TOP EVENTS AND CATALYSTS

The key macro events this week will all arrive on Friday, including CPIs from France and Germany for February, ECB inflation expectations, and the US PCE for January, with consensus expecting a deceleration in headline and core to +2.5% and +2.6% vs. +2.6% and +2.8% in December, and the China NBS PMIs for February on Friday night.

More Fed speakers will be on the calendar. The House could bring its reconciliation blueprint to the floor for a vote this week, although that timeline is at risk of slipping amid pushback from certain party factions on the plan to slash Medicaid/SNAP.

Nvidia’s earnings on Wednesday afternoon will be the biggest catalyst this week. I will have a detailed preview.

The major earnings reports this week include: Monday premarket: DPZ, OC; Monday postmarket: CLF, SBAC, ZM; Tuesday premarket: AMT, HD, KDP; Tuesday postmarket: CART, CAVA, CZR, INTU, KEYS, WDAY; Wednesday premarket: AAP, NRG, TJX; Wednesday postmarket: A, AI, CRM, EBAY, NVDA, PARA, SNOW, SNPS, URBN; Thursday premarket: GLNG, BBWI, NCLH, PENN, VST, WBD); and Thursday postmarket: ADSK, DELL, HPQ, NTAP.

We’ve taken significant steps to resolve the recent (WTF) malware issues we cleaned up quickly but lingered last week for some. It was the first (and last) time this will occur, as I have learned a lot about some of the inner workings of our site and technology. I wanted to thank everyone for their patience and support.

Here are unlocked Currency and Commodity weekly notes. I have a look below at some internals after Friday’s market slam.

Weekend News

- On the geopolitical front, reports suggest Washington is putting intense pressure on Kyiv to sign a mineral rights deal while the world awaits results from the German election later today. (early reports say the conservative right opposition with Friedrich Merz will win).

- Pope Francis is in critical condition. AP

- Musk Says Federal Workers Must Detail ‘What They Got Done’—or Risk Losing Job WSJ

- BRK Berkshire Hathaway – posts robust Q4 earnings thanks to continued insurance strength while cash hits a fresh record at ~$334B.

- Trump warns drug makers to shift production quickly to the US as tariffs will be coming soon (Bloomberg)

- Trump suggests Mexico should impose its own duties on Chinese imports to avoid additional American tariffs Bloomberg

- Trump threatens tariffs in response to countries that impose taxes and regulations on American tech firms WSJ

- Trump signs order for CFIUS to restrict Chinese investments in strategic areas of the US economy Reuters

- Hedge fund manager Steve Cohen made cautious comments on the outlook (according to Bloomberg given deteriorating economic conditions and tariff risks (“I’m actually pretty negative for the first time in a while”).

Charts we are watching

It’s been an “escalator up, elevator down” type of market with another elevator down day on Friday. Recent DeMark Sequential and Combo sell Countdown 13’s. Breaking the TDST Setup Trend support at 6050 is a concern but real risk is breaking below the 5950-5900 levels.

S&P Index daily had an new DeMark Combo 13’s – this one being the more strict 1b version that Tom DeMark has referenced in recent year. Right at the 50 day now. The TDST support at 5887 remains a level we should watch.

The NDX Index (cash) had recent DeMark Sequential and Combo sell Countdown 13’s mid-week

NDX daily dropped hard and is still slightly above the 50 day.

