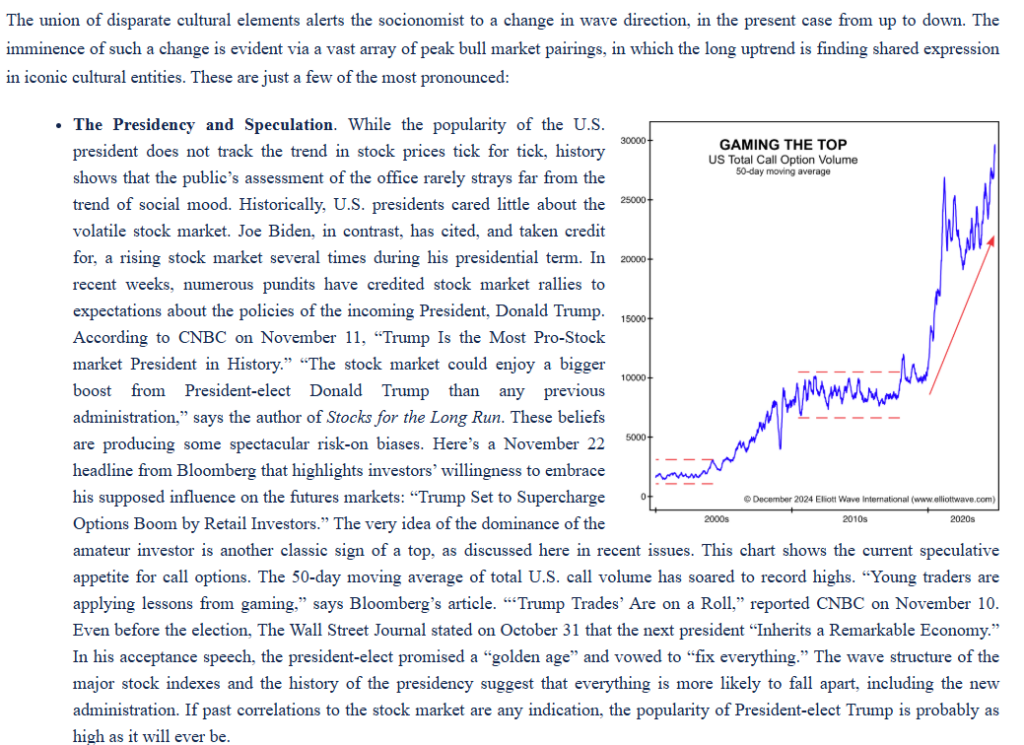

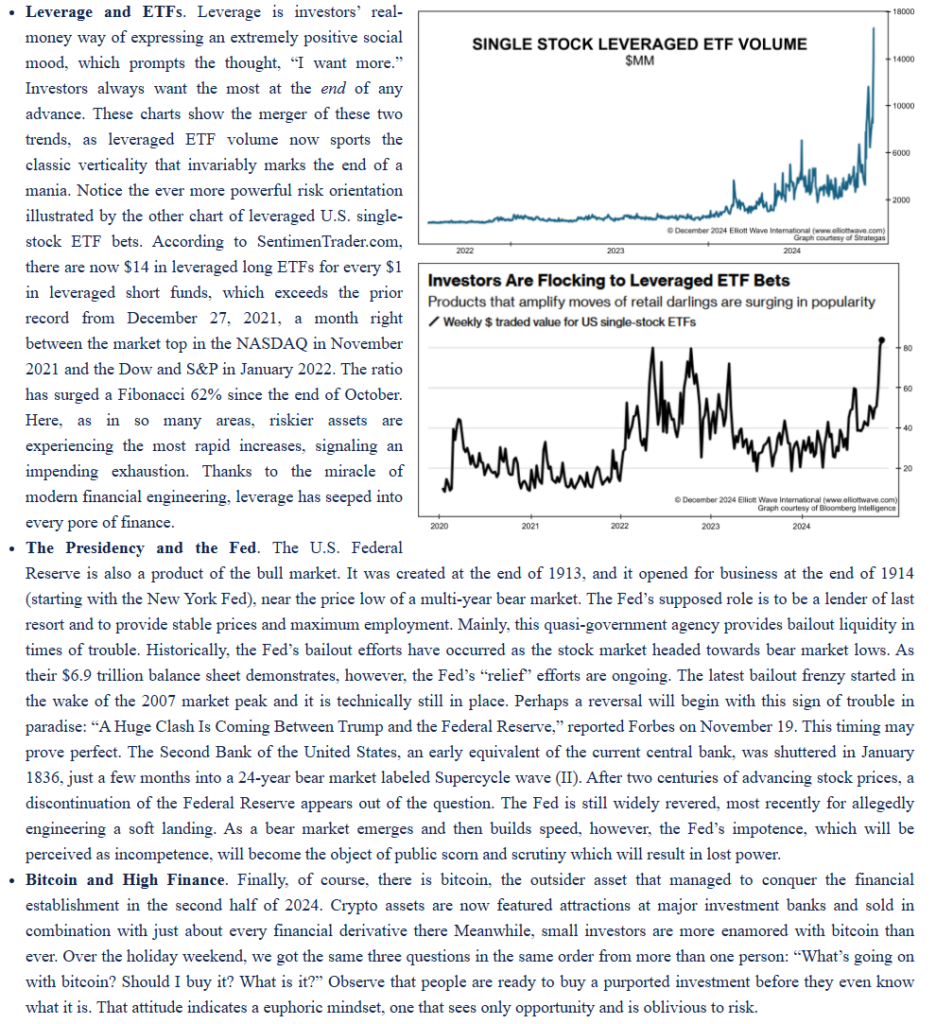

excerpt from Elliott Wave financial forecast

Steve at Elliott Wave posted some thoughts and charts on the signs of excessive speculation. This time is different—it’s incredibly dangerous.

