TOP EVENTS AND CATALYSTS

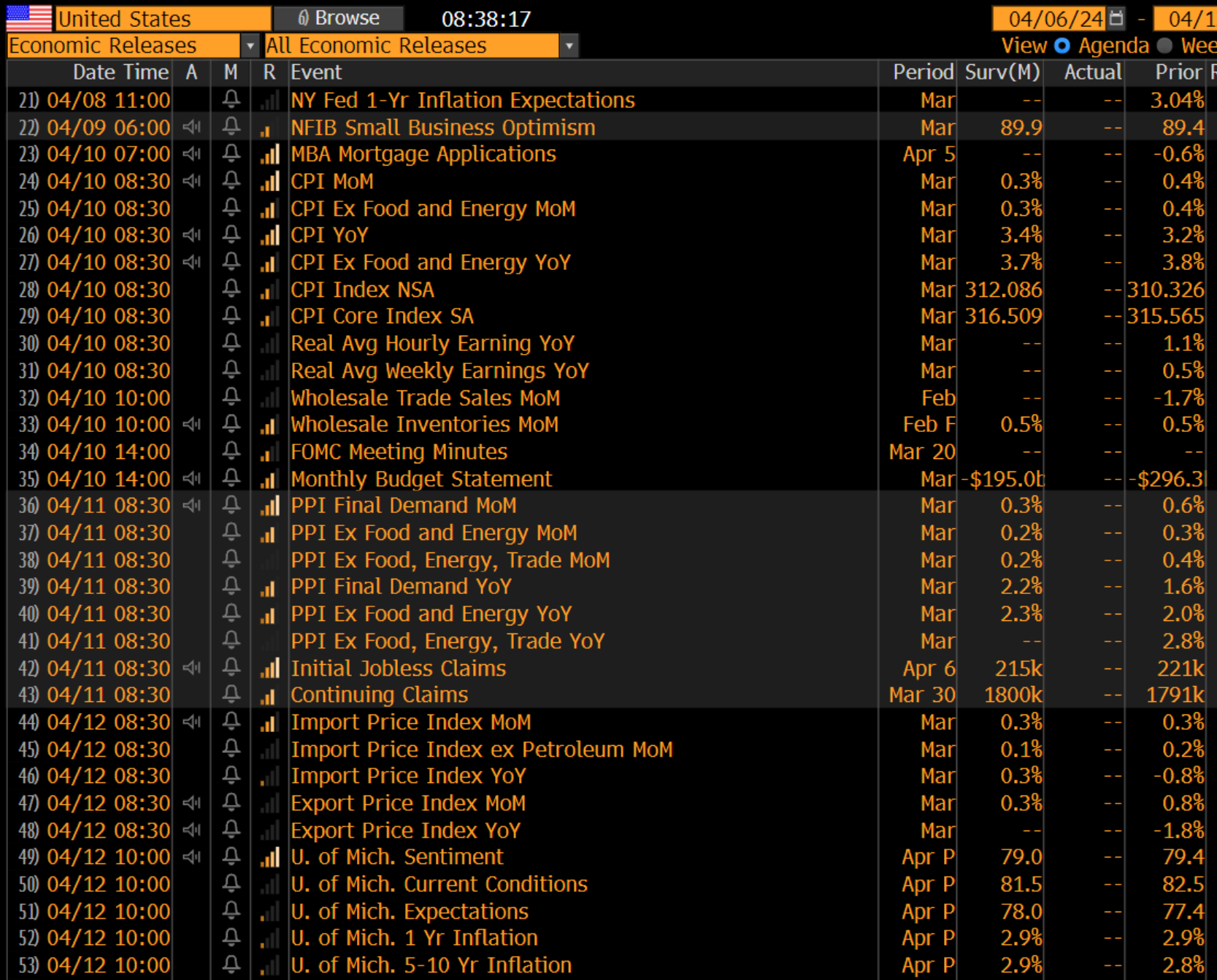

A big week ahead with several important macro events with the main focus on the US CPI inflation data for March on Wednesday morning. The Bank of Canada rate decision and the FOMC meeting minutes on Wednesday, China’s PPI/CPI for March Wedneday night. The ECB policy decision and the US PPI inflation data for March on Thursday morning, and China’s import/exports for March on Thursday night.