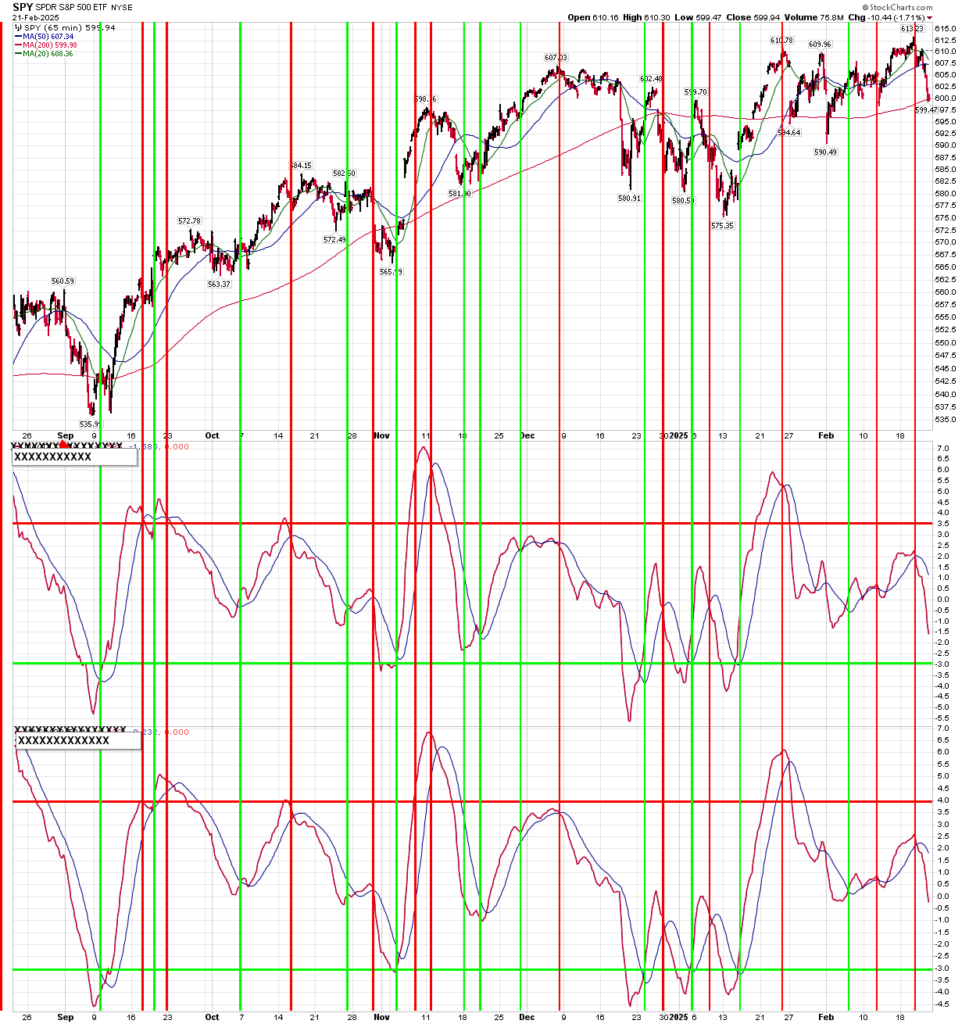

New this year is our short-term SPY and QQQ momentum indicator, which turned to sell nearly at the top, and I added to bring it to 5% weight short for both SPY and QQQ.

