- The market is anticipating the Fed announcement and Powell’s press conference

- The market now has some consensus expectations with Powell and the Fed

- Powell is expected to be hawkish but he’s gotta pull off a very tough trick to also calm the markets

- Raising stops on trading longs SPY, QQQ, IWM. Covering LRCX +13% ahead of earnings

- Credit spreads have not given any risk-off signals like 2018 and 2020

Unlocked Notes

Take a look at some recent samples of our work.

Mixed Messages

- There are a lot of mixed messages with the equity market right now

- I run through sentiment and internals that normally is easy to make a call

- One market that has a very clear message is the bond market

- Adding one new long idea and selling one long idea

- I’m not overly enthusiastic about today’s bounce

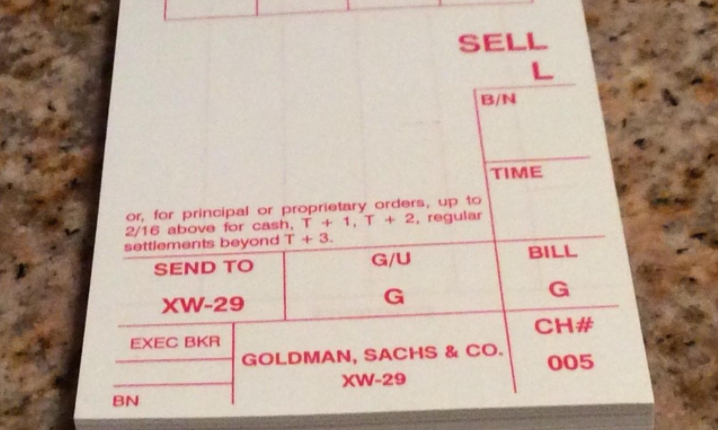

Sell Tickets

- The equity market noticed the rise in rates… finally

- The progression of markets unwinding is briefly discussed

- Some examples of Erlanger Research Type 1 (short squeeze) and Type 4 (long squeeze) short interest candidates

- More details on Rekor Systems

- The “future sellers” thesis is a 2022 risk

- Cutting a couple of recent “knife catcher” long ideas with losses

- Another big report and happily it’s out a lot earlier than yesterday’s note

The more things change, the more they stay the same

- It’s been a day… a long one and I finally finished today’s note

- It’s rare notes get so delayed but I think this note has a lot of good stuff as we start 2022

- Worth it with a few Trade Ideas

First Call December 20, 2021

- US futures are under pressure again

- There is a chance today for a bounce if the overnight lows hold

- The good news is Friday is a holiday and the markets are closed

Commodity Weekly December 19, 2021

- Here’s this week’s Commodity Weekly

- Still, many commodities are struggling despite the inflationary backdrop