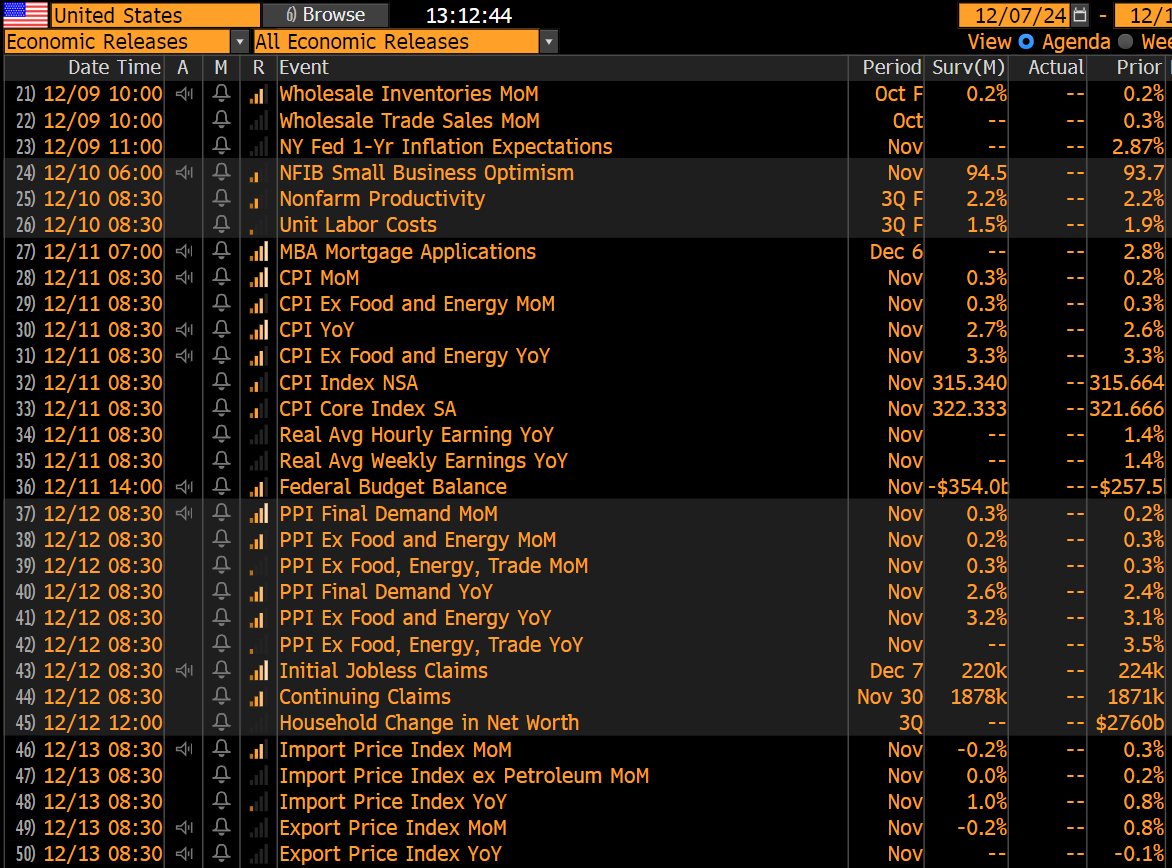

US economic data for the week

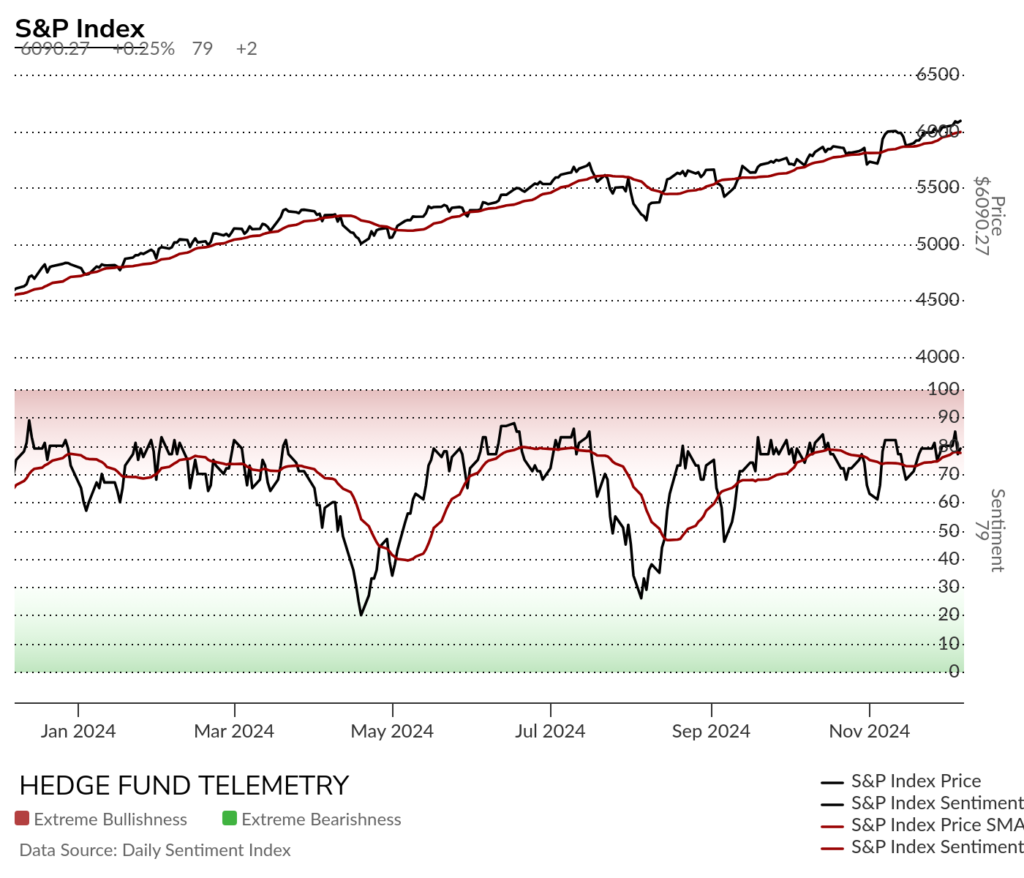

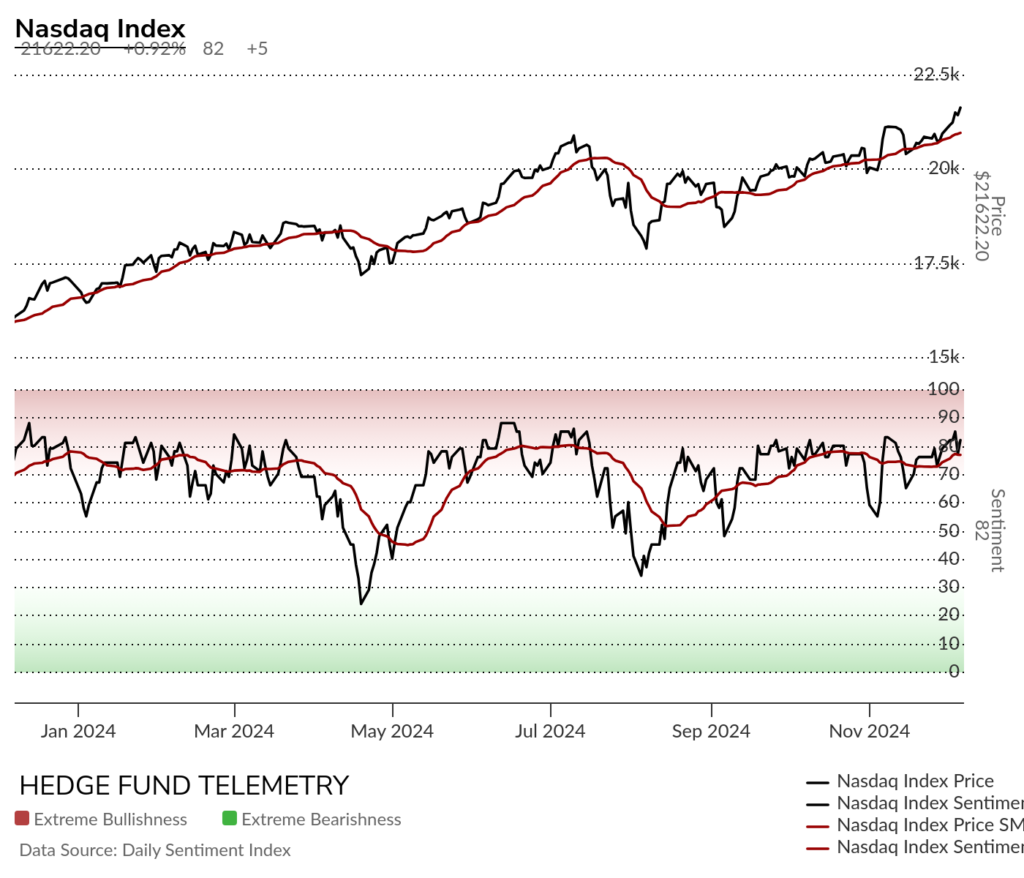

KEY MARKET SENTIMENT

Equity bullish sentiment

S&P and Nasdaq bullish sentiment remains elevated to extreme.

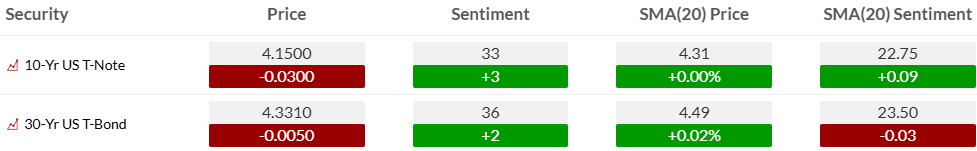

Bond bullish sentiment still ticking a little higher

Currency bullish sentiment with US Dollar and Bitcoin bullish sentiment remaining very strong and overbought with 20 day moving average of bullish sentiment in the extreme zone.