Internals check-up

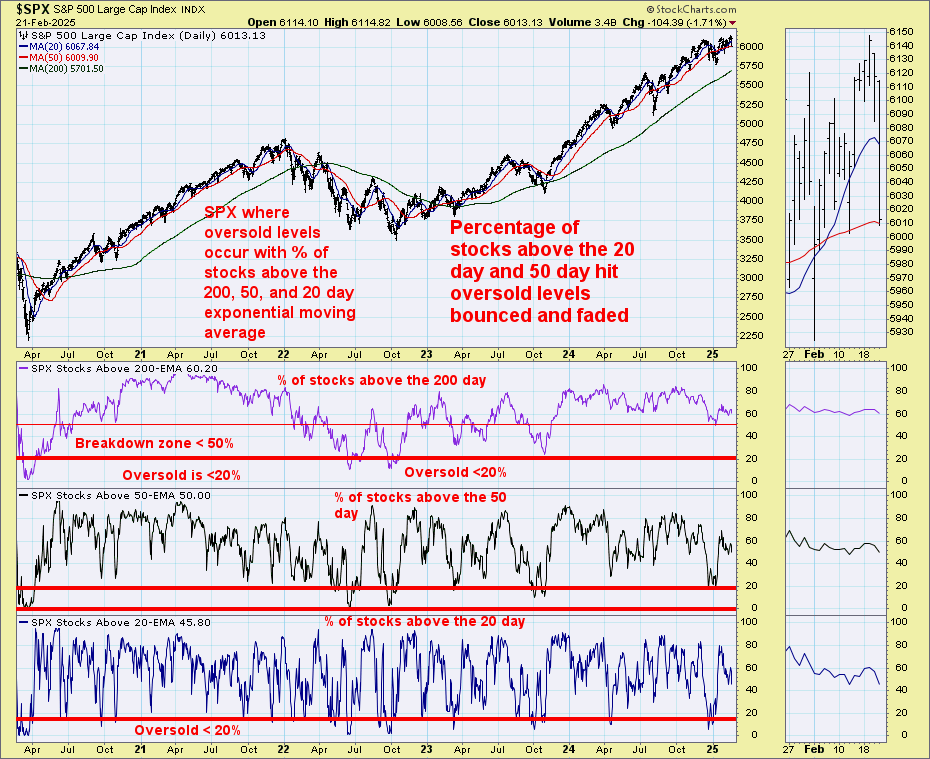

The advance-decline data has slipped in the last month and is not oversold.

The percentage of S&P stocks above the 20, 50, and 200 day made a recent spike but has been drifting in the last two weeks. Let’s see if we can get oversold levels again.

We’ve looked at the low cash levels for investment managers (BofA data) and the NAAIM exposure is elevated at 91.48%

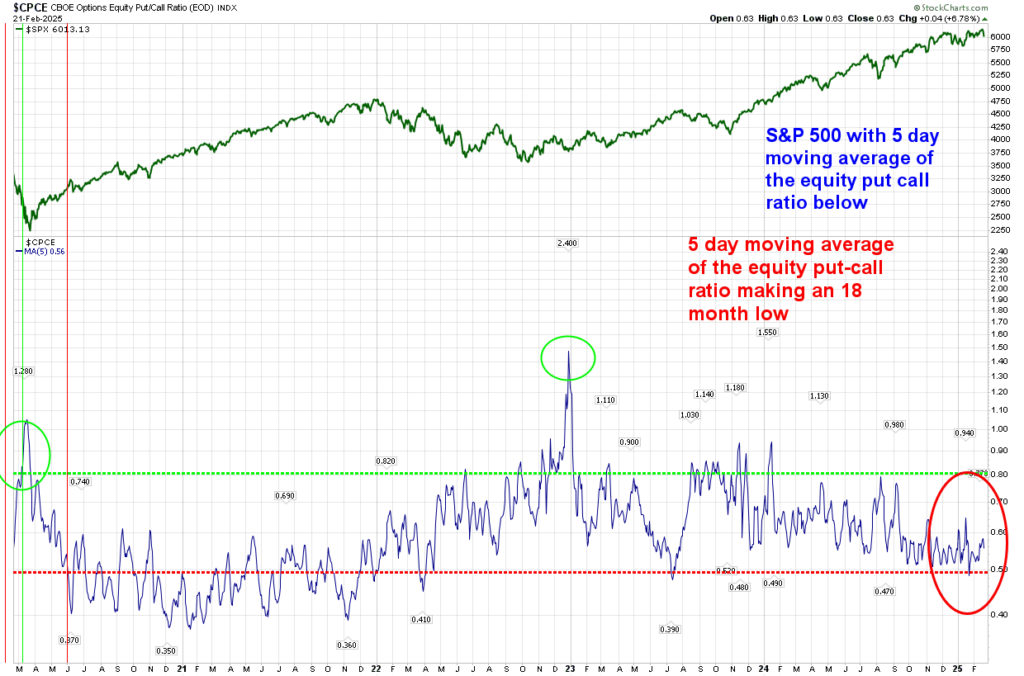

Remarkably, the legion of call buyers remains strong, and that isn’t a great sign if you’re bullish. We’d like to see this spike higher with some real fear in the market with higher levels of put buying.

S&P with McClellan indicators show some recent weakness with the Oscillator anad AD data while the Summation lost some momentum.