The key company-specific catalysts include Google’s Cloud Next conference starts on Tuesday. Q1 earnings start on Wednesday with DAL premarket, COST reports March sales postmarket on Wednesday (this will be watched after the recent soft earnings), Thursday premarket: KMX and bank/financial earnings start Friday with BLK, C, JPM, SST, and WFC. Q1 earnings will ramp up the following week.

Considering the recent positive action with the Commodity markets (with our long DBC ETF) I have unlocked this weekend’s Commodity and Currency weekly notes. These have a lot of value contributing to the overall macro backdrop as our subscribers who have added these two notes to their subscription will tell you. We have a special extra discount for current Hedge Fund Telemetry subscribers to add these both for only $250 for a full year. If you want these added we can enable them for you. Just email us and we’ll set it up for you.

I have a full rundown for tomorrow of all the internals in the market as well a sector focus. Let’s have a great week!

weekend news

- The major news occurred in the Middle East where Israel announced the withdrawal of its ground troop presence in southern Gaza, bringing to an end the active invasion stage of the war. In addition, reports suggest a ceasefire deal in Gaza could be reached in the coming days as negotiations resume in Cairo.

- AI industry faces a “data problem” as it runs out of information to feed its models. Essentially AI companies are finding the internet too small and some companies like META are considering buying publishing companies to expand data to feed into AI models.

- ASML will comply with US demands that it stop servicing some equipment sold to Chinese customers.

- TSLA Elon Musk tweeted after the bell Friday Tesla will unveil its “robotaxi” product on Aug 8, but investors shouldn’t fall for the hype as Tesla’s full self driving remains years away from demonstrating Level 4 autonomy. Tesla has been under severe pressure after reporting horrible delivery numbers which will weigh on earnings in 2024 and 2025. The Reuters story which I think was highly credible about Tesla canceling the next generation Model 2 was vaguely refuted by Elon Musk on Twitter. Expect a bounce with TSLA stock on Monday with limited effectiveness as the pumps vs business weakness reality doesn’t quite do what it used to achieve.

Charts we are watching

The persistance of the move is starting to show signs of stalling as the SPY is nearing the 50 day moving average now only 2.26% above it. March was a choppy month and a break of the 50 day is very possible into April.

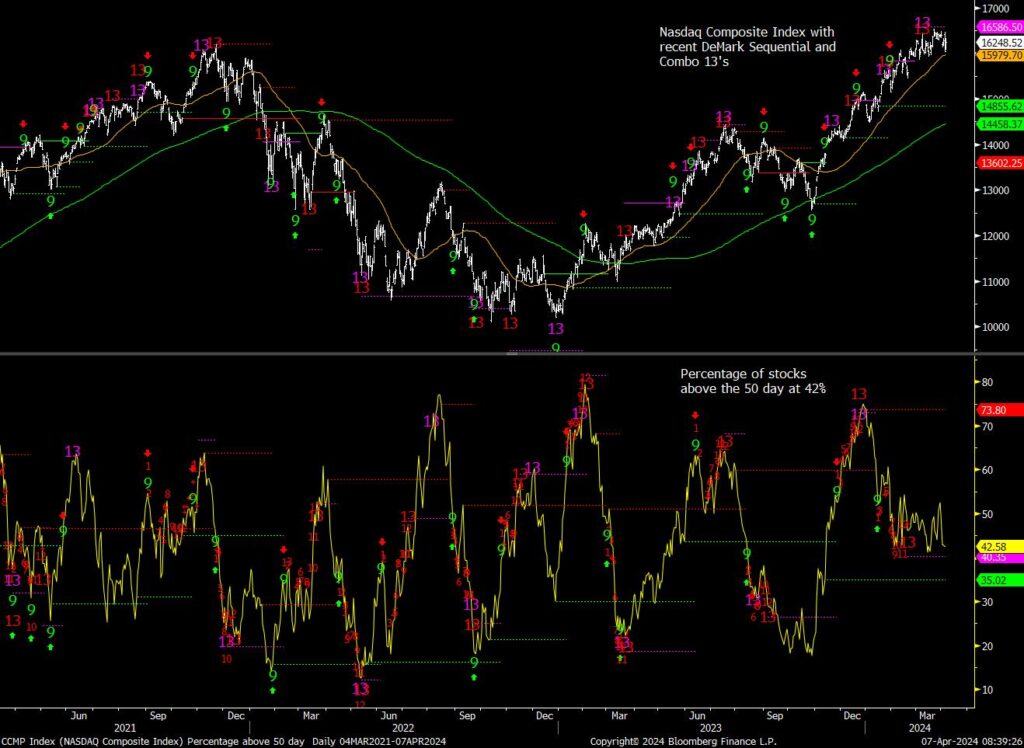

QQQ is only 1% above the 50 day showing more relative weakness vs SPY.