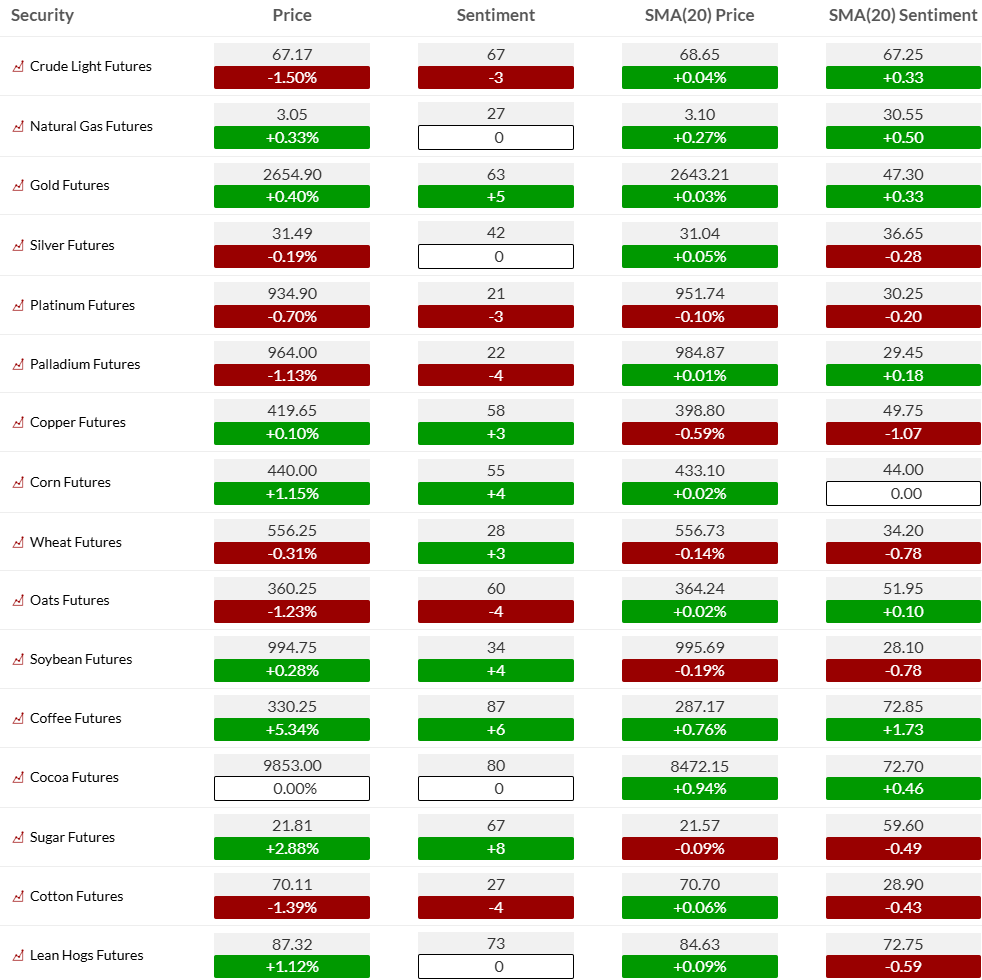

Commodity bullish sentiment with mixed action. More details on the Commodity weekly

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 09-Dec:

- Corporate:

- Earnings:

- Pre-open: MOMO, RENT

- Post-close: AI, BRZE, CASY, GNSS, HQY, MDB, MTN, ORCL, PHR, PL, TOL, YEXT

- Analyst/Investor Events: SLG

- Brokerage Conference:

- American Epilepsy Society Meeting

- Wolfe Research Badishkanian Small Group/1×1 December Conference

- American Society of Hematology Conference

- TD Cowen Human Capital Management Summit

- Wolfe Research Reshoring Conference

- UBS Global Media & Communications Conference

- Bank of America Home Care Conference

- Raymond James TMT and Consumer Conference

- Macquarie Asia Conference

- Stifel MedTech Madness West Coast Bus Tour

- Earnings:

- Economic

- US: Wholesale Inventories

- Europe: PPI y/y, Sentix Economic Index, Industrial Production m/m

- Asia: Trade Balance

- Corporate:

- Tuesday 10-Dec:

- Corporate:

- Earnings:

- Pre-open: ASO, AZO, DBI, FERG, GIII, HEPS, HUIZ, IPA, JOUT, LITB, MNY, OLLI, UNFI, VNCE

- Post-close: LPTV, MAMA, MIND, PLAY, SFIX, SKIL, SPWH

- Analyst/Investor Events: ALK, ASH, GEV, GHC, GRPN, HLF, IQV, LGND, MFC, PHIO, SJM, TCRX, TMDX, TRMB, TRML

- Brokerage Conference:

- American Epilepsy Society Meeting

- Wolfe Research Badishkanian Small Group/1×1 December Conference

- American Society of Hematology Conference

- Wolfe Research Reshoring Conference

- UBS Global Media & Communications Conference

- Bank of America Home Care Conference

- Raymond James TMT and Consumer Conference

- Macquarie Asia Conference

- Stifel MedTech Madness West Coast Bus Tour

- Citi Consumer Conference

- Mizuho Power, Energy & Infrastructure Conference

- Capital One Securities Energy Conference

- BTIG Virtual Software Forum

- NH Cyber Security Corporate Day

- Scotiabank Global Technology Conference

- Jefferies Real Estate Conference

- Nasdaq Investor Conference

- Wells Fargo Midstream, Energy & Utilities Symposium

- Goldman Sachs U.S. Financial Services Conference

- iAccess Alpha Best Ideas Winter Conference

- San Antonio Breast Cancer Symposium

- Earnings:

- Economic

- US: NFIB Small Business Index, Productivity (revised), Unit Labor Costs (revised), Redbook Chain Store, API Crude Inventories

- Europe: CPI y/y, Manufacturing Production y/y, Industrial Production y/y, Industrial Production m/m, Industrial Production y/y (wda)

- Asia: Unemployment Rate, CGPI y/y

- Corporate:

- Wednesday 11-Dec:

- Corporate:

- Earnings:

- Pre-open: BZ, CGNT, PLAB, REVG, VRA, WDH

- Post-close: ADBE, JILL, NDSN, OXM

- Analyst/Investor Events: CNSP, GEF, JBTC, LOW, MTCH

- Brokerage Conference:

- Wolfe Research Badishkanian Small Group/1×1 December Conference

- Raymond James TMT and Consumer Conference

- Macquarie Asia Conference

- Stifel MedTech Madness West Coast Bus Tour

- Jefferies Real Estate Conference

- Nasdaq Investor Conference

- Wells Fargo Midstream, Energy & Utilities Symposium

- Goldman Sachs U.S. Financial Services Conference

- iAccess Alpha Best Ideas Winter Conference

- San Antonio Breast Cancer Symposium

- Benchmark Discovery Conference

- IBF Securities Investor Conference

- Craig-Hallum Nuclear Energy Revisited Conference

- Barclays Global Technology Conference

- Oppenheimer Midwest Summit

- ROTH Deer Valley Conference

- Melius Research Conference

- European Society for Medical Oncology Immuno-Oncology Congress

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, CPI, Hourly Earnings, Average Workweek, Treasury Monthly Budget, DOE Crude Inventories

- Canada: Interest Rate Announcement

- Europe: Final CPI y/y

- Corporate:

- Thursday 12-Dec:

- Corporate:

- Earnings:

- Pre-open: ALOT, CIEN, LEE, LIVE, LQDT

- Post-close: AVGO, COST, GTIM, NX

- Analyst/Investor Events: ABSI, CHRW, CNC, GSAT, INCY, KAI, OLN, PZZA, UA, ZYME

- Brokerage Conference:

- Wolfe Research Badishkanian Small Group/1×1 December Conference

- Stifel MedTech Madness West Coast Bus Tour

- San Antonio Breast Cancer Symposium

- Barclays Global Technology Conference

- Oppenheimer Midwest Summit

- ROTH Deer Valley Conference

- Melius Research Conference

- European Society for Medical Oncology Immuno-Oncology Congress

- Singular Research Best of the Uncovereds Conference

- Northland Growth Conference

- Macquarie Ad Tech C-Suite Virtual Day

- Oppenheimer Movers in Rare Disease Summit

- Syndicate: Service Titan (+TTAN) IPO 8.8M shares expected to price between $52-$57, ~$480M raise

- Earnings:

- Economic

- US: PPI, Weekly Jobless Claims, EIA Natural Gas Inventories

- Canada: Building Permits

- Europe: CPI y/y

- Asia: Tankan Manufacturing Index, Tankan Non-Manufacturing Index, Industrial Production m/m (revised)

- Corporate:

- Friday 13-Dec:

- Corporate:

- Analyst/Investor Events: AFRM

- Brokerage Conference:

- San Antonio Breast Cancer Symposium

- European Society for Medical Oncology Immuno-Oncology Congress

- B&K Indian INC Leaders Conference

- Economic

- US: Export Prices, Import Prices

- Canada: Manufacturing Sales, Wholesale Inventories, Wholesale Trade

- Europe: CPI y/y, Unemployment Rate, Construction Output y/y, Industrial Production y/y, Trade Balance

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.