Like the S&P there was some improvement in recent weeks and slight reversals late in the week.

US economic data for the week

KEY MARKET SENTIMENT

Equity bullish sentiment dropped hard on Friday and back under the 20 day moving average of bullish sentiment. More downside will be needed to clearly spook the market and break sentiment.

S&P and Nasdaq bullish sentiment with reversals on Friday but no major levels have broken. 50% remains the line in the sand

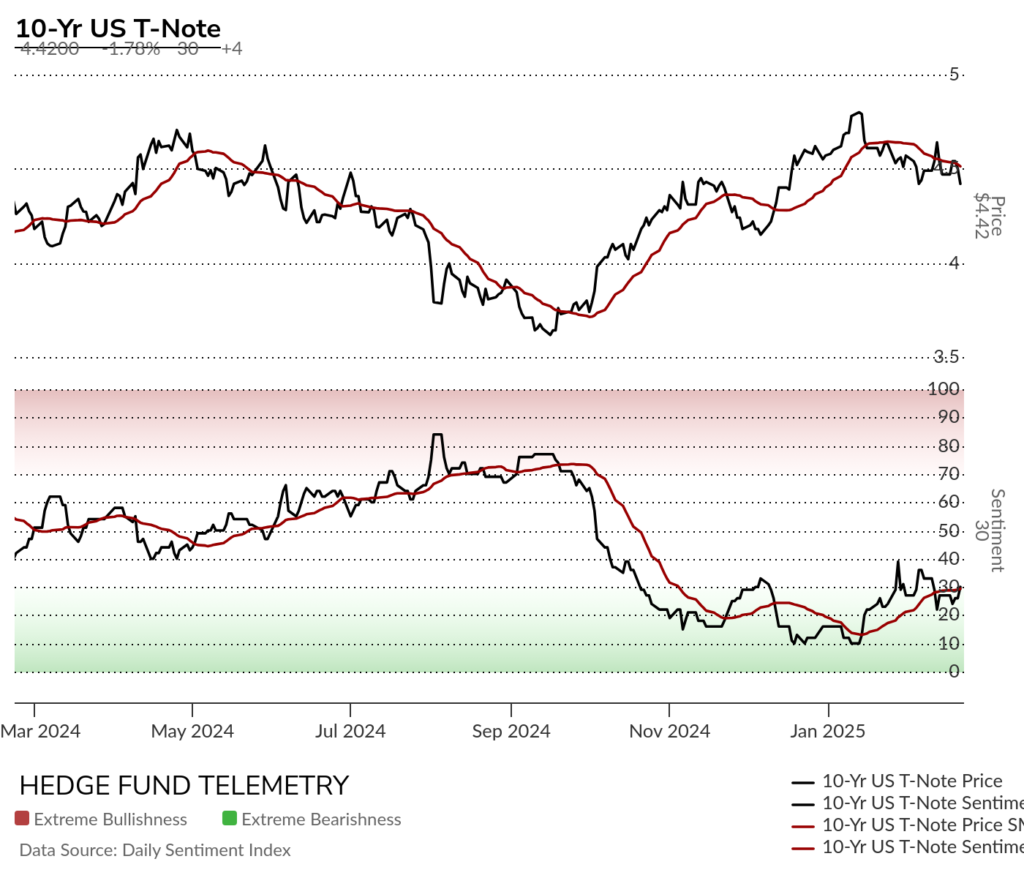

Bond bullish sentiment improved on Friday and has possibly made a higher low. A move over 40% could signal a ‘risk-off’ shift back to bonds if equities continue to fall.

Currency bullish sentiment with US Dollar bullish sentiment saw Dollar and Yen strength with others falling consistently all last week.

Japanese Yen bullish sentiment continues to move higher and remains a macro concern.

Bitcoin bullish sentiment has near term support ~60%. Price action continues sideways holding the important 90k support.

Commodity bullish sentiment saw some decent downside moves on Friday, including crude, metals, and coffee.

Crude remains vulnerable to more downside with sentiment barely holding on to the 40% level while there is a downside DeMark Sequential in progress.