There has been clear negative divergences with the percentage of stocks within the S&P above the 50 day vs the price action. Of course this is due to the mega cap continuing to hold the index higher. This reading at 73% remains overbought and a clear break below 50% and the index breaking below the 50 day would increase the probability of a more meaningful correction.

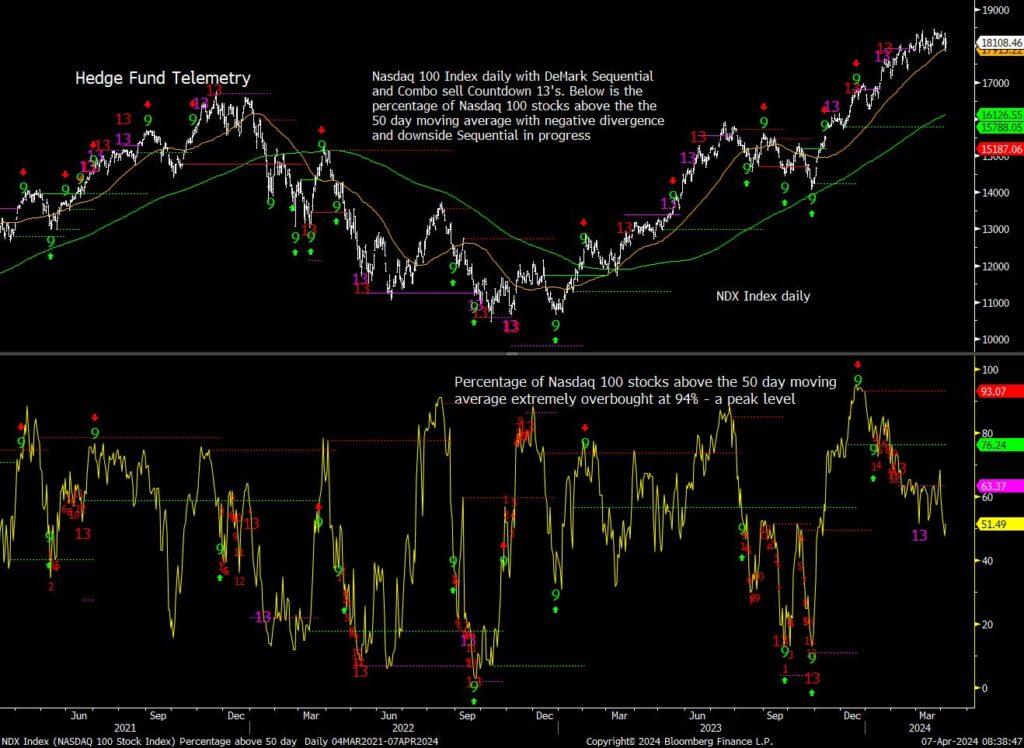

The Nasdaq 100 percentage of stocks above the 50 day fell last week to 51%.

The more broad Nasdaq Composite shows the very clear negative divergence with the percentage of stocks above the 50 day at 42% vs the index price action. Good buying opportunities which I expect occur when these readings get near or under 20%.

DBC Commodity ETF remains in a positive trend on the upside although there are several commodities that can and should consolidate some recent gains. I will continue to hold the 4% sized long position on the Trade Ideas sheet. More details on Commodity Weekly note.

US Dollar Index failed to get through the clear resistance level although there is a pending upside Sequential in progress. I continue to see US Dollar strength.