Gold bullish sentiment has been strong and steady despite the recent DeMark Sequential and Combo 13’s on both daily and weekly time frames.

EARNINGS, CONFERENCES, AND ECONOMIC REPORTS

- Monday 24-Feb:

- Corporate:

- Earnings:

- Pre-open: AZUL, BCRX, CCO, CRGO, CWEN, DPZ, FDP, GTE, HOV, KBR, KOS, KSPI, LINC, OC, SMMT, VLRS, WLK, WLKP

- Post-close: ADUS, AESI, AORT, API, APLE, AROC, BOOM, BRDG, BSM, BWXT, BYON, CHGG, CIVI, CLF, CLNE, CNNE, CTRA, EVER, FANG, FARO, GFL, GSHD, HIMS, HLIO, HLX, HSTM, HVT, INN, ISPO, JBTM, KWR, LTC, MAX, MODG, MYGN, NTST, NVTS, O, OKE, OPAD, PLOW, PRA, PRIM, PSA, RIOT, SBAC, SIBN, TEM, TREX, UCTT, VCYT, VNOM, VRE, VVX, ZD, ZM

- Analyst/Investor Events: IOSP

- Brokerage Conference:

- US HUPO Conference

- BMO Global Metals, Mining & Critical Minerals Conference

- American Association for Cancer Research IO Conference

- ABA Wealth Management and Trust Conference

- J.P. Morgan Global Leveraged Finance Conference

- Earnings:

- Economic

- Europe: IFO Business Climate, CPI y/y

- Asia: CPI NSA Y/Y

- Corporate:

- Tuesday 25-Feb:

- Corporate:

- Earnings:

- Pre-open: ALLT, AMT, AS, AWI, AXGN, BLD, BOW, BTDR, CECO, CIFR, CRI, CYD, DEA, DK, DKL, DNUT, DOCN, DRVN, DSX, ELAN, FULC, HD, HRMY, HSIC, IART, IGT, ITRI, KDP, KTB, LGIH, LIVN, MFIC, MPLN, NOVT, NXRT, OFIX, PEG, PLNT, PNW, PTLO, SEE, SGHC, SHLS, SRE, TILE, TZOO, XHR, XMTR, XPRO, YSG

- Post-close: AGL, AHT, AMC, ARQT, AXON, BASE, BGFV, BGS, BLZE, BWIN, CART, CAVA, CBLL, CCCS, CGBD, CHRD, CPNG, CWH, CZR, DAWN, DHC, DNA, EXLS, EXR, FIHL, FLYW, FSLR, GIC, GO, GPOR, HURN, HY, HYLN, IGIC, INGN, INTU, IPAR, JACK, JAZZ, KEYS, LCID, LMND, LNW, LXFR, MASI, MATX, MMSI, MRVI, NHI, ODD, OLO, ONTF, OSUR, OUT, PARR, PCVX, PLYA, PR, PRCH, PRCT, QUIK, RLJ, RRC, RVLV, RXST, SAM, SES, SEZL, SILA, SLNG, SLRC, SPT, SPXC, SSTI, STRL, SUPN, TTI, USNA, UVE, VTEX, WBTN, WDAY, WK, ZETA, ZI, ZIP

- Analyst/Investor Events: ALNY, HURN, LPTH, MIST, PRPH, PYPL, RAMP

- Brokerage Conference:

- US HUPO Conference

- BMO Global Metals, Mining & Critical Minerals Conference

- American Association for Cancer Research IO Conference

- ABA Wealth Management and Trust Conference

- J.P. Morgan Global Leveraged Finance Conference

- HSBC MENAT Future Forum

- Oppenheimer Emerging Growth Conference

- Intersolar 2025 – Energy Storage North America

- IIFL Enterprising India Global Investor Conference

- BTG Pactual Brazil CEO Conference

- Earnings:

- Economic

- US: FHFA House Price Index, Consumer Confidence, Redbook Chain Store, API Crude Inventories

- Europe: GDP y/y

- Corporate:

- Wednesday 26-Feb:

- Corporate:

- Earnings:

- Pre-open: AAP, ACMR, AER, ALC, APG, ASTE, AVA, AVDX, BATRA, BCO, BKV, BLMN, BSY, BXSL, CBZ, CLDT, COCO, COMM, CTRI, DOLE, DTM, DY, EHTH, EME, ENOV, EYE, FSS, GB, GERN, GOTU, IEP, IMXI, INVZ, ITRN, JBI, LINE, LNTH, MDGL, MGPI, NRG, ODP, OPCH, PLAB, PRKS, RYTM, SHOO, SKYT, SWX, TBLA, TJX, TRIN, TUYA, UTHR, UWMC, VLN, VRSK, WBX, XPEL, YOU, ZVIA

- Post-close: A, AAOI, ACAD, ADTN, AI, AIN, AMBA, AMBC, AMSF, APA, ARDT, ARIS, ARKO, ATEC, BBSI, BHR, BYND, CAPL, CDNA, CERT, CHE, CLPT, CORT, CPK, CPRX, CRM, CSV, DMRC, DORM, EBAY, ECPG, EE, EPR, ERII, ESTA, EVTC, FE, FSK, FTAI, FWRD, GEF, GRBK, HCAT, HEI, HG, HHH, HNST, IBTA, INVH, IONQ, JOBY, KNTK, KTOS, KW, LAB, LSF, LTBR, LXU, LZ, MARA, MDXG, MDXH, MEG, MGNI, MQ, MRAM, MYRG, NEWT, NMFC, NPKI, NSA, NTNX, NVDA, NWPX, ORA, OVV, PARA, PBR, PEB, PERF, PLYM, PSTG, PSTL, ROOT, RRGB, RSI, SBGI, SDGR, SDRL, SEMR, SG, SJW, SNOW, SNPS, SPCE, SRI, SRPT, STR, SUI, SVC, TALO, TASK, TBPH, TDOC, TKO, TNDM, TWI, UHS, UMH, URBN, VAC, VINP, VIR, VSEC, VTOL, WES, WHD, WTRG, XPER, ZIMV

- Analyst/Investor Events: DBD, IMXI, MMM

- Brokerage Conference:

- US HUPO Conference

- BMO Global Metals, Mining & Critical Minerals Conference

- American Association for Cancer Research IO Conference

- ABA Wealth Management and Trust Conference

- J.P. Morgan Global Leveraged Finance Conference

- Oppenheimer Emerging Growth Conference

- Intersolar 2025 – Energy Storage North America

- IIFL Enterprising India Global Investor Conference

- BTG Pactual Brazil CEO Conference

- Goldman Sachs European Technology Conference

- Canaccord Genuity 2025 Sustainability Summit

- Wolfe Research “March Madness” Software Conference

- Bank of America Global Agriculture and Materials Conference

- Wolfe Research Real Estate Conference

- JP Morgan Global Emerging Markets Corporate Conference

- Earnings:

- Economic

- US: MBA Mortgage Purchase Applications, New Home Sales, DOE Crude Inventories

- Europe: PPI y/y, GfK Consumer Confidence, Consumer Confidence

- Asia: Manufacturing Production NSA Y/Y

- Corporate:

- Thursday 27-Feb:

- Corporate:

- Earnings:

- Pre-open: AAON, ACIW, ADT, AMBP, AMWD, BBWI, BECN, CARS, CCOI, CMLS, CMPS, CVEO, CWT, DCI, DCO, DQ, ECVT, EQC, EVRG, EXE, FA, FTI, FUN, FWONK, GBTG, GDRX, GEO, GLNG, GOCO, GOLF, GTN, HAYW, HGV, HRL, HRTX, IBP, INSW, INUV, IPWR, KOP, KRP, LBRDK, LFST, LGND, LIND, LSEA, LTH, MAC, MCS, NAUT, NCDL, NCLH, NREF, NVCR, NXST, OB, ONC, OPRA, PAYO, PENN, PLTK, PRVA, PSBD, PZZA, RMNI, SHC, SLN, SRRK, STGW, STRA, STWD, TCPC, TFX, TGLS, TGNA, THRY, TRS, VCEL, VERX, VITL, VRNA, VST, VTRS, VYX, WBD, WRBY, XRAY, ZLAB