US economic data for the week – cpi in focus

KEY MARKET SENTIMENT

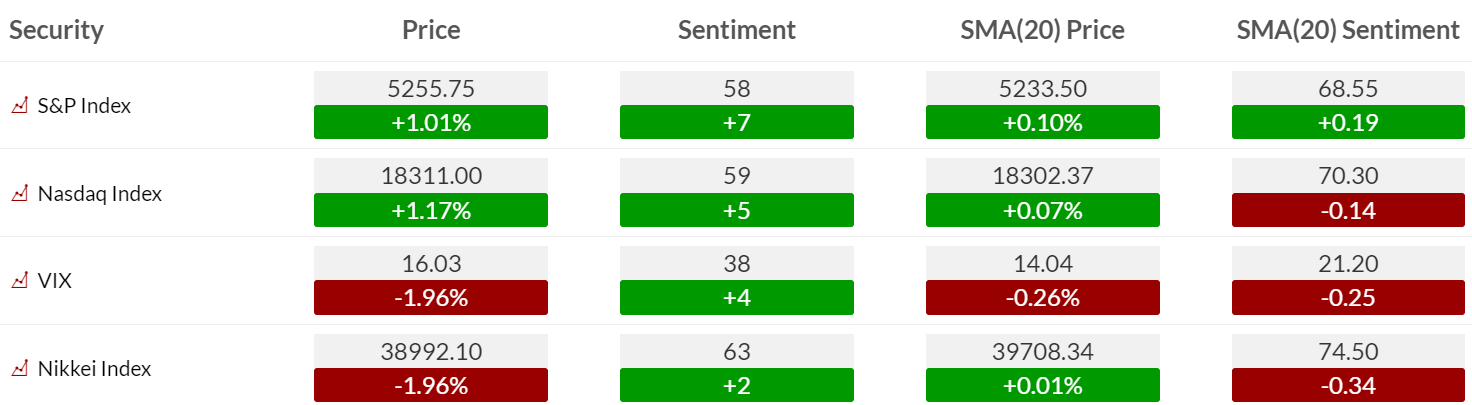

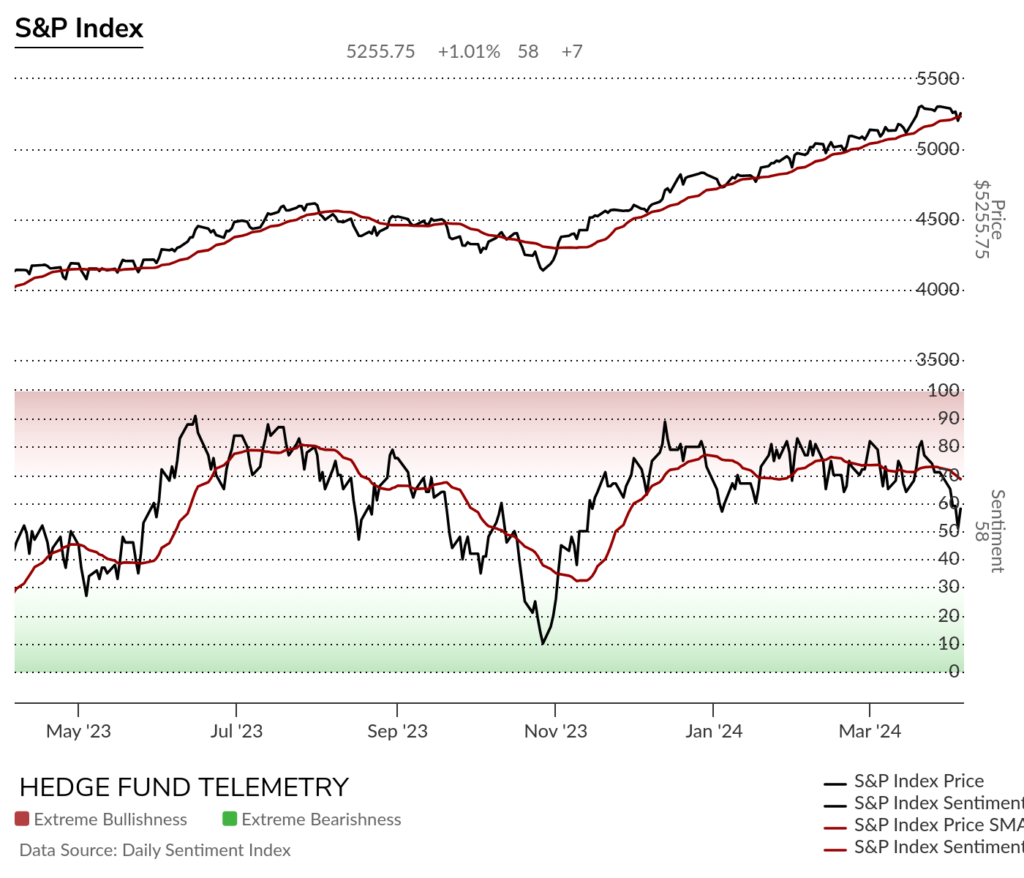

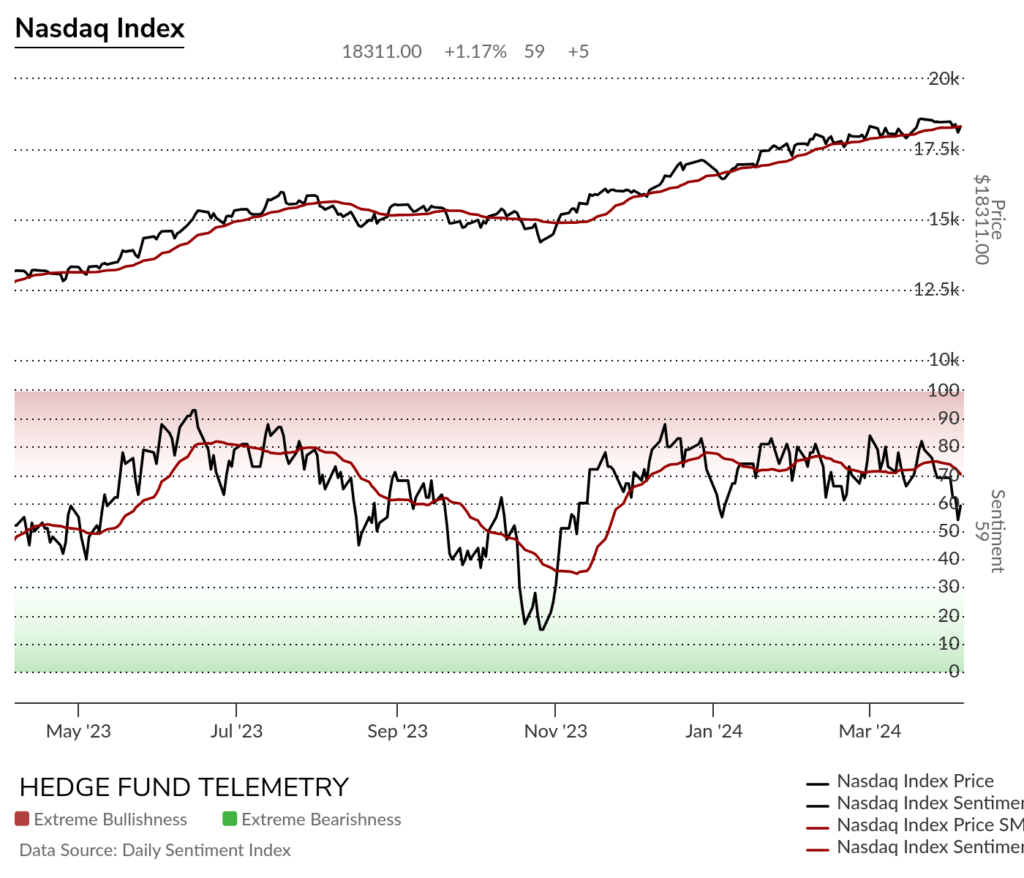

Equity bullish sentiment bounced on Friday after breaking down below the recent 2024 range.

S&P and Nasdaq bullish sentiment bounced after nearing the 50% midpoint majority level and breaking the 2024 range to the downside.