- Post-close: ABCL, ACA, ACEL, ACHC, ACHR, ACIC, ADSK, AES, AGO, AHR, AIRG, ALEX, ALHC, ALKT, AMRC, ARLO, ARRY, ASTH, AVPT, BCSF, BE, BLND, BRFH, BWMX, CABO, CDXS, CLOV, CODI, COLL, CRNX, CSTL, CTKB, CUBE, CYTK, DAIO, DCGO, DELL, DH, DLO, DRH, DUOL, DV, EB, EFC, EIX, EOG, ESTC, EXFY, FIGS, FIP, FOXF, GDEN, GDOT, GMRE, GSBD, HCI, HPQ, ICFI, ICUI, IHRT, INTZ, IOVA, JAMF, KIND, LASR, MAIN, MBI, MOS, MSDL, MTUS, MTZ, NRDY, NTAP, NTRA, OPEN, OPK, ORGO, OSPN, PBYI, PGNY, PGRE, PNTG, PSNL, PTCT, PUBM, QRTEA, RDFN, RDNT, RDVT, RKLB, RKT, RUN, SEER, SLDP, SOLV, SOUN, SSP, TLN, TMCI, TMDX, TTEC, VRRM

- Analyst/Investor Events: FTDR, KZR, MOD, PRMB

- Brokerage Conference:

- Intersolar 2025 – Energy Storage North America

- IIFL Enterprising India Global Investor Conference

- BTG Pactual Brazil CEO Conference

- Wolfe Research “March Madness” Software Conference

- Bank of America Global Agriculture and Materials Conference

- Wolfe Research Real Estate Conference

- JP Morgan Global Emerging Markets Corporate Conference

- Red Cloud Pre PDAC Mining Showcase

- KGI Securities Investor Conference

- ACTRIMS Forum

- Americas Committee for Treatment and Research in Multiple Sclerosis Forum

- Earnings:

- Economic

- US: Durable Orders, GDP/GDP Chain Price (first revision), Pending Home Sales, EIA Natural Gas Inventories

- Canada: Current Account

- Europe: Trade Balance, Retail Sales y/y, PPI m/m, Preliminary CPI y/y, GDP y/y, Business Confidence, Consumer Confidence, M3 Money Supply y/y, Economic Sentiment Indicator, CPI y/y, Final GDP y/y

- Asia: CPI Tokyo y/y, Industrial Production m/m (preliminary), Retail Sales y/y, Retail Sales m/m

- Corporate:

- Friday 28-Feb:

- Corporate:

- Earnings:

- Pre-open: AMR, AMRX, ANIP, APLS, BFLY, BLX, CLMT, DIBS, FLGT, FUBO, GLP, GNL, GTLS, IAS, LANV, NRP, NWN, OMI, PAR

- Brokerage Conference:

- JP Morgan Global Emerging Markets Corporate Conference

- ACTRIMS Forum

- Americas Committee for Treatment and Research in Multiple Sclerosis Forum

- Susquehanna Technology Conference

- B. Riley Securities Precision Oncology & Radiopharma Conference

- American Academy of Allergy, Asthma & Immunology World Allergy Organization Joint Congress

- Earnings:

- Economic

- US: Core PCE, Personal Spending/Income, Wholesale Inventories, Chicago PMI

- Canada: GDP

- Europe: PPI y/y, Core Retail Sales m/m, Retail Sales, Final GDP y/y, Retail Sales y/y, Unemployment Rate, Nationwide House Price Index y/y, Retail sales y/y, Consumer Goods Spending m/m, Preliminary CPI y/y, Final GDP q/q, KOF Leading Indicator, Preliminary GDP (second) y/y

- Asia: Housing Starts y/y, Non Manufacturing PMI y/y, official Manufacturing PMI y/y, Trade Balance

- Corporate:

Thanks to Street Account, Vital Knowledge, and Bloomberg as valued sources.