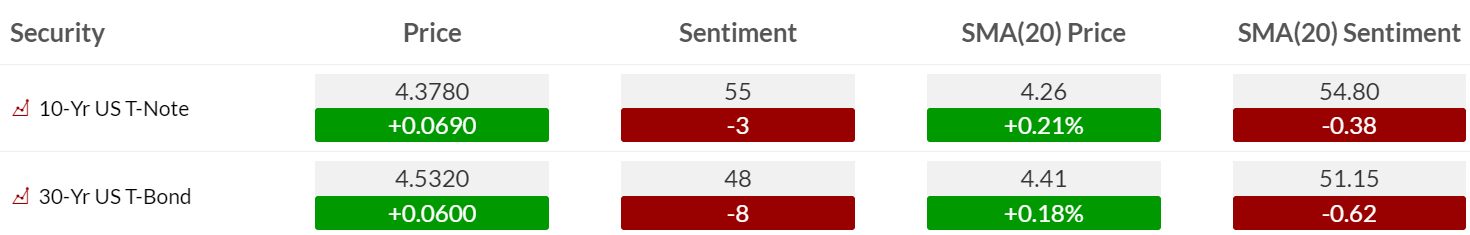

Bond bullish sentiment fell hard on Friday.

Currency bullish sentiment with US Dollar bullish sentiment remaining in the elevated zone

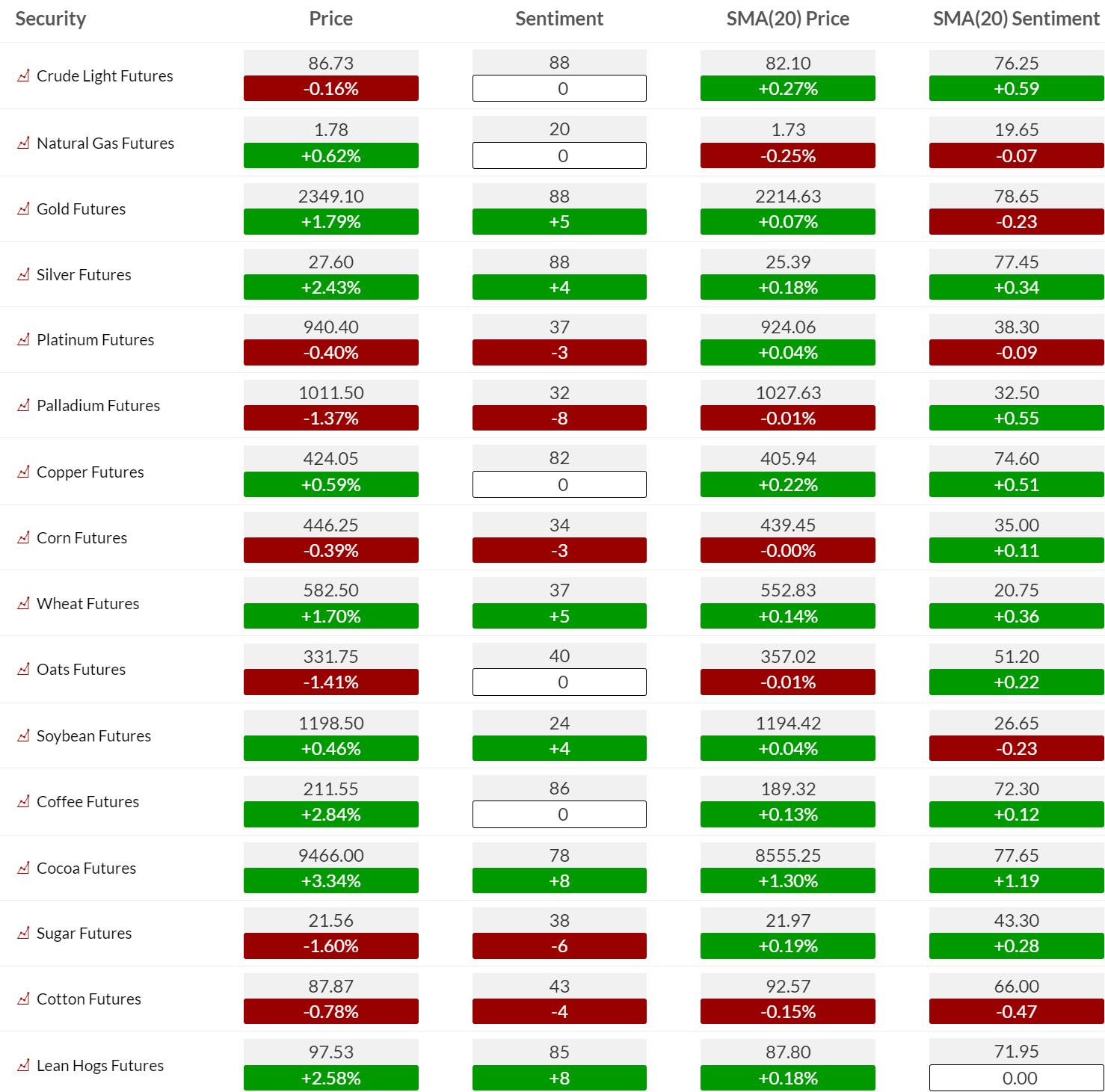

Commodity bullish sentiment has many sentiment levels in the extreme zone: Crude, Gold, Silver, Copper, Coffee, and Hogs. Cocoa is just below and I have a view on Cocoa on the Commodity note.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 08-Apr:

- Corporate:

- Earnings:

- Pre-open: LOT

- Analyst/Investor Events: VINC

- Brokerage Conference:

- American Society of Cataract and Refractive Surgery Meeting

- American Association for Cancer Research Meeting

- American College of Cardiology Scientific

- LD Micro Invitational Conference

- Needham Healthcare Conference

- HSBC Global Investment Summit

- Europe Gold Forum

- Earnings:

- Economic

- Europe: Unemployment rate (sa), Manufacturing Production (s.a.) m/m, Industrial Production m/m, Trade Balance, Sentix Economic Index

- Corporate:

- Tuesday 09-Apr:

- Corporate:

- Earnings:

- Pre-open: CGNT, CREV, NEOG, TLRY

- Post-close: AEHR, GREE, KITT, NRXS, PSMT, RICK, SGH, WDFC

- Analyst/Investor Events: BKSC, IMUX, KXCP, LAUR

- Brokerage Conference:

- American Association for Cancer Research Meeting

- Needham Healthcare Conference

- HSBC Global Investment Summit

- Europe Gold Forum

- BMO & CAPP Energy Symposium

- Deutsche Bank Private Fintech Conference

- Jefferies LatAm Summit

- Wells Fargo Software Symposium

- Earnings:

- Economic

- US: NFIB Small Business Index, Redbook Chain Store, API Crude Inventories

- Europe: CPI y/y, Trade Balance, Industrial Production m/m

- Asia: CGPI y/y

- Corporate:

- Wednesday 10-Apr:

- Corporate:

- Earnings:

- Pre-open: APLD, DAL

- Post-close: LAKE, PCYO, RELL, RENT

- Analyst/Investor Events: KKR, KSCP

- Brokerage Conference:

- American Association for Cancer Research Meeting

- Europe Gold Forum

- BMO & CAPP Energy Symposium

- Deutsche Bank Private Fintech Conference

- Jefferies LatAm Summit

- Wells Fargo Software Symposium

- OTC Markets Group Inc AI & Technology Hybrid Investor Conference

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, CPI, Hourly Earnings, Average Workweek, Wholesale Inventories, DOE Crude Inventories

- Canada: BofC Rate Target, Building Permits

- Europe: Manufacturing Production y/y, Industrial Production y/y, CPI y/y, PPI y/y, Industrial Production m/m, Retail Sales y/y, Final CPI y/y

- Asia: CPI y/y, PPI y/y

- Corporate:

- Thursday 11-Apr:

- Corporate:

- Earnings:

- Pre-open: CONN, FAST, FUFU, HOFT, KMX, LOVE, NTIC, STZ

- Analyst/Investor Events: KSCP, MRVL, SAIC

- Syndicate: +PACS IPO (~$400M offering)

- Brokerage Conference:

- Wells Fargo Software Symposium

- OTC Markets Group Inc AI & Technology Hybrid Investor Conference

- Earnings:

- Economic

- US: PPI, Weekly Jobless Claims, EIA Natural Gas Inventories

- Europe: Industrial Production y/y (wda), CPI y/y

- Asia: Unemployment Rate, Trade Balance

- Corporate:

- Friday 12-Apr:

- Corporate:

- Earnings:

- Pre-open: BLK, JPM, STT, WFC

- Post-close: KULR

- Analyst/Investor Events: CGTX

- Syndicate: +ULS IPO (~$750M offering)

- Earnings:

- Economic

- US: Export Prices, Import Prices, Michigan Consumer Sentiment (Preliminary)

- Europe: CPI y/y, Construction Output y/y, Industrial Production y/y, Trade Balance

- Asia: Industrial Production m/m (revised)

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.